Stop Accepting Default Slippage from Your DEX Router: How Algo Traders Use Real-Time Liquidity Data

Called the “cost of doing business”, slippage has hurt more traders than you know. Some blogs estimate it to be upwards of 2.5 billion USD annually.

Solutions like CoW Protocol's intents, 1inch's dynamic routing, and MEV-protected RPCs have helped, but they come with trade-offs. You're either paying for solver services, locked into predetermined routing logic, or giving up execution control to third-party systems. These work great if you want a turnkey solution. But what if you're building custom strategies that need direct pool access? What if you want to choose your own routes based on real-time conditions?

If naive traders hard-code 0.5% to 3% slippage in their bots or accept whatever default their DEX router suggests, then see live PnL drift away from backtests. In volatile or thin pools, the quote you see before sending a transaction can be quite different from the final execution price, especially when other bots hit the same liquidity in the same block.

To cope, traders either keep querying nodes or routing APIs for fresh quotes or pay execution services, which adds latency and cost without addressing the information gap.

What is missing is a real‑time view of how much size each pool can absorb at different slippage levels, so order sizing and slippage tolerance come from live liquidity, not from guesswork.

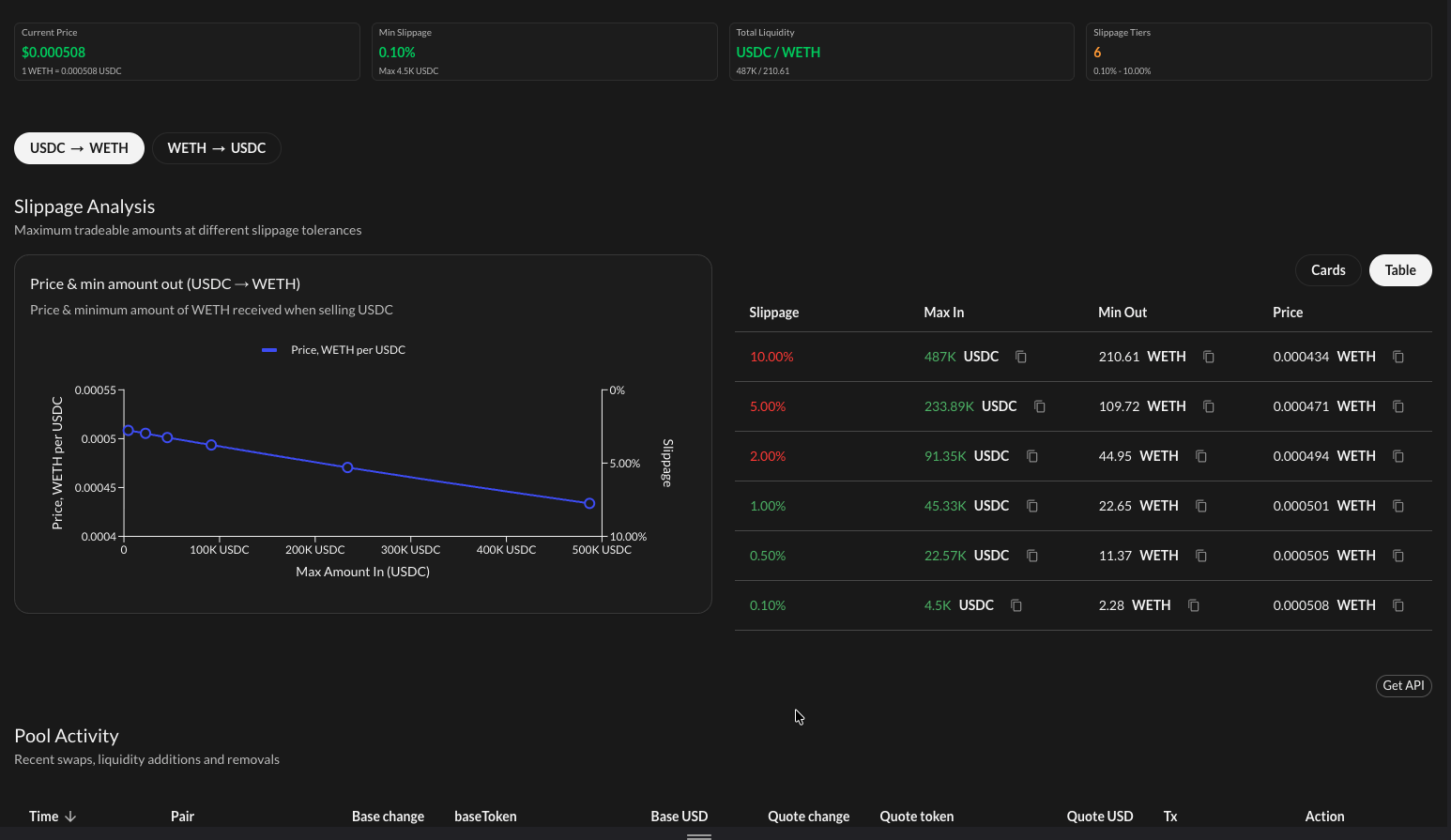

Figure: Real-time slippage chart for the USDC-WETH pool on Uniswap v3, showing maximum tradeable amounts at different slippage tolerances (via DEXRabbit, Bitquery's demo dashboard).

The Problem: Static Slippage Settings

Consider a trader trying to swap 100,000 USDC for WETH on Uniswap v3. Most traders hard-code a 1% slippage setting without knowing whether the pool can actually handle that trade size at that tolerance.

See the slippage API documentation for more query examples.

With a static 1% slippage setting, the bot doesn't know if the pool can actually handle that size at 1% or if the real price impact will be 3% or higher. If the pool's current liquidity only supports 50,000 USDC at 1% slippage, the trade either fails or executes with much worse slippage than expected, eating into profits. Without real-time liquidity data, the trader is forced to either set overly conservative slippage (leaving value on the table) or risk failed transactions and MEV attacks.

Bitquery's Solution: Real-Time Slippage Tables

Bitquery ingests on‑chain data from major DEXes on Ethereum, Base, Arbitrum, BSC and other EVM networks and normalizes it into a DEXPool data model. For each pool, Bitquery continuously tracks swaps and liquidity changes, maintains a current liquidity snapshot, and computes a slippage table that describes how price and output change with trade size. "This information is exposed through GraphQL APIs including dedicated slippage APIs and liquidity APIs and low‑latency data streams (Kafka / WebSocket), so traders do not need to simulate swaps against raw pool state or hammer full nodes for quotes."

The model is cross‑chain by design. A typical query uses EVM(dataset: realtime, network: eth) for Ethereum and can be reused on Base, Arbitrum or BSC by changing only the network argument. That allows a single slippage and liquidity logic to run across multiple EVM chains.

Querying Pool Slippage and Liquidity

You can fetch slippage and liquidity for a specific pool or token pair with a GraphQL query that filters DEXPools and requests PoolPriceTable and Liquidity fields. The following pattern targets the USDC–WETH pool on Uniswap v3 on Ethereum; you can substitute real addresses or symbols as needed.

For complete query examples and response structures, see the DEX Trades API documentation and slippage-based trading guide.

A typical response includes one DEXPool row with reserves and a list of A→B slippage tiers. For example, one entry in AtoBPrices might show SlippageBasisPoints = 100, MaxAmountIn = 50,000 (token units), MinAmountOut = X WETH, Price = Y, meaning that trades up to 50k units of USDC can be executed with at most 1% slippage and at least that MinAmountOut of WETH.

Executing Limit Orders with Live Slippage Data

Traders can set up dynamic limit orders and open positions since they have access to real-time slippage and maximum liquidity at each slippage tier.

Traditional limit orders on DEXs are static: you set a target price and hope the pool can fill your order at that price when it triggers. But without live slippage data, you don't know if the pool has enough depth to actually execute your full size at your limit price or if price impact will push you past your target.

With Bitquery's slippage and liquidity APIs, you can build dynamic limit orders that adjust execution parameters in real-time:

How it works:

-

Your bot continuously monitors the PoolPriceTable for your target pair (e.g., USDC-WETH).

-

When the spot price hits your limit (e.g., 1 WETH = 2,100 USDC), instead of blindly executing, your bot first checks the current slippage table.

-

It looks up: "At my desired order size (say, 50,000 USDC), what slippage tier do I fall into right now?"

-

If the pool can handle your size at acceptable slippage (e.g., ≤1%), the order executes with the correct amountOutMin from the table.

-

If current liquidity is too thin (your size would cause >2% slippage even though price hit your limit), the bot either splits the order, waits for liquidity to improve, or routes to a different pool/chain.

Example:

-

You want to buy 100,000 USDC worth of WETH when the price reaches 0.00048 WETH/USDC.

-

Price hits your limit, but the current PoolPriceTable shows the pool can only handle 60,000 USDC at 1% slippage.

-

Your bot splits the order: executes 60K USDC now at 1% slippage, and queues the remaining 40K to execute when liquidity refreshes or routes it to Base where the pool is deeper.

-

This prevents your single large order from slipping 5%+ and eating into your profit.

By combining price monitoring with live slippage and liquidity data, you turn dumb limit orders into intelligent, liquidity-aware execution strategies.

Integrating Bitquery streams

For a working example of this approach, see the best-route trader demo application and its source code on GitHub. This proof-of-concept demonstrates how to query DEXPool data, compare slippage across multiple pools, and execute trades using the optimal route.

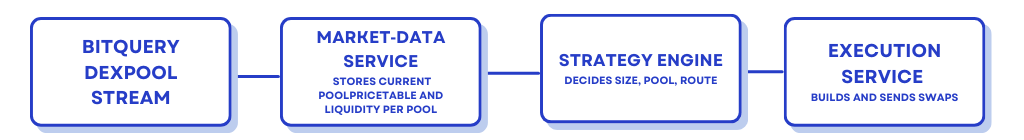

Traders can start by polling GraphQL for DEXPools every few seconds or every N blocks, which is often sufficient for slower strategies. For latency‑sensitive bots, Bitquery provides data streams that publish DEXPool updates as they happen, so the internal slippage view tracks pool changes closely. A typical architecture is:

Figure: Typical trading system architecture using Bitquery DEXPool streams

Realized slippage and execution quality can be logged and compared with the predicted slippage tier from PoolPriceTable, allowing strategies to adjust safety margins or pool filters over time.

Building at Scale

For production systems handling high-frequency trading, Bitquery offers Kafka streaming for real-time DEXPool updates. See the Kafka streaming documentation and sample data format for implementation details.

Advanced systems follow this pattern:

• Run Bitquery Kafka stream subscribed to the DEXPool topic

• Build a local backend to handle the volume of data

• Filter and serve only relevant pools and slippage tiers to your strategy engine

Unlimited Streaming Pricing

Bitquery does not limit by amount of data or rate limits. Streams are sold individually and not by bytes of data, which means pricing is scalable whether you monitor 10 pools or 1,000+ pools across multiple chains. Learn more about Bitquery's unlimited streaming pricing model.

Summary

Slippage does not need to be a fixed configuration value or a guess. By consuming Bitquery’s pre‑calculated slippage tables and liquidity snapshots for DEX pools on Ethereum, Base, Arbitrum, BSC and other EVM chains, algo traders can size orders, set slippage tolerance, and choose pools or routes based on live on‑chain conditions.

This reduces unnecessary failed trades and over‑slippage, and creates a clear path from raw blockchain data to robust execution logic inside trading systems.

Ready to integrate real-time slippage and liquidity data into your trading system? Explore Bitquery's DEX APIs or reach out to the team for enterprise solutions.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.