The Rise and Fall: A Deep Dive into the Phenomenon of Crypto Rug Pulls

In the world of cryptocurrencies, where the thrill of astronomical gains can sometimes cloud the judgment of the most prudent investors, there exists a nefarious scam known as the "rug pull."

This term describes a scenario where developers abruptly withdraw their support from a project, taking with them investors' funds, leaving nothing but a shell of broken dreams and worthless tokens.

Let's dissect the anatomy of rug pulls, understand their impact, identify the warning signs, and explore their various forms. Buckle up, for this is a tale of caution, curiosity, and crypto conundrums!

The Great Disappearing Act: Definition and Explanation

A rug pull in the cryptocurrency universe occurs when the creators of a crypto project suddenly "pull the rug out" from under investors, either by draining the liquidity pool (the reservoir of funds that facilitates trading on decentralized exchanges) or by selling off a massive stash of the project's tokens, resulting in the token's value plummeting to zero. This act is not just a breach of trust; it's a meticulously planned betrayal that can leave investors in financial ruin.

The Fallout: Impact on Cryptocurrency Investors

The impact of rug pulls extends beyond the immediate financial loss. They erode trust in the flourishing crypto ecosystem, deter new investments, and fuel regulatory scrutiny. For the individual investor, the consequences can be devastating, ranging from significant financial losses to a complete erosion of faith in decentralized finance (DeFi). On a larger scale, these scams can trigger market-wide panic, leading to increased volatility and a tarnishing of the cryptocurrency market's reputation.

How Do We Identify a Rug Pull?

Identifying a rug pull before it happens is akin to finding a needle in a haystack, yet not impossible. Here are a few red flags:

-

Anonymous Developers: If the project's creators are shrouded in mystery, proceed with caution.

-

Lack of Code Transparency: Projects that do not have their code audited or made publicly available for scrutiny are more susceptible.

-

Unrealistic Promises: Sky-high returns promised in a short period can be a telltale sign of a scam.

-

Sudden Spike in Token Value: A rapid increase in the token's price without any substantial project development might indicate manipulation.

-

Hidden Clause: If withdrawing your investment is subject to conditions, it's time to reconsider your investment.

Different Types of Rug Pulls

Rug pulls can manifest in various forms, each with its unique method of execution:

-

Liquidity Stealing: The most common form, where developers drain the liquidity pool, leaving the token worthless.

-

Dumping: Developers or early investors sell off a massive amount of tokens all at once, drastically dropping the token price.

-

Scam Tokens: Creating a token that mimics a legitimate one, tricking investors into buying worthless copies.

-

Hard Fork Scams: Announcing a hard fork (a significant change to the network's protocol) to create hype and boost token prices, only for the developers to sell off their holdings and vanish.

Rug Pulls and Short Lifetime Tokens

Last year, rug pulls and related scams totaled up to $760 million. During a year(2023) marked by the theft of $1.7 billion in cryptocurrency by malicious individuals, rug pulls constituted a substantial portion of the incurred losses.

A particularly insidious form involves tokens that live for less than a day, often referred to as 1-day rug pulls. These flash-in-the-pan tokens are minted, hyped, and then disappear within 24 hours, leaving little more than a digital ghost town.

You can track them by checking the change in prices over a short period of time.

The Mechanism Behind the Mirage

The lifecycle of a 1-day rug pull can be broken down into a few key stages:

-

Creation and Hype: A new token is created and listed on decentralized exchanges like PancakeSwap or Uniswap. The creators then generate buzz through social media, often using fake endorsements or manipulated trading data.

-

Investment Influx: Drawn by the hype, investors start buying the token, driving up its price.

-

The Pull: At the peak of the frenzy, the creators sell off their holdings, often removing the liquidity pool entirely, causing the token's value to plummet to zero.

-

The Ghost Town: The token is abandoned, and investors are left with worthless digital assets.

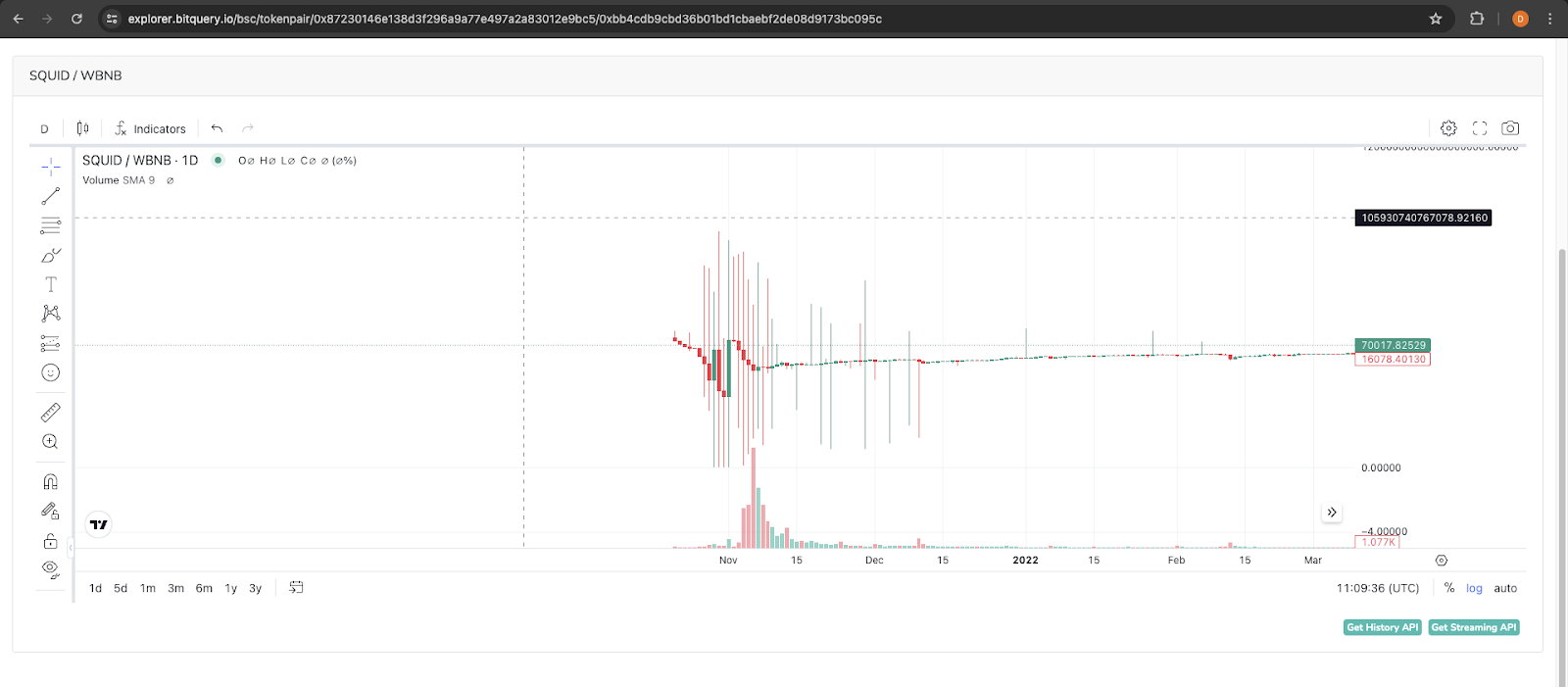

Let’s see this example of SQUID token: A token that went from a couple of cents to over $3100 in a week, before falling to zero in a matter of seconds.

Creation and Hype: A cryptocurrency inspired by the popular South Korean Netflix series Squid Game on November 1, 2021, became the most hyped digital token when its valuation shot up to $2,861 per coin. It is possibly one of the fastest, if not the fastest, rug pull in crypto history. In a matter of a week, scammers escaped with around $3 million. Using the popular Netflix show, a poorly made website with a bunch of errors, typos, and a whitepaper that was also filled with errors, typos and mistakes, going on BSC - Binance Smart Chain - scammers succeeded in giving people hope that they are earning a lot of money, before taking all of it with them. They were listed on Pancakes Wap and had some small, poor liquidity on 26th October. Over the weekend the price went up to $38. In six days it kept going up, hitting ATH of $3100 and then it just went down in a matter of seconds.

The Pull: The whitepaper noted that they implemented an anti-dump mechanism like in BTC, and that users have to collect some "Marbles" in order to sell SQUID, without explaining what Marble is, and how you get it. However, the token appreciated so much (over 100,000%) that at its peak, the combined entry fees were near $500K. People didn't care much given the hype and continued to invest.

The idea was that people would be able to earn SQUID by playing the game, they needed some SQUID to register before the tournament started. When the coin’s price was sky high, the developers ran off with ~$3.3 million from the project. One of the addresses swapped $3.38 million of SQUID to BNB before sending the funds through crypto mixer Tornado Cash.

The Ghost Town: From that moment, the token collapsed to almost 0 after the smart contract administrator sold all the tokens and disappeared. The scammers were tracked but never caught. The website went down, and a telegram channel where stated that "someone is trying to hack them, and their smart contract, Twitter account as well" and it was clear that investors were rug pulled.

The exact message put up on their Telegram channel:

“Squid Game Dev does not want to continue running the project as we are depressed from the scammers and is (sic) overwhelmed with stress. We have to remove all the restrictions and the transaction rules of Squid Game. Squid Game will enter a new stage of community autonomy.

Sorry again for any inconvenience been made for you. If any strange starts coming out of it, ignore it. Thanks!”

Notorious Examples of 1-Day Rug Pulls

While many such incidents have plagued the crypto world, a few stand out for their audacity and the scale of their impact.

- URF meme coin: Investments in the URF meme coin worth about $450,000 disappeared, as did the project team after the presale of the coin. The developers performed a rug pull less than 24 hours after the launch of the URF meme cryptocurrency. The last activity of the project on social networks was recorded on March 26. In addition to the funds raised from the sale, the team also used the funds to trade other meme tokens on the Solana platform.

- AnubisDAO: This dog coin project raised $60 million in ETH (13,597 ETH) from investors in return for native ANKH tokens. Not even 24 hours into the project, funding and the funds in the investment pool were sent to a different address and were never recovered. With no liquidity left for trading the coin, the rug pull crashed the price of the ANKH token to zero.

Outbound transactions through Tornado Cash:

-

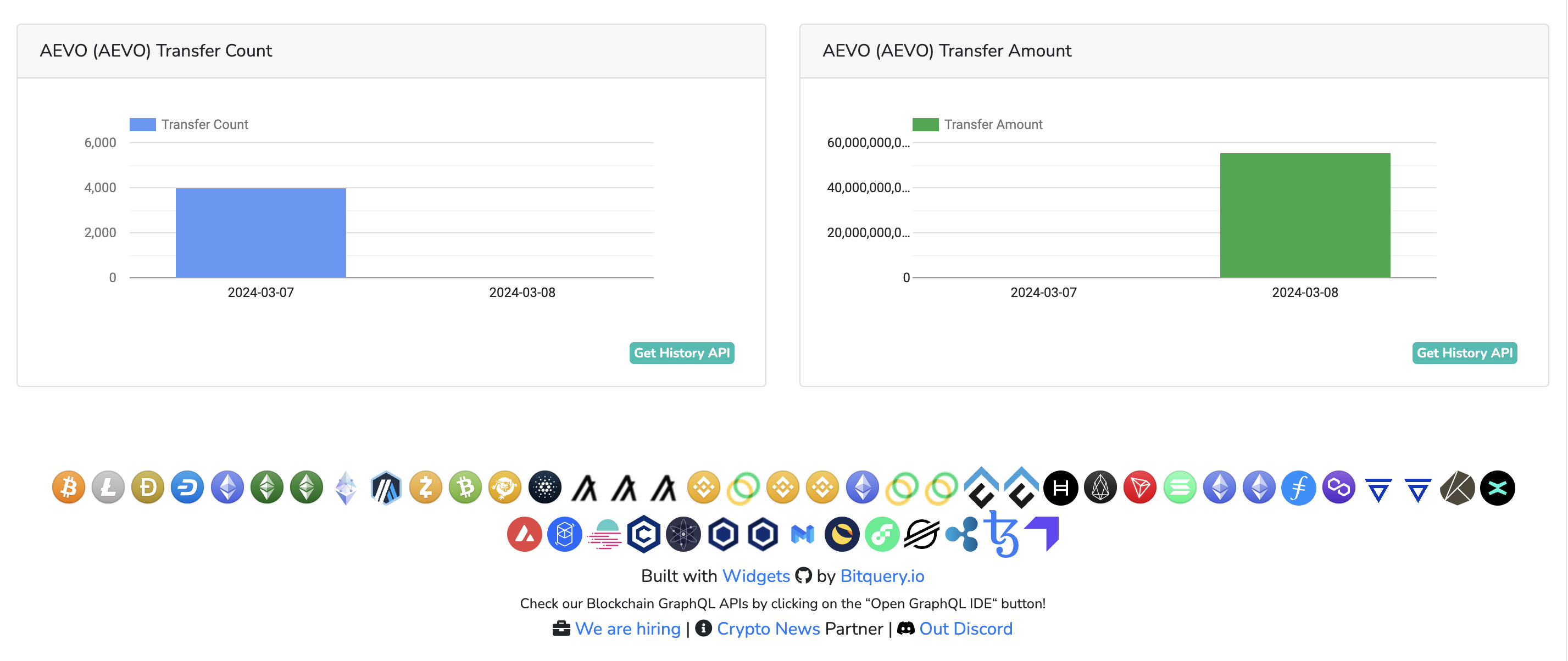

AEVO token: $AEVO a fake token for the DEX was created on BNBChain. The $AEVO deployer dumped tons of $AEVO on #BNBChain for $612K. Its price dropped 98% on March 8th, 2024.

On March 7, there appears to be no significant amount of AEVO transferred as indicated by the absence of a bar in the graph. However, on March 8, there was a massive spike in the transfer amount, showing approximately 55 million AEVO tokens transferred.

Low Transfer Count with High Transfer Amount : If on a certain day, the number of transactions (transfer count) is significantly low, but the amount transferred is extremely high, it suggests that a small number of transactions involved very large amounts of tokens

On March 7, there was a moderate number of transfers, but virtually no AEVO tokens are reported as transferred.

On March 8, the transfer count drops to zero (no transactions recorded), yet there is a massive spike in the token amount transferred.

DEXs and Rug Pull

Decentralized exchanges like PancakeSwap and Uniswap have become hotspots for these types of scams due to their open and permissionless listing policies, especially with 1-day tokens. An alarming number of these tokens list on these platforms, exploit the automated market maker (AMM) mechanism, and vanish. Monitoring the proportion of these tokens can offer insights into the prevalence of rug pulls in the ecosystem.

Case Studies of Extreme Rug Pull Scenarios

For a deeper dive, let's examine two notorious cases: OneCoin and Thodex. Both involved elaborate schemes that promised revolutionary platforms but ended in billions of dollars in losses for investors. These cases serve as stark reminders of the potential dangers lurking in the crypto shadows.

As we saw before, SQUID game was one of the worst rug-pulls in crypto. Capitalizing on the popularity of the eponymous Netflix series, the Squid Game token raised $3.3 million from investors. The developers then drained SQUID's liquidity pools and ran off with users' funds.

There’s another interesting story from the year 2017. Founded in 2017, Thodex was a Turkish crypto exchange that went missing in April 2021 with investors' funds worth over $2 billion. The exchange orchestrated a massive rug pull by halting all trading and withdrawals, then fleeing with $2 billion in investors' funds. The aftermath was catastrophic, with thousands of investors left in financial ruin.

Safeguarding Against Rug Pulls

Protecting yourself from rug pulls requires vigilance, research, and a healthy dose of skepticism. Always investigate the project's team, whitepaper, and community feedback. And remember, if something seems too good to be true in the crypto world, it probably is.

As we navigate the high seas of cryptocurrency investment, let us arm ourselves with knowledge and caution. Rug pulls, though daunting, serve as valuable lessons in the importance of due diligence and the relentless pursuit of transparency in this digital age. Stay informed, stay skeptical, and may your crypto journey be prosperous and secure.

Protecting Yourself from 1-Day Rug Pulls

The best defense against 1-day rug pulls is vigilance and education. Here are a few tips:

-

Research Thoroughly: Look into the token's creators, the project's feasibility, and its community engagement.

-

Beware of Unrealistic Promises: If it sounds too good to be true, it probably is.

-

Monitor the Liquidity: Be wary of tokens with low liquidity or if the liquidity is not locked.

-

Use Trusted Platforms: While not foolproof, using well-regarded exchanges can offer some level of protection.

The Takeaway: A Cryptocurrency Cautionary Tale

Rug pulls serve as a stark reminder of the risks inherent in the cryptocurrency market. While the allure of quick gains can be tempting, it's crucial for investors to conduct thorough due diligence, remain skeptical of too-good-to-be-true promises, and diversify their investments to mitigate risks. Remember, in the digital gold rush of our era, not every shiny token holds value, and not every project is woven on a loom of integrity. Stay curious, cautious, and informed, and you may just navigate the treacherous waters of cryptocurrency with your investments intact.

In the grand tapestry of cryptocurrency investments, understanding the warp and weft of rug pulls is essential for every investor. By staying informed and vigilant, you can avoid falling victim to these digital disappearing acts and help weave a more secure and trustworthy crypto ecosystem.

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Written by Laisha

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.