From Uniswap to SushiSwap: A Deep Dive into Ethereum's DEX Ecosystem

Decentralized exchanges (DEXs) have emerged as a fundamental component within the Ethereum ecosystem, revolutionizing the way digital assets are traded. Unlike centralized exchanges, which rely on a central authority to match buyers and sellers and hold users' funds in centralized wallets, DEXs operate on a distributed network of nodes. This allows users to retain ownership of their assets throughout the trading process and execute transactions directly from their digital wallets.

Let’s take a look at how the DEX space plays out in the Ethereum ecosystem.

Top 5 Decentralized Exchanges (DEXs): A Comparative Overview

Decentralized exchanges (DEXs) are disrupting the traditional model of cryptocurrency trading. Unlike centralized exchanges, DEXs facilitate peer-to-peer trading without intermediaries, offering greater control over your assets and potential anonymity. If you're venturing into the realm of DEXs, here's a breakdown of the top 5 players and what sets them apart.

1. Uniswap: The Established Giant

Uniswap stands as a titan in the DEX landscape, particularly on the Ethereum network. Its core strength lies in its Automated Market Maker (AMM) model, where liquidity pools replace traditional order books. This enables seamless token swaps without relying on buyers and sellers directly matching orders. Uniswap boasts a vast selection of tokens and significant trading volume, contributing to its often competitive pricing.

2. SushiSwap: Fork with a Twist

SushiSwap began as a fork of Uniswap, but it has carved its own niche. SushiSwap incentivizes liquidity providers with its native SUSHI token. Holders also gain a voice in governance decisions. SushiSwap often offers a wider range of less-established tokens, attracting those seeking exposure to newer crypto projects.

3. PancakeSwap: The Binance Smart Chain Heavyweight

PancakeSwap is the dominant DEX of the Binance Smart Chain (BSC). Similar to Uniswap, it utilizes an AMM model for smooth trades. PancakeSwap distinguishes itself through features like yield farming, lotteries, and NFT integrations. While BSC-based, PancakeSwap often has lower fees compared to the Ethereum-focused DEXs.

4. Curve Finance: Stablecoin Specialist

Curve Finance zeroes in on providing deep liquidity and efficient swaps for stablecoins (e.g., USDC, DAI) and other pegged assets. Its specialized algorithm is tailored for maintaining minimal price slippage during stablecoin trades. If your trading strategy centers around stablecoins, Curve Finance is likely top of the list.

5. Balancer: The Customizable AMM

Balancer extends the AMM (Automated Market Maker) concept with greater flexibility. Liquidity providers can create pools with up to eight tokens instead of the standard two-token model. They can also customize the weighting of tokens within the pool. This functionality opens up possibilities for sophisticated liquidity provision strategies.

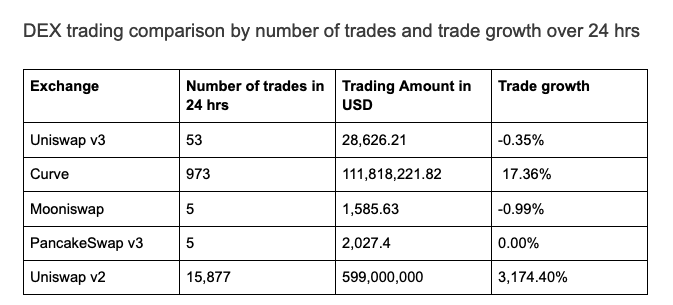

DEX Trading Comparison by Number of Trades and Trade Growth over 24 hrs

The above table shows trades done over 24 hours in the top 5 DEXs. We see that Uniswap v2 has the most growth exceeding 3,147 % with the largest trading volume in that period followed by Curve.

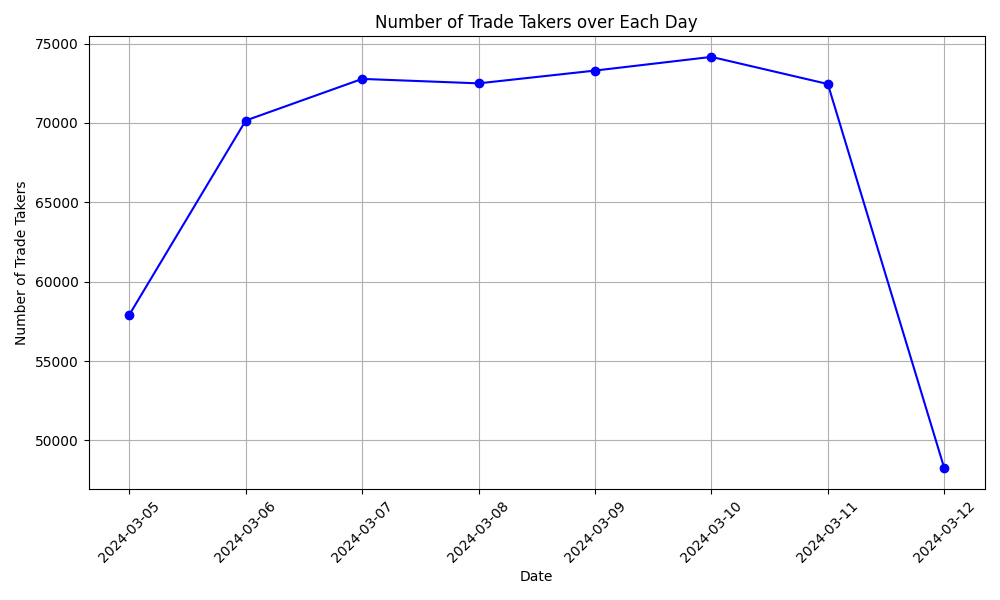

Moreover, while looking at comprehensive stats, the following plot depicts the number of trade takers recorded over seven days, from March 5th, 2024 to March 11th, 2024, suggesting a general increase from around 55,000 trade takers on March 5th to nearly 75,000 on March 11th.

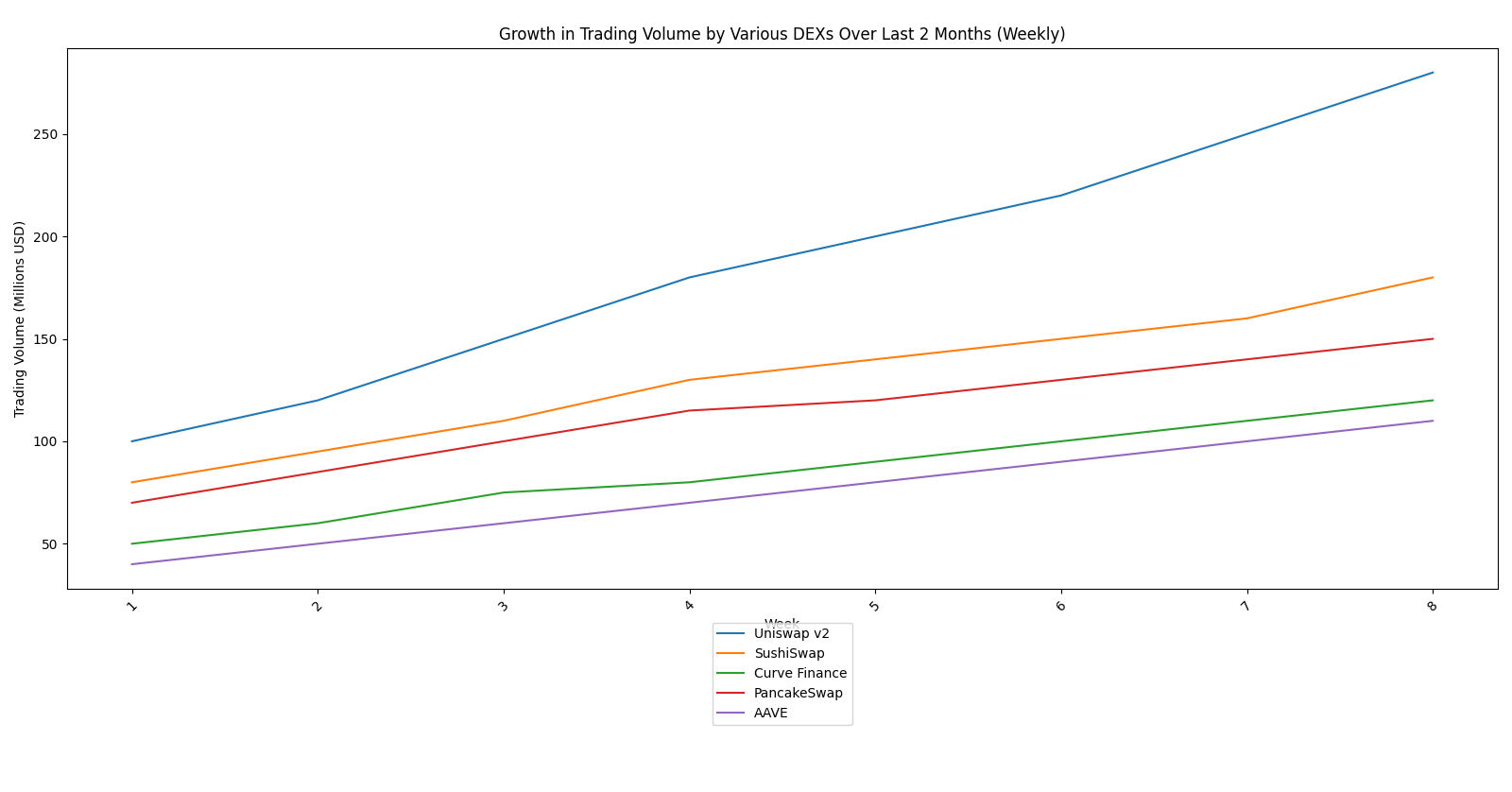

DEX Trading Volumes in Two Months

Using Bitquery DEX API, we can analyze top 5 decentralized exchange (DEX) platforms by trading volume. Uniswap leads the list with over 1.5 million trades and a staggering trade amount of $94.27 billion, experiencing a trade growth of 389,547.25%. SushiSwap follows closely with 22,527 trades and $105.72 billion in trade volume. PancakeSwap, Balancer, and Zerox Exchange also demonstrate significant trading activities. These DEX platforms play a crucial role in the decentralized finance (DeFi) ecosystem, providing users with decentralized trading options for various cryptocurrencies and tokens.

The growth trend is also in favor of UniswapV3. Nonetheless, SushiSwap and Curve Finance exhibit significant trading volume. This indicates they are strong contenders attracting a sizeable portion of DEX users.

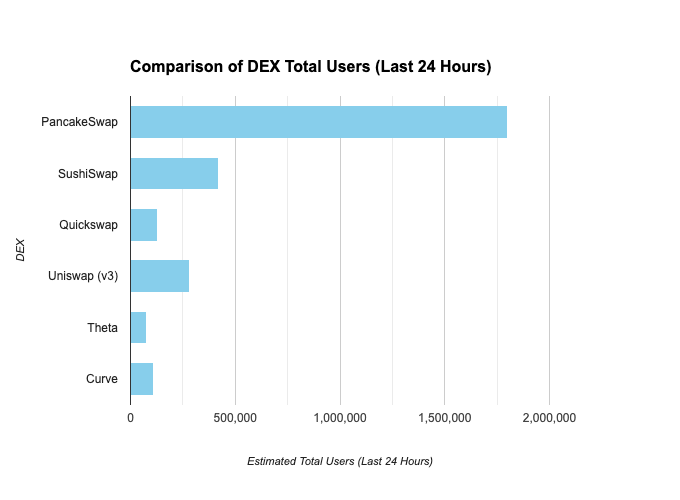

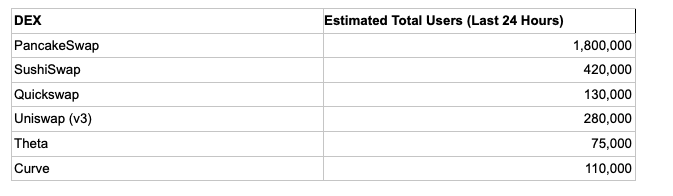

Dex Daily User Activity: A Snapshot of a Week

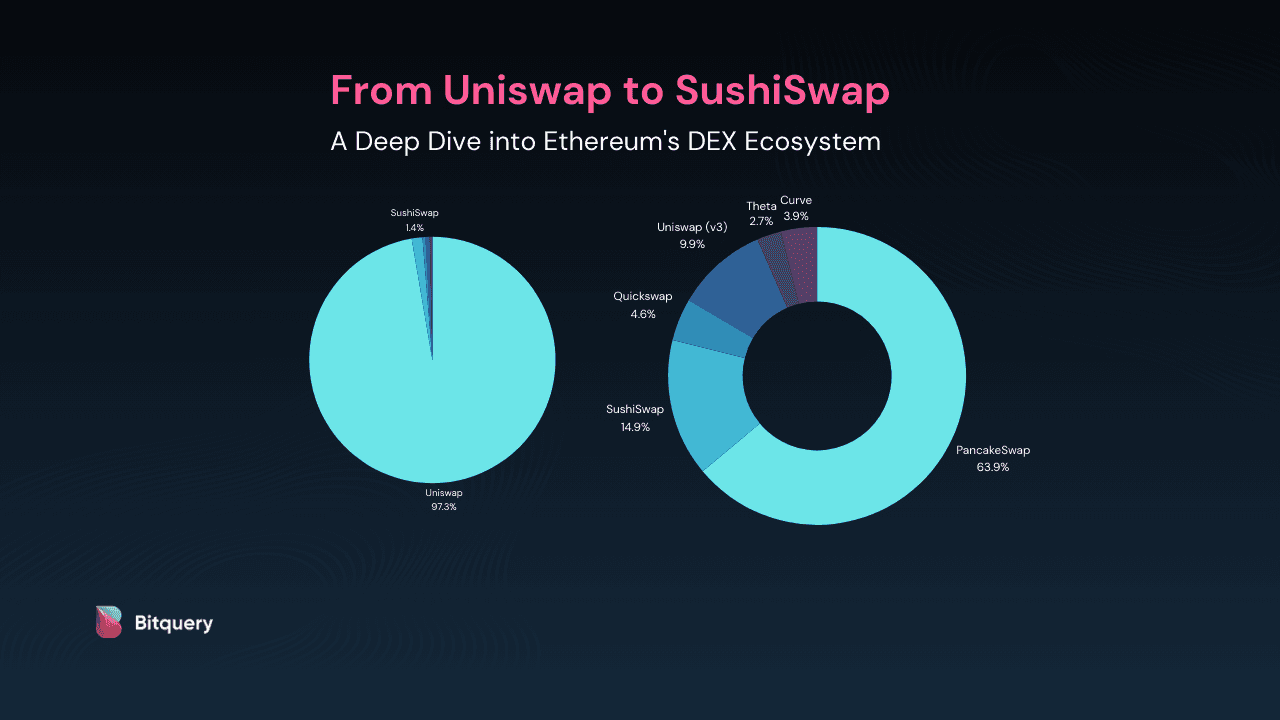

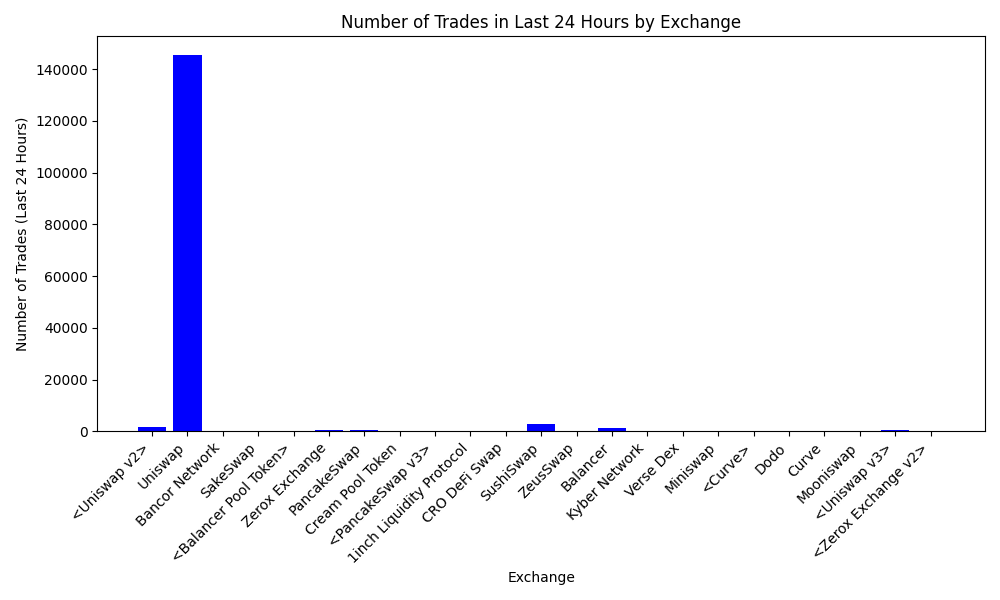

Decentralized Exchanges (DEXs) are becoming increasingly popular for trading cryptocurrencies without relying on centralized platforms. Understanding user activity across different DEXs can be insightful for investors and developers. This analysis dives into the estimated total number of users on various DEXs in the last 24 hours,

The dominance of PancakeSwap with an estimated 1.8 million users in the last 24 hours. SushiSwap follows with a significant presence at 420,000 users. Uniswap (v3) and Quickswap hold positions as established players with user bases exceeding 200,000 in this hypothetical day. Curve and Theta round out the chart with user estimates of 110,000 and 75,000 respectively.

While this data offers a snapshot, it highlights potential trends. PancakeSwap's substantial user base suggests it caters to a broader audience or offers features attractive to a larger user pool. SushiSwap's strong presence indicates its continued relevance in the DEX landscape. Notably, Uniswap (v3) figures suggest healthy user adoption despite being a newer version of the popular Uniswap protocol.

Upward trends are present but not as significant as those of Uniswap v2. Events such as the launch of Uniswap v3 in the past and Pancakeswap version 4 could be contributing factors.

Examining various metrics like user growth, trading volume, and trade count provides a multi-faceted view of Decentralized Exchange (DEX) popularity. While Uniswap v2 emerges as a leader in several aspects, with the highest user growth and potentially the most trade volume and taker activity within the analyzed periods, other DEXes like SushiSwap, PancakeSwap, and Curve Finance showcase significant presence as well.

The dominance of DEXs in the trade count metric further suggests a potential shift in user preference towards decentralized trading platforms. It's important to remember that the data represents limited timeframes, and long-term analysis would be crucial for solidifying these trends. Additionally, factors like specific DEX features, external market conditions, and user behavior should be explored for a more comprehensive understanding of the evolving DEX landscape.

Blog written by Kshitij M

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.