How to Get S&P 500 Onchain Data

The rise of Real World Assets (RWAs) in the decentralized finance (DeFi) landscape marks a significant evolution in how traditional financial instruments can be accessed and traded. RWAs refer to tangible assets or financial instruments that are tokenized and represented on a blockchain, bridging the gap between conventional finance and the innovative world of DeFi.

This tokenization process allows for increased liquidity, accessibility, and transparency,

transforming the way investors engage with assets like real estate, commodities, and equities.

In recent years, the growth of RWAs has been quite adequate and hence the future holds quite promising, reflecting a growing demand for yield-bearing financial assets.

Traditionally, investing in the S&P 500 has involved opening a brokerage account and following regulations set by centralized financial institutions. However, the emergence of Decentralized Finance (DeFi) offers alternative ways to gain exposure to this influential stock market index. DeFi protocols have introduced innovative strategies, such as synthetic assets and tokenized baskets, that allow investors to participate in the S&P 500 through blockchain technology.

Among the various approaches to gaining exposure to RWAs, two prominent DeFi strategies stand out, particularly for investors interested in theS&P 500:

Synthetic Asset Protocols

Synthetic asset protocols, such as Synthetix, allow users to create and trade synthetic versions of real-world assets. These synthetic assets, known as Synths, track the price movements of underlying assets like stocks or commodities without requiring direct ownership. For instance, investors can gain exposure to the S&P 500 by trading synthetic assets that mirror the performance of the index, providing a way to speculate on its movements without the complexities of traditional equity markets.

Basket Tokenization Protocols

Basket tokenization protocols, exemplified by Backed Finance, offer another innovative approach to accessing the S&P 500. Backed Finance has developed the Backed CSPX CoreS&P 500 (bCSPX), a tokenized representation of the iShares CoreS&P 500 UCITS ETF. This ERC-20 token is designed to track the performance of the underlying ETF, allowing investors to participate in the index through a blockchain-based asset. Unlike traditional ETFs, this tokenized version provides greater flexibility and accessibility, enabling trading on decentralized exchanges while maintaining a 1:1 backing with the underlying asset.

As the DeFi ecosystem continues to mature, the integration of RWAs presents a transformative opportunity for both investors and the broader financial landscape. The ability to tokenize traditional assets like those in the S&P 500 not only enhances liquidity and democratizes access but also paves the way for innovative financial products that could reshape the investment landscape.

TokenizedS&P 500 index and stocks

The tokenization of the S&P 500 index and its constituent stocks represents a significant advancement in how investors can access traditional equity markets through blockchain technology.

This innovative approach allows for the creation of digital assets that mirror the performance of well-established financial instruments, enhancing liquidity and accessibility. Here are some notable tokenizedS&P 500 assets along with their key metrics:

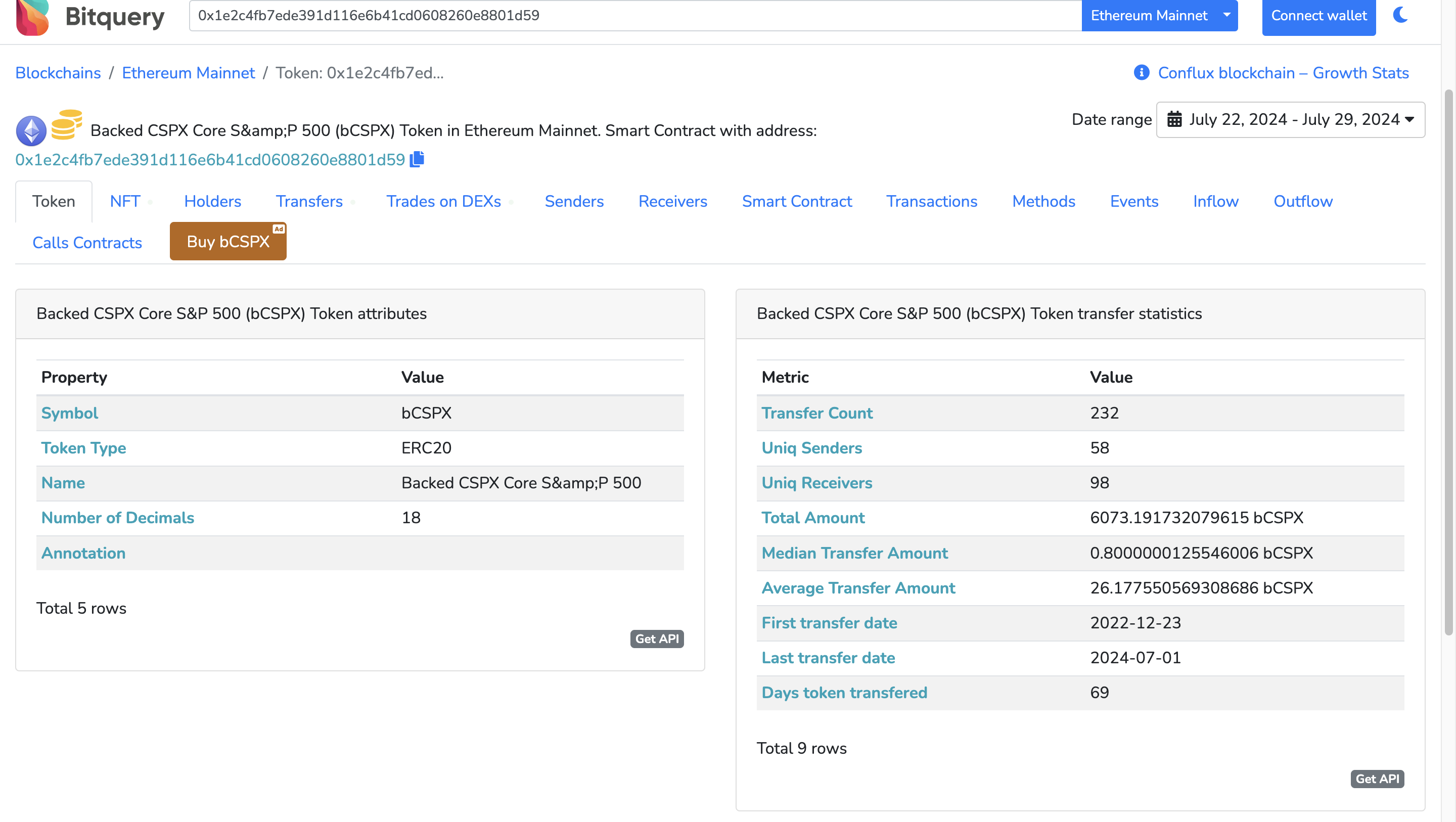

Backed CSPX CoreS&P 500 (bCSPX)

A token designed to track the performance of the iShares CoreS&P 500 UCITS ETF, providing investors with exposure to a diversified portfolio of large-cap U.S. companies.

-

Asset Chain: Ethereum

-

Asset Market Cap: $1,077,059

-

Asset Monthly Trading Volume: $12,878

-

Holders: 67

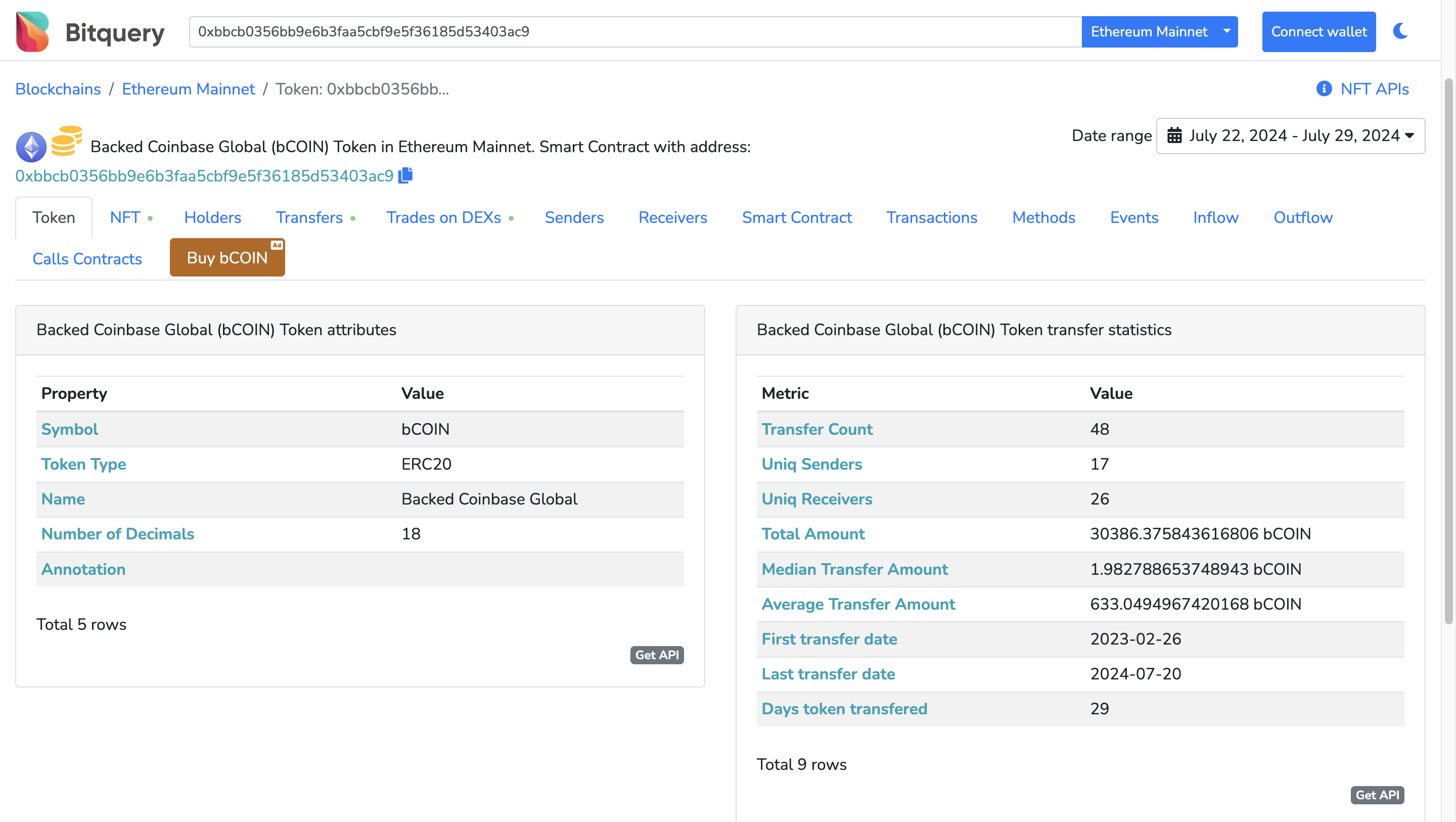

Backed Coinbase (bCOIN)

A tokenized version of Coinbase shares, allowing investors to participate in the growth of this leading cryptocurrency exchange while leveraging the advantages of decentralized finance.

-

Asset Chain: Ethereum

-

Asset Market Cap: $3,166,743

-

Asset Monthly Trading Volume: $329

-

Holders: 16

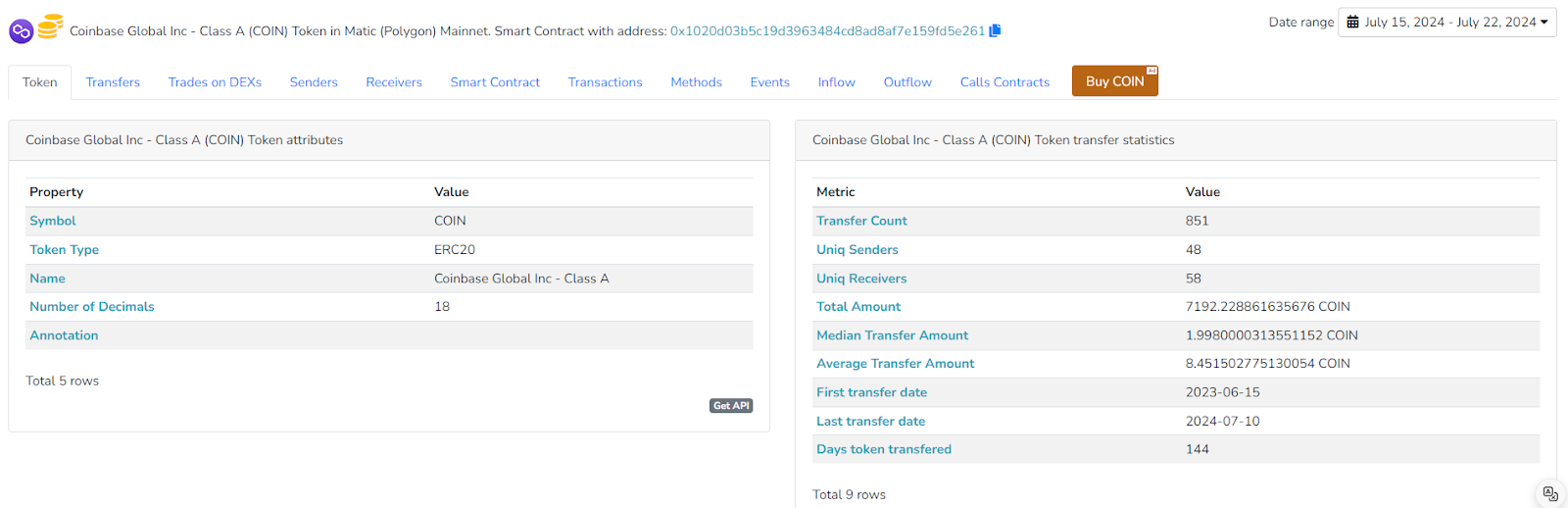

Swarm Coinbase (sCOIN)

Swarm's tokenized version of Coinbase shares, enabling users to invest in the performance of Coinbase through the Polygon network, facilitating a more accessible trading experience.

-

Asset Chain: Polygon

-

Asset Market Cap: $158,825

-

Asset Monthly Trading Volume: $103,313

-

Holders: 34

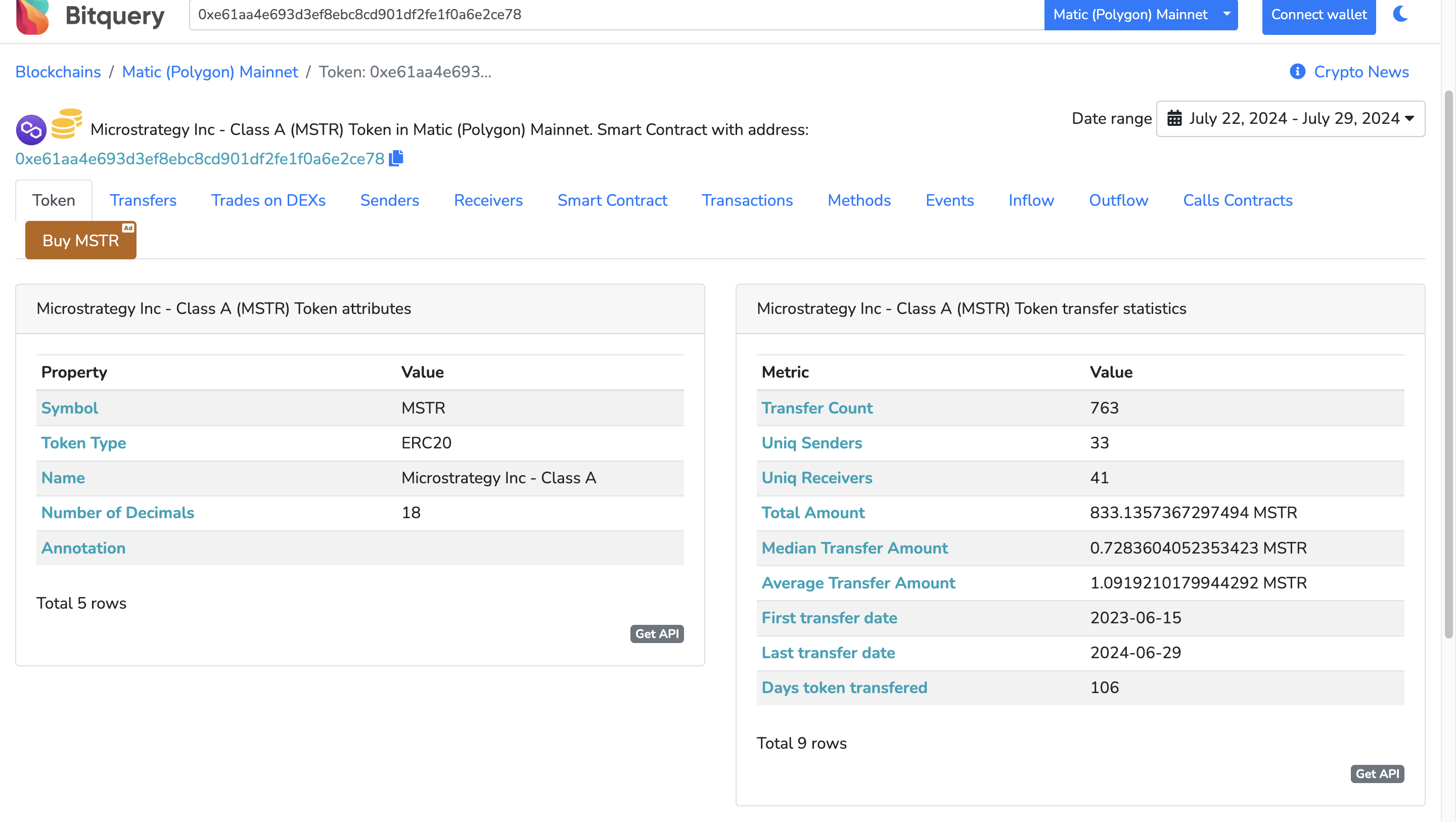

Swarm Microstrategy (sMSTR)

A token that provides investors with exposure to Microstrategy, a company known for its significant Bitcoin holdings, allowing users to invest in the stock while benefiting from blockchain technology.

-

Asset Chain: Polygon

-

Asset Market Cap: $128,052

-

Asset Monthly Trading Volume: $6,421

-

Holders: 22

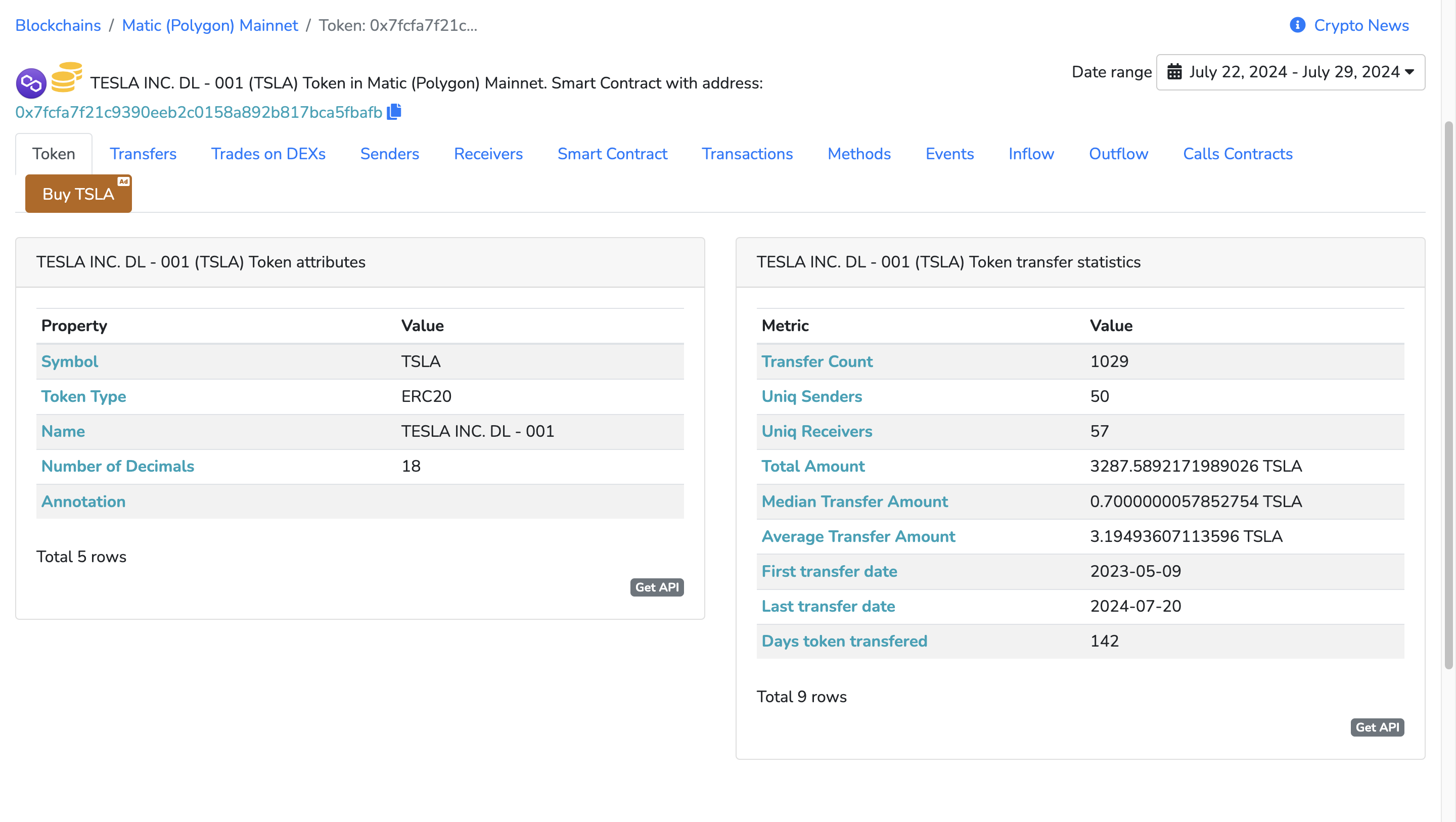

Swarm Tesla (sTSLA)

A tokenized representation of Tesla shares, enabling investors to gain exposure to this innovative company in the automotive and energy sectors through the Polygon network.

-

Asset Chain: Polygon

-

Asset Market Cap: $54,056

-

Asset Monthly Trading Volume: $43,186

-

Holders: 31

SPDRS&P 500 ETF Tokenized Stock FTX (SPY)

This tokenized version of the SPDRS&P 500 ETF allows investors to gain direct exposure to the S&P 500 index, which comprises 500 of the largest publicly traded companies in the U.S. It provides a convenient way to invest in a diversified portfolio without the need for traditional brokerage accounts.

-

Asset Chain: FTX

-

Asset Market Cap: $21,565

-

Asset Monthly Trading Volume: N/A

-

Holders: 21

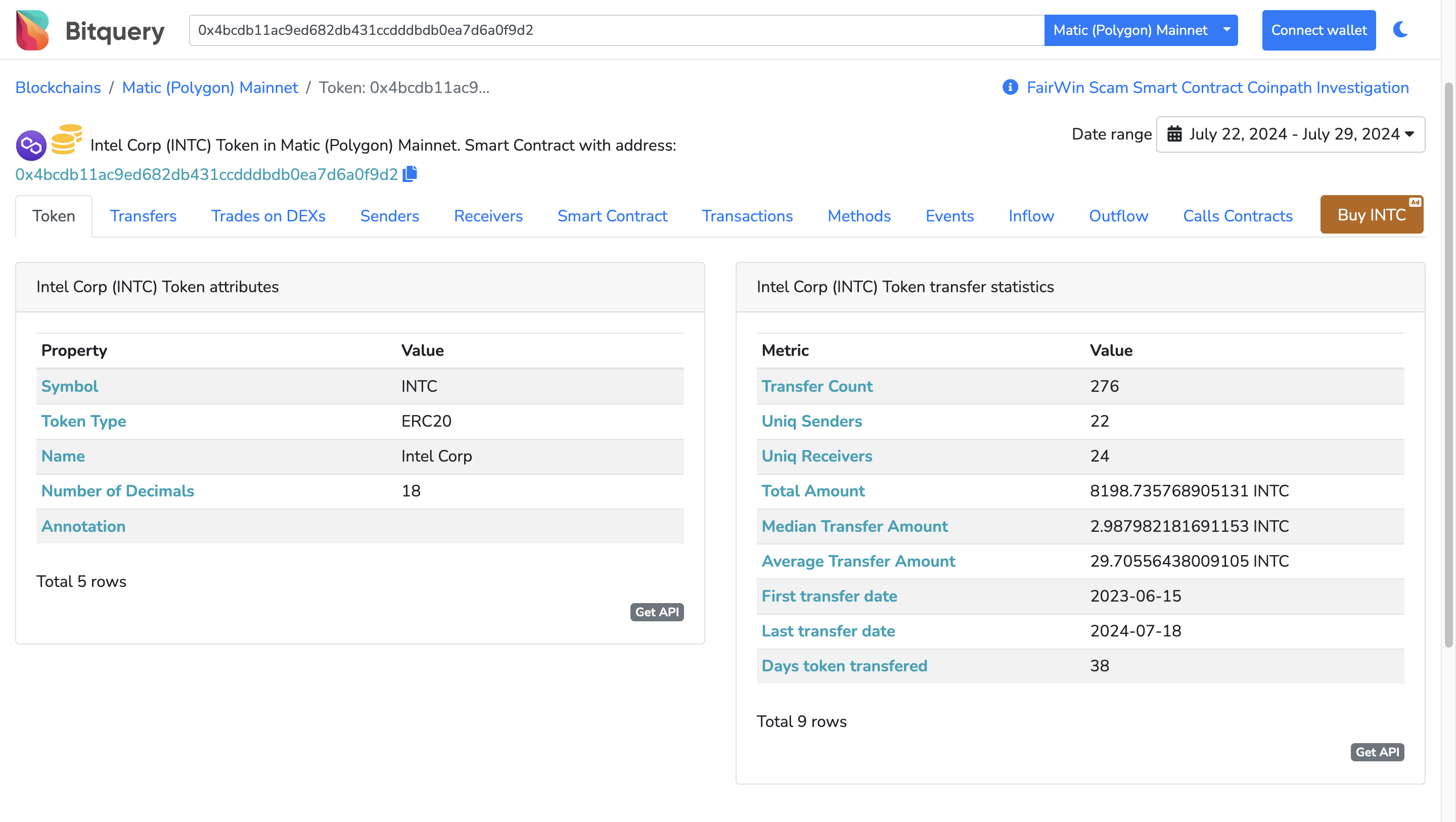

Swarm Intel (sINTC)

The Swarm Intel token (sINTC) represents a tokenized version of Intel Corporation shares, enabling investors to gain exposure to this leading semiconductor company through the Polygon network. By tokenizing Intel, Swarm provides a way for investors to trade this asset on-chain, enhancing liquidity and accessibility.

-

Asset Chain: Polygon

-

Asset Market Cap: $42,115

-

Asset Monthly Trading Volume: $3,618

-

Holders: 13

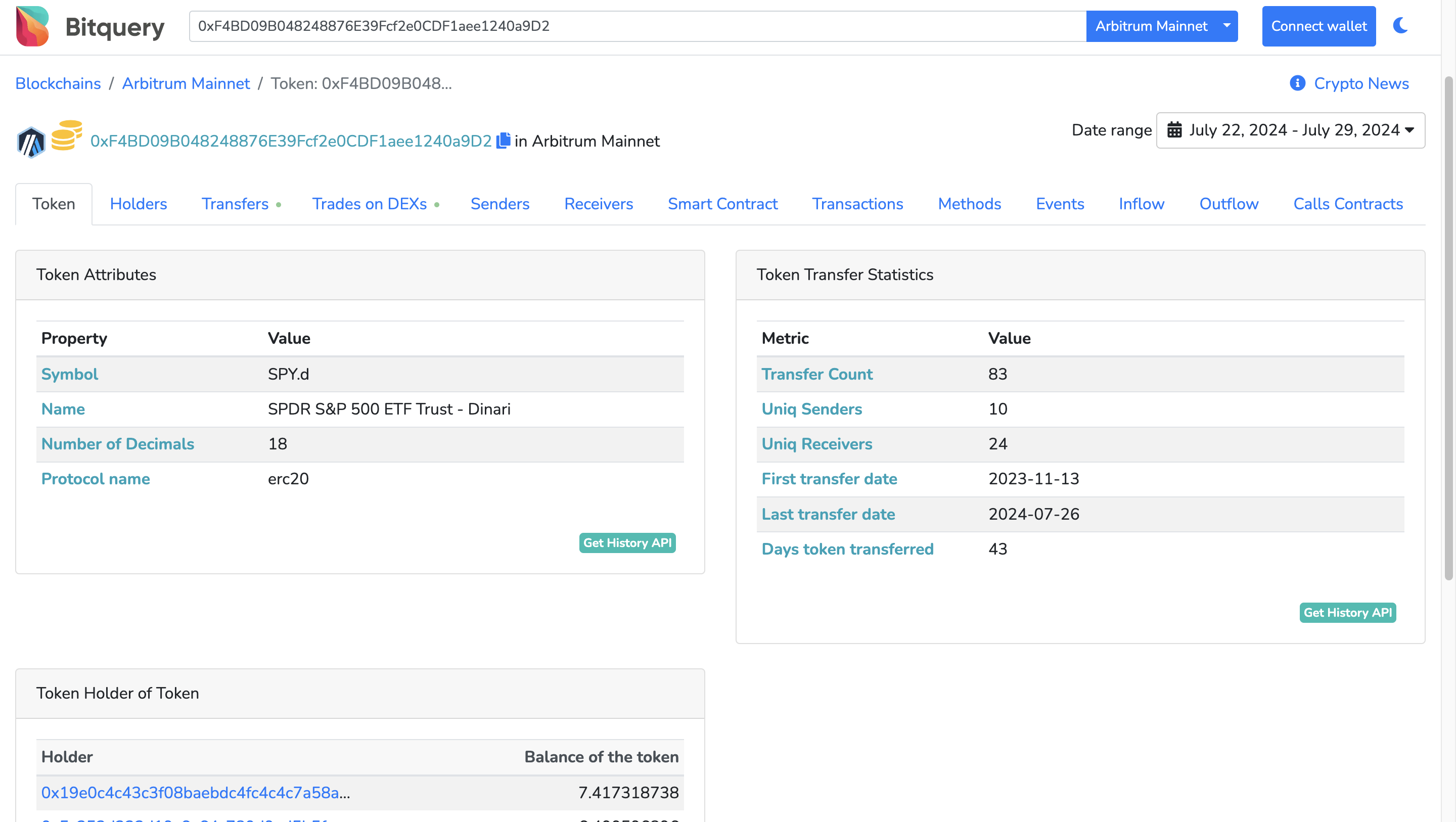

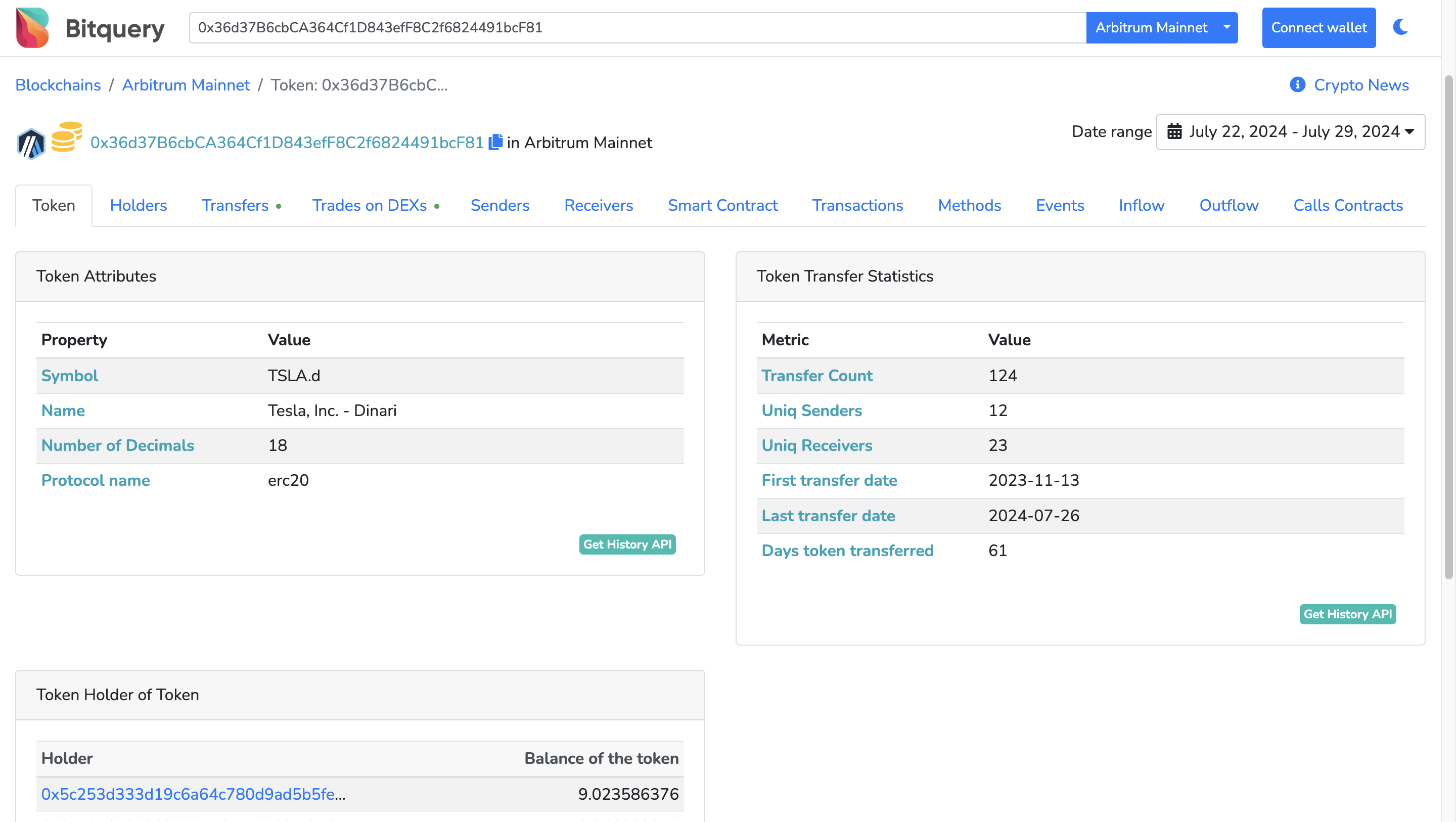

Tokenized Tesla (TSLA.d)

The tokenized Tesla equity (TSLA.d) allows investors to participate in the growth of Tesla, a leader in electric vehicles and renewable energy. This asset is fully backed by the underlying shares, providing a secure way to invest in Tesla's performance through blockchain.

-

Asset Chain: Ethereum

-

Asset Market Cap: $27,550

-

Asset Monthly Trading Volume: $3,958

-

Holders: 19

The data indicates that while these tokenized S&P 500 assets exist, there is currently no active trading volume or circulating supply, which may reflect their nascent stage in the market.

However, the introduction of these tokenized versions of popularS&P 500 ETFs and stocks highlights a growing interest in providing investors with blockchain-based exposure to the index, potentially paving the way for increased trading activity and liquidity in the future.

How to access the on-chain data of the S&P 500?

Bitquery offers functionalities to retrieve on-chain data for Real-World Assets (RWAs) and tokenized assets. Their RWA Data Solutions cater to various needs, including:

-

Issuers of tokenized assets: Track key metrics like liquidity, asset movement, ownership distribution, and total value locked (TVL) for their tokenized RWAs. This allows for transparency, investor confidence, and compliance.

-

DeFi participants: Analyze protocols and DeFi instruments related to tokenized RWAs. Gain insights into platforms like Maple, Goldfinch, Centrifuge, and others to understand performance, risks, and opportunities within the DeFi ecosystem.

Here's a general approach to get started with Bitquery for RWA and tokenized asset data:

- Explore Bitquery's Documentation: Bitquery offers comprehensive documentation to guide you through its functionalities. Head to the Real World Assets (RWA) Data Solutions page to understand their capabilities and available data sets.

- Identify Blockchain and Asset: Specify the blockchain network (e.g., Ethereum, Polygon) where the tokenized asset resides. Then, pinpoint the specific token representing the RWA you're interested in (e.g., security token for a specific bond).

- Utilize GraphQL Queries: Bitquery leverages GraphQL, a query language for APIs. Their platform offers a GraphQL playground where you can build queries to retrieve the desired data. Explore Bitquery's documentation for GraphQL examples and tutorials related to RWAs and tokenized assets. Bitquery helps in finding and analyzing the RWAs, for example: This query will help you find the TVL of a RWA. Bitquery's API can help you a lot to analyze, invest, and make an informed decision. For example, this query helps you get the basic info on an RWA.

- Bitquery Explorer: In addition to the GraphQL functionality, Bitquery also offers a block explorer. While the explorer might not be specifically designed for RWAs, it can be a useful tool for general blockchain exploration and inspecting token details on supported blockchains.

By understanding these steps and referring to Bitquery's resources, you can leverage their platform to extract valuable on-chain data for informed decisions regarding RWAs and tokenized assets.

A Look Ahead: The Future of S&P 500 on Blockchain

The tokenization of S&P 500 assets marks a pivotal shift in finance, offering unprecedented access and liquidity to global investors. While challenges remain, this innovation paves the way for a more inclusive and efficient financial ecosystem. Bitquery's powerful analytics tools stand at the forefront, enabling investors and developers to navigate this new landscape with confidence. As blockchain and traditional finance continue to converge, the future of index investing looks increasingly decentralized and accessible.

-- Written by Harshil

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.