Exploring Latest Liquid Staking Protocol - Diva Staking

In the dynamic world of decentralized finance (DeFi), platforms like Lido have assumed a crucial role, providing users with the means to stake assets while retaining liquidity. However, a recent headline has thrust a new player into the spotlight. Diva, a liquid staking platform, has initiated a 'vampire attack' on the industry giant, Lido. Through its innovative liquid staking solution and enticing incentives, Diva has successfully attracted a substantial amount of staked ETH.

Before delving into the intricacies, let’s take a look at what ‘Liquid staking’ and ‘Vampire attack’ in DeFi are all about.

Liquid Staking

With the advent of Proof of Stake (PoS) chains, it is required to stake native crypto assets to validate a block. But in this case, funds are locked for a certain duration of time, depending on the chain. Users also needed to go through an unbonding phase which didn't give any reward.

This is where protocols like Lido came into the picture. These liquid staking protocols provide an alternate platform to the users where they can stake their assets in return for protocol-specific liquid tokens proportional to their stake.

These protocols further team up with different Defi projects to increase the utility of their native token, also providing a solid foundation for activities like lending protocols and yield farming activities. Moreover, after the ‘merge’, it became more prominent within the Ethereum ecosystem.

Lido is the biggest player in this space with a TVL of over $18 billion, far beyond any protocol next in the list. Nonetheless, we have other protocols like Ribbon, and Pendle, tapping into the liquidity of stETH with various structured products and liquidity-based incentives. But the rapid growth of Diva, still being at a developing stage project, is worth looking at.

Vampire Attack

This term gained notoriety through SushiSwap's move over Uniswap, attracting over $1 billion in liquidity in less than a week. This strategy is born out of competition, where newer protocols can leverage to grow adoption and TVL. This is done by siphoning liquidity from an existing protocol by incentivizing its liquidity providers.

The vampire attack begins by enticing liquidity providers from an existing platform to stake their LP (Liquidity Provider) tokens on the new platform, promising additional rewards in the form of the platform's native token.

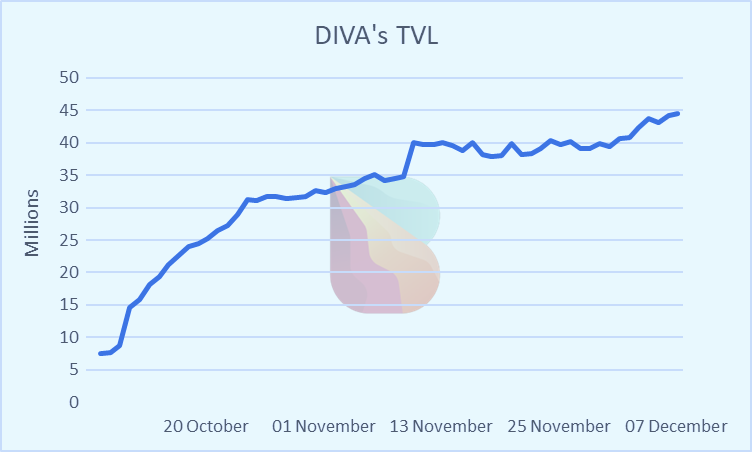

In the aftermath of a successful attack, we see; the dominant player experiencing a decline in its influence while the new player captures some of its TVL, users, and proponents. This we can see in the case of Diva too, which in just two weeks, has witnessed a staggering 600% surge in TVL, currently holding over 17k stETH, valued at over $37 million.

Diva has devised a novel liquid staking solution powered by Distributed Validator Technology (DVT), positioning itself as a compelling alternative to Lido. But why Lido? Apart from the obvious immense TVL, we need to look at the market activity related to Lido and what made users switch from such an established platform.

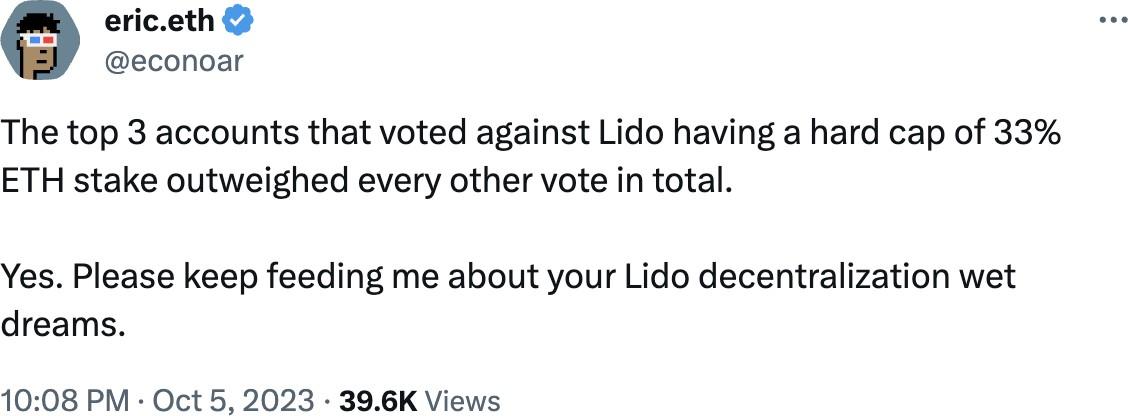

If not the core, one factor is sure decentralism and community voice for it. Lido is nearing the critical 33% threshold in Ethereum staking, which raises concerns within the Ethereum community. This isn't just a numerical milestone; it signifies a significant challenge, akin to breaching a barrier crucial for maintaining Ethereum's decentralization and neutrality.

Many in the Ethereum community are wary of Lido surpassing this threshold, seeing it as a growing threat to Ethereum's decentralization and credible neutrality.

Introduction of Diva

DVT technology, also known as "Squad Staking," holds the promise of enhancing Ethereum's network stability, increasing the total number of Ethereum validators, and boosting staking rewards in $ETH. Diva is leveraging DVT to develop a novel staking protocol that distinguishes itself through its technical advancements.

To participate, simply deposit your stETH (or regular ETH) into Diva's enzyme vaults. Your $DIVA rewards will be determined by the amount and duration of your deposits. Early depositors are incentivized with a higher $DIVA reward structure. Node Operators need only deposit >1 ETH to qualify for staking validator eligibility. In Diva’s model, each validator is comprised of 16 Ether deposits made

by individual operators in 1 Ether increments, along with an additional 16 Ether deposits dedicated to the LSD token. This strategy significantly expands the network's node count while enhancing security by distributing the workload across 16 operators per validator.

Karpatkey, a leading DAO treasury management platform in DeFi, has made a significant contribution to Diva's growth by depositing 305 stETH (approximately $500,000) into its Vampire Attack contracts. Gnosis, another prominent player in the decentralised finance space, has further bolstered Diva's liquidity by depositing 3,011 stETH (equivalent to $4.7 million) into its vampire attack vault.

The Diva airdrop has been well-received, garnering attention and support from various members of the Ethereum community. With 40% of $DIVA tokens allocated to DAO reserves, Diva is well-positioned to fuel liquidity mining initiatives, stimulate divETH liquidity, and prepare for an upcoming vampire attack on Lido.

Combining all, we see Diva’s TVL jump over 300% over a month and user counts by 250%.

Dominance of stETH in DeFi

When it comes to LSD Dominance by Market Cap, stETH dominates with an impressive 73%. In the broader DeFi space, three major protocols, namely Lido (48.7%), Aave v2 (28%), and Curve (11.3%), collectively hold over 80% of stETH. In contrast, Diva's stETH holding is still below 1%.

Including lendings, liquidity pools, and yield protocols, stETH holds 39% circulation in DeFi. The amount of (w)stETH in DeFi has increased steadily over the period.

As of November 19, 2023, there is over 2 million (w)stETH in DeFi. The majority of (w)stETH in DeFi is held in liquidity pools. There are over 1.5 million (w)stETH in liquidity pools. This is followed by lendings, with over 400,000 (w)stETH. Other protocols hold the remaining (w)stETH. No doubt it is one of the prime tokens to target.

Needless to say, for Diva to keep growing, it needs to solidify its hold within the lending space with its token.

How Diva stands against the giant

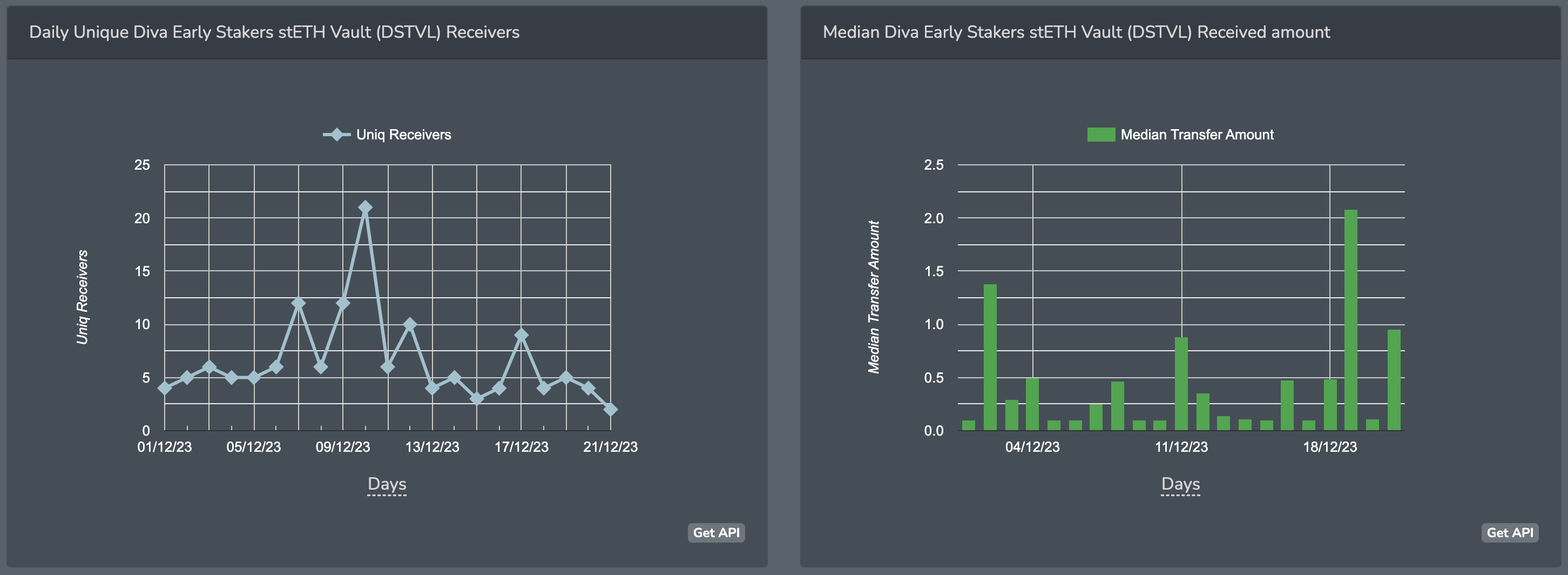

Based on data from Bitquery data, as of November 2023, there are 17,585.8 stETH held by 700 DIVA depositors, and the top 5 depositors collectively own almost 40% of the total stake (in Diva Early Stakers stETH Vault). Moreover, Divascan states the validator's number to be 1040 and the total nodes are 402. Currently, Lido's focus is on stETH, but there's potential for expansion within their ecosystem.

Lido has a significant stake, with over 9 million ETH, accounting for 31.86% of all ETH deposits, contributed by 200,122 unique depositors.

The growth of lido; unique holders, TVL, and stETH circulating have all been growing at a faster rate to offset the loss to Diva. This growth indicates a notable surge occurring concurrently with Diva receiving stake, revealing that the Total Value Locked (TVL) did not experience a significant negative impact.

Both Diva and Lido offer convenient staking options for Ethereum holders. Diva requires no minimum ETH for staking and offers a 90% net staking reward, while Lido requires a minimum of 32 ETH. Diva's 16-node per validator redundancy compares to Lido's 1-node per validator setup. The choice between Diva and Lido depends on individual preferences and risk tolerance.

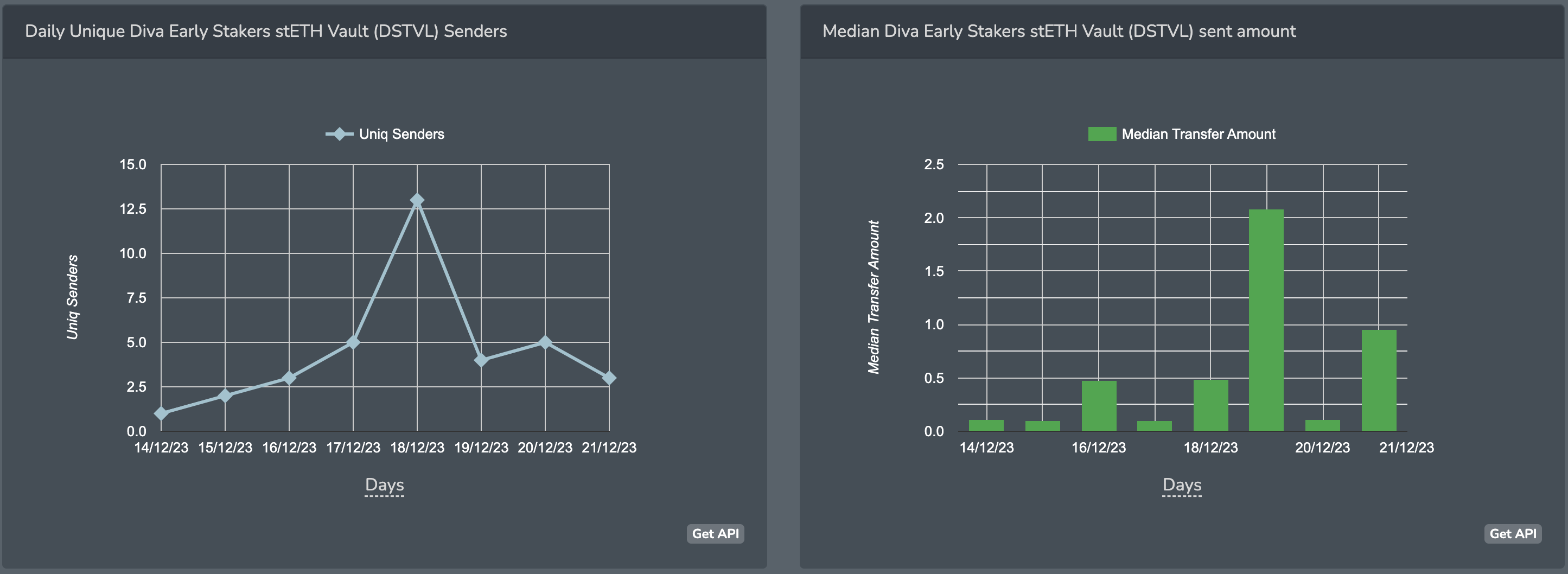

Nonetheless, on top of the total stats, we can also find the daily unique sender users on each platform, which is 5 or less on Diva and 650-800 on Lido.

Although competitors, we can see Diva solely as a loot to Lido. Possibly, in the short term, this might attract more Lido deposits by encouraging stEth purchases, the primary emphasis lies in recognizing that a robust Ethereum network benefits all stakeholders, including Lido. Diva is poised to emerge as a high-performing LSD soon.

About Bitquery

Bitquery is your comprehensive toolkit designed with developers in mind, simplifying blockchain data access. Our products offer practical advantages and flexibility.

-

APIs - Explore API: Easily retrieve precise real-time and historical data for over 40 blockchains using GraphQL. Seamlessly integrate blockchain data into your applications, making data-driven decisions effortless.

-

Coinpath® - Try Coinpath: Streamline compliance and crypto investigations by tracing money movements across 40+ blockchains. Gain insights for efficient decision-making.

-

Data in Cloud - Try Demo Bucket: Access indexed blockchain data cost-effectively and at scale for your data pipeline. We currently support Ethereum, BSC, Solana, with more blockchains on the horizon, simplifying your data access.

-

Explorer - Try Explorer: Discover an intuitive platform for exploring data from 40+ blockchains. Visualize data, generate queries, and integrate effortlessly into your applications.

Bitquery empowers developers with straightforward blockchain data tools. If you have questions or need assistance, connect with us on our Telegram channel. Stay updated on the latest in cryptocurrency by subscribing to our newsletter below.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.