Crypto Regulations in Major Jurisdictions

DISCLAIMER: The information provided in this article is for general informational and educational purposes only. It is not intended as, and should not be construed as legal advice. While efforts were made to ensure the accuracy of the information, laws, and regulations may vary by jurisdiction and are subject to change. Readers are advised to consult with a qualified legal professional for advice tailored to their specific circumstances. The author and publisher disclaim any liability for any actions taken or not taken based on the contents of this article.

Throughout history, states have pursued control over economic transactions using a wide array of regulatory tools, from the Sherman Act and the Securities Act in the U.S. to the complex regulation of derivatives. Just a few years after Satoshi Nakamoto published the now infamous whitepaper, states all around the world realized that a new potential disruption for the financial system was being born and that it required a regulatory framework.

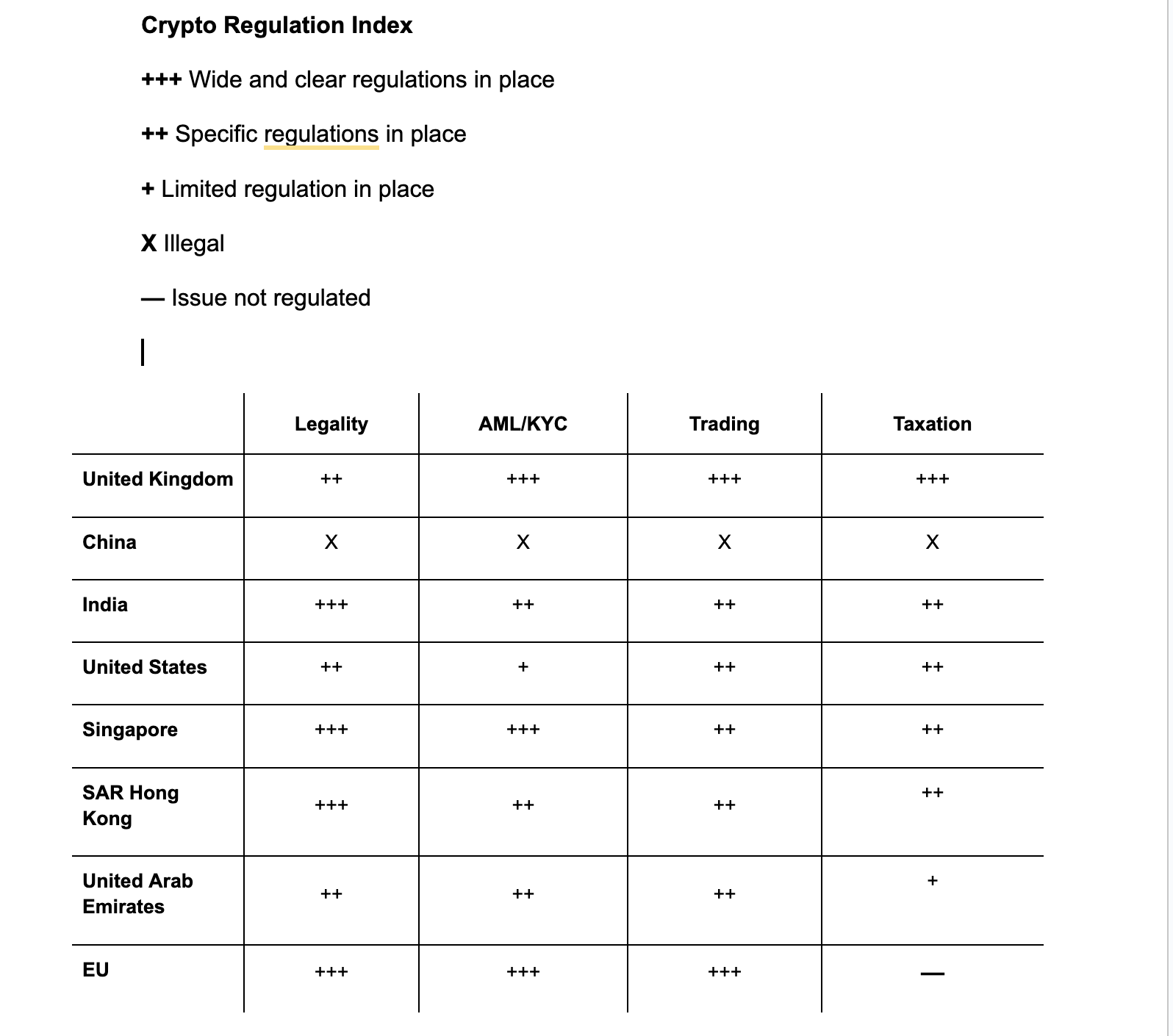

In this article, we analyze crypto regulations and their developments across the most important jurisdictions. The range of analyzed issues was chosen on the basis of their applicability in the course of business activities, that can be done in the selected jurisdictions.

The reason behind such a choice of described jurisdictions is, such as the existence of regulatory policy for crypto-assets and blockchain, the history of its application, and the exciting business activity in the described countries.

Importance of Crypto Compliance

For companies in the crypto sphere it is extremely imporant to be aware of different requirements to meet their compliance obligations. That’s is because a lot of entities have faced charges, fines, and penalties, in some cases, up to criminal liability for various violations. Mistakes in terms of compliance in some jurisdictions can easily entail a whole array of legal troubles.

This article is written for those interested in entering the crypto domain, but are not about the regulations or are currently looking for the best suitable legal regime. Please note, that this is an educational article and we strongly advice to consult with a qualified attorney for any specifics.

Common Approaches

A number of states prefer not to draft any new legislation regarding crypto-assets and try to fit to exciting scopes of regulation. For example, usually, governments refer to cryptocurrency as “virtual assets”. Thus, they are not creating a special legal regime for cryptocurrencies by extending the exciting one for virtual asset relates transactions: payment methods, sales, Initial Coin Offerings, Anti Money Laundering, etc.

The Regulators

Usually, regulations for digital assets and crypto are drafted by national financial regulators. For instance, in Singapore, the regulations are issued by the Monetary Authority of Singapore (“MAS”). Some states devote the regulations to their respective Central Banks.

The United States

Legality

In the United States, the legal status of cryptocurrencies is shaped by federal agencies like the Securities Exchange Comission (“SEC”), Commodity Futures Trading Commission (“CFTC”), and the US Treasury. While the Fed has been active in addressing cryptocurrencies, formal regulations remain limited. Recent legislative efforts, such as the Responsible Financial Innovation Act [1] and the Digital Commodities Consumer Protection Act [2], aim to provide clarity and integrate digital assets into existing legal frameworks. States vary in their approach, with some, like Wyoming, enacting favorable laws to attract blockchain businesses, while others impose stricter regulations, such as requiring money transmitter licenses for cryptocurrency transactions.

AML/KYC

Congress, the DOJ, and the Treasury have targeted anti-money laundering in the digital asset industry. In 2023, Senator Warren introduced the Digital Asset Anti-Money Laundering Act [3]. This legislation would require virtual asset service providers to report suspicious transaction activity to federal regulators. The bill mandates that FinCEN require U.S. persons to report digital asset transactions exceeding $10,000 through foreign accounts. Additionally, it directs the Treasury to create regulations for financial institutions dealing with digital assets and requires the SEC and CFTC to implement anti-money laundering risk assessments.

VASPs are also under an obligation to obliged to take precautions against economic crimes, including implementing Know Your Customer (KYC).

Taxation

In the US, cryptocurrencies are treated as property for tax purposes. Crypto holders must report capital gains or losses upon selling, trading, or disposing of their crypto assets. Short-term capital gains (for assets held less than one year) are taxed at the same rates as ordinary income, ranging from 10% to 37% based on the individual’s total taxable income. Long-term capital gains (for assets held for more than one year) are taxed at lower rates, which can be 0%, 15%, or 20% depending on the taxpayer's income level. Additionally, cryptocurrency transactions such as receiving crypto as payment for goods or services, staking rewards, mining, airdrops, or referral bonuses are considered taxable income.

Trading

The sale of cryptocurrency is regulated if it involves selling a security under state or federal law, or counts as money transmission under state law or makes the seller a money services business (MSB) under federal law. For example, the CFTC took action against Avraham Eisenberg for allegedly misappropriating over US$100 million in digital assets through "oracle manipulation" on the Mango Markets platform [4].

United Kingdom

Cryptocurrency is legal in the United Kingdom. The UK government and Parliament had adopted a pro-innovation approach while protecting consumers and maintaining stability of the financial system. HM Treasury and the Financial Conduct Authority (FCA), have set up frameworks to regulate various aspects of cryptoassets, including security tokens, exchange tokens (BTC), utility tokens, and NFTs.

The UK does not directly regulate cryptocurrency itself. Instead, the regulators decided to regulate specific characteristics and activities involving this type of asset. Crypto-related activities in the UK are subject to two main regulatory frameworks. First, if a cryptoasset activity poses a money laundering risk, firms must register with the FCA under the Money Laundering Regulations (MLRs) [5]. Second, the regulation applies if a crypto asset qualifies as a "specified investment" under the UK’s security regulation [6].

AML/KYC

The UK’s MLRs require cryptoasset businesses to implement risk-based policies and procedures to prevent their systems from being used for money laundering or terrorist financing. Since January 2020, when the Fifth Money Laundering Directive (MLD5) was incorporated into UK law, businesses involved in cryptoasset activities must register with the FCA and comply with these regulations.

The MLRs apply to cryptoasset businesses identified as being at higher risk for money laundering or terrorist financing. These businesses, referred to as “relevant persons,” must ensure they follow the MLRs to operate legally in the UK.

Taxation

There is currently no specific tax regime in the UK for cryptoasset transactions, so existing tax rules apply, though some uncertainty remains. Tax treatment depends on the nature and use of the cryptoasset, not just its classification.

HMRC has issued guidance, mainly on the taxation of exchange tokens, but this guidance is not legally binding. Notably, exchange tokens are not treated as money or fiat currency for tax purposes, and contributions of these tokens to pension funds are not tax-relievable. In April 2022, the government announced plans to review the tax system to support the cryptoasset market, including considerations for DeFi loans, extending the Investment Manager Exemption to cryptoassets, and negotiating new global tax reporting standards.

Trading

There is currently no specific regulation on crypto trading in the UK, however the general consensus is that trading in cryptocurrencies is legal.

China

Legality

China has implemented a prohibitory stance on cryptocurrency. Chinese regulations emphasize that virtual currencies lack legal status and classify related activities as illegal financial operations. Offshore exchanges are also prohibited from serving Chinese residents, with strict enforcement against any form of assistance to these exchanges.

Taxation

Up to this moment, there are no express provisions for taxing crypto assets. But, if cryptocurrencies are being traded as commodities, the transaction may be imposed with value-added tax for the sale of intangible assets.

AML and KYC

AML mechanisms in China largely focus on the KYC system, primarily on the client identity data and transaction records, and on transactions in which large amounts of funds are used (including dubious transactions). However, most of operations in PRC are made not in the sight of AML mechanisms. Moreover, the cross-border flow of crypto assets bypasses the monitoring and approval of the State Administration of Foreign Exchange.

Crackdown on traders

As recently as in June 2020 the Chinese authorities have cracked down on several thousands of bank accounts belonging to cryptocurrency traders. Chinese police allege that accounts were involved in illicit activities, including money laundering. This shows the intent of the PBOC (People's Bank of China) to actively hunt down money laundering schemes. However, most of the time such crackdowns of authorities are groundless.

India

India still needs to adopt specific legislation on cryptocurrencies. However, it has amended its corporate legislation, to require reporting of virtual digital assets.

The government’s stance on VDAs, which was expected to be clarified with the proposed Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, remains pending. Public statements suggest a shift towards a globally coordinated regulatory framework. As G20 president, India is leading international discussions on crypto regulation and has issued a Presidency Note to guide global efforts in establishing a framework for crypto assets.

AML/KYC

The Prevention of Money Laundering Act (PMLA) and its accompanying rules aim to prevent money laundering, seize assets obtained through such activities, and ensure that those involved are prosecuted.

On March 7, 2023, the Ministry of Finance issued a notification expanding the scope of the PMLA to include all entities dealing with Virtual Digital Assets (VDAs), such as exchanges, custodians, and wallet providers [7]. This allows authorities to closely monitor and track encrypted transactions, including those that cross international borders. These entities are now also subject to the reporting obligations set out in the PMLA and its rules.

However, since the PMLA only applies within India, it is implied that foreign cryptocurrency exchanges operating outside India, even if they offer services to Indian users, are not subject to this notification.

Taxation

The Finance Act, 2022, and subsequent guidelines have placed VDAs under the tax regime. A broad definition of VDAs includes both digital assets and NFTs. Income from the transfer of VDAs is taxed at 30%, with no deductions allowed except for the cost of acquisition. Additionally, a 1% withholding tax is required on VDA transactions. Gifts of VDAs are also taxable if they exceed INR 50,000 in value.

Trading

In the absence of specific laws governing Virtual Digital Assets (VDAs), existing regulations related to securities trading, commodities, foreign exchange, and deposit acceptance may apply depending on the nature and use of the VDA.

An asset like Bitcoin can be freely traded by individuals in India, with only income tax obligations. However, Indian entities are obliged to report their VDA holdings in their annual returns. If digital assets are traded by Indian residents outside India, they may fall under foreign exchange regulations. If VDAs issued by Indian entities grant ownership rights or constitute securities, those entities may need to comply with securities and investment regulations.

Singapore

The Singapore Government adopts a permissive and pragmatic approach towards cryptocurrency regulation. Cryptocurrencies are not treated as legal tender; instead, their classification varies based on their characteristics, potentially falling under-regulated categories such as capital markets products, e-money, or digital payment tokens (DPTs). The Monetary Authority of Singapore (“MAS”) has not issued any cryptocurrencies but launched exploratory projects to test blockchain and CBDCs for financial applications [8].

To address emerging risks, Singapore has introduced cryptocurrency trading guidelines, amended the Payment Services Act 2019 (PSA), and enacted the Financial Services and Markets (FSM) Act. Additionally, in a 2023 landmark ruling, the Singapore High Court recognized crypto assets as personal property, capable of being claimed or held in trust, solidifying their legal standing.

AML/KYC

Singapore’s AML regulations apply to cryptocurrencies, requiring reporting and compliance measures. Entities must report suspicious transactions and comply with guidelines under various AML acts. MAS imposes specific regulations on digital payment token services, including mandatory reporting, compliance with financial sanctions, and additional safeguards to protect consumers and ensure financial stability. The regulations extend to entities operating both within and outside Singapore, ensuring comprehensive oversight in the fight against money laundering and terrorism financing.

Taxation

Taxation of cryptocurrency in Singapore depends on the nature of the activity undertaken by a person or entity. Profits from cryptocurrency trading conducted as part of regular business activities are subject to income tax. However, capital gains from cryptocurrencies held as long-term investments are not taxed, as Singapore does not impose CGT. When cryptocurrencies are used for payment, the business providing goods or services is taxed on the value of those goods or services, as cryptocurrencies are treated as intangible property and transactions are considered to be facilitated by a “barter trade”.

Trading

Cryptocurrency trading in Singapore is subject to regulation based on whether the cryptocurrency falls under the Payment Services Act or the Securities and Futures Act. If the cryptocurrency is classified as a security, securities-based derivative, or a unit in a collective investment scheme, a prospectus must be prepared and lodged with the Securities Comission before offering it for sale, unless an exemption applies under the SFA, such as private placement or small offer exemptions.

SAR Hong Kong

Under Hong Kong law, cryptocurrencies are not recognized as legal tender and are not regulated by the Hong Kong Monetary Authority (“HKMA”). The Securities and Futures Commission (SFC) and the HKMA define virtual assets broadly as digital representations of value, including digital tokens, stablecoins, and security or asset-backed tokens, regardless of whether they are classified as securities or futures contracts under the Securities and Futures Ordinance. However, CBDCs are excluded from this definition.

AML/KYC

Under Hong Kong's Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), financial institutions—including HKMA-authorized institutions (banks), SFC-licensed corporations, licensed insurance companies, stored value facility issuers, and money service operators, are subject to AML/KYC obligations. These obligations also extend to licensed VASPs under the new regulatory regime.

Taxation

Hong Kong follows a territorial taxation treatment, meaning only profits derived from business activities within Hong Kong are subject to profits tax (15% for unincorporated businesses and 16.5% for corporations). Notably, Hong Kong does not impose turnover taxes, CGT, withholding tax on dividends and interest, or generally tax dividend income.

Trading

In Hong Kong trading of virtual asset products is regulated under the Securities and Futures Ordinance and is considered as dealing in "complex products." The SFC and the HKMA require intermediaries distributing digital asset products to adhere to industry guidelines, including ensuring suitability, conducting thorough due diligence, and providing specific risk disclosures. Intermediaries must also ensure that clients meet the "Sufficient Net Worth Requirement," meaning they have enough financial capacity to bear potential losses.

United Arab Emirates

The UAE is considered to be one of the top business and crypto hubs in the world. Emirates are deemed to be considered one of the most progressive crypto jurisdictions on the planet.

AML/KYC

VASPs are obliged to implement AML/KYC measures to prevent the use of virtual assets for illicit purposes. This includes measures to identify and report suspicious activity, aligning the reporting with national AML legislation and FATF requirments.

Taxation

UAE, provides a highly favorable tax environment for cryptocurrency investors. Jurisdiction imposes no personal income tax or CGT on individual crypto holdings, making it an attractive destination for global investors. This means that profits from activities such as the sale, staking, or mining of cryptocurrencies remain untaxed for individuals.

Trading

Crypto traders in the UAE must comply with the country's regulatory framework, which includes licensing requirements, AML regulations, and KYC procedures. At the federal level, the Securities and Commodities Authority oversees these activities through the Crypto Assets Activities Regulation which governs the offering, issuing, listing, trading, and associated financial services like custody and fundraising platforms.

In Dubai, the Virtual Asset Regulatory Authority was established to regulate virtual asset services and ensure investor protection and financial stability. VARA enforces the Virtual Assets Law No. 4 of 2022, which applies throughout Dubai, excluding the DIFC zone, and covers various related activities, including brokerage, custody, and exchange services [9].

European Union

Cryptocurrency is legal within the European Union, where the EU's Markets in Crypto-Assets (“MiCA”) regulation provides a comprehensive framework for the sector [10]. MiCA categorizes crypto-assets into three main types: utility tokens, asset-referenced tokens, and electronic money tokens. The regulation aims to ensure market integrity, consumer protection, and financial stability, while also fostering innovation. Additionally, MiCA introduces specific rules for significant ARTs and EMTs, but generally excludes NFTs and financial instruments from its scope.

The deeper regulation is within the jurisdiction of the Member States. MiCA provides just the bedrock for national legislation.

AML/KYC

The Anti-Money Laundering and Countering the Financing of Terrorism regulation framework within the European Union is primarily governed by the Anti-Money Laundering Directive (AMLD). The EU is currently preparing the sixth version of this directive (AMLD6), which is expected to be enacted between late 2024 and early 2025 [11]. This framework mandates that AML/CFT policies must be proportionate to the risks posed by the entity, considering its scale and type of business. For instance, Virtual Asset Service Providers (VASPs) operating as exchanges are deemed to have higher risk profiles compared to those offering custodian services, which are less vulnerable to money laundering activities.

In addition to these general requirements, VASPs must implement specific measures to mitigate risks associated with transactions involving self-hosted addresses. These measures include taking risk-based actions to identify and verify the identities of the originators or beneficiaries of transfers involving self-hosted addresses, as well as gathering additional information on the origin and destination of the crypto-assets. Furthermore, VASPs are required to conduct enhanced ongoing monitoring of such transactions and adopt any other necessary measures to mitigate the risks of money laundering, terrorism financing, and evasion of targeted financial sanctions.

Taxation

There is no EU-wide taxation. However, some EU implement taxation of digital assets.

Trading

MiCA introduces a comprehensive framework for the regulation of crypto-assets across the European Union. MiCA harmonizes rules related to the issuance, offering, and trading of crypto-assets, ensuring consistency with existing financial services legislation. It establishes a clear regulatory structure, categorizing various types of crypto-assets, including unclassified crypto-assets (e.g., Bitcoin), E-Money tokens (stablecoins), and Asset-Referenced tokens (RWA stablecoins pegged to assets).

Furthermore, MiCA requires crypto-asset service providers to obtain authorization from their respective national authority, aligning with EU financial services regulations. CASPs must adhere to strict requirements regarding governance, conduct of business, and economic substance. The regulation also introduces market abuse rules to combat insider trading and market manipulation in the crypto space. MiCA's provisions, have taken effect from June 2024, signifing a crucial step towards a unified and transparent regulatory environment for crypto-assets in the EU, contributing to the broader digital finance ecosystem.

Conclusion

All companies engaged in crypto-related operations must be ready for compliance procedures, primarily in the sphere of taxation and AML, as it seems like those fields are the most worrying for all the major jurisdictions.

Some of the laws of the major jurisdiction are already being applied to companies in various, as it is proved by litigation examples. Sooner or later, we will witness the same level of regulation and liabilities linked with it, as it is currently in the banking sector and in the sphere of securities. That means that in some time in the future there will be criminal cases against crypto companies, who do not comply with the necessary requirements. Why? Because such a process is inevitable. Governments worldwide always had pursued control over the financial sector and crypto is a part of this future.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.