Exploring the Symbiotic Relationship Between Meme Coins and Their Native Networks

Meme coins have gained significant traction in the cryptocurrency market, driven by community engagement, humor, and speculative trading. Despite their often playful origins, coins like Dogecoin, Shiba Inu, BONK, WIF, PEPE etc. have developed substantial market presence and captured a significant percentage of the mindshare of the crypto participants, and in a market where attention is the only scarce resource they can no longer be overlooked by any serious trader or speculator. This article explores the symbiotic relationship between these meme coins and their native networks, focusing on how network activity impacts meme coin valuations.

Understanding Meme Coins and Their Networks

Meme coins, known for their humorous and satirical nature, have emerged as notable players in the crypto market. Key examples include:

Dogecoin (DOGE)

Initially created as a joke, the first meme coin ever. It has grown into one of the most recognisable and discussed cryptocurrencies. It is the progenitor of all categories of meme investing.

Launch Date: December 6, 2013

ATH Date: May 5, 2021

Holders Count: 6.9 Million

Shiba Inu (SHIB)

An Ethereum-based token dubbed the "Dogecoin killer." It has been tested over the bear market and was able to maintain its stronghold amongst the largest cryptocurrencies.

Launch Date: Aug 1, 2020

ATH Date: Oct 28, 2021

Holders Count: 1395205

PEPE Coin (PEPE)

According to PEPE’s official website, “PEPE is a meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. The coin is completely useless and for entertainment purposes only.” and yet it finds itself hard to be displaced for the list of top 50 crypto currencies.

Launch Date: April 17, 2023

ATH Date: May 15, 2024

BONK

A meme coin on the Solana network, known for its popular meme and as the $DOGE of SOL surged in unison with the rise of SOL.

Launch Date: December 25, 2022

ATH Date: March 4, 2024

Native Network Price (SOL):

Dogwifhat (WIF)

Another Solana-based meme coin with significant trading volumes.

Launch Date: 20 November, 2023

ATH Date: Mar 31, 2024

These coins leverage the infrastructure of native networks such as Ethereum and Solana, which provide essential support for transactions, smart contracts, and liquidity.

Price Dynamics and Network Activity

Historical data reveals a strong correlation between meme coin price surges and spikes in network activity. For instance, BONK and WIF experienced significant price increases in Q4 2023 and Q1 2024, coinciding with record trading volumes and active addresses on the Solana network, which can be seen in the BONK and WIF price action correlation graphs in the next section.

Data Analysis

- Solana Network Activity: During periods of intense meme coin trading, Solana's decentralized exchange (DEX) volume reached record highs. In March 2024, Solana's trading volume hit nearly $3 billion, surpassing Ethereum's volume during the same period

- Price Surges: BONK surged by 218% over seven days, with a corresponding increase in Solana's network activity. Similarly, PEPE saw a 406% weekly gain, driven by heightened activity on the Ethereum network.

Graphical Representations (Price action correlation)

ETH vs PEPE Price Action correlation

ETH vs SHIB Price Action correlation

SOL vs Bonk Price Action correlation

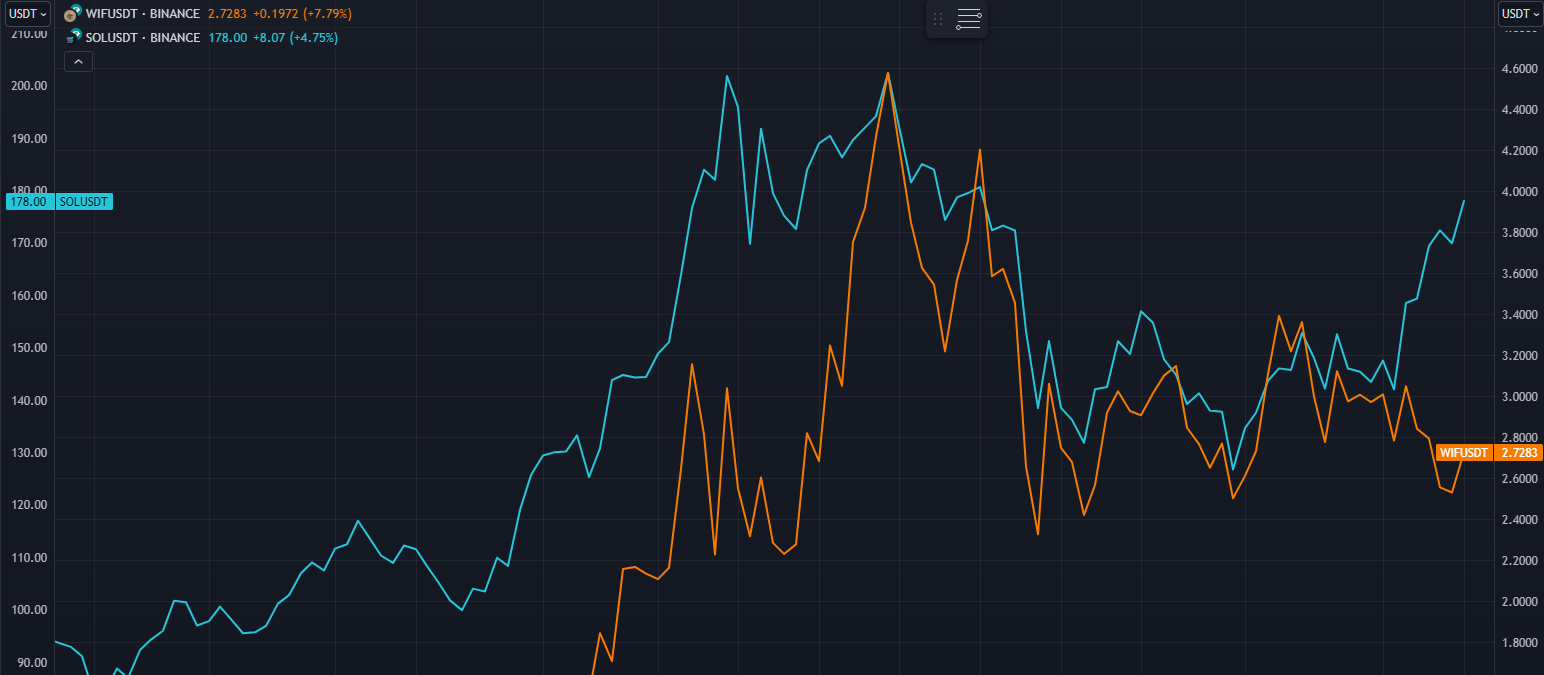

SOL vs WIF Price action correlation

The charts reveal that meme coin surges generally follow the surge in their native network assets. For instance, SHIB's sharp spikes tend to occur after significant movements in ETH, and PEPE's price increases lag behind Ethereum's upward trends. Similarly, BONK and WIF show price jumps that align with or come after notable increases in SOL. This pattern suggests that meme coins often respond to the performance of their native networks, with their value fluctuations and surges typically trailing behind the more stable and influential movements of the network assets like ETH and SOL.

Case Studies and Real-World Examples analysis using Bitquery API

Case Study: WIF and Solana

In early 2024, WIF's price surge was accompanied by a marked increase in Solana's network metrics. Transaction volumes, active addresses, and DEX activity all peaked during this period, highlighting the interconnectedness of meme coin success and network performance. Let’s take a look at some on chain metrics using the bitquery GraphQL IDE

Solana Daily Active Users Query and Total transactions By Month

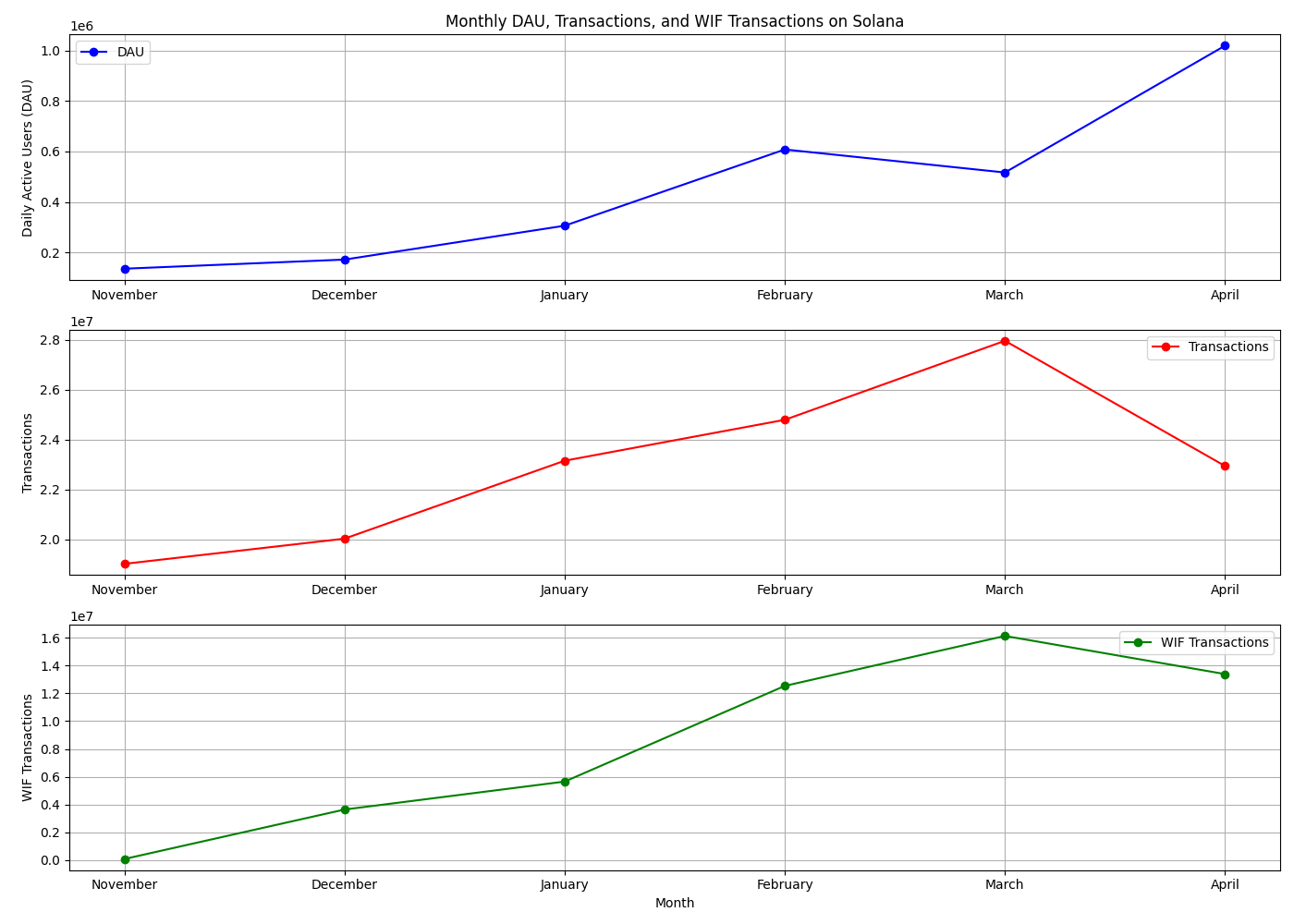

Let's delve into Solana's network activity to better understand the relationship with WIF's price movements. We begin by examining the daily active users and total transactions on the Solana network. These metrics will help us gauge the overall engagement and workload on the network during the period of interest.

Total WIF’s transactions by month

Next, we focus specifically on WIF's transactions. Analyzing the volume of transactions directly related to WIF will provide insights into its trading dynamics and popularity among users during the surge periods.

The graphs below display the trends in network activity alongside WIF's transactions. Notice how fluctuations in daily users and transaction volumes correlate with changes in WIF's transaction numbers, offering a visual representation of their interconnectedness.

Case Study: PEPE and Ethereum

PEPE's price explosion in early 2024 was closely tied to Ethereum's network activity. The coin's value surged as Ethereum's price surpassed $3,000, sparking interest in ETH-based assets. Social media trends and whale trading activities further amplified PEPE's price movements. Let’s take a look at some on chain metrics using the bitquery GraphQL IDE

Holder growth Month over Month Query

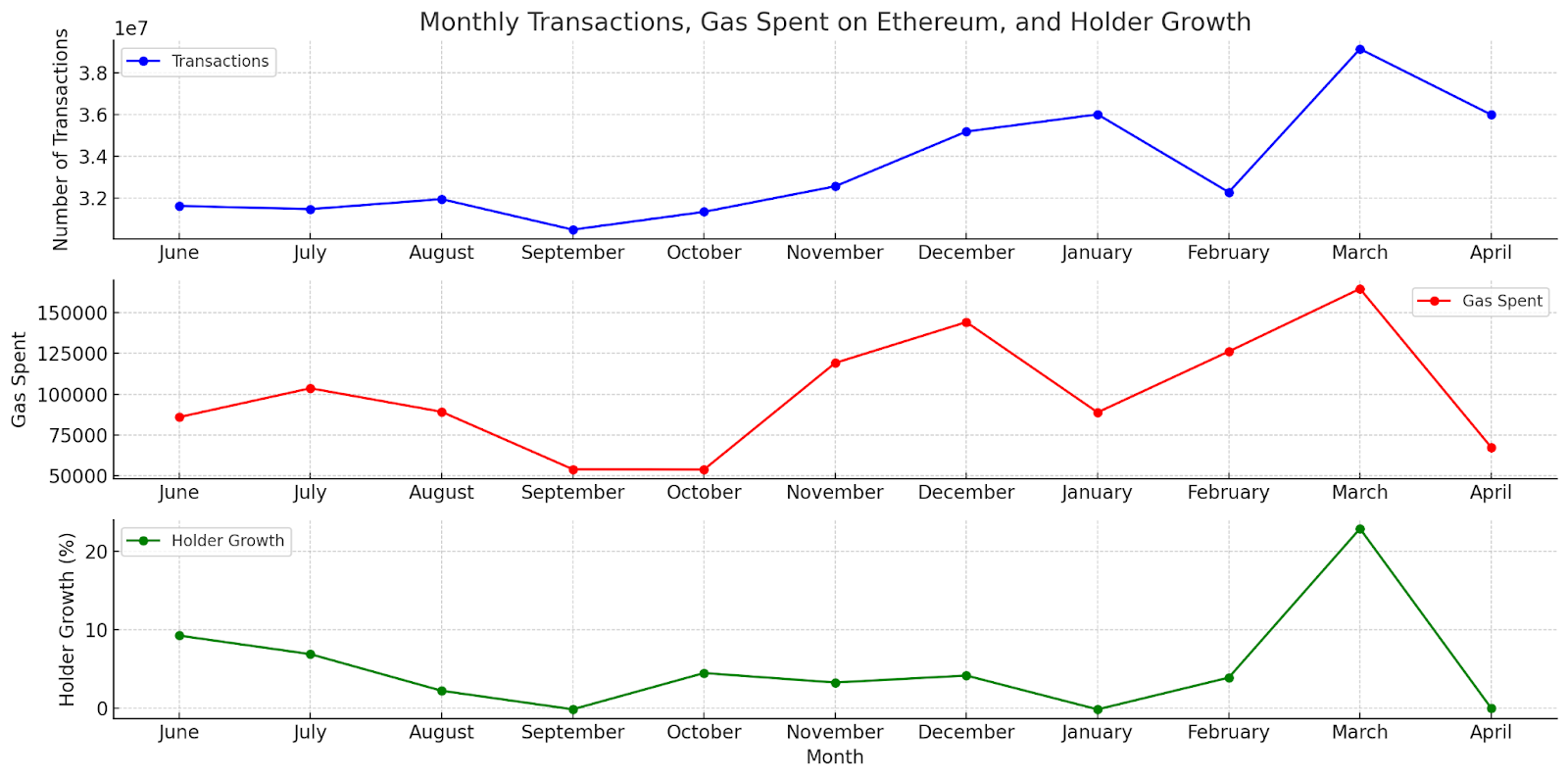

To understand the impact of Ethereum's market dynamics on PEPE, we start by looking at the monthly changes in PEPE holders. This metric will help us assess investor interest and adoption rates as Ethereum's price fluctuated.

Monthly PEPE Holder's change

Holder growth reflects the number of unique addresses holding PEPE, indicating user adoption and network confidence. For instance, despite the high gas expenditure in March 2024, there is a notable increase in PEPE holders by 22.91%, demonstrating strong investor interest.

Gas Spent vs Total Transactions

Further, let's explore Ethereum's network efficiency and cost-effectiveness during this period by examining the total gas spent and the number of transactions. These figures are crucial for understanding the network's performance and how it might influence PEPE's transaction costs and accessibility.

An increase in gas consumption is typically associated with growth in network activity. Higher gas values indicate more users interacting with the network or executing more complex operations. For example, in November 2023 and March 2024, we observe significant spikes in gas expenditure, suggesting increased network activity during these periods as can be seen in the above query.

Below are graphs/tables charting the relationship between Ethereum's transaction counts, gas expenditures, and the percentage change in PEPE holders.

% change vs Gas spent vs Total eth transactions vs PEPE holders from June 2023 to April 2024 ($PEPE)

Conclusion

Our analysis reveals a strong correlation between native network usage and meme coin activity, with specific focus on WIF on Solana and PEPE on Ethereum.

WIF on Solana

From November to April, there was a significant increase in Daily Active Users (DAU) on Solana, peaking in April with over 1 million users.

WIF transactions mirrored this growth, peaking in March. This suggests a positive correlation between Solana's network activity and WIF transactions.

PEPE on Ethereum

PEPE transactions showed substantial growth during periods of high Ethereum activity. Peaks in Ethereum transactions coincided with spikes in PEPE transactions.

High gas fees during these peak periods also influenced PEPE transactions, indicating that broader network congestion impacts meme coin activity.

Both WIF and PEPE demonstrated increased activity during times of high network engagement, highlighting that meme coin transactions are significantly influenced by the overall usage of their native networks, the network usage peaks also coincided very closely with the ATH(All time high) prices of the network tokens and the meme coins.

In conclusion, the analysis underscores the positive correlation between native network metrics, meme coin prices, and overall meme coin activity, illustrating that heightened network engagement drives meme coin success.

Written by Anish M

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.