Real-World Assets Are Changing Global Finance: A Complete Research Deep Dive

Imagine you're sitting in a small café in Nairobi, scrolling through your phone. The local currency is unstable, your bank's savings account barely earns any interest, and inflation keeps eating away at the money you've worked so hard to save.

Now imagine this: with just your smartphone and an internet connection, you could invest in U.S. government bonds, one of the safest financial assets in the world. No middlemen, no minimum $1,000 deposit, no trips to the bank. Just a few taps, and you're earning steady interest in digital dollars. This shift isn’t just about convenience, it represents a fundamental transformation in how financial assets are accessed and managed.

Historically, preserving wealth hasn’t been so simple. Currencies around the world, from the Roman denarius to the Zimbabwean dollar, have repeatedly lost value due to inflation, devaluation, or poor monetary policy. Even relatively stable currencies like the U.S. dollar have seen their purchasing power erode over time. For many, especially in emerging markets, storing value in local currencies has been unreliable. This instability has fueled the global demand for safer, more stable, and more accessible forms of investment.[4]

The evolution of financial infrastructure reflects this ongoing search for trust and stability. Early societies traded with shells and beads, later replaced by metal coins, then paper money, and eventually centralized banking systems. Each phase advanced the way people stored, transferred, and protected their wealth. But while traditional systems brought improvements, they also introduced inefficiencies, high entry barriers, and heavy reliance on intermediaries.

In the 20th century, innovation accelerated with the rise of electronic banking, payment networks, and capital markets, enabling broader, faster access to financial services. Yet, these services remained largely confined within national borders and controlled by centralized institutions. That changed with the advent of blockchain technology, which introduced decentralized, transparent, and programmable financial systems that reduced dependence on traditional gatekeepers.

Today, we’re witnessing the next phase: the emergence of Real-World Assets (RWAs)[1]. These bring traditional financial instruments like U.S. Treasuries, real estate, commodities, and private credit onto the blockchain. By doing so, they bridge legacy finance and decentralized infrastructure, making historically exclusive assets more accessible, liquid, and interoperable for a global audience.

RWAs are like putting the real world inside the internet of money. And they’re not just for Wall Street anymore, they’re for you, me, and anyone with a phone.

What Exactly Are RWAs?

Real-World Assets are physical or traditional financial assets that are represented digitally, as tokens on a blockchain. These tokens can be bought, sold, and used just like cryptocurrencies, but real, tangible things back them.

The tokenization of real-world assets (RWAs) is rapidly transforming global finance, bringing traditional assets like U.S. Treasuries, private credit, and commodities onto public blockchains. As of June 2025, the total value of RWAs on-chain has soared to $23.23 billion a 5.49% increase from just 30 days prior while the number of asset holders has grown by 13.64% to 113,670. This surge reflects growing investor interest in blockchain based finance, particularly in secure and yield-generating assets.

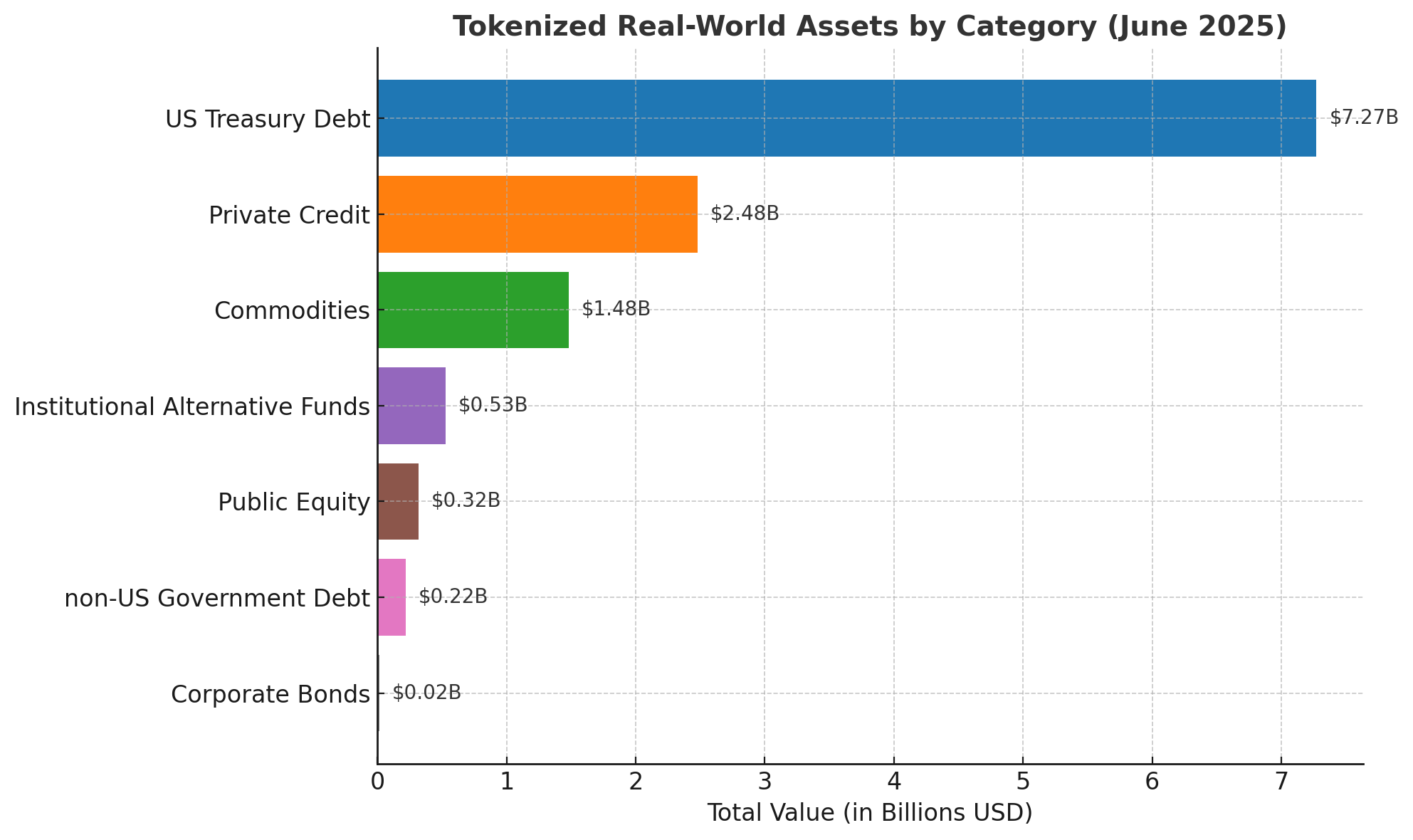

According to data[1], US Treasury Debt leads the market with $7.27 billion in value and a 59.06% market share, followed by Private Credit at $2.48 billion (20.12%). Other emerging asset classes include Commodities ($1.48B), Institutional Alternative Funds ($527.8M), and Public Equity ($317.4M), although Public Equity recently saw a sharp 33.84% monthly decline. The momentum is clear: tokenized finance is no longer just a fringe experiment it’s a fast-growing segment of the financial world with increasing relevance for both retail and institutional investors.

Fig: Tokenized Real-World Assets by Total Value

Let’s walk through the main categories of RWAs in brief:

-

Government Bonds and Treasuries

Tokenized bonds and Treasuries are traditional bonds like U.S. government debt turned into digital tokens, making them easier to buy, trade, and use around the world through blockchain technology. Countries like the U.S. borrow money and promise to pay it back with interest. These bonds are considered super safe. Now, with RWAs, these bonds are turned into digital tokens like USDY or BUIDL that can be traded online.

You earn interest daily, and you can use these tokens in other apps too, such as Flux, Morpho, Mountain Protocol, Maple Finance, and Balancer for borrowing, lending, or earning extra yield in decentralized finance (DeFi). As of June 2025, U.S. Treasury Debt dominates the tokenized asset market, with a total value of $7.27 billion, making up 59.06% of the entire RWA market. You don’t need to live in the U.S. or be rich to invest in these anymore. Even $1 gets you in.

-

Tokenized Stocks

Platforms are working to digitally represent shares of real companies like Apple, Tesla, or Google as tokens you can trade 24/7. These tokens are often backed 1:1 by actual shares held by a licensed custodian. Tokenized equities are still a small but emerging category in the RWA space, with a total on-chain value of $317.4 million (just 2.58% of the market).

Projects like Backed Finance and synthetic stock protocols such as Synthetix are pioneering this area. Eventually, you could buy global stocks instantly from anywhere, no brokerage account needed

-

Commodities (Like Gold, Oil, etc.)

Gold bars are heavy and hard to move. But a token representing real gold? Easy to store, trade, and use instantly. With RWAs, commodities like gold, silver, oil, and even carbon credits can be bought as digital tokens, backed by real reserves.This category has grown steadily, now holding a total value of $1.48 billion, or 12.04% of the tokenized RWA market.

Tokenized gold, for example, is backed by real vault reserves but traded as digital tokens, making it easier for users to diversify into safe-haven assets with the click of a button. You can diversify your investments without needing physical storage

- Institutional Alternative Funds

Institutional alternative funds like those focused on private credit or venture capital were once only available to large investors. Now, thanks to tokenization, these professionally managed funds are coming on-chain. With a market size of $527.8 million (4.29% share), these funds are now accessible to a broader investor base.Platforms like Superstate, BCAP, and Apollo are turning exclusive investment strategies into digital tokens that can be traded, held, or used in DeFi. This shift opens up new, stable income opportunities for a wider range of investors, all with the security and transparency of blockchain.

- Real Estate

Imagine owning a piece of a fancy apartment in Paris or a warehouse in Germany, not the whole building, just a small slice. RWAs allow real estate to be divided into small tokens. You can buy a share, earn rent, and even sell your piece later all digitally.It makes investing in property possible for people who don’t have millions

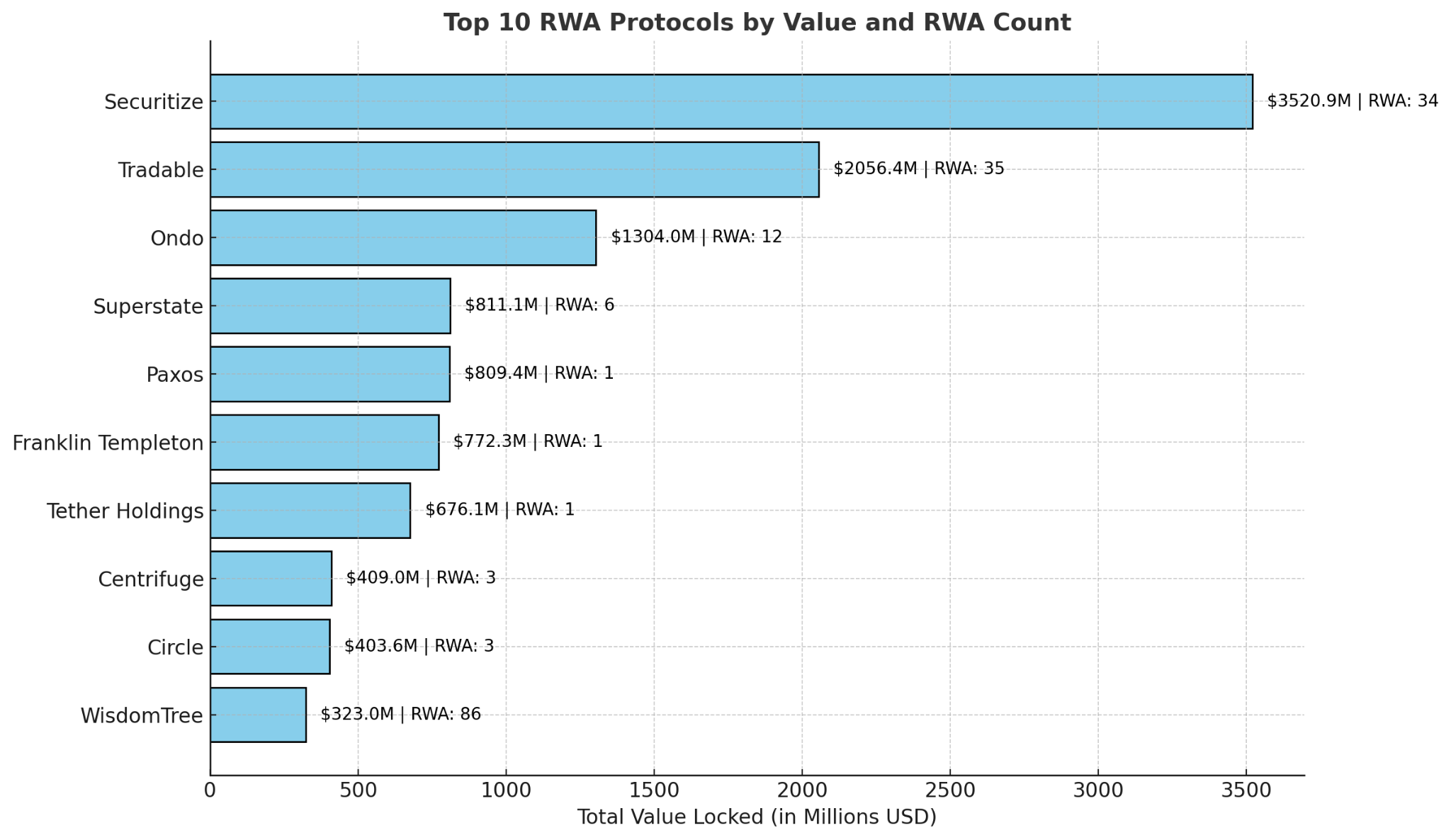

Fig: RWA by Protocols and RWA Count

Now that we've introduced the main categories of Real-World Assets (RWAs), let’s take a closer look at each one, exploring how they aim to solve real-world financial problems, how their tokenized markets are growing, and what limitations still exist. The key question we’ll ask throughout: Are RWAs truly reshaping global finance for the better, or simply reinventing the old system in a digital form?

1. Tokenized Treasuries: A New Era of Safe Yield

What If Anyone Could Invest in U.S. Bonds? Even From a Village in Kenya or a Café in Argentina?

For decades, the safest investment in the world, U.S. government bonds (Treasuries), has been mostly limited to wealthy individuals and institutions in developed countries. If you didn’t have thousands of dollars, access to a foreign brokerage, and the right passport, you were locked out. But today, something big is changing.

These traditional financial assets are being tokenized, meaning they're turned into digital tokens that can be bought, sold, and held just like cryptocurrencies. These digital assets are called Real-World Assets (RWAs). And one of the most powerful examples? Tokenized U.S. Treasuries.

Let’s break this down.

When we talk about tokenized U.S. Treasuries, we are referring to short-term debt instruments issued by the U.S. government traditionally used to raise funds now represented in digital form on blockchain networks. This innovation allows individuals around the world, including those without access to traditional financial systems, to invest using just an internet connection and a crypto wallet. Tokenized Treasuries offer several advantages over their traditional counterparts: they typically have low entry points (often as little as $1 to $100), enabling broader participation; they are available 24/7, unlike conventional financial markets; and they allow for instant transfers and settlement. Additionally, the use of blockchain technology enhances transparency, making ownership, transactions, and yields more visible and verifiable in real time.

2. How Does It Work?

Here’s what happens when you invest in a tokenized U.S. Treasury product:

Choose a Platform: You visit a platform like Ondo Finance, OpenEden, or Securitize.

Complete KYC: You go through a Know Your Customer (KYC) process to verify your identity and eligibility.

Deposit Funds: You deposit money either in USDC (a stablecoin) or via a bank wire (typically for larger amounts).

Receive a Token: Once the tokenization process is complete, you receive a digital token such as USDY, OUSG, or TBILL. These tokens are fully backed by real U.S. Treasury assets, meaning each token represents a claim on a portion of short-term government debt held by a regulated custodian. As a holder, you begin earning yield automatically either through a daily rebasing mechanism that increases your token balance or via gradual price appreciation.

Behind the scenes of tokenized U.S. Treasuries lies a carefully structured and regulated process. First, the actual U.S. Treasury securities are securely held by a licensed and regulated custodian such as JPMorgan or State Street. These institutions are responsible for the safekeeping and integrity of the underlying assets. Next, a platform or issuer such as Ondo Finance or BlackRock (often working through partners like Securitize) manages the portfolio of Treasury bonds. They are in charge of issuing the blockchain-based tokens that represent ownership or economic exposure to these real-world assets.

The link between the digital token and the underlying treasuries is established through a legal contract, not a smart contract. While smart contracts facilitate on-chain transactions and automation, they cannot enforce claims over real-world assets like U.S. Treasuries, which require off-chain legal agreements. This structure ensures that holders of the token have a legally enforceable claim or entitlement to the real securities or their cash flows, blending traditional finance safeguards with blockchain transparency and programmability.

The Risk to Understand: You don’t directly own the bond you own a claim to it. If the platform fails, gets hacked, or is shut down, you could lose access to your funds. The bond is safe, but your ability to redeem it depends on the platform’s trustworthiness.

In traditional finance, trust is placed in governments and regulated financial institutions. In tokenized finance, trust shifts to smart contracts, custodians, and protocol governance. That’s why it’s essential to know who the issuer is and where the underlying assets are held. Trustworthy issuers and regulated custodians, like JPMorgan or State Street, add credibility and security. Always review the legal agreements and understand your redemption rights to know exactly what your token represents. Most importantly, choose platforms that are transparent and comply with regulations to ensure your investment is protected

3. Why Do Tokenized Treasuries Matter?

Traditionally, access to U.S. Treasuries, the world’s most trusted and stable financial assets, was limited to a privileged few. You typically needed a minimum of $1,000 or more to get started, along with a U.S.-based brokerage account something not easily accessible for international investors. The process was often slow and involved paperwork, making it less convenient for modern, digital-first investors.

For most individuals in developing countries or without access to advanced banking infrastructure, U.S. Treasuries were simply out of reach.

That’s changing. With tokenized treasury products like Ondo’s USDY, BlackRock’s BUIDL, and OpenEden’s TBILL,and many more, anyone with a smartphone and an internet connection can now:

- Store savings in digital dollars

- Earn 4–5% annual yield, backed by real U.S. government debt

- Bypass capital controls and avoid unstable local banks

- Start investing with as little as $1, using stablecoins like USDC

This is a major shift in global finance. Tokenized Treasuries are not just more efficient they’re more inclusive. They bring safe, yield-generating assets to people who’ve never had access before, from students in Ghana to small business owners in Vietnam.

And this is only the beginning.

4. A Short History of Money and the Erosion of Currency Value

To understand the rise of tokenized real-world assets (RWAs), it helps to step back and look at the long arc of money itself.

In early societies, money wasn’t coins or paper, it was objects of shared value like shells, stones, or beads. These items were scarce, durable, and trusted across communities. As civilizations grew, money evolved into metal coins, then paper currency, and eventually digital entries in centralized bank ledgers. Each evolution made money easier to transfer, store, and verify, but it also gave more power to central authorities.Over time, this power has often been misused.

From the Roman Empire debasing the silver content in its coins to more recent cases like Zimbabwe and Venezuela, history shows that governments frequently erode the value of money through inflation, overprinting, or fiscal mismanagement. Even stable currencies like the U.S. dollar have steadily lost purchasing power; what cost $1 in 1950 costs over $12 today.

This erosion is especially harmful in emerging markets, where local currencies can be volatile and inflation unpredictable. In such environments, storing wealth in local money can be a losing battle.

That’s why the move toward digital, programmable assets backed by real value, like tokenized U.S. Treasuries, is so significant. It isn’t just a tech upgrade; it’s the next phase in the story of money. It reflects the same human need that drove early barter systems and coinage: a secure, trusted store of value that transcends borders and politics.

Real-World Assets (RWAs) on-chain are a modern answer to an ancient question: How do we preserve value over time?

What Problems Do Tokenized Bonds Solve?

While many tokenized products are still geared toward institutions, the benefits of tokenizing bonds go well beyond access. They address long-standing pain points on both sides of the market for issuers who create them and for investors who need them.

For Issuers: Efficiency, Transparency, and Global Reach

- Reduced Cost and Friction: In traditional finance, issuing a bond involves banks, brokers, custodians, lawyers, you name it. Each layer adds cost and delay. Tokenized bonds use smart contracts to automate much of this, reducing both cost and complexity.

- Borderless Distribution: Most bonds today are limited to investors in certain regions. Tokenized bonds can be distributed globally to anyone with a wallet and internet connection, no bank account or broker needed.

- Programmable Compliance Manual checks for things like lock-up periods and investor eligibility are outdated. Tokenized assets can embed these rules directly into the token, making compliance faster and more secure.

- Real-Time Transparency: On-chain tokenization means issuers see ownership and fund flows instantly, not quarterly or monthly. This makes fund management and reporting dramatically more efficient.

For Investors: Access, Flexibility, and Control

-

Global Access to Safe Yield: In countries like Argentina or Nigeria, where inflation is high and the dollar is hard to get, tokenized Treasuries offer a lifeline. They let users earn stable interest, without needing access to a U.S. bank.

- Fractional Investing: Previously, you needed thousands to buy bonds. Now you can start with min. $1 to $100. Platforms like OpenEden make it possible for everyday people to build dollar-based savings in a trust-minimized, secure way.

- 24/7 Liquidity & Fast Settlement: Selling a bond used to take days. Now, you can trade and transfer tokenized bonds instantly, just like a stablecoin.

- DeFi Utility Tokens like rUSDY and OUSG can be used as collateral in DeFi apps like Flux and Morpho. This means investors can borrow against their bonds, earn extra yield, or plug them into yield strategies.

-

Transparency & Self-Custody: Tokenized bonds can be held directly in your crypto wallet, no third party required. You get real-time updates on yield, value, and ownership, without relying on brokers or banks.

Tokenized U.S. Treasuries: Market Snapshot and Who’s Participating

As of 2025, the tokenized U.S. Treasury market has surpassed $7 billion[[1]] in total value locked (TVL), marking an explosive growth from just $114 million in early 2023. There are currently 46[1] active tokenized treasury products spread across multiple chains like Ethereum, Solana, Polygon, and Avalanche. These products are issued by a mix of asset managers, DeFi-native protocols, and traditional institutions, and together they represent a new frontier in how governments, companies, and individuals engage with public debt.

Out of the 46 products:

- 10 are accessible to retail investors

- Only 5 of those 10 are available to non-U.S. retail users

- The remaining 36 products are exclusively for institutional investors, accredited investors, or qualified purchasers

- A large portion of the offerings are geographically restricted, with over 40 countries blocked on many platforms due to regulatory concerns

So, despite the promise of "global access," the reality today is that tokenized Treasuries are still mostly an institutional product with true retail inclusion remaining a work in progress.

Top 4 Tokenized U.S. Treasury Products by Market Cap

While dozens of platforms now offer tokenized access to U.S. government bonds, just four products dominate the market. Together, USDY, OUSG, BUIDL, and BENJI represent nearly 60% of the total tokenized U.S. Treasury ecosystem. These leaders indicate where the space is heading: a mix of institutional-grade infrastructure, with growing interest from retail and DeFi users, but also significant barriers still in place.

Let’s take a closer look at each:

1. BUIDL – BlackRock / Securitize

BUIDL, launched by BlackRock in collaboration with Securitize, is one of the largest tokenized U.S. Treasury products, with a market cap of approximately $2.88 billion. Designed specifically for large institutional investors, BUIDL offers a yield of around 4% and requires a minimum investment of $5 million in USDC. It serves as a powerful tool for institutional treasury management and is increasingly being integrated into DeFi ecosystems, including protocols like MakerDAO and Ondo, where it can be used as high-quality collateral.

BUIDL is the largest product in the tokenized treasury space. Issued by BlackRock and tokenized via Securitize, it offers blockchain-native access to a U.S. government money market fund. It combines daily liquidity with real-time NAV, tailored for institutional capital.

Strictly limited to qualified institutional buyers with a high minimum investment, making it inaccessible to most retail users and smaller firms.

2. USDY – Ondo Finance

USDY, issued by Ondo Finance, has a market cap of approximately $631 million and is tailored for non-U.S. retail and accredited investors. Offering a yield of around 4.25%, USDY is available across multiple blockchains, including Ethereum and Solana, enhancing its accessibility and flexibility. It’s commonly used for savings, cash management, and as collateral in DeFi applications, making it a versatile option for users seeking stable, interest-bearing digital assets backed by U.S. Treasuries.

USDY is one of the most retail-accessible tokenized treasury products, backed by short-term U.S. Treasuries and demand deposits. It comes in two formats:

- USDY (accumulating): Increases in value daily

- rUSDY (rebasing): Increases in quantity to reflect yield

Although designed for non-U.S. retail, USDY remains restricted in over 40 countries due to regulatory and compliance constraints. Also, tokens are only minted after a 40–50 day lock-up.

3. OUSG – Ondo Finance

OUSG, another offering from Ondo Finance, holds a market cap of approximately $615 million and is designed for institutional investors, specifically U.S.-based Qualified Purchasers. With a yield of around 4.07%, OUSG is commonly used for DAO treasuries, capital preservation, and as a stable, yield-generating reserve in DeFi treasury management. Its institutional-grade structure and focus on regulatory compliance make it a preferred choice for large-scale, strategic capital deployment.

OUSG provides institutional-grade exposure to short-term U.S. Treasury ETFs. It’s especially popular among DAOs and DeFi-native treasuries, and integrates with protocols like Flux and Morpho.

Only available to U.S. Qualified Purchasers, with low on-chain liquidity and limited DeFi composability due to its security token classification.

4. BENJI – Franklin Templeton

This product is a tokenized U.S. government money market fund designed for both institutional investors and U.S. retail clients accessing it through brokerage channels. It offers daily yield payouts and real-time net asset value (NAV) updates, providing transparency and liquidity. Fully compliant with SEC regulations, it allows investors to gain tokenized exposure to a traditional mutual fund, combining regulatory safeguards with the convenience of blockchain technology.

BENJI brings Franklin Templeton’s government money market fund on-chain. With daily yield reporting and full regulatory compliance, it’s a benchmark example of TradFi merging with blockchain.

While technically accessible to U.S. retail investors, access requires going through a traditional brokerage, limiting permissionless use and DeFi-native integration.

What These Four Tell Us

- Institutional dominance is clear: three of the top four are geared toward large investors.

- Retail access is growing, but remains fragmented and highly jurisdiction-dependent.

- DeFi utility is increasing, but tokenized Treasuries are still often semi-permissioned, highlighting the balance between innovation and regulation.

These four products aren't just financial tools—they're shaping the infrastructure of tomorrow’s global capital markets.

If They Can Buy Direct, Why Are Institutions Going On-Chain?

What we've seen in the top 4 tokenized U.S. Treasury products is clear: institutional players dominate the space. Platforms like BlackRock’s BUIDL and Ondo’s OUSG are built for large investors, with minimum investment thresholds, regulatory compliance layers, and custodian-backed security.

But that raises a logical question: If institutions can already buy U.S. Treasuries directly through traditional brokers or custodians, why go on-chain at all?

Here’s why tokenization still adds powerful value for institutions, too

-

Faster Settlement: On-chain Treasuries settle instantly, unlike the 1–2 day delays in traditional markets.

-

24/7 Liquidity: Institutions can trade or rebalance anytime, not just during market hours.

-

Programmability: Smart contracts enable automated yield, compliance, and fund logic.

-

DeFi Integration: Tokenized Treasuries can be used as collateral in protocols like Morpho or MakerDAO.

-

Real-Time Transparency: Blockchain provides instant, auditable tracking of holdings and activity.

-

Future-Readiness: Tokenization helps modernize legacy infrastructure and prepares firms for an on-chain financial future.

In short, tokenized Treasuries aren't just about access, they're about efficiency, automation, and integration with the next generation of finance.

Global Impact: A Lifeline for Small Economies—or a Double-Edged Sword?

Tokenized treasuries aren’t just a technological milestone; they have the potential to be a lifeline for individuals in fragile economies.

In many developing countries, inflation, currency devaluation, and unstable banking systems make it difficult, sometimes impossible, for people to save or build wealth. In such places, the ability to hold dollar-backed assets like USDY or TBILL on a smartphone could be transformative.

For the first time, people in countries like Argentina, Turkey, or Nigeria can:

- Store value in a stable currency

- Earn a 4–5% yield backed by U.S. Treasuries

- Bypass capital controls, failing banks, and political instability

In that sense, tokenized treasuries aren’t just another crypto feature; they could be a new kind of financial infrastructure. But here’s the twist:

The Risks and Realities Behind the Promise

1. True Global Access? Not Yet.

Despite all the marketing around “open access,” most tokenized treasury platforms still enforce strict geographic and investor restrictions.

More than 40 countries are blocked from participating, including:

- Most of Africa

- Parts of Asia (e.g., Iran, Afghanistan, North Korea)

- Much of Latin America

Why? Mostly regulatory and compliance concerns. Platforms like Ondo’s USDY or OUSG require users to be accredited investors or qualified purchasers, often proving high net worth or income.

So while the technology enables access, legal frameworks still limit who can benefit. For now, most small savers in the Global South are still on the sidelines.

Dollarization: Helping Individuals, Hurting Nations?

In countries facing high inflation, people are increasingly turning to stablecoins and tokenized dollars as a safer way to store value. For example, in Argentina, where annual inflation has surged above 200%, many citizens have adopted digital dollars like USDC or USDT to protect their savings. This move offers individuals much-needed financial stability but it also raises concerns at the national level.

As more people and businesses adopt digital dollars:

- Local currencies may weaken further

- Central banks could lose control over monetary policy

- Capital outflows might accelerate, especially during crises

- Remittances may bypass traditional banking systems, reducing foreign exchange reserves

Take Brazil, for instance. The Brazilian central bank has flagged growing concerns about the use of U.S. dollar-backed stablecoins for remittances. Around 90% of crypto flows in Brazil involve stablecoins, which are often used to send money abroad without going through official banking channels. This makes it harder for the central bank to monitor capital movements, manage currency stability, and maintain healthy foreign reserves. (Reuters, May 2025)

While digital dollars empower individuals especially in unstable economies they may also weaken national financial systems. It’s a delicate balance between personal security and systemic stability that policymakers and innovators must navigate carefully.

3. New Technology, Same Old Bottlenecks

Even in this cutting-edge space, some old problems persist:

- Compliance Delays: Products like USDY require a 40–50 day lock-up period before tokens are tradable, slowing user access and flexibility.

- Centralized Custody: Most real-world assets are still held by traditional custodians (e.g., JPMorgan, State Street), creating points of central control.

- Limited Composability: Some tokens can’t be used in DeFi protocols, or have legal limitations that restrict their utility compared to truly native on-chain assets.

So while we’ve made huge progress, the revolution is still midway through its journey. The rails are being built, but not everyone is riding them yet.

Limitations and Risks: What’s Still Holding Back Adoption?

Despite the promise of tokenized Treasuries' speed, global access, and programmable yield, several critical barriers still limit widespread adoption. These challenges impact both retail users and institutions, and in some cases, undermine the very benefits these products aim to deliver.

Let’s explore the key limitations, with real-world examples:

1. KYC and Eligibility Barriers

Most platforms require users to undergo Know Your Customer (KYC) verification and, in many cases, prove they are accredited investors or qualified purchasers.

Example: To invest in Ondo’s OUSG, users must meet strict U.S. regulatory definitions and complete documentation. Similarly, BlackRock’s BUIDL requires a minimum of $5 million and is limited to institutional investors.

This excludes most global retail users, especially in developing countries from participating.

2. Delayed Token Minting (40–50 Days)

Many tokenized Treasuries have a waiting period after investment before tokens are issued, due to securities law compliance like Rule 144A.

Example: With USDY, users receive a “temporary global certificate” first. Actual tokens are only minted 40–50 days later, delaying liquidity and DeFi utility.

This slows down onboarding and creates confusion for new users expecting instant access.

- Custodial & Counterparty Risk

Although the underlying assets (U.S. Treasuries) are safe, your access depends on centralized entities, issuers, custodians, and smart contract operators.

Example: If a platform like Securitize (BUIDL) or Ondo faces a technical failure, legal issue, or gets shut down, users may lose access to their assets even though the Treasuries themselves are fine.

Unlike self-custodied crypto, users rely on intermediaries for redemption and trust, reintroducing TradFi risks.

4. Limited DeFi Utility and Composability

While some tokens are DeFi-compatible, many tokenized Treasuries are restricted or semi-permissioned, limiting their use in decentralized applications.

Example: OUSG is recognized in DeFi protocols like Morpho, but still cannot be freely traded or composably used like a native token due to its security status.

This reduces the ability to borrow, lend, or deploy yield strategies across DeFi ecosystems.

5. Jurisdictional Restrictions

Many platforms block access to 40+ countries, including most of Africa, Latin America, and parts of Asia.

Example: USDY excludes users from countries like India, Venezuela, North Korea, and nearly all of Africa, except a handful of exceptions like Nigeria or South Africa.

This undermines the goal of global access and financial inclusion for unbanked or inflation-affected populations.

While tokenized Treasuries represent a major leap in financial technology, they still face legacy roadblocks. From onboarding delays to legal walls, the path to truly global, permissionless, and retail-friendly treasury markets remains under construction. Solving these issues is the next frontier for unlocking their full potential.

The Future: What Comes Next?

Tokenized U.S. Treasuries remain a small segment compared to the traditional bond market about $7 billion versus over $28 trillion in conventional bonds but they are growing rapidly. In 2023 alone, the market experienced an impressive 641% growth and now serves over 18,000 users across various DeFi protocols. Major financial institutions like BlackRock, Franklin Templeton, and Ondo back these tokenized assets, lending them credibility and momentum.

If this adoption trend continues, we could soon see tokenized Treasuries integrated into everyday financial tools such as payroll systems, savings apps, and remittance services. Local banks may also begin offering direct access to tokenized bonds. Industry experts, including McKinsey, predict that tokenized assets could reach a $2 trillion[3] market size by 2030, signaling a transformative shift in how financial assets are accessed and managed.

2. Investing Unchained: The Rise of Tokenized Stocks in a Decentralized World

From Wall Street to Web3—how owning a piece of Apple or Tesla is now just a wallet away.

Welcome to the Future: Stocks Meet the Blockchain

Imagine you're in Lagos, Manila, or Buenos Aires. You’ve saved up a little money, but your local currency keeps losing value due to inflation. You want to invest in something stable, maybe Apple, Microsoft, or Tesla. However, gaining access to U.S. stocks typically requires a broker, a U.S. bank account, and sufficient capital to purchase whole shares. Now imagine this instead: you open your crypto wallet, and with just $5 worth of stablecoin (like USDC), you buy a token that represents a slice of Apple stock. No middlemen. No trading hours. No borders.

Welcome to the world of tokenized stocks, traditional equities reimagined for a decentralized, always-on global economy. These aren’t fake or “pretend” versions of stocks. Tokenized stocks are real shares held by licensed custodians, mirrored onto the blockchain. It’s like owning Apple stock but in a crypto-native, globally accessible format.

What Is a Tokenized Stock?

A tokenized stock is a digital asset that represents ownership in a real-world stock, like Apple (AAPL), Tesla (TSLA), or the S&P 500 ETF (SPY). Each token is backed 1:1 by an actual share held by a licensed custodian. That means if you hold 1 tokenized Apple share in your crypto wallet, somewhere in a traditional brokerage or bank, one real Apple share is held in custody on your behalf.

This isn’t synthetic or simulated exposure. It's direct, blockchain-based ownership of a real asset secured by the same legal structures that underpin traditional equities, but made programmable and globally accessible.

How It Works: From Wall Street to Your Wallet

In the traditional financial world, buying a share of a company like Apple or Tesla involves going through a regulated broker, linking a bank account, and often navigating trading hours and jurisdictional limitations. That model has worked well for decades, but it excludes billions of people worldwide who don’t have access to U.S. brokers or the right banking infrastructure.

Enter tokenized stocks: a revolutionary blend of traditional finance and blockchain technology that brings real-world equities onto the decentralized web.

The Process: How It Works Behind the Scenes

To understand the mechanics, let’s walk through the lifecycle of a tokenized stock:

-

Acquisition and Custody: A regulated financial institution (such as a broker-dealer or custodian bank) buys the actual stock, say 1,000 shares of Apple, on a traditional stock exchange like NASDAQ. These shares are stored in a segregated account, typically held under a legal structure such as a Special Purpose Vehicle (SPV) or a trust.

-

Token Creation: Using blockchain infrastructure, the custodian or issuing platform then mints 1,000 digital tokens, each representing 1 share of Apple, and deploys them as smart contracts on a public blockchain (like Ethereum, Polygon, or Base). These tokens are cryptographically secured and traceable on-chain.

-

On-Chain Trading: Once minted, these tokens can be bought, sold, or traded just like cryptocurrencies. Investors use stablecoins such as USDC, DAI, or USDT to purchase these assets, removing the need for traditional fiat rails or bank accounts.

-

24/7 Market Access: Unlike traditional stock markets that operate during business hours, tokenized stocks can be traded 24/7, including weekends and holidays. This unlocks continuous, borderless access to global equities, whether you're in New York or Nairobi, London or Indore.

-

Redemption (Optional): Some platforms also offer a redemption mechanism. If you hold a full tokenized share, you may be able to redeem it for the underlying asset or cash equivalent, depending on the platform’s terms, compliance status, and jurisdiction.

Under the Hood: Smart Contracts and Legal Compliance

The backbone of tokenized stocks lies in smart contracts—self-executing code on the blockchain that automates ownership, transfers, and regulatory compliance. These contracts often embed investor protections, such as:

- Whitelisting (to enforce KYC/AML rules)

- Transfer restrictions (to comply with local securities laws)

- Real-time audit trails (visible on-chain to anyone)

Moreover, the legal structure ensures that token holders are the beneficial owners of the real-world stocks, even if the shares themselves are held in a centralized custodian account.

This approach blends the legal rigor of traditional finance with the programmability and openness of Web3, creating a new kind of financial asset: fully regulated, yet decentralized.

Platforms Bringing Stocks On-Chain

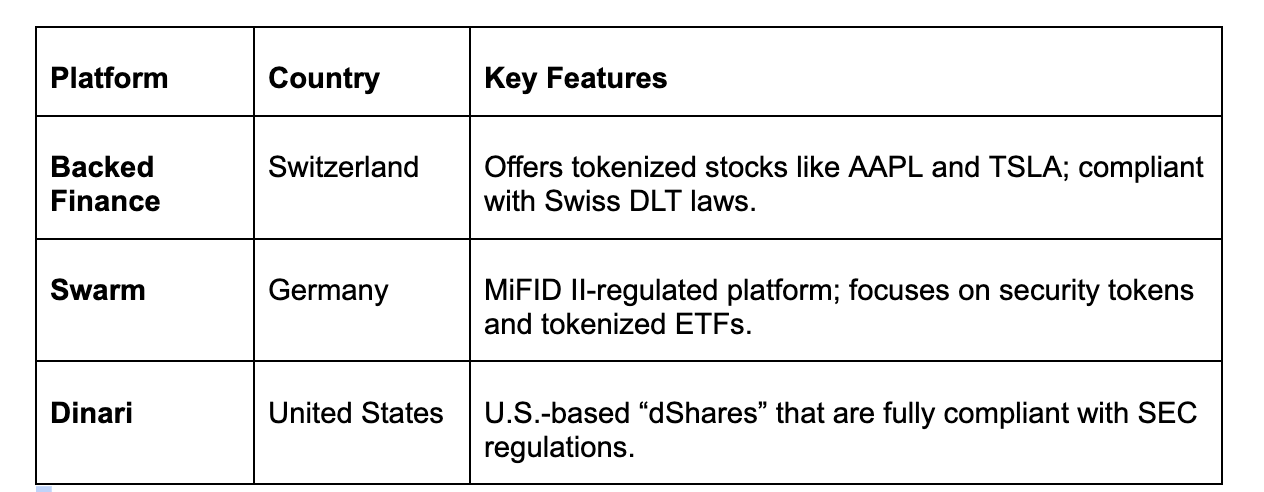

Several platforms have already launched live, regulated, tokenized stock products, each with its own regional flavor and technical approach:

Why This Matters: Smashing Barriers to Investing

For decades, investing in stocks has been a privilege of the few, those with access to brokers, bank accounts, and hundreds of dollars to spare. But what if the ability to own a piece of Apple or Microsoft wasn’t locked behind borders, paperwork, or income level?

Tokenized stocks are flipping that script. By turning traditional equities into blockchain-based assets, tokenized stocks are removing the old barriers and creating a more inclusive financial future.

Traditional stocks versus tokenized stocks across key features:

Traditional stocks require a broker and usually have a more minimum investment, while tokenized stocks can be purchased with just a crypto wallet and often allow fractional ownership starting at low. Trading traditional stocks is limited to standard market hours 9 am to 5 pm on weekdays whereas tokenized stocks trade 24/7, including nights, weekends, and holidays. Additionally, traditional stocks are subject to geographic restrictions and limited accessibility, but tokenized stocks offer borderless, global access to anyone with an internet connection.

A Gateway to Economic Inclusion

This shift isn’t just about making Wall Street digital. It’s about opening the gates to the 1.7 billion unbanked people worldwide, those who’ve been locked out of the global financial system simply because they lack access to a traditional bank.

Tokenized stocks offer investors a powerful combination of benefits. They serve as a hedge against local economic instability by providing exposure to stable, diversified global companies. Beyond merely preserving wealth, tokenized stocks give people the opportunity to actively build wealth through accessible and flexible investment options. Most importantly, they act as a bridge to global financial markets opening doors for individuals who previously had limited or no access to international equities, enabling truly borderless participation in the world economy.

In essence, tokenized stocks democratize investing. No brokers. No borders. No banks. Just an opportunity.

Real-World Impact

Nowhere is this transformation more powerful than in regions grappling with unstable currencies and economic restrictions. Take:

- Venezuela or Turkey, where inflation regularly erodes savings

- Nigeria or Lebanon, where accessing U.S. dollars is difficult

- India or the Philippines, where investing in U.S. stocks traditionally required costly intermediaries

For people in these countries, tokenized stocks offer more than investment—they offer financial survival. Instead of watching local currency lose 30–50% of its value in a year, individuals can now preserve wealth in the form of Apple, Tesla, or Microsoft shares all through a smartphone and crypto wallet.

Solving Real Problems: What Tokenized Stocks Fix

Tokenized stocks aren’t just a shiny new tool in the crypto world—they’re a solution to some of the most frustrating and systemic problems in traditional finance. From everyday users in emerging markets to fintech platforms trying to bridge old and new finance, tokenized equities are unlocking unprecedented opportunities.

For Everyday Investors: Access, Ownership, and Control

In the traditional world of investing, barriers abound. You need a brokerage account, government-issued ID, and often hundreds of dollars just to buy a single share. Trading is restricted to business hours, and navigating the paperwork can feel like learning a new language.

Tokenized stocks change that equation entirely.Here’s how:

1.Global Access (No Borders, No Banks): If you have a smartphone and internet connection, you can now invest in global giants like Apple, Tesla, or Microsoft. Whether you’re in Nairobi or New York, Istanbul or Jakarta, the playing field has been leveled.

-

Simplicity (Invest With Stablecoins, No Broker Needed): No need for a brokerage account or fiat bank. Using stablecoins like USDC, DAI, or USDT, anyone can buy tokenized shares directly through decentralized apps. It's as simple as swapping crypto no third-party intermediaries required.

-

Fractional Ownership: High stock prices no longer lock you out. Want a piece of Amazon but can’t afford $3,000 per share? No problem. Tokenized stocks offer fractional shares, so you can invest with as little as $1 owning a slice of the stock and its future.

-

Self-Custody (You Hold the Keys): Unlike traditional brokerages that technically hold your assets on your behalf, tokenized stocks can live in your personal crypto wallet. That means you own them directly no counterparty risk, no middleman, full control.

For Platforms and Fintech Builders: A Better Financial Rail

The innovation isn’t just on the user side. Tokenized stocks unlock entirely new capabilities for financial platforms, developers, and Web3 projects.

-

Wider Reach (Tap into Global Demand): By offering tokenized stocks, platforms can serve millions of users who’ve never had access to equities. From developing markets to crypto-native investors, the potential user base is massive and largely untapped.

-

Automated Compliance: Smart contracts bring built-in compliance tools: KYC verification, access controls, jurisdictional restrictions, and more. Instead of manually managing regulations, platforms can code them into the system from the start.

3. Programmability (DeFi Meets Real Stocks):

Perhaps the most powerful feature? Tokenized stocks are programmable assets. That means they can be:

- Used as collateral in crypto lending platforms

- Included in automated yield strategies

- Integrated into savings accounts or on-chain ETFs

Imagine earning interest on tokenized Tesla shares. Or sending tokenized Microsoft stock as a remittance. These aren’t just concepts—they’re already being built.

The Builders Behind the Movement: Who’s Making Tokenized Stocks a Reality

Every revolution has its pioneers and in the case of tokenized equities, a small but growing group of platforms is leading the charge. These builders are not just experimenting they’re launching fully live products, attracting global users, and navigating the complex world of regulation to bring stocks on-chain.

Let’s meet the key players shaping the future of investing:

-

Backed Finance (Switzerland): Real Stocks, Tokenized

Backed is a Swiss-based platform offering fully collateralized tokenized versions of some of the most iconic U.S. stocks and ETFs think Apple (bAAPL), Tesla (bTSLA), and more. These tokens are backed 1:1 with actual securities held by a licensed custodian in Switzerland, and they follow a rigorous compliance model. Backed has gained a reputation for transparency and precision, bridging TradFi and DeFi with Swiss quality.Fractional, fully-backed Apple and Tesla shares you can trade with stablecoins on-chain.

-

Swarm (Germany): Regulation-First Innovation

Swarm takes a different route building from the ground up with European regulatory compliance in mind. Based in Germany, Swarm is MiFID II-compliant, offering tokenized stocks and ETFs that prioritize investor protection and security. Their equity tokens are built for both retail and institutional users, with programmable compliance baked into every trade.Regulated stock tokens designed for secure, long-term investing with investor-first features.

-

Dinari (USA): The “dShares” Model

Dinari, operating out of the United States, has launched “dShares” fully regulated tokenized stocks that comply with U.S. securities law. Each dShare represents a real-world stock and is backed 1:1 by shares held in a brokerage account. Dinari is also pioneering DeFi integrations, allowing these dShares to be used in smart contract environments, while still adhering to the highest regulatory standards. Fully legal tokenized stocks available to U.S. and global users with on-chain capabilities.

-

Mirror/Agora: Synthetic, Not Backed

Not all tokenized stocks are created the same. Platforms like Mirror and Agora offer synthetic stock tokens digital assets that track the price of real-world stocks but aren’t backed by actual shares. Instead, they rely on price oracles and derivatives to mimic performance. While riskier, synthetics offer broader composability and fewer barriers to entry for DeFi-native investors.Borderless exposure to equities without needing real-world custody ideal for experimentation and DeFi use cases.

The Numbers: What the Data Tells Us About Growth

While tokenized stocks may still be a niche within the broader financial landscape, their growth is nothing short of explosive. As of May 2025, the total market size of tokenized equities has reached approximately $350 million[1], spread across a growing number of platforms. There are now over 40 tokenized stocks and ETFs available on-chain, including some of the world’s most iconic companies and indexes ranging from tech giants like Apple and Tesla to diversified funds like the QQQ ETF.

The momentum is accelerating. From 2024 to 2025, on-chain equity volume has surged by 125%, indicating strong and rising demand among investors. The user base is largely made up of global retail investors, especially those from regions with limited access to traditional financial markets. However, institutional players are beginning to test the waters as well, signaling that this trend may soon reach the mainstream.

Among the most popular assets, Apple (bAAPL) tops the charts, followed closely by Tesla (bTSLA) a favorite among growth investors. Microsoft (dMSFT) is gaining traction, particularly with institutions, while sQQQ, a tokenized version of the NASDAQ ETF, appeals to those looking for passive investment options within decentralized finance (DeFi) portfolios.

Although $350 million is just a sliver compared to the $124 trillion[6] global equity market, that’s exactly what makes this so exciting we’re still early. Even if just 1% of global stock trading moves on-chain, it would unlock a $1 trillion opportunity for tokenized equities.

All signs point to an industry in motion. More platforms are launching, more real-world assets are being tokenized, and more users especially from underserved and inflation-hit regions are embracing this new financial rail. Institutions are quietly stepping in, exploring pilot programs and potential integrations. What started as a crypto experiment is evolving into the infrastructure for a borderless, 24/7, and permissionless investment ecosystem one that could ultimately complement or even rival traditional financial systems like Wall Street.

What People Are Buying: Tokenized Stocks in Action

Tokenized stocks are no longer just theoretical innovations—they’re actively being used by a growing global community. As of May 2025, the tokenized equity market has reached $350 million[1] in value, covering 40+ tokenized stocks and ETFs. Growth is surging, with a 125% increase in on-chain stock sales year-over-year (2024–2025)[1], driven primarily by global retail users. Here are the top assets investors are actually buying, and what makes each of them stand out:

1. bAAPL – Tokenized Apple Stock

- Platform: Backed Finance (Switzerland)

- Market Share: ~30% of tokenized stock volume (RWA.xyz, May 2025)

- Custody: Real Apple shares held 1:1 by a Swiss-licensed custodian

- Use Case: Global tech exposure for everyday investors

Apple is the single most popular tokenized equity across platforms like Backed Finance. Its brand strength, historical performance, and global trust make it a go-to option for users in volatile economies.

Real-World Impact: In countries facing inflation or capital controls such as Nigeria or Argentina users are buying fractional Apple stock using stablecoins like USDC. A $5 investment in bAAPL allows them to hedge against currency devaluation and store value in one of the world’s most iconic companies.

2. bTSLA – Tokenized Tesla Stock

- Platform: Backed Finance (Switzerland)

- Market Share: ~18% of tokenized equity volume (RWA.xyz, May 2025)

- Custody: Fully collateralized Tesla shares held by a Swiss financial institution

- Use Case: Access to U.S. high-growth equities

Tesla appeals to users looking for growth and innovation—particularly in emerging markets where access to disruptive companies is limited. bTSLA allows anyone to participate in the EV revolution, regardless of geography or financial background.

Real-World Impact: A university student in the Philippines can invest $10 into bTSLA and gain exposure to a high-upside U.S. equity, bypassing both traditional brokers and minimum investment thresholds.

3. dMSFT – Tokenized Microsoft Stock

- Platform: Dinari (U.S.)

- Market Share: ~15% of tokenized equity volume (RWA.xyz, May 2025)

- Custody: Regulated under Dinari’s “dShares” framework with real MSFT shares

- Use Case: Institutional-grade equities brought on-chain

Microsoft is favored for its dividend history, stability, and institutional appeal. dMSFT is fully compliant with U.S. securities laws, making it one of the most regulated offerings in the space.

Real-World Impact:A fintech startup in Latin America could integrate dMSFT into a mobile savings app, offering users exposure to a stable, long-term equity without needing local investment licenses or traditional bank partnerships.

4. sQQQ – Tokenized NASDAQ ETF

- Platform: Swarm (Germany)

- Market Share: ~10% of tokenized equity volume (RWA.xyz, May 2025)

Custody: MiFID-compliant real ETF shares under German regulation - Use Case: Passive investing with diversification

sQQQ tracks the NASDAQ-100, offering broad exposure to the tech sector in a single token. It’s ideal for users who prefer index-style diversification rather than picking individual stocks.

Real-World Impact: A DeFi user in Argentina can use sQQQ as collateral in a yield farming strategy, combining passive investing with decentralized capital efficiency something nearly impossible in the traditional system.

The tokenized equities market hit ~$350 million in May 2025, with these four assets accounting for over 70% of all volume and user engagement. Their strength lies not just in the companies they represent, but in what they unlock for users around the world:

- Dollar-denominated savings in inflation-hit economies

- Access to high-growth equities for underserved youth

- Diversified tech exposure for DeFi power users

- Compliant on-chain infrastructure for fintech builder

This isn’t just about tokenizing Wall Street stocks. It’s about redistributing access to the financial system one smart contract at a time.

Freedom or Fragility? The Double-Edged Sword of Tokenized Stocks

Tokenized stocks are revolutionizing global finance by offering individuals unprecedented access to traditional equity markets. They bring hope, especially in regions grappling with inflation, currency collapse, or exclusion from legacy financial systems. But like any innovation, they come with trade-offs. Behind the promise of democratized investing lies a more complex picture one that demands careful attention to potential unintended consequences.

Let’s explore both sides of the coin.

The Upside: A Lifeline for the Underserved

-

Inflation Protection: In countries like Argentina, Turkey, or Venezuela, local currencies have lost over 50–90% of their value in the past decade. Tokenized stocks backed by strong global companies like Apple or Microsoft offer a way for citizens to preserve wealth. By converting their savings into tokenized U.S. equities using stablecoins like USDC or DAI, people can hedge against domestic economic instability.

-

Global Market Access: Traditionally, investing in U.S. stocks required going through brokers, banks, and regulatory hoops often inaccessible to the unbanked or underbanked. With a simple crypto wallet and stablecoins, anyone can now gain exposure to global markets through tokenized versions of leading stocks and ETFs, 24/7 and from anywhere.

-

Financial Inclusion at Scale: With over 1.7 billion people globally still unbanked, tokenized stocks unlock a door to long-term savings and capital markets. Fractional ownership allows users to start investing with as little as $1, making wealth-building tools accessible to communities that have historically been excluded.

The Trade-Offs: Risks That Can't Be Ignored

-

Capital Flight: As tokenized stocks become more accessible, there’s a real risk of money flowing out of struggling local economies and into U.S. markets. While this empowers individuals, it can also deprive domestic systems of vital liquidity. For example, if thousands in Nigeria or Egypt start storing wealth in Apple or Tesla tokens, local banks and businesses could see reduced deposits and capital availability.

-

Dollarization by Proxy: Most tokenized assets are linked to U.S. equities and priced in U.S. dollars. This creates an indirect form of dollarization—where people across the globe shift their financial behavior toward the U.S. financial system. Over time, this could weaken the role of national currencies and make entire economies more vulnerable to U.S. monetary policy or corporate performance.

-

Regulatory Pushback: Not all governments welcome this change. Some may view tokenized stocks as a threat to capital controls or monetary sovereignty. As a result, we could see more restrictions, licensing demands, or outright bans on platforms offering tokenized equities. In fact, regulatory tensions are already simmering in parts of Asia, Africa, and Latin America as crypto adoption outpaces traditional oversight.

Jurisdiction Matters: Are Tokenized Stocks Truly Global?

Based on the official restricted countries list from Backed Finance, their tokenized stock products are either prohibited or not offered in a total of 27 countries.This includes 4 countries where services are prohibited, and 23 where services are simply not available.

Tokenized stocks promise a new era of open, borderless finance allowing anyone, anywhere, to access shares in global companies using just a crypto wallet and stablecoins. However, while the technology may be decentralized and borderless, the regulatory environment is not. Jurisdictional restrictions remain one of the most significant hurdles preventing tokenized stocks from being truly global.

Despite the appeal of 24/7 on-chain access, many tokenized equity platforms are bound by the financial regulations of the countries in which they operate. As a result, platforms often restrict access based on user location, citizenship, or regulatory status. For example, Backed Finance, which offers tokenized stocks like bAAPL and bTSLA, blocks users from the United States, China, and other high-risk or non-compliant jurisdictions, in accordance with Swiss and EU financial laws. Similarly, Dinari, a U.S.-based platform offering dShares such as dMSFT, only permits users from select U.S. states and approved international jurisdictions. Swarm, operating under Germany’s MiFID II framework, may also restrict access to retail users in certain regions to remain compliant with European financial laws.

This means that while the assets themselves are tokenized and live on permissionless blockchains, actual user access is often controlled through geo-blocking, KYC (Know Your Customer) requirements, and AML (Anti-Money Laundering) compliance protocols. As a result, the reality is that tokenized stocks are not universally accessible. For instance, a user in Argentina might be able to invest in Apple stock via bAAPL, but someone in New York might be blocked from using the same platform due to SEC regulations even though both users are leveraging the same decentralized technology.

This creates a clear tension between compliance and openness. Fully regulated platforms like Dinari and Swarm are more attractive to institutions and long-term investors due to their legitimacy and transparency, but they sacrifice accessibility for global retail users. On the other hand, more open or synthetic approaches, like those previously seen on platforms such as Mirror Protocol, offer greater inclusivity but have also faced significant regulatory pushback, especially in the United States. In 2024, the SEC explicitly warned against offering tokenized stocks to U.S. investors without registration, prompting several platforms to restrict U.S. access altogether.

Looking forward, solving this dilemma will be crucial for the long-term viability and growth of tokenized equities. Some innovators are exploring hybrid approaches, embedding jurisdictional controls directly into smart contracts or developing “tiered access” models that differentiate between retail and accredited investors. Others are advocating for international regulatory coordination to create clear, consistent frameworks that can support cross-border tokenized stock offerings.

Until such frameworks are established, tokenized stocks will remain programmable and borderless in theory but jurisdictionally fragmented in practice. While the promise of global financial inclusion remains strong, the road to truly universal access will require not just technical innovation, but regulatory alignment across nations

Challenges Blocking Mass Adoption

Tokenized stocks offer a compelling vision for the future of investing: 24/7 access to global equities, fractional ownership, and seamless digital custody. Yet despite rapid growth and increasing interest, they remain a niche within the broader financial ecosystem. Why?

The answer lies in a set of key challenges technical, regulatory, and infrastructural that must be addressed before mass adoption becomes a reality. Here’s a breakdown of the major barriers and what’s being done to overcome them:

1. Custodial Risk: Who’s Holding the Real Shares?

At the heart of any tokenized stock is a real-world asset. But that raises a critical question: Who is holding the actual stock certificate in the traditional financial system?

Custodial risk refers to the potential failure or misconduct of the institutions that safeguard these real shares on behalf of token holders. If a custodian is underregulated, lacks transparency, or becomes insolvent, users may lose access to their assets even if the blockchain shows ownership.

Today, leading platforms like Backed Finance (Switzerland) and Dinari (U.S.) are addressing this with fully licensed custodians, regular audits, and transparent legal structures. However, until these practices become standardized and globally trusted, skepticism around custody will persist.

- KYC/AML Compliance: Balancing Access with Regulation

One of the defining features of crypto is the ability to transact without intermediaries. But tokenized securities are still securities and that means they must comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations in many jurisdictions.

Some users, particularly in regions with strict privacy laws or weak identification infrastructure, may find this burdensome or exclusionary. On the other hand, institutional investors and regulators require these safeguards to ensure legality and transparency.The challenge is striking the right balance: maintaining accessibility without compromising compliance. Emerging models like zero-knowledge KYC and embedded identity verification in wallets are promising steps in that direction.

3. Regulatory Gray Zones: Uncertainty Holds Back Growth

Tokenized stocks sit at the intersection of traditional finance and blockchain an area still largely uncharted by regulators. While some countries like Germany and Switzerland have introduced clear frameworks for digital securities, others (notably the U.S.) remain in flux.

In the U.S., the SEC has yet to definitively classify or regulate tokenized equities, leaving platforms and investors in a legal limbo. This lack of clarity discourages broader participation, especially among regulated institutions and fintech developers.

Until global regulatory bodies align on definitions and standards, jurisdictional uncertainty will remain a drag on adoption.

4. Liquidity Limitations: Few Buyers, Fewer Sellers

For any financial market to thrive, it needs liquidity—active buyers and sellers trading regularly. Despite the growing number of tokenized assets (over 40 stocks and ETFs across platforms as of May 2025), most see relatively low trading volume.

This can lead to high slippage, price inefficiencies, and poor user experience. Without deep and consistent liquidity, users may be hesitant to invest, fearing they won’t be able to exit their positions efficiently. Market makers, institutional on-ramps, and integration with decentralized exchanges (DEXs) are critical solutions currently in development to improve liquidity in this space.

- Smart Contract Bugs: A Technical Weak Point

While smart contracts power the automation and transparency of tokenized assets, they’re not infallible. Code vulnerabilities can be exploited, leading to asset loss or platform instability. As tokenized equities are integrated into DeFi protocols (e.g., loans backed by tokenized stocks), the complexity of interactions increases and so does the risk. Past DeFi exploits have cost users billions, and that memory still lingers.

To counter this, platforms are investing in third-party security audits, formal verification, and bug bounties. But for true institutional confidence, the industry will need to implement bank-grade security standards.

Solutions on the Horizon

Despite these challenges, the ecosystem is moving forward quickly. Innovations in multi-chain custody, regulated DeFi platforms, and smart contract insurance are actively addressing the bottlenecks to adoption. More importantly, as mainstream fintech firms and global regulators pay closer attention, the gap between crypto-native solutions and traditional investor expectations is starting to close.

In the words of one industry analyst: “The barriers to adoption are real but so is the momentum. We’re solving 20th-century finance problems with 21st-century infrastructure.”

Mass adoption may not happen overnight but with each iteration, the foundation grows stronger.

The Road Ahead: Trillions on the Table

Despite the current limitations, the long-term trajectory of tokenized stocks is highly promising. We're witnessing the early days of a transformation that could reshape global capital markets much like the rise of ETFs or internet banking did in past decades. According to RWA.xyz and industry forecasts, tokenized real-world assets (RWAs) including stocks, bonds, and commodities are expected to reach $16 trillion[5] in value by 2030. That’s more than 45x today’s ~$350 million tokenized stock market.

-

Mobile-First Platforms: User-friendly apps are already in development to let anyone buy tokenized equities with just a few taps eliminating the complexity of current crypto interfaces.

-

Bank-DeFi Bridges: Traditional financial institutions are beginning to integrate compliance-layered DeFi protocols, allowing tokenized stocks to exist within a legally acceptable, transparent framework.

-

On-Chain ETFs and Retirement Accounts: Tokenized ETFs and even on-chain pensions are emerging providing diversified exposure and long-term savings options through DeFi rails.

-

Cross-Border Remittances in Stocks: Imagine sending your family not just cash, but tokenized Apple shares. This is becoming possible with smart wallets that allow for instant, global remittance in stable tokens or tokenized equities.

-

DeFi Loans Backed by Stocks: Platforms now allow users to borrow stablecoins using tokenized Microsoft (dMSFT) or Apple (bAAPL) as collateral, blending the worlds of traditional equity and decentralized finance.

From Wall Street to Wallet Street

We are witnessing a profound shift in how capital flows and who has access to it. For the first time in history, someone in Lagos, Caracas, or Manila can own a piece of Apple, Microsoft, or Tesla without a broker, a bank, or even a stable local currency.Tokenized stocks don’t just change how we invest.They change who gets to invest.

From a $350 million niche to a multi-trillion-dollar frontier, the path ahead is clear: a more open, accessible, and programmable financial system that empowers people everywhere not just those with Wall Street connections.

And this time, the stock market lives on-chain.

- Tokenized Commodities: Gold, Oil, and Value You Can Hold Digitally

Think about this: your grandfather might have stored gold in a hidden box under his bed. You? You can now store it in your smartphone digitally, securely, and globally accessible.

Welcome to the world of tokenized commodities, where physical goods like gold, silver, and even oil are represented by digital tokens, tradable 24/7 on the blockchain. This isn’t the future, it’s happening right now.

Let’s break it down in a simple, story-like way so that anyone, anywhere, can understand how tokenized real-world assets (RWAs) like commodities are quietly transforming global finance.

- Why Commodities Matter in Finance

Commodities like gold, oil, silver, and platinum have always played a central role in the global economy. These are the real, tangible assets that power industries, preserve wealth, and stabilize financial portfolios. Gold is known as a safe-haven asset trusted for centuries to protect value during war, inflation, and market downturns. Oil fuels everything from transportation and power to manufacturing and logistics. Silver and platinum are essential to electronics, renewable energy, and medical technologies. In short, commodities are not just market instruments they’re the foundation of modern life.

For investors, commodities offer one key benefit: diversification. When stock markets tumble or inflation rises, physical assets like gold tend to hold their value or even increase. That’s why institutional investors like banks, pension funds, and hedge funds have always included commodities in their portfolios to reduce risk and protect wealth.

However, access to these assets hasn’t always been easy. Traditionally, buying commodities meant working with brokers, needing large amounts of money, and relying on custodians or vaults to store physical goods. For most people—especially in developing economies owning commodities like gold or oil was simply out of reach.

But as we’ll see, that’s now changing. Thanks to blockchain and tokenization, these once-elite assets are becoming available to anyone with a phone and an internet connection.

What Are Tokenized Commodities?

Tokenized commodities are physical assets like gold, silver, or oil represented by digital tokens on a blockchain. Think of it as wrapping a bar of gold in code. For example, if you own 1 gram of gold stored in a secure vault in Dubai, a token such as CGO (Comtech Gold) can be issued on a blockchain to represent that exact gram.

These tokens can move freely, just like cryptocurrencies. You can trade them 24/7, send them across borders instantly, or even redeem them for the physical commodity, depending on the platform. Behind the scenes, the real asset is fully insured, stored in professional vaults, and regularly audited to verify its existence.

Smart contracts manage the records, ensuring every token is backed by a real, physical item. So instead of needing trucks, shipping documents, and intermediaries to move commodities, you just send a token as easily as sending an email. It’s a digital leap that makes owning and transferring physical value faster, cheaper, and more accessible.

.

Global Access Without Borders

For decades, investing in commodities like gold was a privilege reserved for the financial elite. You needed access to brokers, bank accounts, and often lived in countries with strong financial infrastructure. The minimum investment amounts were high and the process was slow, paper-heavy, and limited by borders.Tokenization has changed all that.

Today, anyone with a smartphone and internet connection—whether in rural India or Lagos, Nigeria can download a crypto wallet and buy as little as $10 worth of tokenized gold like PAXG or CGO. There’s no need for a bank account, no lengthy paperwork, and no geographic limitations. The gold is securely stored in professional vaults, while your ownership is recorded on the blockchain.

This is more than just convenience it’s financial inclusion. Tokenized commodities are giving millions of people access to real, inflation-resistant assets for the first time. No banks. No borders. Just digital ownership of real-world value.

Tokenized Commodities in Action: Real Assets, Real Platforms

Now that we understand what tokenized commodities are and how they remove borders, let’s take a closer look at the platforms and tokens making this digital gold revolution a reality. These aren’t just experimental projects they’re regulated, audited, and backed by real-world assets. Each of these tokens is helping bring commodities from vaults into digital wallets, allowing users to hold, trade, and even redeem physical gold with just a few clicks..

1. Paxos Gold (PAXG)

-

What it is: A highly regulated token backed 1:1 by London Good Delivery gold bars

-

Custody: The gold is stored in Brink’s vaults in London.

-

Regulation: Issued by Paxos Trust Company, regulated by the New York Department of Financial Services (NYDFS).

-

Redemption: Users can redeem as little as 0.1 ounces of gold through Paxos.

-

Features:

-

Monthly third-party audits.

-

No custody fees.

-

Widely integrated into DeFi platforms like Aave and Compound.

-

Market Cap: Over $770 million as of May 2025.

-

Limitations: Not available to U.S. retail investors.

PAXG is considered one of the most trusted and transparent tokenized gold products. Its strong regulatory foundation makes it a go-to for institutional investors and DeFi users alike.

2. Comtech Gold (CGO)

-

What it is: A gram-based token, where each CGO represents 1 gram of 999+ purity gold.

-

Custody: Vaulted in DMCC-certified storage facilities in Dubai, with full insurance and third-party audit reports.

-

Regulation: Licensed by DMCC (Dubai Multi Commodities Centre) and Shariah-compliant, making it especially relevant in Islamic finance.

-

Redemption: Physical redemption is allowed for 1kg or more.

-

Unique Features:

-

Optional gold financing model where holders can lease gold to vetted traders.

-

Bi-yearly audits, low gas fees on the XDC Network, and global availability.

-

Market Cap: Approx. $11.3 million, with 389 verified holders and increasing monthly activity.

-

Accessibility: Available in most countries, including UAE, India, Africa, and Southeast Asia.

CGO is designed with financial inclusivity in mind, offering low-cost access, flexible redemption options, and compatibility with Islamic finance principles. It’s also gaining traction in regions underserved by traditional gold products.

3. Tether Gold (XAUT)

-

What it is: A token issued by TG Commodities S.A., backed 1:1 by LBMA gold stored in Swiss vaults.

-

Custody: Switzerland-based storage with full insurance.

-

Redemption: Minimum of 430 XAUT tokens (~430 ounces) to redeem a full gold bar.

-

Regulatory Jurisdiction: Based in El Salvador (post-2025 update); previously registered in the British Virgin Islands.

-

Limitations:

-

Not available to residents of the U.S., Canada, and Singapore.

-

Legal responsibility shifts to the user in case of vault issues.

-

Market Cap: Over $628 million as of May 2025.

-

Trading: Limited DeFi exposure but high liquidity on centralized exchanges.

XAUT is ideal for high-net-worth individuals and institutions looking for large gold positions, though its redemption size and limited legal protections may not suit smaller retail investors.

- Tangible and Troy: Expanding the Horizon

While gold dominates the tokenized commodity space, platforms like Tangible and Troy are extending the model to other assets, including:

- Oil-backed tokens, pegged to barrels of crude oil.

- Tokenized gold bars, redeemable through jewelry retailers.

- Real-world delivery options, creating a bridge between on-chain ownership and off-chain utility.

These platforms aim to tokenize energy, property, and industrial metals, bringing broader diversity to the RWA (real-world asset) ecosystem.

Together, these platforms are bridging the gap between traditional vaults and modern digital wallets. Whether you're looking for compliance and scale (PAXG), flexibility and Shariah-compliance (CGO), or institutional-grade storage (XAUT), there’s now a tokenized commodity product tailored to your needs.

For the first time in history, real assets like gold are becoming digitally accessible to everyone, regardless of location, wealth, or banking status.

This isn’t just about digital tokens,it’s about making global financial infrastructure fairer, faster, and more inclusive.

Benefits of Tokenized Commodities: Security, Liquidity, and Transparency

One of the main reasons people are turning to tokenized commodities is the combination of security, liquidity, and transparency they offer three qualities that traditional commodity markets have often struggled to deliver to everyday investors. With tokenized gold, silver, and oil, these barriers are being removed, making real assets easier to access, safer to hold, and simpler to trade.

Security is the foundation of trust in tokenized assets. When you buy a token like PAXG (Paxos Gold) or CGO (Comtech Gold), you’re not just getting a digital symbolyou’re buying a real piece of gold stored in an insured, professional vault. PAXG, for example, is backed by gold held in Brink’s vaults in London and regulated by the New York Department of Financial Services. Similarly, CGO is backed by gold stored in DMCC-certified vaults in Dubai, with insurance coverage and regular third-party audits. This means you're not relying on vague promises or paper claims you have legal rights to an actual asset, stored safely and professionally.

Liquidity is another major advantage. Unlike traditional gold markets that operate only during business hours and require brokers, tokenized commodities can be traded 24/7 on both centralized exchanges like Binance and Bitfinex, and decentralized platforms like Uniswap or XSwap. You can instantly buy or sell your gold tokens, convert them to crypto or fiat, and move them around the world with just a few clicks. According to data from RWA.xyz, tokenized commodity platforms processed over $1 billion in monthly transfer volume, showing strong and active market participation.

Transparency is perhaps where tokenized commodities shine the most. On traditional markets, you rarely get a clear picture of how much gold exists, who holds it, or how it's being managed. But with blockchain-based tokens, everything is visible. The number of tokens issued, current market cap, number of holders, and recent trades are all public and verifiable in real time. Platforms like RWA.xyz make this data accessible and easy to follow. As of May 2025, gold-backed tokens like PAXG, XAUT (Tether Gold), and CGO together represent over 98% of the tokenized precious metals market, with PAXG leading at around $773 million in market cap.

But perhaps the most important benefit is this: you control the asset, not a bank. With tokenized commodities, your gold or oil tokens sit in your own digital wallet. You decide when to trade, where to store them, and even whether to redeem them for physical delivery. In a world where financial systems are increasingly fragile and centralized institutions are being questioned, the ability to hold a secure, verified, and globally recognized asset in your own custody is nothing short of revolutionary.

Why Do We Need Tokenized Commodities When We Already Have Products Like Sovereign Gold Bonds?