Bitcoin Halving and its imapct

Bitcoin operates on a unique monetary policy known as “halving”. This mechanism, designed by the elusive “Satoshi Nakamoto”, has significant implications for miners and the entire Bitcoin ecosystem. To truly understand Bitcoin, delving into the intricacies of halving is essential. Let’s begin.

What is the Bitcoin Network?

Understand the Bitcoin network before diving into Bitcoin halving. Imagine a financial system without middlemen, where trust and power are distributed across a global network of individuals. That's the core principle of the Bitcoin network. It is based on the underlying blockchain technology, a decentralised ledger where every transaction is publicly verified and recorded in a block. Instead of relying on a single entity, the miners are individuals who dedicate their computational power to solve complex puzzles and secure the network. By solving these complex problems, miners earn newly minted Bitcoins. This proof-of-work mechanism ensures the accuracy and security of transactions. It's called proof-of-work because solving the encrypted hash takes time and energy, which acts as proof that work was done. The process is called mining, which confirms the legitimacy of the transactions in a block and opens a new one. Nodes then verify the transactions further in a series of confirmations. This process creates a chain of blocks containing information, forming the blockchain.

What is Bitcoin halving?

Imagine Bitcoin's block rewards as newly minted coins, distributed to miners for their invaluable service of validating transactions and securing the network. Every four years, the Bitcoin ecosystem experiences a pivotal event known as "halving", a pre-programmed mechanism that cuts the block reward for miners in half. Think of it as periodically squeezing the faucet of newly minted Bitcoins entering the circulation. Initially, in 2009, miners earned a generous 50 BTC per block, incentivizing participation and securing the network. However, this reward gets halved approximately every 210,000 blocks mined, roughly every four years. Currently, it stands at a mere 6.25 BTC per block, and the halving cycle will continue until the total supply of 21 million Bitcoins is mined by 2140.

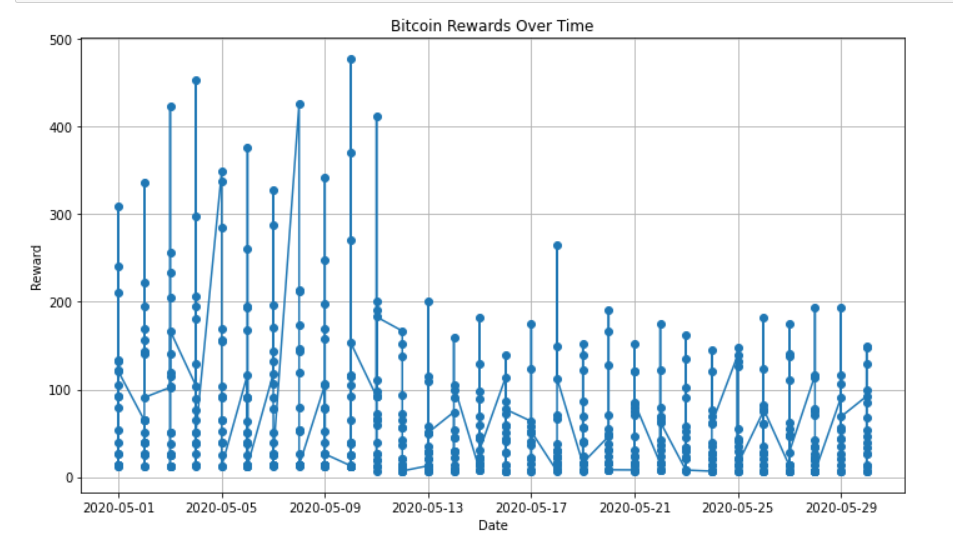

As you can see in the data by Bitquery plotted above, after the last halving, which took place on May 11, 2020, the average reward of all miners was cut to half. Try the above query in the IDE.

Why Satoshi Implemented Halving

Satoshi Nakamoto incorporated the halving mechanism into Bitcoin's protocol for several reasons. Firstly, it ensures scarcity by gradually decreasing the rate at which new bitcoins are introduced into circulation. This mirrors the supply curve of precious metals like gold, fostering a sense of digital scarcity and potentially increasing Bitcoin's value over time. Secondly, halving acts as a countermeasure against inflation, safeguarding the purchasing power of existing bitcoins. Lastly, it provides an incentive for miners to participate in securing the network while maintaining a balance between miners' rewards and Bitcoin's long-term sustainability.

The halving stands as a cornerstone in Bitcoin tokenomics, governing the dynamics and valuation of the cryptocurrency by ensuring a steady issuance of Bitcoin into circulation while capping the total supply at 21 million. Currently, with 19.53 million BTC (93%) mined, only 1.47 million BTC remain to be mined over the next 116 years

Bitcoin halving’s effect on miners

Previous halving events have been pivotal moments in Bitcoin's history. The reduction of block rewards has a direct impact on miners, as it decreases their profitability unless accompanied by an increase in the price of Bitcoin.

Every 2,016 blocks (roughly two weeks), the network recalculates the mining difficulty based on the actual time it took to mine the previous 2,016 blocks. If the average time was less than 10 minutes, the difficulty increases proportionally. Conversely, if it is more than 10 minutes, the difficulty decreases. This way, the network self-regulates to maintain the desired block creation time.

As the technology becomes better at solving these problems, the difficulty of mining also increases with time, which is why some miners may be forced to shut down operations if the cost of electricity and equipment outweighs the rewards. This has led to concerns about centralization, as smaller miners may be squeezed out by larger, more efficient operations, potentially compromising the decentralisation of the network.

Security concerns also arise due to the reduction in miner rewards. With fewer bitcoins awarded per block, miners may seek alternative revenue streams, such as transaction fees. However, if transaction fees alone are insufficient to sustain mining operations, there's a risk that some miners may prioritise transactions with higher fees, leading to potential delays and congestion in the network. This underscores the importance of balancing incentives for miners to ensure the security and efficiency of the Bitcoin network.

Impact of halving

The impact of halving extends beyond miners to the entire Bitcoin ecosystem. Reduced miner rewards may lead to increased competition among miners, driving innovation and efficiency in mining operations. Additionally, halving events often generate significant media attention and speculation and serve as a reminder of Bitcoin's deflationary nature and its potential as a store of value.

Moreover, If the amount of rewards given to the miners starts to decrease, the security of the network might also decrease. If the security decreases significantly, there could be large-scale double-spend attacks on exchanges. This could lead exchanges to increase their confirmation times. Eventually, the attackers might have so much hashpower that even a significant number of confirmations might not be enough to guarantee security. On the other hand, fees tend to increase as the value of the network and its usage rise, reflecting a balance between the block reward (newly minted BTC and fees) and adoption. This indicates that financial incentives drive participants' actions, rather than altruism. If Bitcoin's adoption continues to grow, its security will also increase.

After the last Bitcoin Halving, which is assumed to occur in 2140, significant changes are expected:

-

Miner Rewards: Miners currently receive newly minted bitcoins as rewards. After all 21 million bitcoins are mined, there will be no more block rewards. Miners will rely on transaction fees instead.

-

Transaction Fees: With no new supply, transaction fees become the primary income for miners. Higher demand may lead to high transaction fees, influencing network security and decentralization.

-

Ecosystem Adaptation: Miners may explore new revenue streams, affecting network stability and processing times. Innovations may emerge to sustain operations in a fee-based model.

History of Bitcoin Halving

Each halving has been a pivotal moment in Bitcoin's history, leaving indelible marks on the ecosystem. While not always immediate, significant changes have followed:

November 28, 2012 - First Halving: The first halving event occurred after 210,000 blocks were mined, reducing the block reward from 50 BTC to 25 BTC. July 9, 2016 - Second Halving: The second halving event took place after another 210,000 blocks, reducing the block reward from 25 BTC to 12.5 BTC. May 11, 2020 - Third Halving: The third halving event reduced the block reward from 12.5 BTC to 6.25 BTC..

Next Bitcoin Halving

The exact date depends on the block mining rate, but it's estimated to occur between mid-March and mid-April 2024. Currently, the block reward is 6.25 BTC, and it will be reduced to 3.125 BTC per block.

Potential Impacts

Some of the potential impacts can be:

- Reduced block rewards could impact some miners, especially those with less efficient hardware.

- Larger mining pools might become more dominant.

- Strong overall network security due to difficulty adjustments, but concerns about long-term incentives need monitoring.

While past Bitcoin halvings have coincided with price changes, expecting a repeat is not a guarantee. Even though Bitcoin thrived during low interest rates (2020-2021), attributing its success solely to this factor is misleading. Market forces and other factors beyond historical trends will be influencing future performance.

Conclusion

Bitcoin halving, a periodic event slashing block rewards in half, ignites a fiery debate across the cryptocurrency landscape. While some laud its virtues, others raise cautious eyebrows. While being intriguing as a concept, it is a double-edged sword. It bolsters scarcity and network security and curbs inflation, potentially benefiting long-term value and investor strategies. However, it can squeeze miner profitability, raising concerns about centralization and the need for future incentive solutions. Ultimately, halving is a fundamental part of Bitcoin’s monetary policy and its impact depends on your perspective and the evolving landscape of Bitcoin and digital currencies.

This article’s purpose was to educate you and not to give you an investment strategy. Stay informed and approach predictions with nuance!

About Bitquery

Bitquery is your comprehensive toolkit designed with developers in mind, simplifying blockchain data access. Our products offer practical advantages and flexibility.

-

APIs - Explore API: Easily retrieve precise real-time and historical data for over 40 blockchains using GraphQL. Seamlessly integrate blockchain data into your applications, making data-driven decisions effortless.

-

Coinpath® - Try Coinpath: Streamline compliance and crypto investigations by tracing money movements across 40+ blockchains. Gain insights for efficient decision-making.

-

Data in Cloud - Try Demo Bucket: Access indexed blockchain data cost-effectively and at scale for your data pipeline. We currently support Ethereum, BSC, Solana, with more blockchains on the horizon, simplifying your data access.

-

Explorer - Try Explorer: Discover an intuitive platform for exploring data from 40+ blockchains. Visualize data, generate queries, and integrate effortlessly into your applications.

Bitquery empowers developers with straightforward blockchain data tools. If you have questions or need assistance, connect with us on our Telegram channel. Stay updated on the latest in cryptocurrency by subscribing to our newsletter below.

This article has been written by guest writer Kshitij Chandrachoor

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.