MakerDAO Spike of Popularity

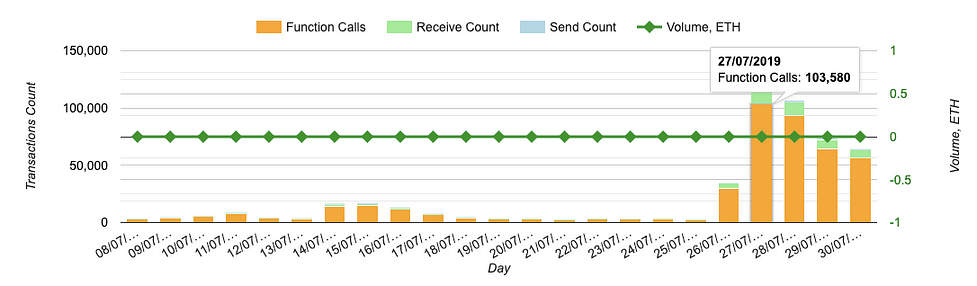

MakerDAO "SaiTub" smart contract daily call number immediately grown from a previous average ~10K/day to astonishing 103,580 calls per day at Saturday, 27 July 2019:

Daily calls of SaiTub smart contract, source

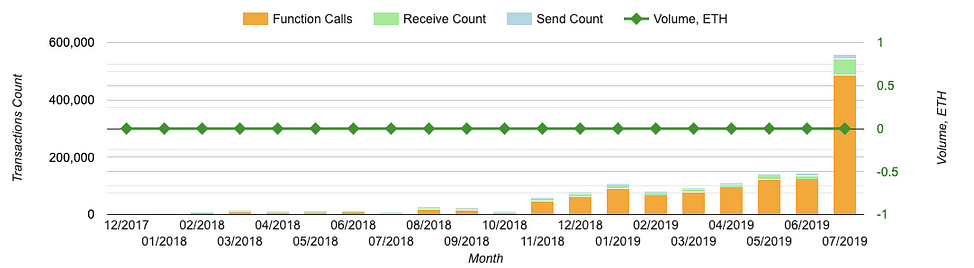

This is absolute daily maximum, and it made July as the most active month in all MakerDAO history:

Monthly calls of SaiTub smart contract, source

Actually without this particular spike, which lasted from 27 to 31 July, this July would look rather normal, with the same average statistics as the previous June.

So, this looked kind of strange and abnormal, and we wanted to look closer on this activity.

Which methods were used?

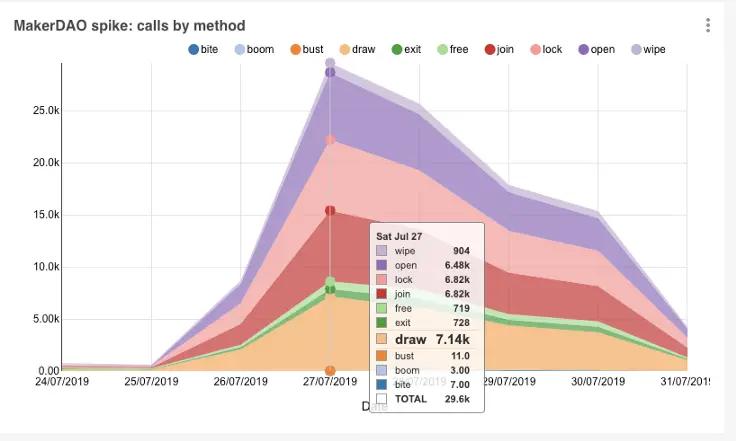

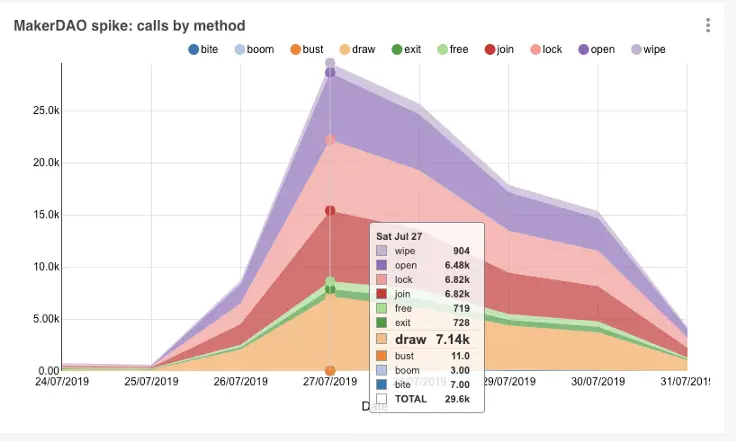

First lets look at the top methods that were actually called:

Contract Methods Call number, by day,

Top methods by call number are

- draw (7.14K / day ) issue the new DAI

- lock ( 6.82K / day ) add PETH collateral

- join ( 6.82K / day ) deposit ETH in exchange to PETH

- open ( 6.48 K /day ) creates CDP

More details on MakerDAO methods can be found in described in Maker DAO Transactions Illustrated article.

The first impression from the the top methods list is that people, absolutely new to MakerDAO project, are opening the new CDP by placing their own ETH. The sequence then should look as

JOIN -> OPEN -> LOCK -> DRAW

Let’s look at particular addresses in this time frame to confirm this:

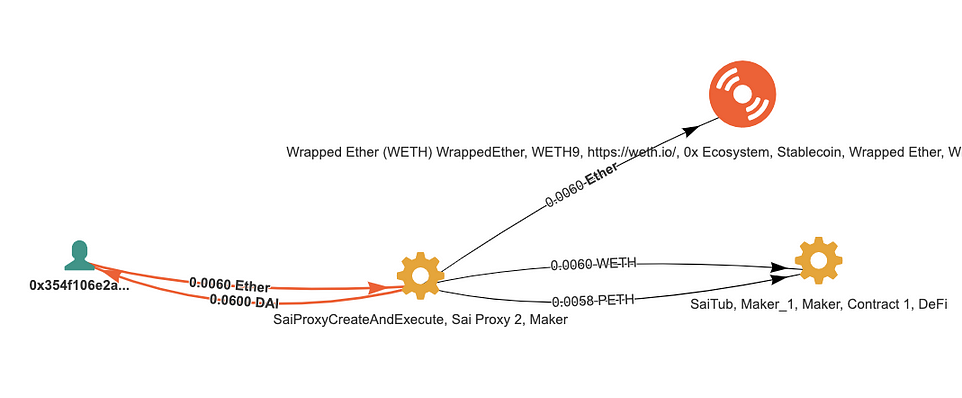

Example of the transaction over SaiProxy. Source

This transaction is doing exactly all operations listed above, through the proxy smart contract. From user perspective, it gets DAI in exchange to Ether for the caller. Internally, it invokes JOIN -> OPEN -> LOCK -> DRAW sequence of SaiTub smart contract.

How many people involved?

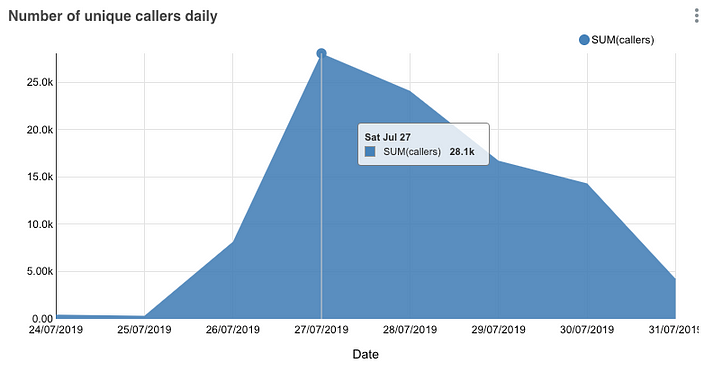

Here is the most interesting part. In one day, more than 27 thousand addresses called Maker DAO !

Daily unique smart contract callers ( senders of TX )

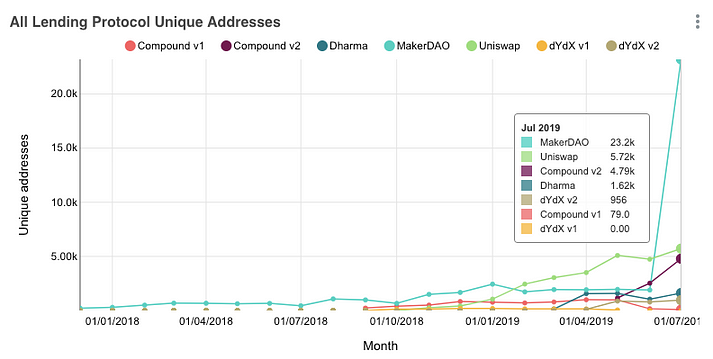

Is it a lot? Yes! Lets compare that with auditorium of some other DeFi projects to make sense of it:

Monthly unique users of lending protocols

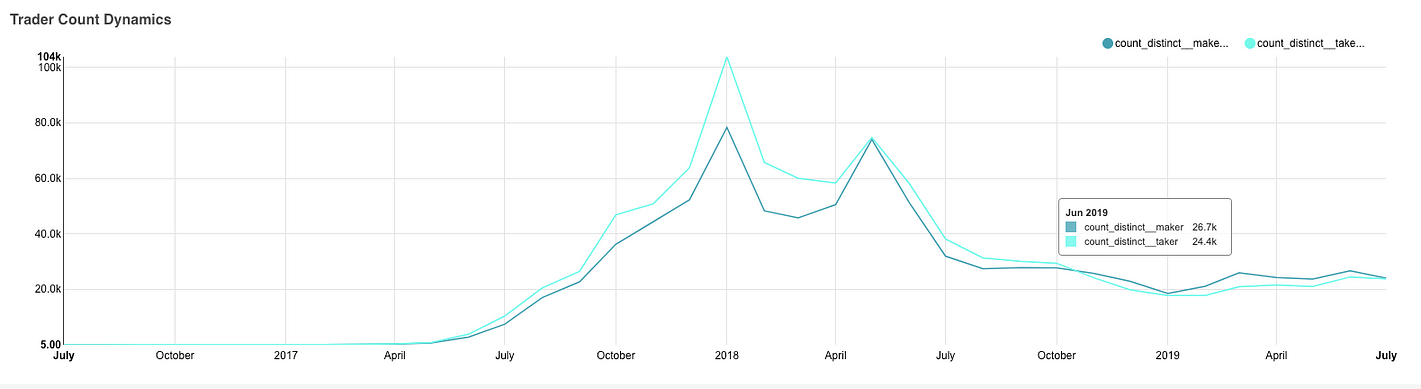

So this number appear to be well above all other similar project metrics. This is high even comparing with ALL traders ( makers / takers ) count on all Ethereum DEX'es:

DEX traders counts Source

How much money involved?

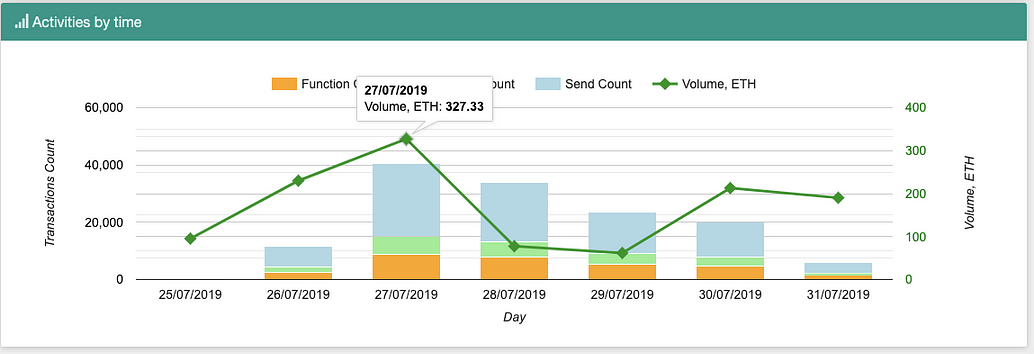

Not so much… just ~ 327 ETH ( in + out ) in a day :

ETH deposited using proxy contract. Source

ETH deposited using proxy contract. Source

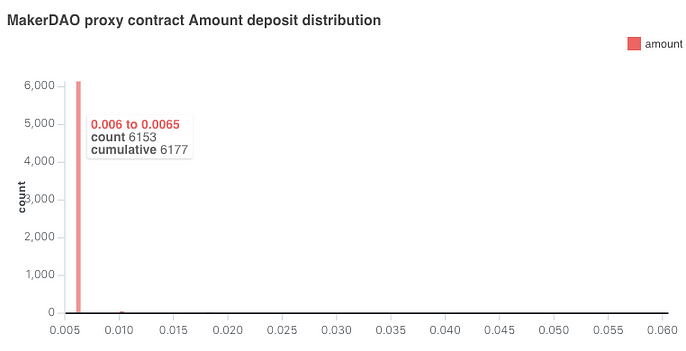

Average deposited amount ~ 327 / 2 / 28,000 = 0.005 ETH per address. Not so much, around $14.What is more interesting, they all deposited virtually THE SAME amount, around 0.006 ETH :

Distribution of amounts deposited, in ETH

Where they come from?

There is a strong suspect, that all the activity is caused by Coinbase advertising in DAI Lesson that gives 14 USD in DAI token when you pass it.

Need not be Sherlock to identify this features

- all amounts are the same

- many people involved doing the same activity

- limited in time and bound to advertising campaign ( it appeared 26 June in Twitter ).

- Good news is this allows to get a lot of unique users of MakerDAO technology.

Conclusion

This is a good example, when we found the consequence as event, as anomaly data on-chain, and ultimately get to the reasons of this.

Digital marketing probably has the new area of analytics, using the blockchain. This allows to combine the existing tracking capabilities, as Google analytics, with on-chain analytics, as Bloxy.info to measure the efficiency of ad campaigns.

It is very easy to measure MAU/DAU metrics, but way more important is to measure the retention of users on specific project, as MakerDAO. Even more important is to get revenue / ROI figures, that can be derived from the blockchain explicitly.

We can look in a month if any of these addresses started using DAI / PETH with Maker DAO smart contract and how successfully. We hope some of them will convert to Maker DAO traders.

This article was composed from the data and by analytical tools from Bloxy.info analytical engine. Bloxy.info web site provides a set of tools for analytics, traders, companies and crypto enthusiasts. The tools include APIs, dashboards and search engine, all available on-site, providing accurate data, indexed directly from the blockchain live node. Bloxy mission is to make blockchain more transparent and accessible to people and businesses. Please, make a reference to the source of data when referencing this article.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.