MakerDAO Tokens Explained: DAI, WETH, PETH, SIN, MKR. Part 1

Maker Dao

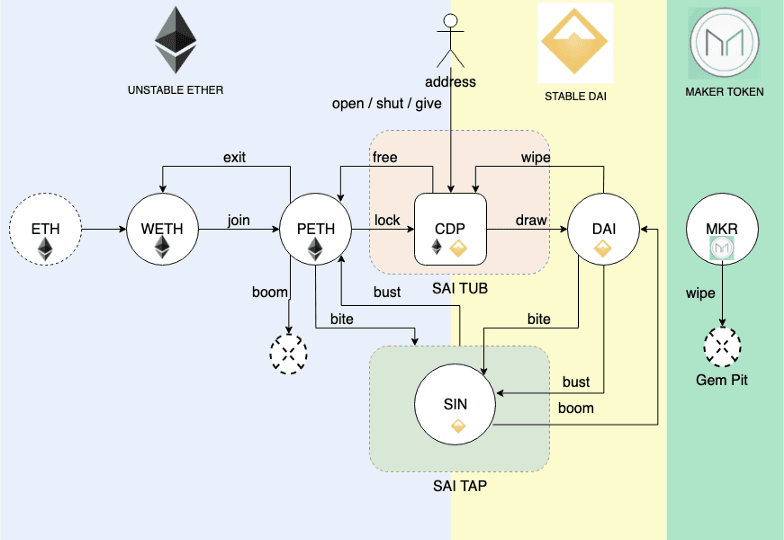

Maker DAO system consists of several smart contracts ( Sai Tap, Sai Tub, Vox, Medianiser, etc.), and ERC-20 tokens. Together they work to ensure the stability of DAI token.

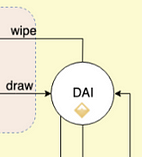

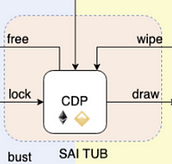

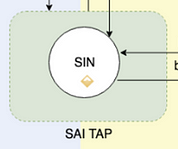

In this article, we will mostly focus on how tokens are rotated, and used. The diagram below shows the main token flows and smart contract methods, used to convert one token to another:

Maker DAO Tokens Turnaround and Contract Methods

Tokens are shown as circles, while smart contracts and their entities are rounded rectangular. The arrows on the diagram means that using these smart contract methods you can change the balance from one token to another.

For example, calling join() will remove WETH tokens from you and give you appropriate amount of PETH tokens instead.

Also read : MakerDAO Spike of Popularity.

Unstable ( "Ether"-like) Tokens

The left side of the diagram shows tokens, related to Ether:

Ether

Ether

Ether itself is not directly used in Maker DAO system. If you have Ether originally ( as most of us ), you have to first convert it to WETH ( Wrapped ETH ) token.

Weth

Weth

WETH is one-to-one reflection of ETH, but as ERC-20 token. In any moment you can change Ether to WETH and back. The downside is that every such transformation requires gas.

PETH

PETH

PETH is short for “Pooled Ether”. When you deposit WETH to Maker DAO, you get back this token. Note, that It is not exactly one-to-one to Ether, it rate is calculated.

Stable ( "DAI"-like ) Tokens

DAI

DAI

DAI is MakerDAO stable coin, which is expected to be close enough to 1 US dollar. It is minted for you when you generate a loan with CDP

SIN

SIN

SIN token represent the liquidated debt. It is equal in value to 1 DAI and used instead of DAI in debt clearance process

Maker DAO Utility Token

MKR

MKR

MKR token used to pay commission fee on closing the debt ( by wipe method ).

Smart Contracts

SAI Tub

SAI Tub

Sai Tub smart contract stores CDP’s. CDP is your debt in DAI leveraged by PETH. Most operations with Maker DAO done using it.

SAI Tap

SAI Tap

Sai Tap smart contract allows to liquidate the debt and generate the profit from it.

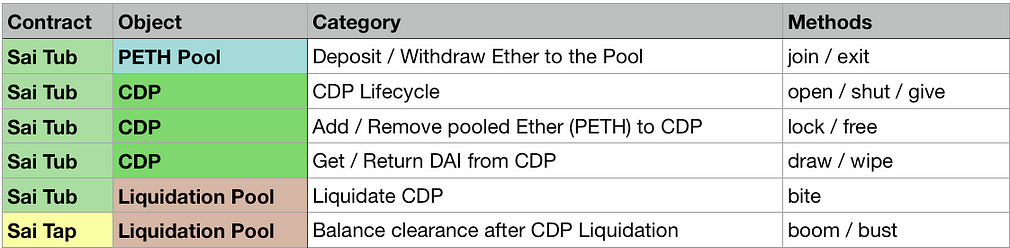

Smart Contract Methods

Maker DAO smart contracts have a lot of methods, major of them are categorized in the table below

Maker DAO smart contracts

Most of the method operate with the tokens we listed above and with CDP as internal Sai Tub entity.

A more detailed description of these methods you can find in Maker DAO transactions Illustrated article.

Token Usage Pattern

The material below is created based on the Bloxy.info and Bitquery Token Flow tool and Maker DAO analytical dashboard.

Bloxy.info web site provides a set of tools for analytics, traders, companies, and crypto enthusiasts.

The tools include APIs, dashboards, and search engine, all available on-site, providing accurate data, indexed directly from the blockchain live node.

Bloxy's mission is to make blockchain more transparent and accessible to people and businesses.

Please, make a reference to the source of data when referencing this article.

Our goal was to match the smart contract code and the diagram above with actual token flows and user actions regarding these tokens. We will investigate tokens one by one, from different perspectives, using our tools and analytical approach.

And our first token is….

WETH ( Wrapped Ether)

WETH is wrapped Ether and can be used instead of Ether where ERC-20 tokens are expected. The first coming to mind is decentralized exchanges (DEX). Typically DEX protocols expect ERC20 tokens as buy/sell-side assets, and they can not work with Ether directly. So you first change your Ether to WETH, exchange it, and later WETH can be changed back to Ether.

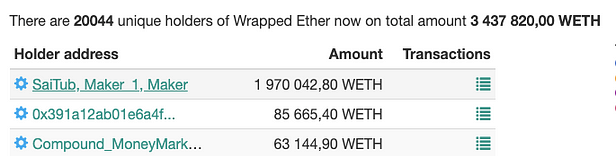

This token started at December, 2017, the same time as Maker DAO protocol. Note, that the largest holder is Maker DAO smart contract:

WETH largest holders

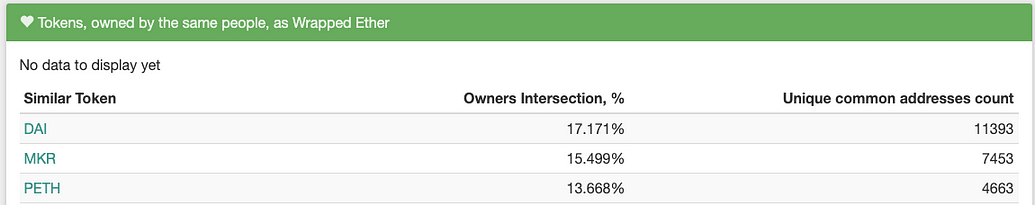

The intersection by owners with other tokens also shows Maker DAO tokens:

Tokens correlated by common holders, Source: Bitquery

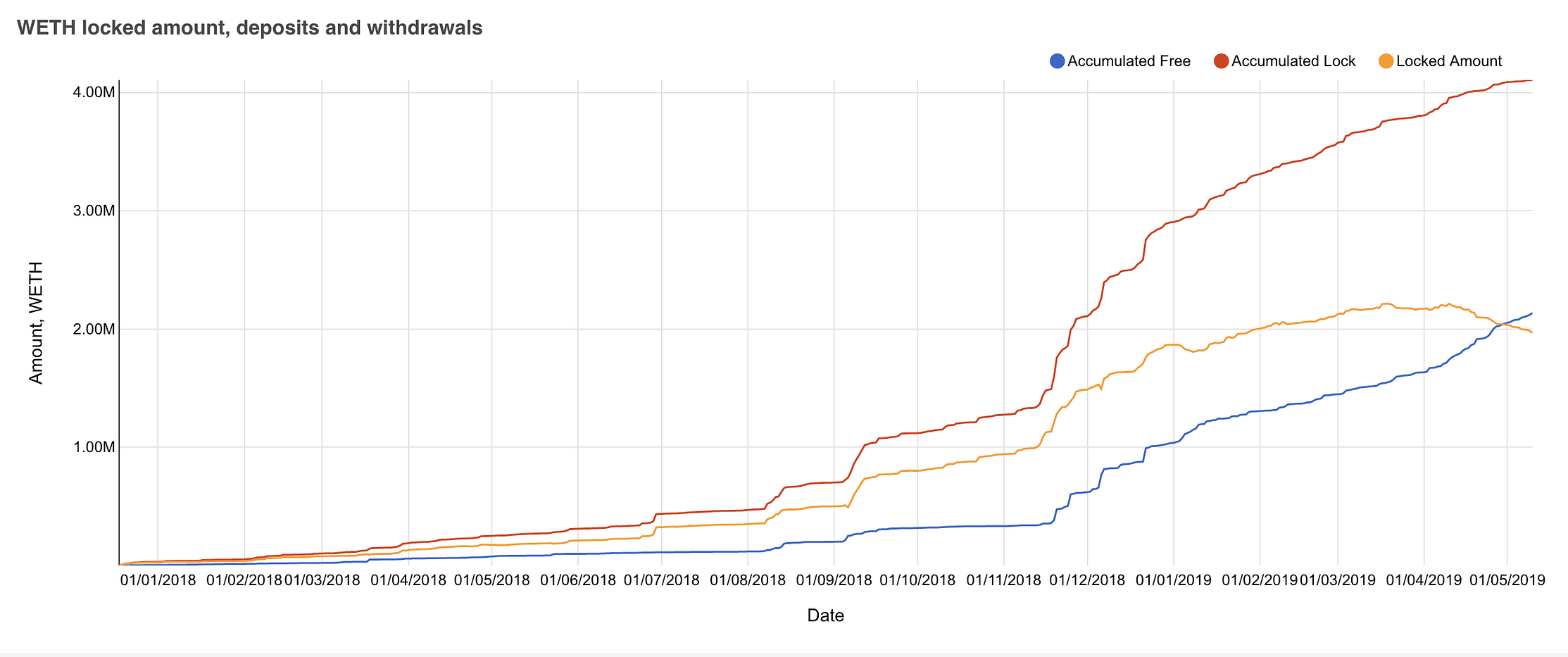

This high WETH balance on SaiTub MaerDAO smart contract appear, as users deposit WETH to Maker DAO’s SaiTub smart contract to create CDPs later. We analyzed the dynamics of this process on the MakerDAO dashboard:

WETH locked amount, deposits, withdrawals. Source: Bitquery MakerDAO dashboard

As seen from this graph, on 10 May, 2019 the locked WETH amount is approx. 2 million ETH ( orange line), while totally minted amount is above 4 million ETH.

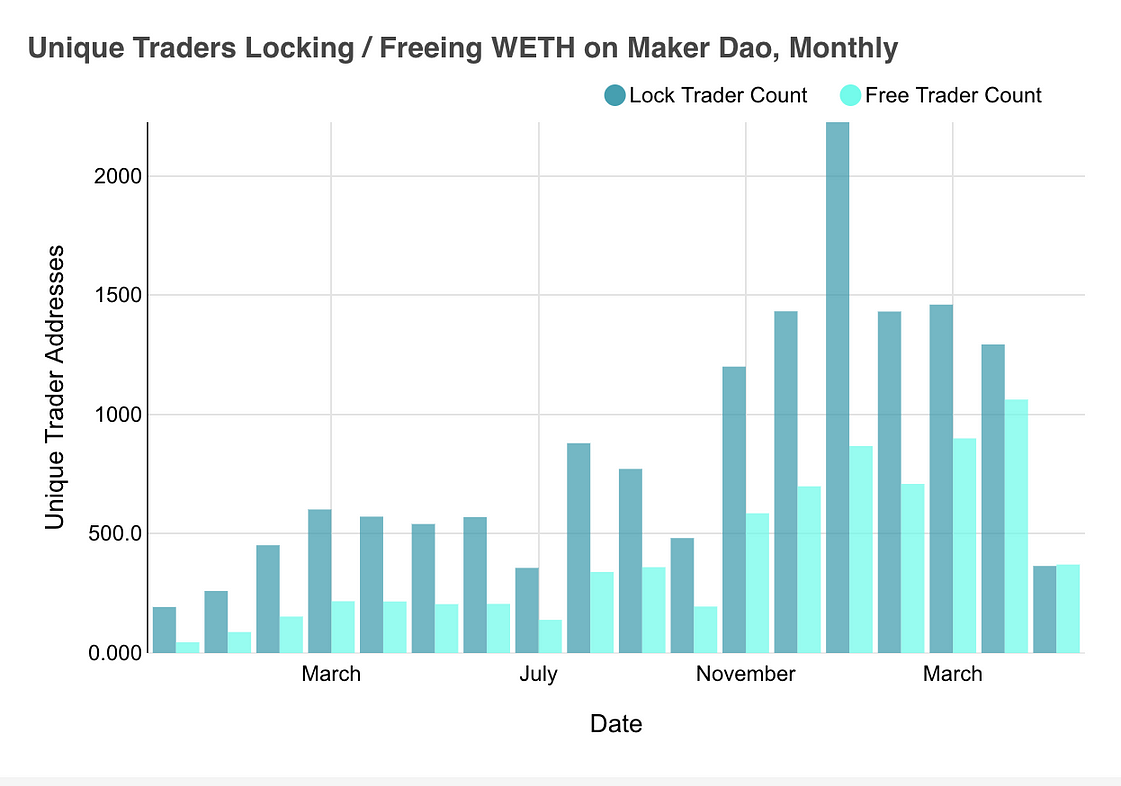

How many people involved in this activity? The number of traders can be estimated by unique addresses, initiating exit/join transactions on SaiTub smart contract:

Unique count of addresses, locking and freeing WETH on Maker DAO smart contract. Source: Bitquery

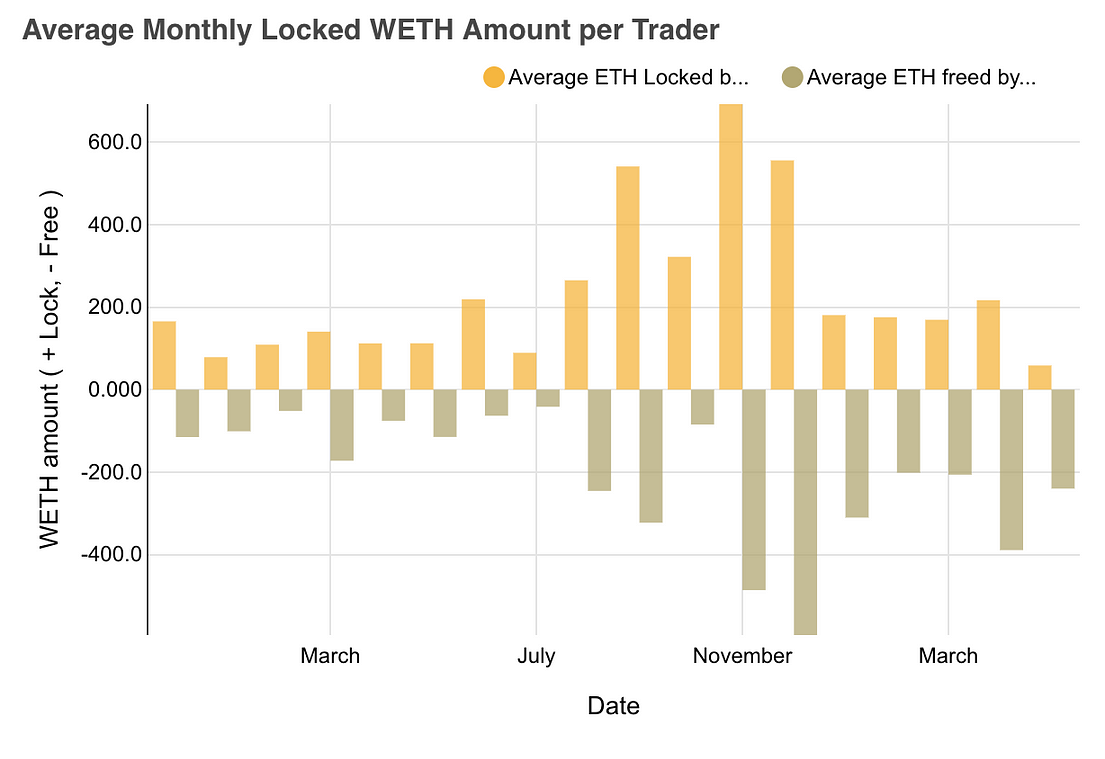

Traders behavior is described by how many WETH the lock and free each month:

Monthly free/lock WETH amount. Source: Bitquery

Interesting trend that the lock and free amount looks rather symmetrical, before the April 2019, when more people started to withdraw ( free ) WETH from Maker DAO, comparing to deposit ( lock ) it. These are 2 right columns of this diagram. This in turn caused that reduction in WETH balance on Maker DAO.

WETH outside Maker DAO?

The question is - is it used anywhere except Maker DAO?

Answer is yes. First, it is very actively traded on ZeroX and Oasis ( Matching Market ) exchanges, as shown on Bloxy.info WETH trading page.

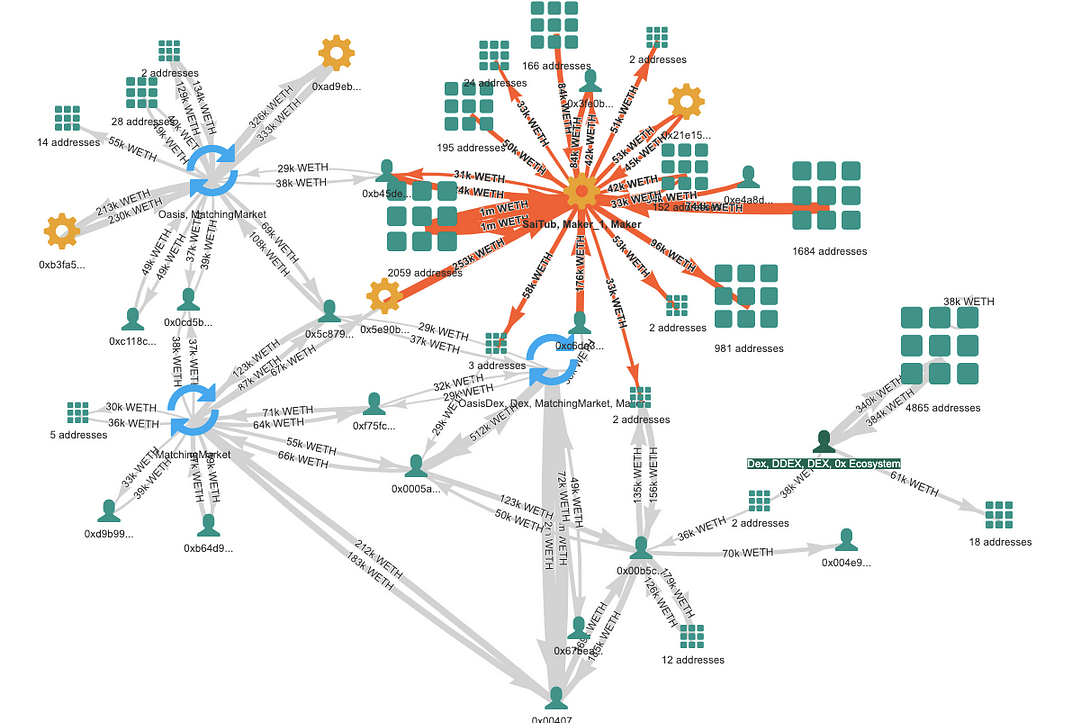

Token Flow Tool shows major flows of WETH:

Main WETH flows. Source: bloxy.info

As you see, there are several "centers of gravity" for WETH token:

- SaiTub from MakerDAI

- Oasis, DDEX exchanges

- ZeroX (not involved in transfers, so not explicitly shown on this graph)

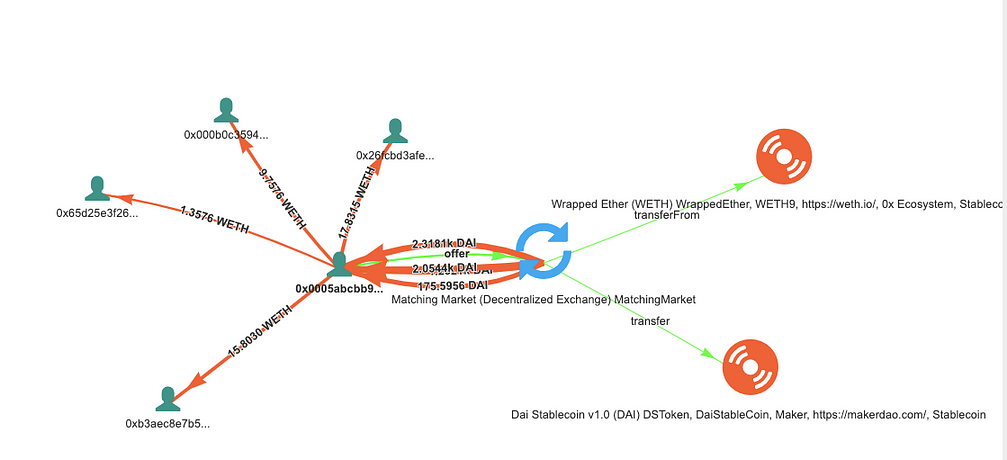

Example of WETH trading by one of the most active traders on DEX is this transaction:

DEX trade between many parties with WETH/DAI pair. Source: bloxy.info

WETH is traded not just agains DAI, here is the list of top 10 pairs on DEX exchanges:

Top 10 pairs for WETH on DEX. Source: bloxy.info DEX API

PETH ( Pooled Ether)

PETH represents ETH, that you put into Maker DAO smart contract to create DAI debt in the future. It has the rate against WETH, equals to

PETH = (WETH balance ) / (Total PETH supply) WETH

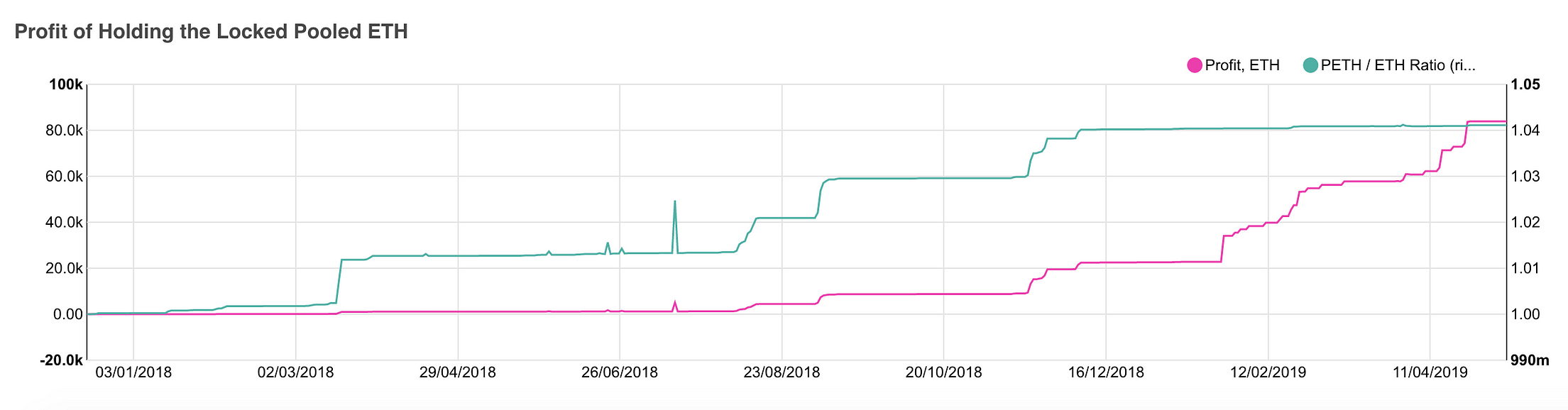

It is now equal to 1.04, as part of PETH has been burnt due to debt liquidations. This number increased with time as shown on the diagram:

PETH/WETH rate and profit associated with it. Source: bloxy.info

The change of PETH/WETH rate generate the APR and profit for the users, who joined the pool and received PETH in exchange to WETH, long time ago. Their summary profit is estimated around 80,000 ETH.

PETH is not traded on DEX and seems to be used solely inside MakerDAO infrastructure.

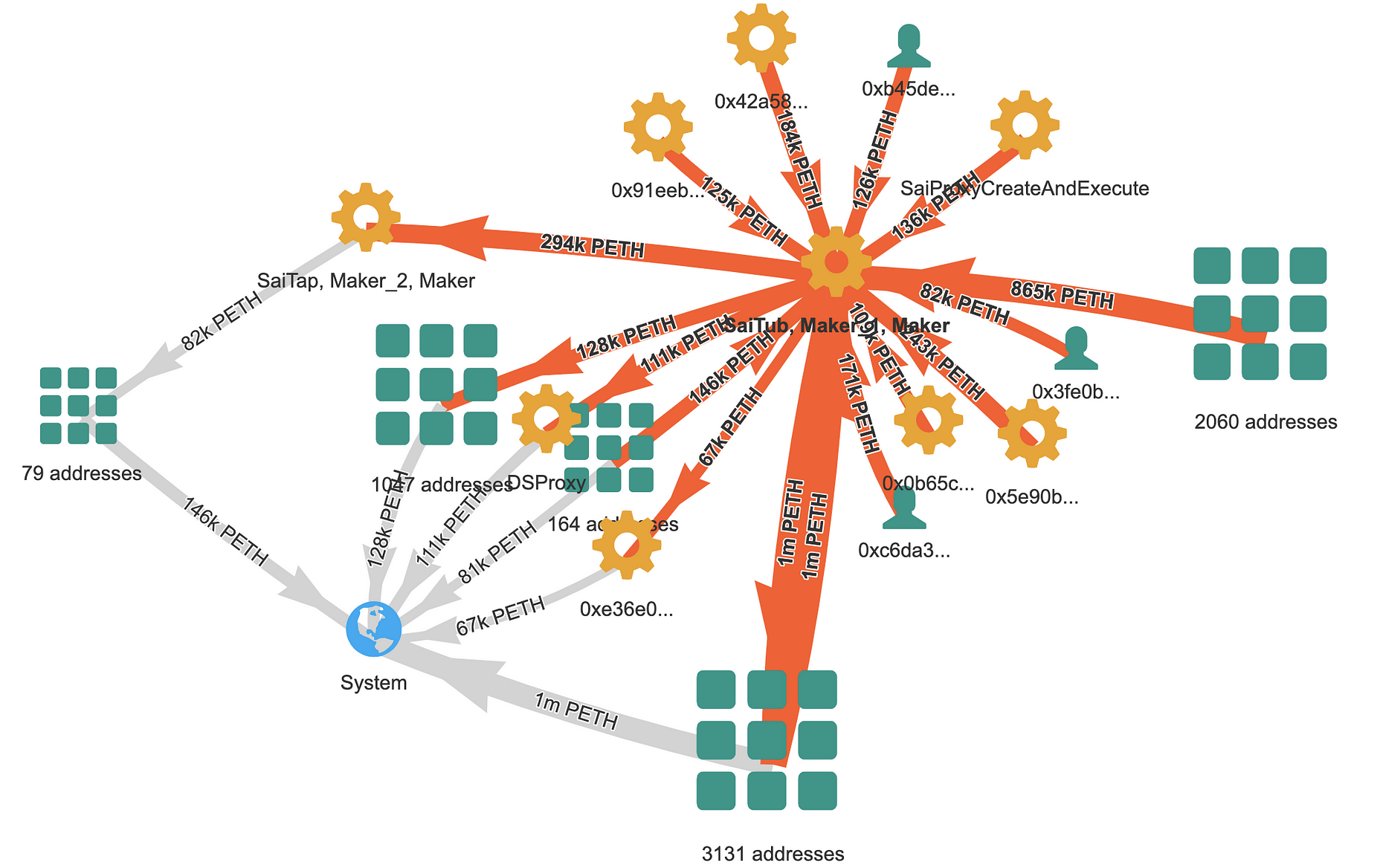

Token flow below shows, that the major PETH flow goes from traders to Sai Tub smart contract. Part of the flow then goes to SaiTap ( in case of debt liquidation), or to system address ( for burning ):

PETH token flow. Source: Bitquery MoneyFlow tool

To be continued! In part 2 we will talk about the tokens DAI, MKR and SIN !

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.