Tokenized Real Estate: Transforming How We Invest in Property

Real-World Assets (RWAs) represent tangible, physical assets like real estate, commodities, or precious metals that are brought onto blockchain platforms through a process known as tokenization. Tokenization is the act of converting ownership rights of an asset into a digital token that can be stored, transferred, and traded on a blockchain.

RWA in real estate, what is it?

In the context of real estate, tokenization allows investors to own a fraction of a property, rather than the entire asset. This method democratizes access to real estate investments, making it possible for smaller investors to participate in markets that were previously inaccessible due to high entry barriers. Through the use of blockchain technology, tokenized real estate provides a transparent and efficient platform for buying, selling, and managing property assets, while also offering the potential for enhanced liquidity compared to traditional real estate markets.

Overview of Tokenized Real Estate Market

Current Market Size and Growth Trends

-

Market Valuation: The tokenized real estate market is still in its nascent stage but has shown promising growth, with the global market valuation estimated to reach several billion USD in the coming years.

-

Growth Rate: The sector will experience a compound annual growth rate (CAGR) of approximately 75% in the coming years, driven by increased interest from institutional investors and the rise of blockchain technology.

-

Adoption: Major cities and financial hubs like New York, London, and Dubai are becoming hotspots for tokenized real estate projects, reflecting the global spread and adoption of this innovative approach.

-

Market Drivers: Key factors contributing to the market’s growth include the democratization of investment opportunities, enhanced liquidity through fractional ownership, and the use of blockchain for increased transparency and security in transactions.

Key Players and Platforms

Blocksquare : Blocksquare is a pioneering platform in the realm of real estate tokenization, particularly relevant for the Rwandan market as it seeks to democratize property investment. By leveraging blockchain technology, Blocksquare allows for fractional ownership of real estate assets, making it accessible to a broader audience. This approach not only lowers the barriers to entry for individual investors but also enhances liquidity and transparency in real estate transactions.

Yield24: Yield24 operates on EVM-compatible chains and offers restaking to optimize assets such as BNB, ETH, and BTC. It functions on both L1 and L2, enabling users to stake assets directly or through liquid staking tokens. The protocol enhances cryptoeconomic security and integrates with various applications, including real-world assets and lending platforms, providing additional reward opportunities.

CitaDAO: CitaDAO is a decentralized finance (DeFi) platform that tokenizes real estate assets, allowing investors to gain exposure to and trade fractionalized ownership of properties on the blockchain. Founded in 2021 and based in Cardiff, Wales, CitaDAO aims to democratize access to high-value real estate investments by breaking down properties into smaller, more affordable tokens.

Parcl : Parcl is a decentralized trading platform that allows users to speculate on real estate markets by trading perpetual futures based on real estate price indexes. It operates without a central authority, meaning that accounts are non-custodial and trades are executed autonomously.

These players are at the forefront of the tokenized real estate market, each bringing unique offerings that contribute to the sector's expansion and maturation.

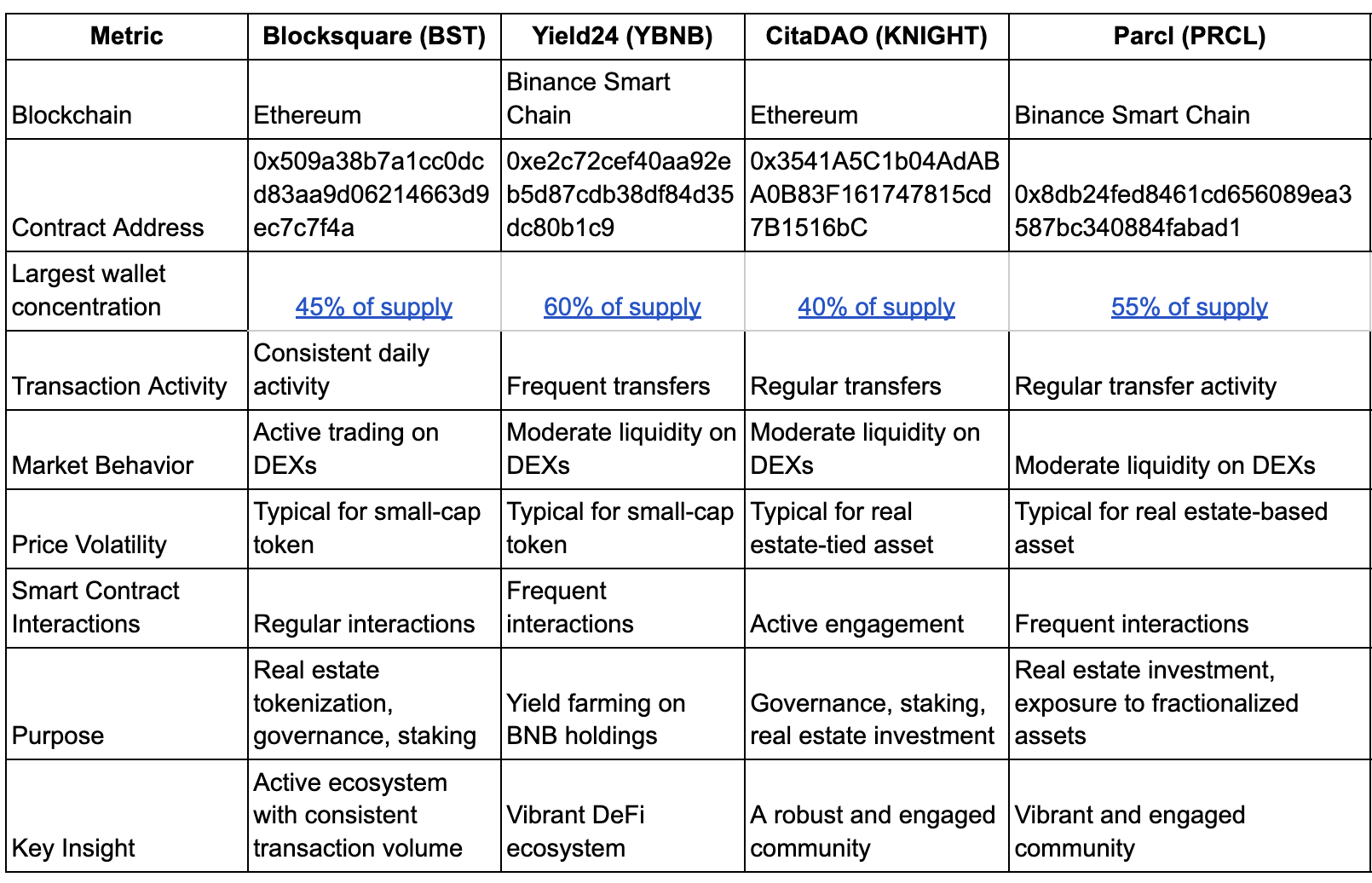

Analysis of Major Real Estate RWA Tokens

To provide a deeper analysis of these tokens and their on-chain activity, we can use Bitquery. By querying Bitquery’s blockchain data, we can gather insights into transaction volumes, investor demographics, token distribution, and market trends for each of these platforms. This data-driven approach will help us understand how these tokens are performing in the real estate market and their impact on the broader RWA ecosystem.

A. Blockchain Platforms Used

The foundation of real estate tokenization lies in the choice of blockchain platforms, which play a critical role in determining the efficiency, security, and scalability of the tokenized assets. Commonly used platforms in real estate tokenization include:

-

Ethereum: As one of the most widely used blockchain platforms, Ethereum offers a robust environment for deploying smart contracts and managing tokens. It supports the ERC-20 and ERC-721 token standards, which are essential for creating fungible and non-fungible tokens, respectively. Ethereum's large developer community and extensive documentation make it a popular choice, despite its relatively high transaction fees and scalability issues.

-

Polygon (formerly Matic): Polygon is a Layer 2 scaling solution for Ethereum that offers faster transactions and lower fees. It maintains compatibility with Ethereum’s ecosystem, making it an attractive option for real estate tokenization projects that require scalability and cost-efficiency without sacrificing security.

-

Solana: Known for its high throughput and low transaction costs, Solana is gaining traction in the tokenization space. Its ability to handle thousands of transactions per second makes it suitable for platforms anticipating high transaction volumes, such as those dealing with fractional ownership or frequent trading of real estate tokens.

-

Binance Smart Chain (BSC): BSC offers lower transaction fees and faster block times compared to Ethereum. It supports Ethereum-compatible smart contracts, making it a viable alternative for projects seeking to minimize costs while leveraging the security and features of a major blockchain.

B. Smart Contract Implementation

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of real estate tokenization, they automate the execution of transactions, ownership transfers, and other contractual obligations, ensuring that all parties adhere to the terms without needing intermediaries.

- Calls and Events Data

-

Function Calls: Smart contracts in real estate tokenization often include function calls that handle tasks such as transferring ownership, distributing dividends, and voting on governance decisions. By analyzing these function calls, we can understand the most common operations performed on the platform and identify key trends in how the platform is being used.

-

Event Data: Smart contracts generate events that log specific actions or changes within the blockchain. For example, an event might be emitted when a property is successfully tokenized or when a dividend is paid out to token holders. Monitoring these events provides valuable insights into the platform’s operational efficiency and investor activity.

- Security Measures

-

Smart Contract Audits: Regular audits are crucial for identifying vulnerabilities in smart contracts before they are deployed. These audits typically involve a thorough review of the code by security experts who assess the contract for potential flaws or exploits.

-

Multi-Signature Wallets: To enhance security, many platforms use multi-signature wallets, which require multiple private keys to authorize a transaction. This reduces the risk of unauthorized access or fraudulent transactions, ensuring that control over the assets remains secure.

-

Immutable Contracts: Many smart contracts are immutable once deployed, meaning they cannot be altered or tampered with. This immutability ensures that tokenized asset rules are enforced consistently, reducing the risk of malicious changes.

-

Oracle Integration: Oracles are used to bring off-chain data (such as property valuations or market prices) onto the blockchain, which is essential for accurately executing certain smart contract functions. Secure Oracle integration is vital to ensure that the data fed into smart contracts is reliable and tamper-proof.

By focusing on these technical aspects, platforms can ensure that their tokenized real estate offerings are not only efficient and user-friendly but also secure and resilient against potential threats. Understanding the blockchain platforms and smart contract implementations used in real estate tokenization provides a solid foundation for assessing the technical integrity and long-term viability of these projects.

Importance of Fractional Ownership in Real Estate RWAs

Fractional ownership, enabled by real-world asset (RWA) tokenization, is revolutionizing the real estate investment landscape. It allows investors to own a fraction of a property rather than the entire asset, bringing significant benefits to both investors and the broader market.

A. Democratization of Real Estate Investment

-

Accessibility: Fractional ownership democratizes access to real estate investment, making it possible for individuals with limited capital to participate in markets that were previously exclusive to wealthy investors. By lowering the minimum investment threshold, more people can invest in high-value properties, gaining exposure to real estate without needing substantial funds.

-

Global Participation: Through tokenization, investors from around the world can access real estate markets across different countries. This global participation is breaking down geographical barriers, allowing investors to diversify their portfolios internationally without the complexities of traditional real estate transactions.

-

Empowerment of Smaller Investors: Fractional ownership empowers smaller investors by giving them the opportunity to invest in lucrative real estate markets that would otherwise be inaccessible. This democratization leads to a more inclusive investment environment, where the benefits of real estate ownership are more evenly distributed.

B. Increased Liquidity and Lower Barriers to Entry

-

Easy Liquidity: Traditional real estate investments are typically illiquid, meaning that selling a property can be a lengthy and complex process. Tokenization, however, introduces liquidity to the market by allowing fractional shares of properties to be traded on secondary markets. Investors can buy and sell tokens with relative ease, similar to trading stocks, which significantly enhances liquidity.

-

Lower Barriers to Entry: By enabling fractional ownership, tokenized real estate lowers the barriers to entry for investors. Instead of needing to purchase an entire property, which requires substantial capital, investors can buy smaller shares that align with their financial capabilities. This opens up real estate investment to a broader audience, including those who may not have been able to afford direct property ownership.

-

Reduced Transaction Costs:. By cutting out intermediaries and streamlining processes, tokenized real estate can offer a more cost-effective way for investors to enter the market.

C. Portfolio Diversification Opportunities

-

Diversified Investment Options: Fractional ownership allows investors to spread their capital across multiple properties, rather than concentrating it in a single asset. This diversification reduces risk, as the performance of a portfolio is less dependent on the success or failure of a single property. Investors can allocate funds across various property types, locations, and market segments, creating a more balanced and resilient investment portfolio.

-

Risk Mitigation: Diversifying into multiple real estate assets helps mitigate risks associated with market volatility and economic downturns. For example, if one property underperforms due to local market conditions, other properties in the portfolio may continue to perform well, balancing out potential losses.

-

Customizable Portfolios: Tokenized real estate allows investors to build customized portfolios that align with their investment goals and risk tolerance. Whether focusing on residential, commercial, or industrial properties or selecting properties based on location or market segment, investors have the flexibility to tailor their portfolios to suit their specific preferences.

Fractional ownership through real estate RWAs not only broadens access to real estate investment but also provides increased liquidity, lower entry barriers, and greater diversification opportunities. These benefits are reshaping the real estate market, making it more dynamic, accessible, and attractive to a wider range of investors.

Regulatory Landscape

A. Current Regulations and Jurisdictional Differences

-

Varying Regulatory Environments: The regulatory framework for real estate tokenization differs significantly across jurisdictions. In some regions, regulators have embraced blockchain and tokenization, providing clear guidelines for compliance. For example, the United States, through the SEC, has established rules around token offerings that classify many real estate tokens as securities, subjecting them to stringent regulations. In contrast, other countries may have less developed or even ambiguous regulatory frameworks, creating challenges for companies operating across borders.

-

Compliance Requirements: Real estate tokenization platforms must adhere to various compliance requirements, including Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These requirements are designed to prevent fraud and ensure that all transactions are legal and transparent. However, they also add complexity and cost to the tokenization process, particularly when dealing with international investors.

-

Securities Classification: One of the primary regulatory challenges is whether tokenized real estate assets are classified as securities. If they are deemed securities, they must comply with securities laws, which include registration requirements, restrictions on who can invest, and disclosure obligations. This classification can vary by jurisdiction, adding to the complexity of launching and managing real estate tokens.

B. Future Regulatory Outlook

-

Evolving Frameworks: As the market for real estate tokenization grows, regulators are increasingly focusing on establishing clear guidelines to protect investors and ensure market stability. Future regulations may include standardized procedures for token issuance, trading, and custody, as well as enhanced investor protections.

-

Global Harmonization: There is a growing call for harmonization of regulations across different jurisdictions to facilitate cross-border investments in tokenized real estate. This could involve international cooperation to create common standards for tokenization, which would simplify compliance and reduce barriers to entry for global investors.

-

Innovation-Friendly Policies: Some jurisdictions are adopting innovation-friendly regulatory policies to attract blockchain and fintech companies. These policies include sandbox environments where companies can test new technologies under regulatory supervision, as well as fast-tracked licensing processes for compliant platforms.

Market Challenges and Opportunities

A. Adoption Barriers and Scalability Issues

-

Technological Complexity: One of the main barriers to adoption is the complexity of the technology involved in tokenization. Both issuers and investors may find the technical aspects of blockchain and smart contracts difficult to understand, which can hinder widespread adoption. Simplifying user interfaces and improving education around these technologies are critical to overcoming this barrier.

-

Regulatory Uncertainty: As mentioned earlier, varying regulations across different regions create challenges for platforms looking to operate globally. The lack of a unified regulatory framework can deter potential investors who are uncertain about the legal implications of their investments.

-

Scalability Concerns: As the tokenized real estate market grows, scalability becomes a significant issue. Blockchain platforms must be able to handle a large number of transactions quickly and efficiently to support a global market. Current scalability issues, such as high transaction fees and slow processing times on some blockchain networks, need to be addressed to ensure the market can expand.

B. Potential for Market Growth and Innovation

-

Increasing Institutional Interest: As real estate tokenization proves its viability, institutional investors are becoming more interested in this market. The involvement of large financial institutions could provide the liquidity and legitimacy needed to drive widespread adoption.

-

Innovation in Token Structures: There is significant potential for innovation in how real estate tokens are structured. For example, platforms could introduce tokens that represent different aspects of property ownership, such as rental income, appreciation, or voting rights. These innovative structures could attract a broader range of investors with different risk appetites and investment goals.

-

Integration with DeFi: The integration of real estate tokens with decentralized finance (DeFi) platforms could open up new possibilities for leveraging real estate assets. For example, token holders could use their tokens as collateral for loans or participate in liquidity pools, creating additional value and utility for their investments.

-

Expansion into New Markets: As regulatory frameworks become more supportive and technology improves, real estate tokenization could expand into new markets, including emerging economies. This expansion would provide new opportunities for investors and help to diversify the global real estate market.

The regulatory landscape and market challenges present both obstacles and opportunities for the future of real estate tokenization. By navigating these challenges and capitalizing on emerging opportunities, the market has the potential to grow significantly and transform the real estate investment landscape.

Conclusion

Real estate tokenization is transforming the investment landscape by offering fractional ownership, increased liquidity, and broader access to property markets. Key players like Elevate, Propy, and RET are driving innovation, supported by blockchain platforms that ensure secure and transparent transactions.

Despite regulatory complexities across jurisdictions, the market is poised for growth. As regulations evolve and harmonize, the sector is likely to attract more institutional interest, paving the way for further innovation and expansion.

For investors, tokenization offers new opportunities to diversify portfolios and access global real estate markets with lower entry barriers. For the real estate industry, it represents a shift toward more efficient and accessible investment models. While challenges remain, the future of real estate tokenization is promising, with the potential to reshape how real estate investments are made and managed.

-- Written by Harshil

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.