Understanding Tokenized US Bonds

The process of turning physical assets like stocks, commodities, and real estate into digital tokens on a blockchain is called tokenization of traditional assets, or crypto RWAs (Real World Assets). In comparison to conventional paper-based methods, this procedure offers increased transparency, security, and efficiency by allowing ownership and rights to be permanently recorded on the blockchain.

Conventional asset classes are progressively moving onto the blockchain, such as business loans, commercial and residential mortgages, and sovereign debt. The goal of streamlining procedures, cutting expenses, and improving investor accessibility is what is driving this change. Issuers may take use of blockchain technology's advantages, including improved liquidity, automated compliance, and real-time settlement, by tokenizing these assets.

Why are Conventional Asset Originators Take Into Account On-chain Financing ?

For fiduciary and strategic reasons, traditional asset originators are increasingly taking on-chain financing into consideration. From a strategic perspective, on-chain financing presents the chance to improve market liquidity, attract a larger pool of investors, and get access to international financial markets. Fiduciary motivations include lowering transaction costs, enhancing transparency, and automating smart contracts to reduce counterparty risk.

Overview of Tokenized US Bonds

Tokenized US bonds, represents a modernized approach to traditional fixed-income securities, leveraging blockchain technology to digitize ownership and facilitate seamless trading. Tokenization essentially turns traditional bonds into digital assets, allowing for improved accessibility, better liquidity, and fractional ownership for investors.

It simply refers to the process of converting a traditional bond, which represents a debt instrument issued by a government or corporation, into tokens that are issued on a blockchain.

Emergence in the Digital Era

The rise of tokenized US bonds is indicative of the expanding convergence between blockchain technology and conventional banking. There is an increasing need for alternative investment alternatives that provide transparency, efficiency, and security as financial markets adopt digitization and decentralized technologies. These needs are met by tokenized US bonds, which act as a link between established financial institutions and the digital economy.

Propelled by developments in blockchain technology and regulatory policies, tokenized US bonds have numerous significant benefits in comparison to their conventional counterparts. These consist of lower transaction costs, more efficient issuing procedures, and access to a worldwide investor base. Tokenization also opens up new opportunities for fractional ownership, real-time settlement, and automatic compliance, which democratizes access to fixed-income investments.

Introduction of tokenized assets on public blockchain networks

The emergence of tokenized assets signifies a fundamental change in the way we view and engage with conventional financial instruments and physical assets. Tokenization increases liquidity, simplifies trading procedures, and democratizes access to investment opportunities by digitizing ownership and permitting fractional ownership.

Public blockchain networks are basically decentralized platforms that make it easier to issue, transfer, and manage digital tokens which is essential to the spread of tokenized assets. Public blockchains promote inclusivity and interoperability globally since they are open and available to everybody with an internet connection, in contrast to private or permissioned blockchains, which are limited to authorized participants.

Understanding how tokenized bonds are created

An easy way of demonstrating how this traditional bonds transition to blockchain will be this below ⤵️

-

Selecting the desired bond: This is the first step in which the bond issuer (government, corporate entity or financial institution) selects a bond to be tokenized. This can be a traditional debt instrument with a fixed interest rate and maturity date.

-

Creating a blockchain token : The issuer can work with any public blockchain network or service provider to create a token that will represent the ownership of the bond. In most cases, the token typically corresponds to a fraction of the total value of the bond.

-

Issuance on the blockchain: The issuer deploys the token on-chain which ensures transparency and tamper-proof record keeping of ownerships and transactions related to the bond.

-

Smart Contract Integration: This involves the automation of various aspects of bond issuance and trading. A smart contract, which is a self executing code will be written where the terms of the agreement on the bond are directly written into the code and verified before deploying on-chain.

This can include things such as interest payments, redemption at maturity, and compliance with regulatory requirements.

-

Compliance and Regulation: In this step, everything is thoroughly checked to ensure regulatory compliance with the applicable securities regulations and legal requirements. This may involve obtaining regulatory approvals, conducting investor due diligence, and adhering to Know Your Customer (KYC) protocol and Anti-Money Laundering (AML) guidelines.

-

Distribution and Trading: The tokens can now be distributed to investors through several channels such as token sales, initial coin offerings, or even using a traditional securities exchange. Investors can now trade these tokens on secondary markets, which allows for increased liquidity and accessibility.

Differentiating Tokenized Funds from Onchain Assets and Tokens

Tokens, on-chain assets, and tokenized money are all significant parts of the developing blockchain ecosystem, but they have different uses and special qualities.

Tokenized funds:

Also known as investment vehicles are those that are represented on a blockchain as digital tokens. They are typically managed by an investment or fund manager; these funds might include equities, bonds, commodities, and crypto, among other assets. Tokenized funds provide investors with access to a variety of asset classes and the advantages of blockchain technology, including enhanced accessibility, liquidity, and transparency.

On-chain Assets:

Digitized physical assets that are registered on a blockchain are referred to as on-chain assets, or crypto RWAs (Real World Assets). Real estate, commodities, securities, and other physical financial or monetary assets might be included in this category. Compared to paper-based systems, tokenizing assets on the blockchain results in permanent record-keeping of ownership and rights, increasing efficiency, security, and transparency.

Tokens:

Tokens are digital assets on a blockchain that stand in for rights or ownership. Tokens are different from tokenized funds and on-chain assets in that they do not always have intrinsic value or reflect ownership of underlying assets, even if they can represent a broad range of assets, including cryptocurrency and digital collectibles. Tokens may be used for a number of things, such as access to decentralized apps (DApps), voting, payments, and governance.

Significance of Tokenized US Bonds in the Financial Industry

-

Enhanced Accessibility: Fractional ownership is made possible by tokenizing US bonds, this allows investors to buy smaller bond units. This makes it available to a wider variety of investors who might not have had access to traditional bond markets.

-

Enhanced Liquidity: Digitizing bonds as tokens on public blockchain networks, it is easier to tap into existing crypto markets and boost overall liquidity.

-

Global Accessibility: Tokenized assets on chain are much easier to access for investors around the globe, as there are less middlemen, no legal hassles, and geographical constraints to participate.

-

Efficiency and Automation: Blockchain automates many of the processes involved in bond issuance, trading, and settlement. Smart contracts also simplify operations and save administrative costs by automating regulatory compliance, interest payments, and maturity redemptions all written in code.

-

Transparency: Leveraging blockchain's immutability, transactions and ownership of these tokenized bonds are made transparent, boosting investors' confidence.

-

Cost Savings: By removing the need for middlemen like custodians, brokers, and clearinghouses, tokenization of US bonds decreases investor transaction costs. This cost decrease might lead to increased returns for bond holders.

Performance Analysis Using Bitquery Data

Let’s analyze the top tokenized assets on chain with Bitquery

BlackRock USD Institutional Digital Liquidity Fund ($BUIDL)

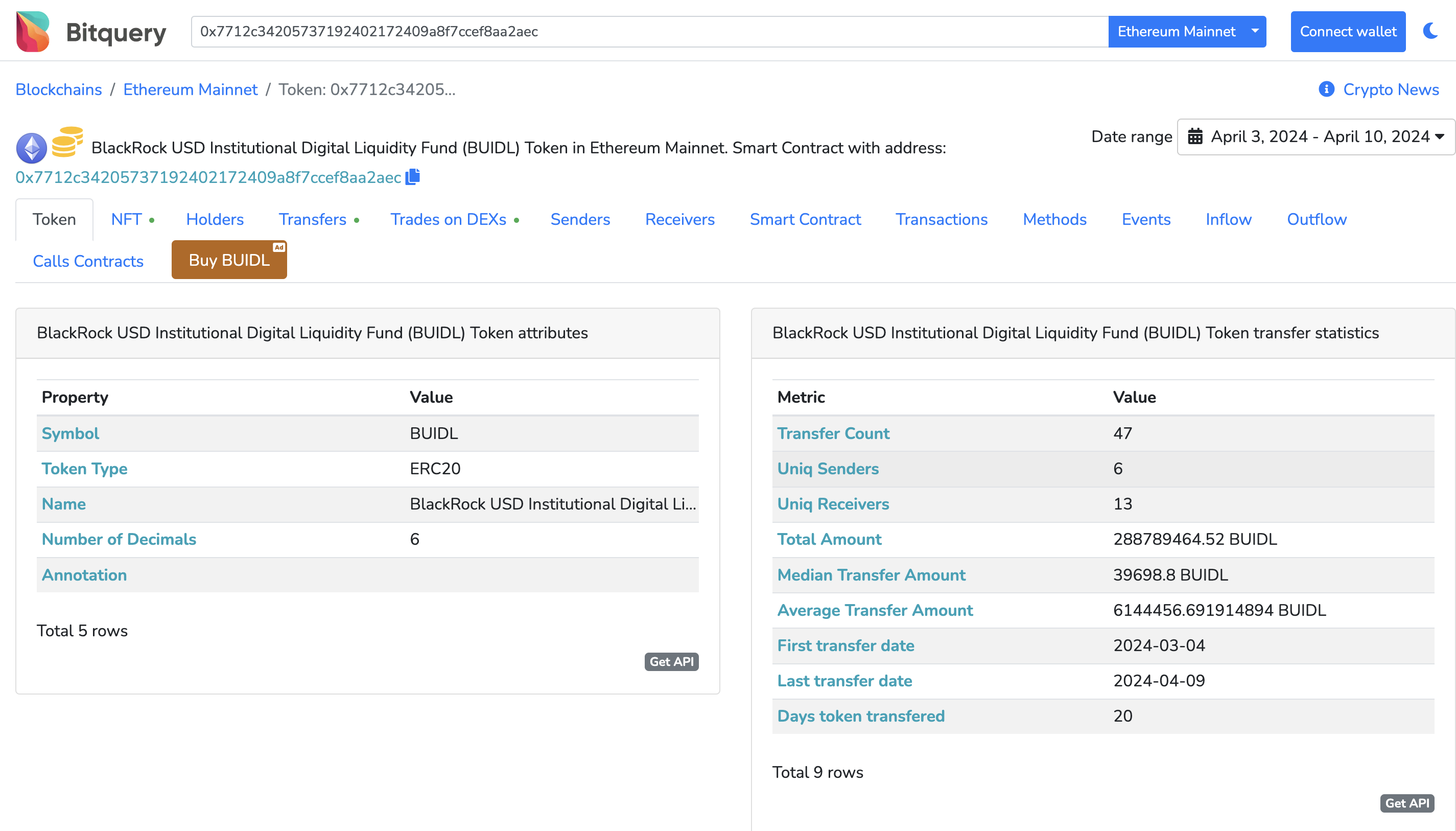

For the purpose of this blog, we will be using BlackRock USD Institutional Digital Liquidity Fund ($BUIDL) by Blackrock

This fund seeks to provide high current income while protecting capital and liquidity, by maintaining a portfolio of superior short-term "money market" instruments. Its principal investments are in fully collateralized repurchase agreements and premium securities such as variable rate notes, commercial paper, and certificates of deposit.

The above page indicates the basic metrics which are transfer count of the token, the unique senders and receivers, total amount of token created, first and last transfer date (as at writing) and the average transfer amount.

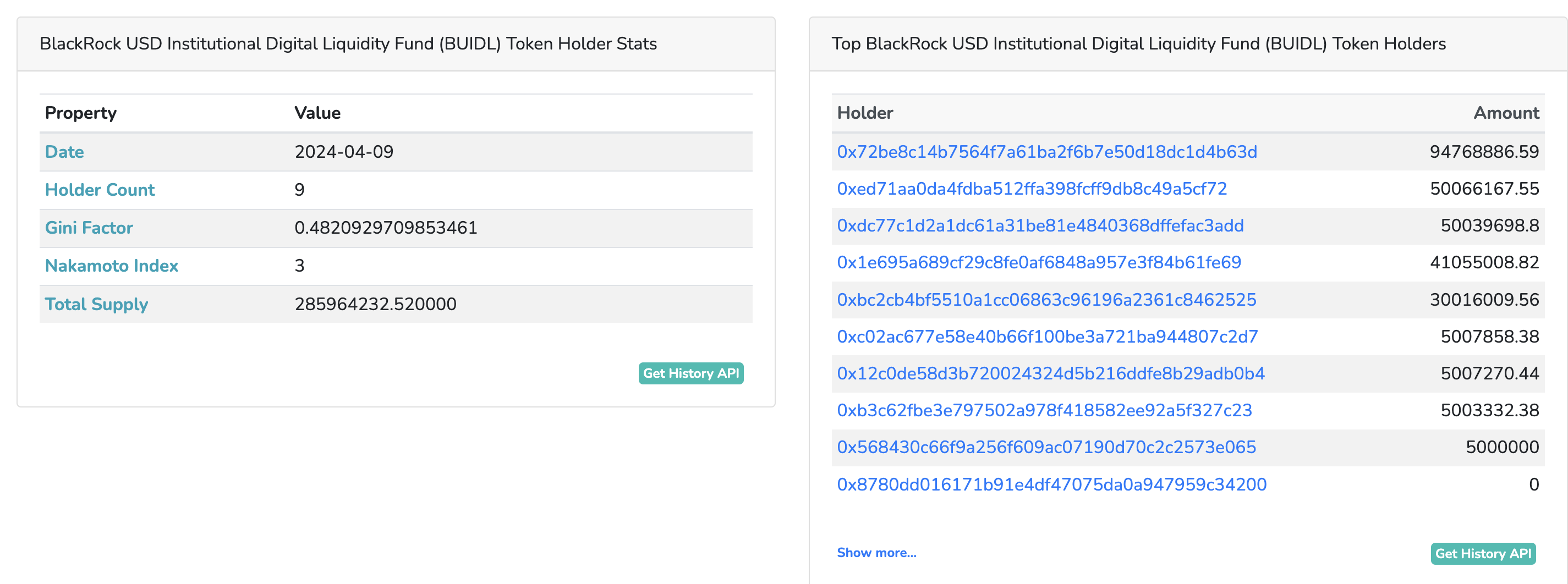

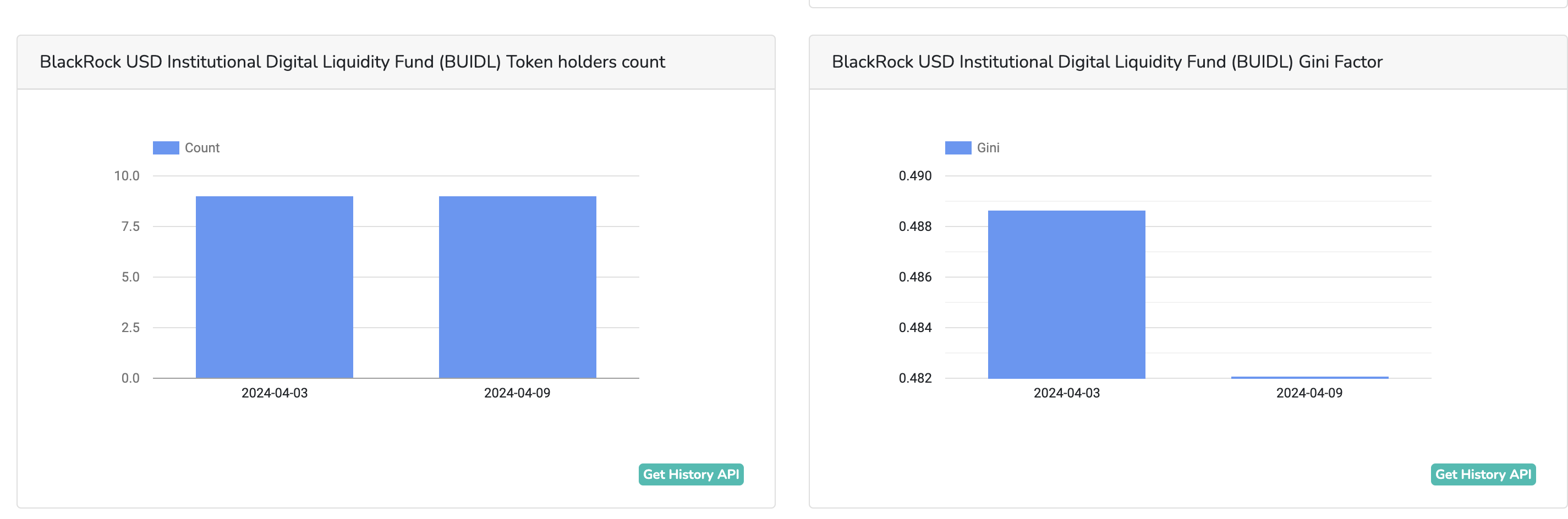

Diving deeper, we can start checking out the token holders here

The page shows the total token holders with links to the addresses, total supply, holders count and the amount held by each holder address, with the largest token holder being this address here with 94768886.59 of the token.

Parameters we can also check out includes token transfers, events, senders , receivers , and contract calls

Other tokenized assets worth taking a look at on-chain via Bitquery are:

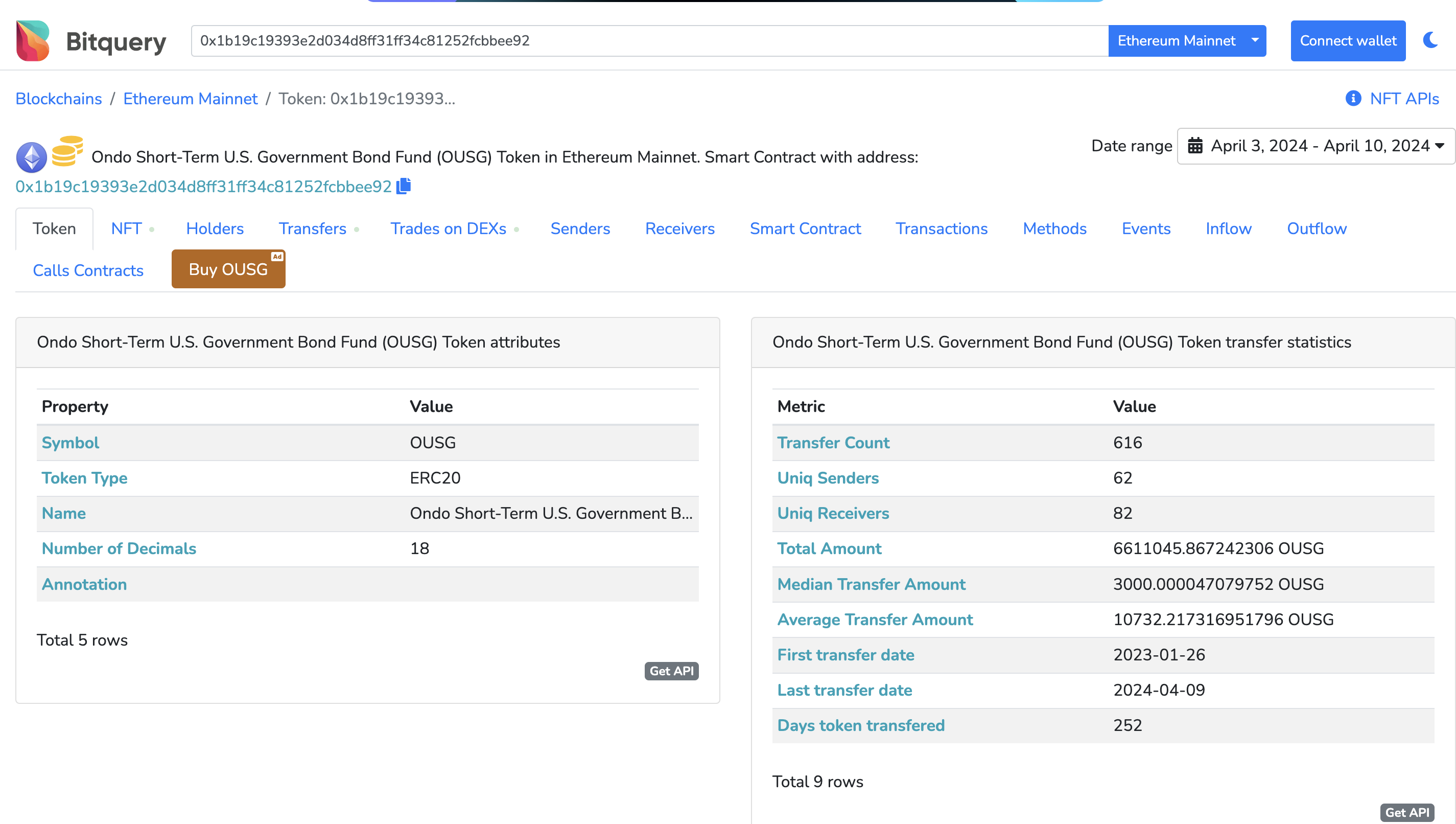

Ondo Short-Term US Government Bond Fund ($OUSG)

This asset provides liquid exposure to short-term US Treasuries with 24/7 stablecoin subscriptions and redemptions.

The significant majority of this portfolio is currently in the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), with the remainder in BlackRock’s FedFund (TFDXX), bank deposits, and USDC for liquidity purposes. The portfolio may, in the future, include other US Treasury funds and/or direct investments in US Treasuries according to Ondo Finance.

Contract Address - 0x1b19c19393e2d034d8ff31ff34c81252fcbbee92 (Ethereum)

https://explorer.bitquery.io/ethereum/token/0x1b19c19393e2d034d8ff31ff34c81252fcbbee92

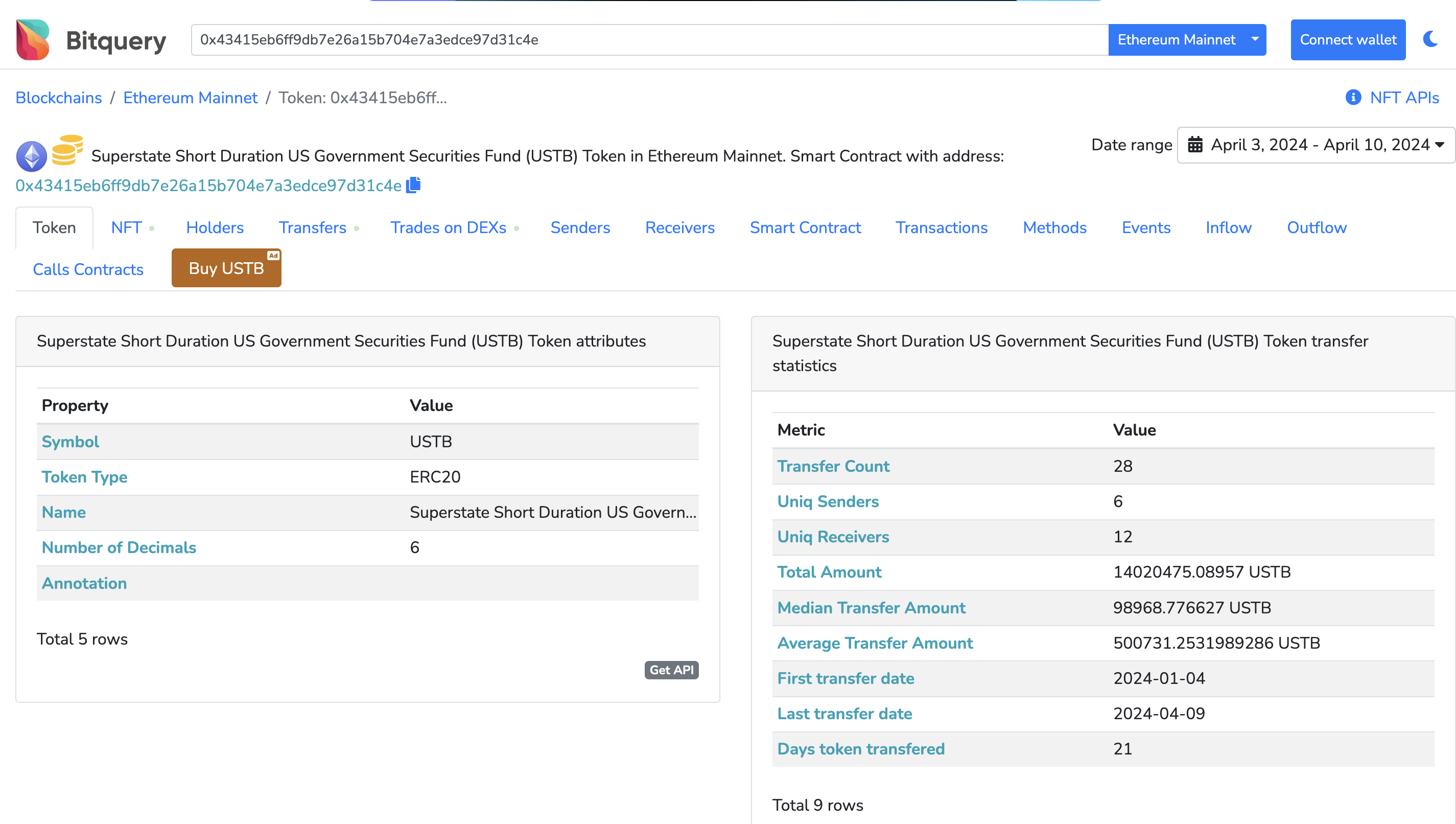

Superstate Short Duration US Government Securities Fund (USTB)

The Superstate Short Duration U.S. Government Securities Fund (the “Fund”) offers Qualified Purchasers access to short-duration Treasury Bills and Agency securities. The Fund’s investment objective is to seek current income as is consistent with liquidity and stability of principal, targeting returns in line with the federal funds rate. Ownership in the Fund is represented by an ERC-20 token, USTB. Subscriptions and redemptions are facilitated through USD or USDC, with liquidity each market day.

Contract Address - 0x43415eb6ff9db7e26a15b704e7a3edce97d31c4e (Ethereum)

Link to token on Bitquery : https://explorer.bitquery.io/ethereum/token/0x43415eb6ff9db7e26a15b704e7a3edce97d31c4e

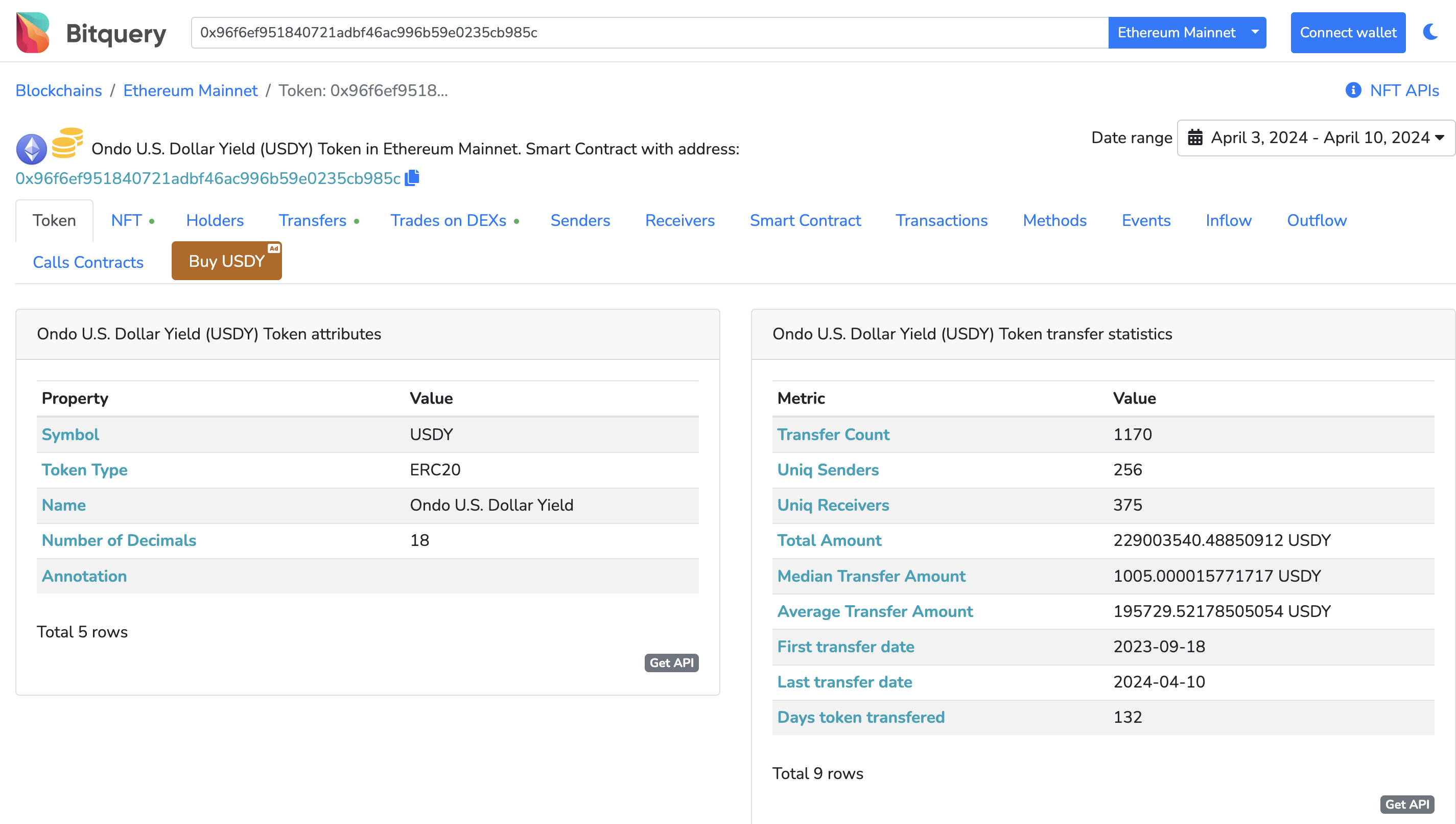

Ondo U.S. Dollar Yield

Contract Address - 0x96f6ef951840721adbf46ac996b59e0235cb985c (Ethereum)

Link to token on Bitquery: https://explorer.bitquery.io/ethereum/token/0x96f6ef951840721adbf46ac996b59e0235cb985c

Conclusion

Tokenization essentially converts conventional fixed-income securities into digital assets that provide investors more transparency, liquidity, and accessibility. The motivating forces behind this transition between blockchain technology and traditional banking are the objectives of expediting processes, reducing constantly rising expenditures, and improving investor access.

For fiduciary and strategic reasons, traditional asset originators are increasingly taking on-chain financing into consideration. From a strategic perspective, on-chain financing presents chances to expand the investor base, improve market liquidity, and get access to international financial markets. Reducing transaction costs, boosting transparency, and automating smart contracts to reduce counterparty risk are examples of fiduciary objectives.

Tokenized US bonds are significant because they provide automatic compliance, real-time settlement, fractional ownership, and democratize access to fixed-income assets.

Written by Eugene Nnmadi

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.