$4 Million Gone in Seconds

Imagine an attractive person reaching out to you on social media, building a friendly connection, and then sharing a hot tip about a fantastic investment opportunity. They boast about generating impressive passive income and encourage you to invest a small amount. At first, everything seems legitimate—you can even withdraw some “profits.” But in reality, this is often just a Ponzi scheme, where new victims’ deposits fund early withdrawals.

This is what happened with Adam (name changed for anonymity) lost $4 million USD due to an investment scheme promising substantial returns. The scam involved another person who lost $3 million USD.

Over time, these scammers persuade victims to invest more money, promising unrealistic returns of over 1% daily through buzzwords like arbitrage, AMM fees, and smart contracts. Unfortunately, many people end up investing more than they can afford, chasing these false promises of easy money.

Where do we start looking?

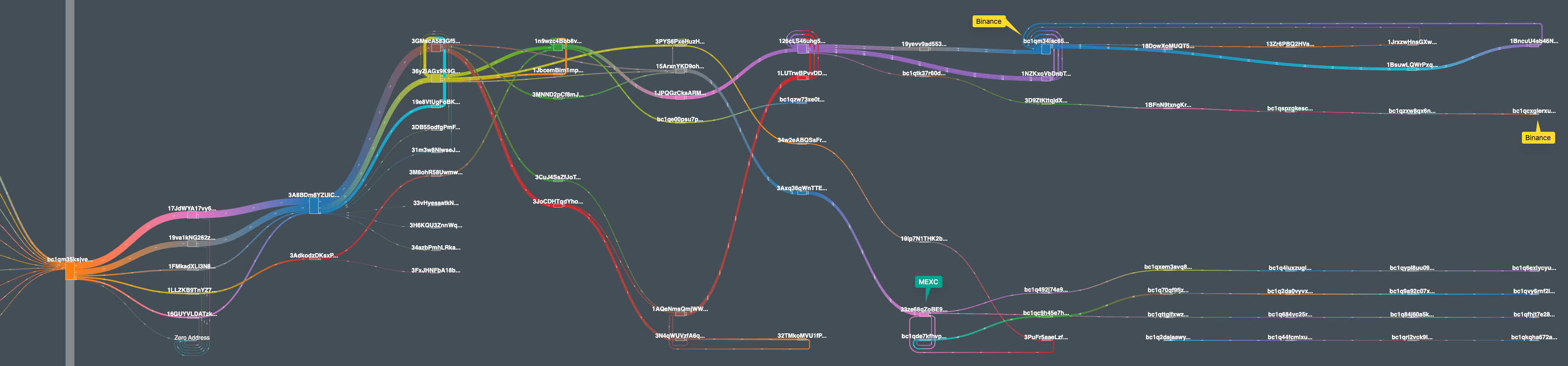

The first step in recovery is to identify Adam’s wallet address and the transaction details that led to the fraudulent platform. In these cases, we analyze their transaction statements to trace the corresponding blockchain activities.

For this particular case, the victims used Strike to convert fiat into BTC. We used Moneyflow to trace the flow of funds from BTC to exchanges. Our investigation involved analyzing Strike statements to pinpoint the wallet addresses.

-

Once we obtained the origin wallet address, we investigated the flow of funds from these wallets to other entities. In this case, we traced up to 7 levels of fund transfers which can be seen starting on the left side of the graph.

-

Thanks to automatic clustering and tracing on Moneyflow, we can easily observe subsequent transfers of these assets between wallets.

-

When the funds are transferred to a known entity, such as an exchange or any other Virtual Asset Service Provider (VASP), Moneyflow automatically stops tracing, indicating where the funds were deposited.

Where did the trace lead us?

In this case, we traced deposits to Bybit wallet 1FeM5NFwxpsDegpxfvMw2u18WsEikcbk3C and multiple Binance Hot Wallets including bc1qm34lsc65zpw79lxes69zkqmk6ee3ewf0j77s3h and 15BoAx4mT1zaRHvDQQp26yigeRanvde3S7

Due to the centralized nature of these services, we are still determining what happens next with these assets; they are usually traded on the exchange into other assets, such as fiat currencies, and transferred to bank accounts. With the involvement of law authorities, these service providers can provide additional information, which greatly aids further investigation.

The Legality of the Process

We identified which Virtual Asset Service Provider (VASP) received the stolen funds. We then report the incident to law enforcement or lawyers in the victim’s home country. While we strive to communicate with exchanges, legal constraints often limit our ability to recover assets. As forensic experts, we play a crucial role in explaining the transaction flow to support the legal process.

The further steps are outside our jurisdiction, and we must rely on law enforcement to submit formal requests for additional information to the involved entities.

We also attempt to communicate with exchanges, but we are often limited to the information we receive and the legal avenues available for asset recovery. Depending on the individual case, there is a legal process that we try to support in our role as forensic experts, explaining the transaction flow of the proceeds.

Latest Updates

Since launching our asset recovery service, most of our cases are still under investigation by law enforcement. Although we continue to provide support and follow-ups, the legal process tends to move slower than in the fast-paced world of Web3 and crypto.

How Bitquery Got Involved

Bitquery has built a strong reputation in the field of asset recovery, thanks to our effective online presence and word-of-mouth referrals. Victims often find us through our website or are referred by satisfied customers, lawyers, and law enforcement agencies. People submit their cases through our website, and we receive numerous referrals from existing customers, lawyers, and law enforcement.

What Can You Do if You’ve Been Scammed?

-

Document Everything: At the first sign of suspicious activity, save copies of all conversations, fund transfers, and blockchain transaction details.

-

Report to Authorities: Inform your local law enforcement agency about the incident.

-

Seek Expert Assistance: Contact legal and forensic experts like Bitquery for a consultation.

-

Preliminary Analysis: We can help determine if funds have been transferred to exchanges or other VASPs that might hold KYC data of the recipient accounts.

-

Monitor Fund Movements: Set up alerts for any activity involving your stolen funds. If the funds are moved to an exchange, act quickly to provide evidence and request a freeze on further transactions.

-

Backup Your Data: Keep backups of all your evidence, as scammers often delete chat histories and other crucial information.

By taking these steps, you can enhance your chances of recovering lost assets and holding scammers accountable. Quick action, thorough documentation, and expert support are key to navigating the asset recovery process and regaining your peace of mind.

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.