The Illusion of Easy Money: Why Memecoins Always Burn the Retail Investor

The Curious Case of a Trader’s Wallet

Crypto markets thrive on volatility, with sharp rises and declines being the norm. At Bitquery, we were analyzing trade data on Solana. We came across a wallet that, at the time of writing, holds 342 SOL and 254 WSOL (tokens that hold real value), also held 9,290 different memecoin tokens at the same time.

This raised a series of questions;

Why such a heavy investment in assets known to crash? What’s the strategy here—if any? Also, are there more investors like these asset holders? What are they betting on?

The Risk of Memecoins and Their Rapid Decline

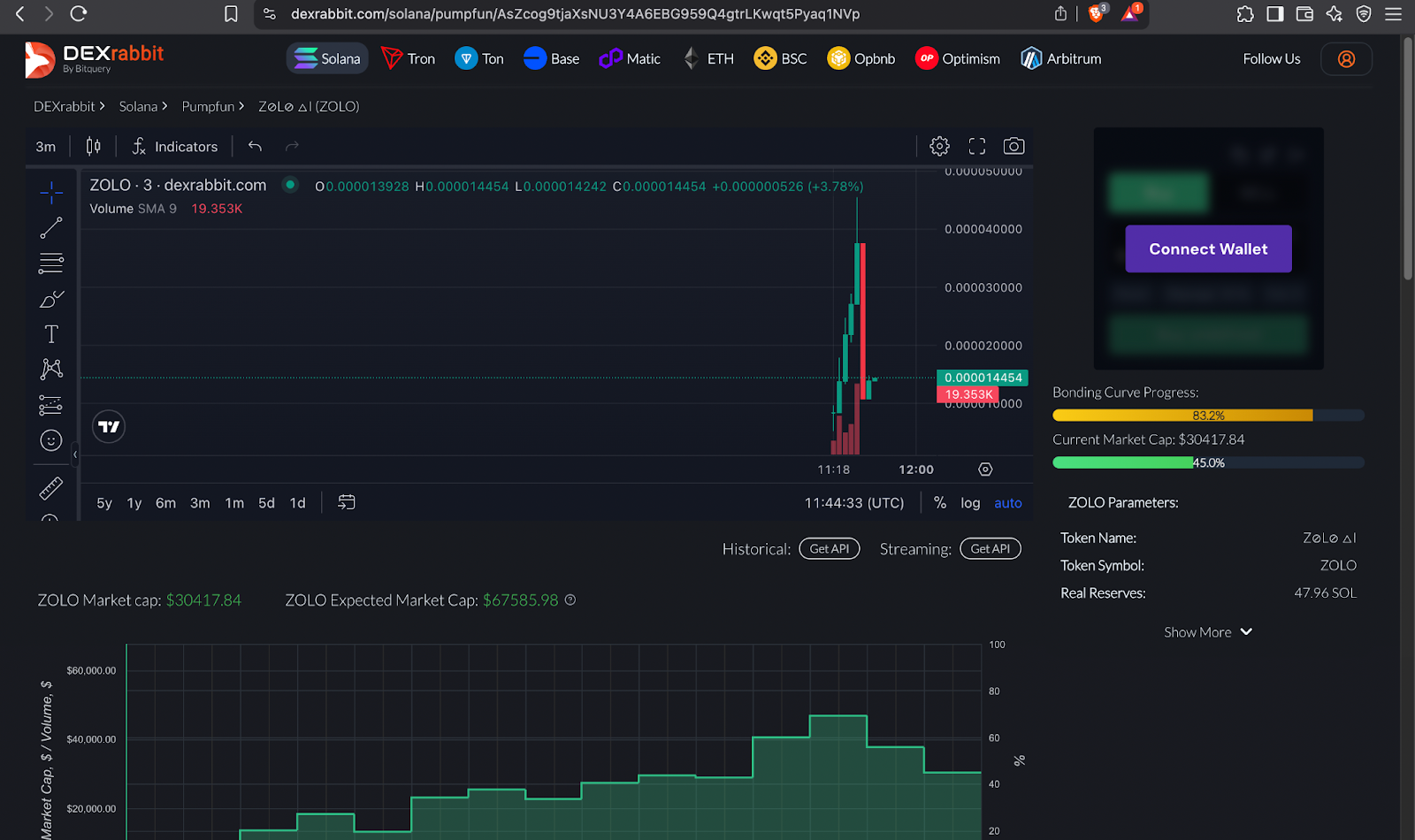

Memecoins supposedly lose value within minutes of their launch. At the time of writing, we picked a random Pumpfun token, as shown below.

Figure 1: OHLC Graph of the token

Figure 1: OHLC Graph of the token

As the bonding curve reaches close to 100%, the token loses all its value. The same happens to most memecoins of which a lot of them do not graduate to Pumpswap, pumpfun’s own AMM.

Why then would whale wallets with SOL upwards of 100k invest in memecoins, knowing it's a money pit? There are a few reasons that we can think of;

Why are the Big Guns Trading Memecoins?

A. Whales as Market Movers

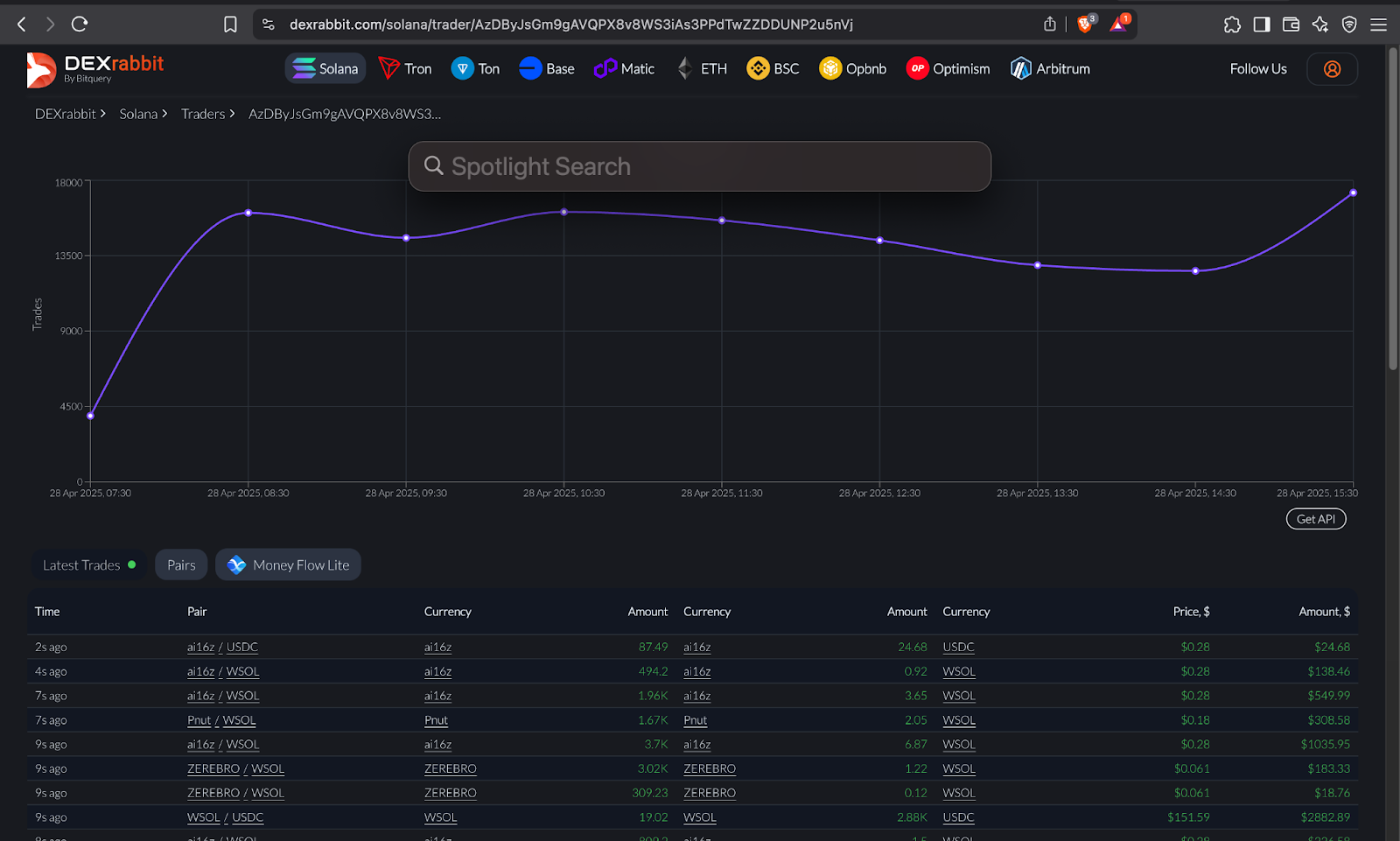

First, whales are considered a source of truth for a lot of traders. If you look at the top traders of any “unserious coin”, the top traders are responsible for huge volumes. For example, this wallet traded about $91.95M in Trump COIN per day as seen on DEXRabbit.

This wallet is considered a bigwig given the number of trades ( upwards of 10k trades) they make. Following this wallet, 100s of other wallets could start buying the token. These bagholders might then become a scapegoat or exit liquidity for the top traders who made a profit from the rise.

Figure 2: Trade activities of a token

Figure 2: Trade activities of a token

B. Possible Money Laundering via Memecoins

There is another lesser-known reason: easy token deployment has attracted launderers who wish to move large sums of money across borders while obscuring their origins. As recently covered by the DailyMail in the UK and noted by expert witness Gary Carroll, the token smart contract developers are paid some of this cash to create the token, which is then bought with the laundered money. Once the price rises, this profit appears legit.

Still Falling for Memecoins? Why New Traders Keep Losing Their Money

A. Chasing a Dream

Newly created memecoins are a high-risk high-return trading opportunity. For whales, the risk is acceptable because they often invest only their disposable income. Even in a worst-case scenario, the downside is limited, but the upside can be 2x, 3x, or even higher. Moreover, whales could also look at these newly created memecoins as an opportunity to create a rug pull or dump on these tokens.

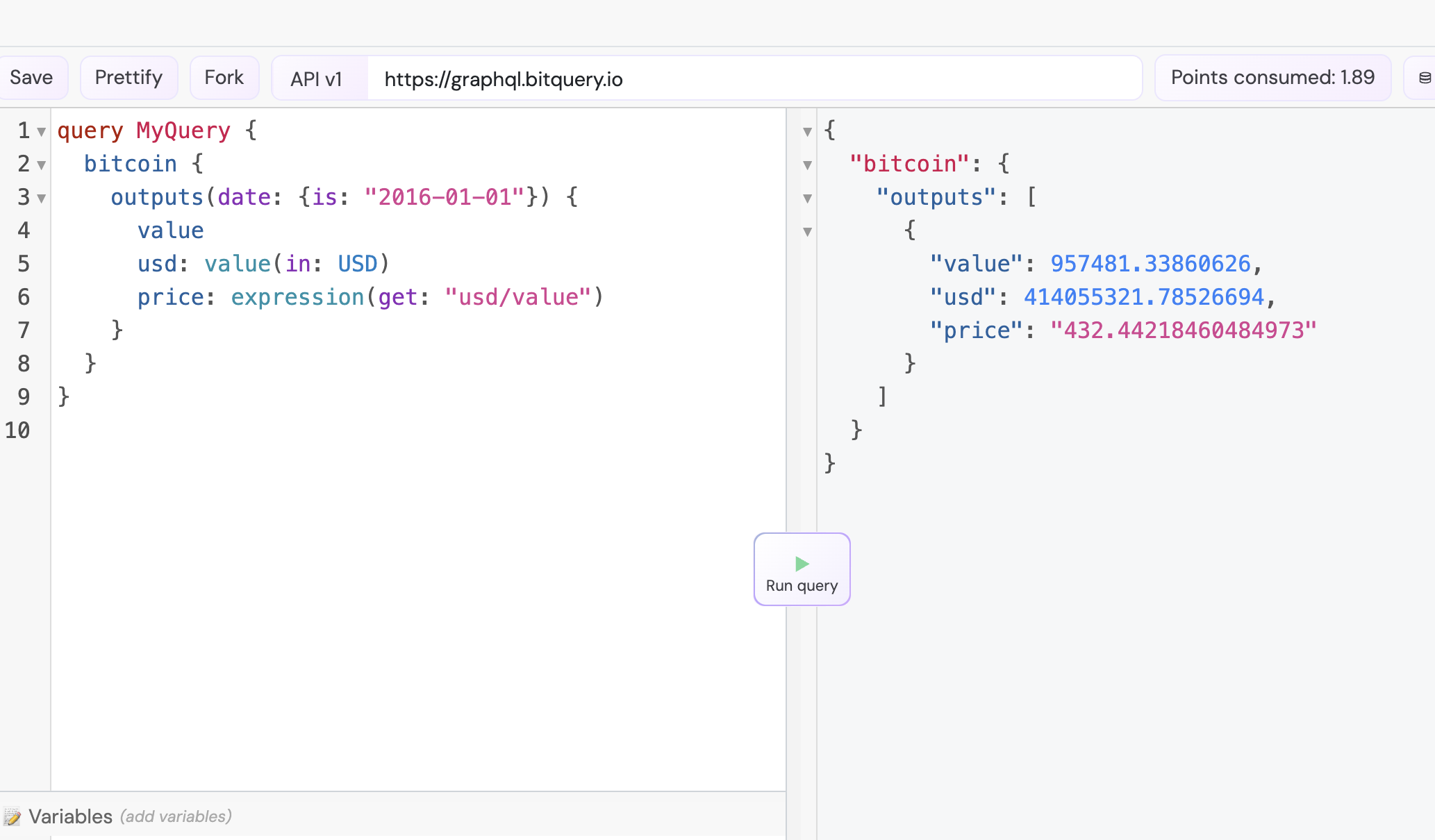

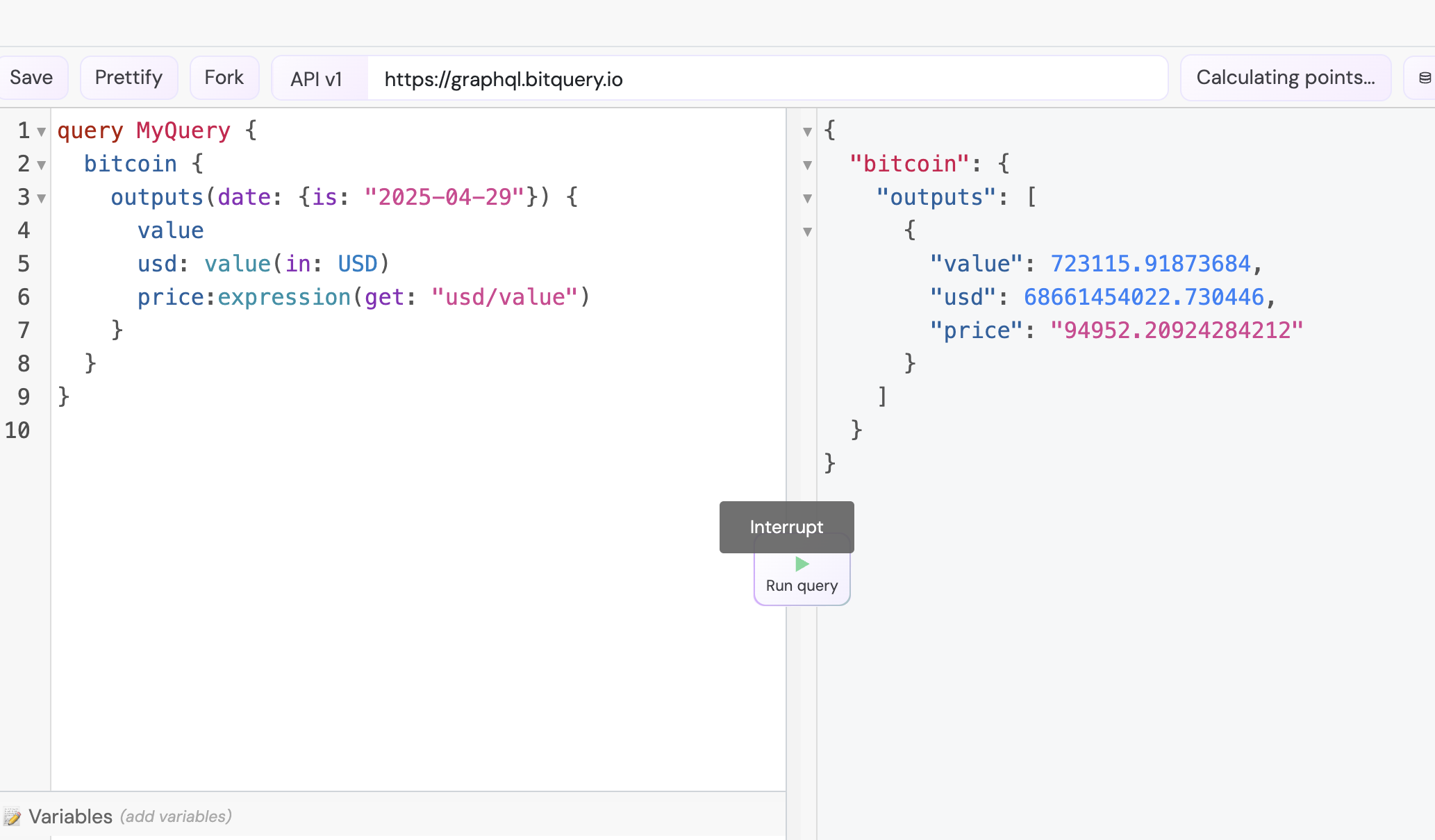

New traders, however, often buy into memecoins after the initial price spike, hoping the coin will bounce back. This belief is frequently rooted in FOMO. Many of these traders missed out on early opportunities in BTC, ETH, DOGE, SHIB, or PEPE, as seen in numerous Reddit threads. These tokens too were once treated like a joke by skeptics. As a result, some investors now doubt their own judgment, wondering if they’re repeating the same mistake by overlooking coins that initially seem like jokes.

This FOMO is not completely unjustified, given the comparison of the current price of Bitcoin to its price at the start of 2016.

Figure 3: Price of BTC at the start of 2016

Figure 3: Price of BTC at the start of 2016

Figure 4: Current Price of BTC

Figure 4: Current Price of BTC

B. Social Media Hype and KOLs

On Solana, token popularity often depends less on fundamentals and more on who’s tweeting about it. Key Opinion Leaders (KOLs), especially those with large followings on X (formerly Twitter), play a huge role in shaping the narrative around new tokens. A single tweet or retweet from a known memecoin trader or influencer can kick off a chain reaction: early buys start coming in, trading volume picks up, and soon enough, social sentiment trackers start flagging the token. That perceived momentum draws in more buyers, and just like that, a feedback loop is born.

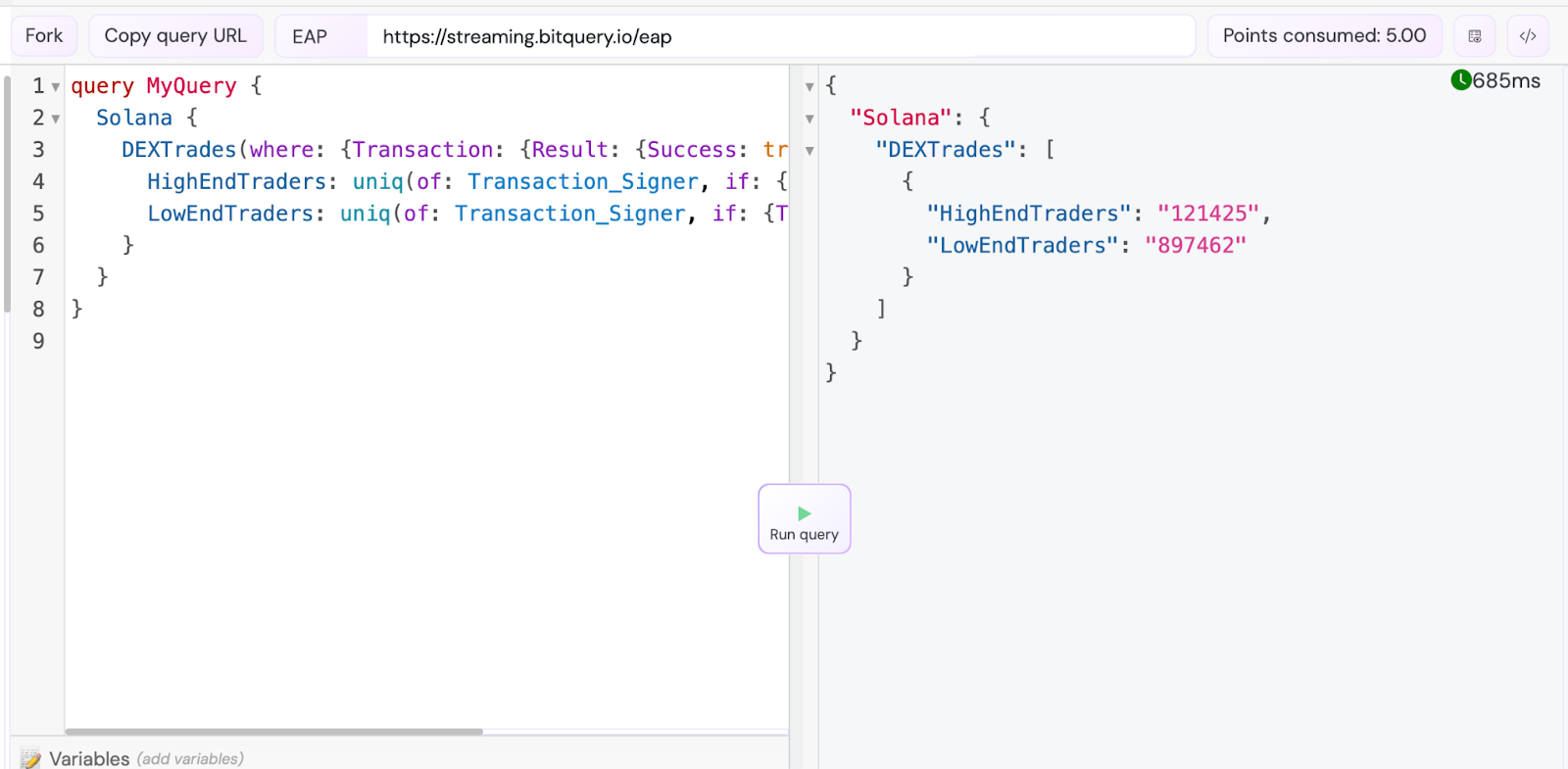

In the end, KOLs are less about marketing and more about market-making—at least in the short term. Their tweets don’t just influence sentiment; they often shape the price chart itself, which is quite easy given that memecoin trading is filled with inexperienced traders which we can evidently infer from this Bitquery Solana API which shows that over 80% traders place trades less than 100$ and only 20% traders place trades over 100$.

Figure 5: Number of high end traders and low end traders

For new traders, this influence is potent. Many don't understand the tokenomics or project behind a memecoin—they just see a tweet, a few green candles, and jump in. By the time they enter, the early buyers have often already started exiting. This cycle turns influencers into pseudo-market makers and creates an illusion of demand that lures inexperienced wallets into becoming exit liquidity.

This brings us to the most important part of all of this, the only thing we should be looking at, the key to all of this is liquidity!.

Why Liquidity is Everything When it Comes to Manipulating the Market

Why are Memecoins with Low Liquidity Targeted

Many large traders usually target tokens with low liquidity because low liquidity generally means prices are easier to manipulate.

Take, for example, there is a token pair between a meme coin and WSOL, where there is 1 WSOL token and 1 billion meme coin tokens. Many liquidity pools in Solana constant product algorithm to calculate the price of a token against the other, i.e., the price of a token against the other token is calculated based on the ratio of supply of these tokens. For a liquidity pool with low liquidity, a whale or a big trader could easily buy half of the available memecoins, making the ratio shifts dramatically. This makes the price of the memecoin shoot up, even though the actual demand may be low.

Perception of Other Traders

To novice and immature traders, this might look like a price surge driven by high demand. This illusion can trigger more buying from FOMO-driven traders, allowing the original buyer to sell at inflated prices. However, more experienced traders might actually analyse this price surge based on different parameters like volume, number of trades, or liquidity, and then may or may not buy that token based on their devised strategy.

Now all of this sounds very good on paper, but how do these traders get into the market before any of us?

Executing Trades Before We Blink

Technically, the major challenge for whale wallets or sniper bot traders is the speed of trade execution, as they need to execute trades within seconds or even milliseconds of a token launch. This raises the question of what kind of infrastructure they are using.

How much of their wealth are they spending to set up such high-speed trading?

It is not possible to manually buy and sell a coin within milliseconds. We found that large traders and potential whale wallets either own their own Solana nodes or collaborate with Solana validators.

This helps them to execute faster trades due to direct access to blockchain and a lack of load as the entire infrastructure is private. Moreover, this provides them with advantages such as mempool data visibility and priority transaction inclusion even during the peak network activity.

Technical Insights to Reduce Latency

Even with a highly optimised trade execution logic, the secret of speed still remains in the infrastructure. Let's say that we want to build our own program that detects the newly created memcoins, then buys them before some whale decides to dump that currency. We would need to establish a pipeline that gets the newly created memecoin tokens with low latency and then buy these tokens within milliseconds.

For example, suppose we are retrieving information about newly created tokens using Bitquery Kafka streams, which deliver data with sub-second latency. In that case, we would need to run a program to execute a trade and deploy it on a virtual machine, such as an AWS instance located close to the servers sending the data. This setup would allow the program to run continuously, with delays of only a few hundred milliseconds and at high speed.

Final Thoughts: Strategy or Speculation?

There are, of course, exceptions to this rule. There are investors here and there who have made money, but they are not public figures. They don't out themselves to the community. They don't make posts on Reddit. They don't even tell other people in their lives that they made money. They quietly reinvest the money into stablecoins and watch it grow or retire early.

From whales using traders as exit liquidity to new investors driven by emotion and misinformation, the memecoin ecosystem is complex, risky, and often irrational.

Whether it’s about fast profits, laundering schemes, or social media manipulation, one thing is clear: memecoins aren't a calculated investment—they’re a gamble. And in a volatile market like Solana’s, they continue to attract both savvy players and unsuspecting newcomers.

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.