Unveiling the Crypto Puzzle: Decoding VC Token Holdings

In the fast-changing world of cryptocurrency, smart investors must figure out who the important players are and know what they're doing strategically. One crucial aspect often overlooked is the involvement of venture capitalists (VCs) in shaping the crypto landscape.

In this article, we delve into the intricacies of identifying VC holdings, exploring the significance of this knowledge in making informed investment decisions and conducting thorough risk assessments. Additionally, we shed light on the broader implications of VC participation in the crypto ecosystem and how leveraging Bitquery APIs can be a game-changer for staying ahead in this ever-evolving space.

The Power of VC Token Holdings

Venture Capitalists are not merely passive participants in the crypto space; they are strategic architects, funding projects with the potential to disrupt industries. By identifying VC token holdings, investors may gain a valuable lens into the perceived value and potential success of a project. Analyzing VC token holdings reveals the depth of confidence and support a project has from industry experts, which is crucial for making informed investment decisions by assessing its growth and sustainability potential.

The Broader Implications of VC Involvement

VCs wield broad influence in the crypto ecosystem, shaping trends, fostering innovation, and advancing emerging technologies, contributing to the maturation of the space with not just capital but also experience, industry connections, and strategic guidance.

As VCs allocate funds to specific projects, they contribute to the maturation of the market, influencing not only the success of individual ventures but also the overall direction of the crypto space. Understanding these broader implications is essential for investors looking to navigate the crypto landscape with foresight and strategic acumen.

Leveraging Bitquery APIs for Informed Decision-Making

To delve deeper into the world of VC-backed crypto projects and their token holdings, let's zoom in on the portfolios of some influential Venture Capitalists. Understanding the holdings of these key players not only sheds light on their investment strategies but also provides a blueprint for potential market trends.

Bitquery APIs help monitor VCs and popular trading firms’ fund movements in the crypto space. These APIs provide a deep dive into blockchain data, allowing users to track token movements, smart contract interactions, and, much more.

Pantera Capital

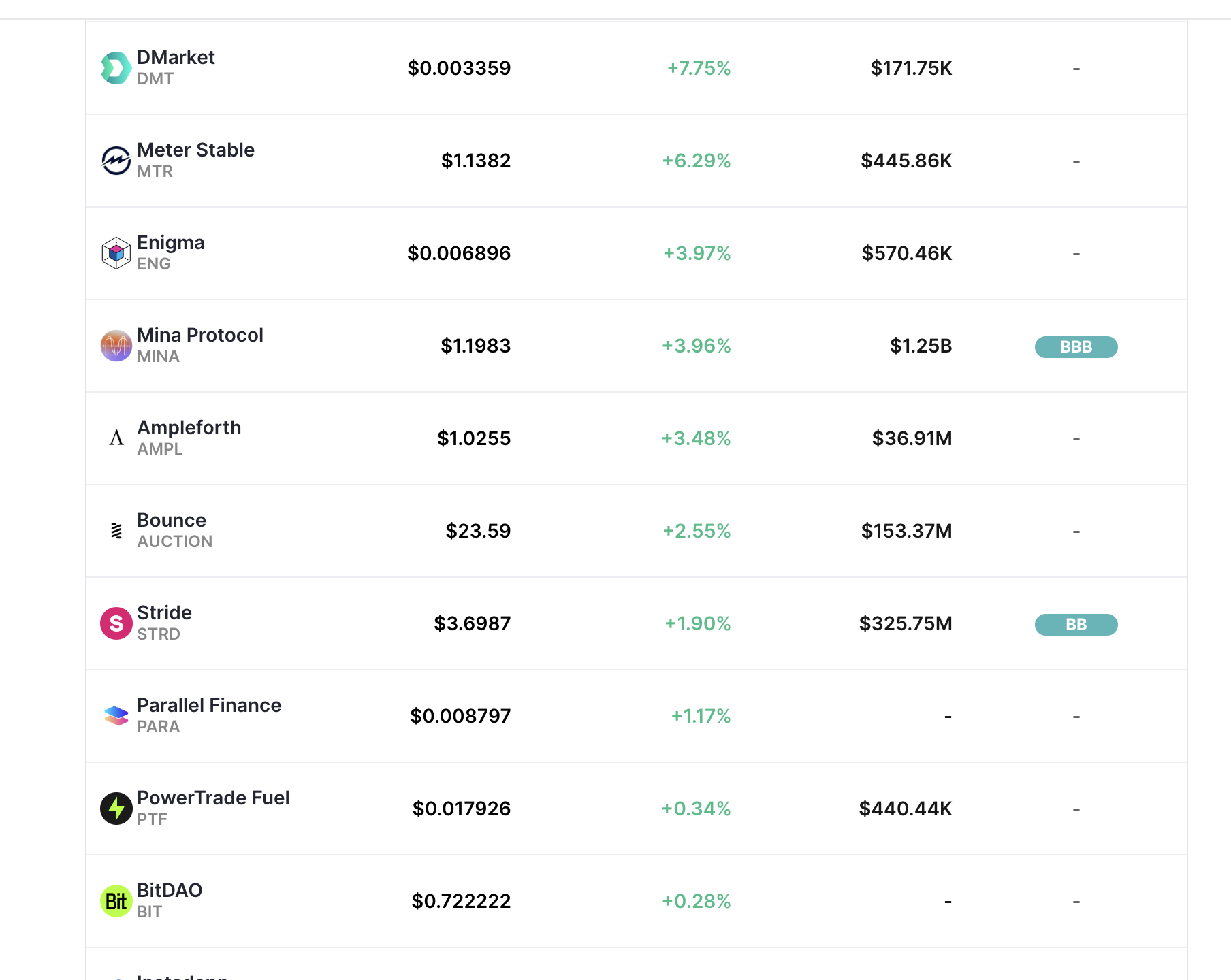

In Panterra's publicly accessible portfolio, they showcase investments in a broad array of projects including Filecoin, 0x, Liquity, and Mina, which span across DeFi, consumer, and infrastructure sectors.

Pantera Capital Portfolio according to various sources, contains 53 coins as of today with a total market capitalization of ~$1.25T and an average price change of +4.36%. They are listed in size by market capitalization.

The tokens within the Pantera Capital Portfolio are strategically invested in thematic ideas and projects which include exchanges, custodians, institutional trading tools, decentralized finance, next-generation payment systems, and more. Since 2013, Pantera Capital has supported over 100 blockchain companies and participated in 110 early-stage token deals.

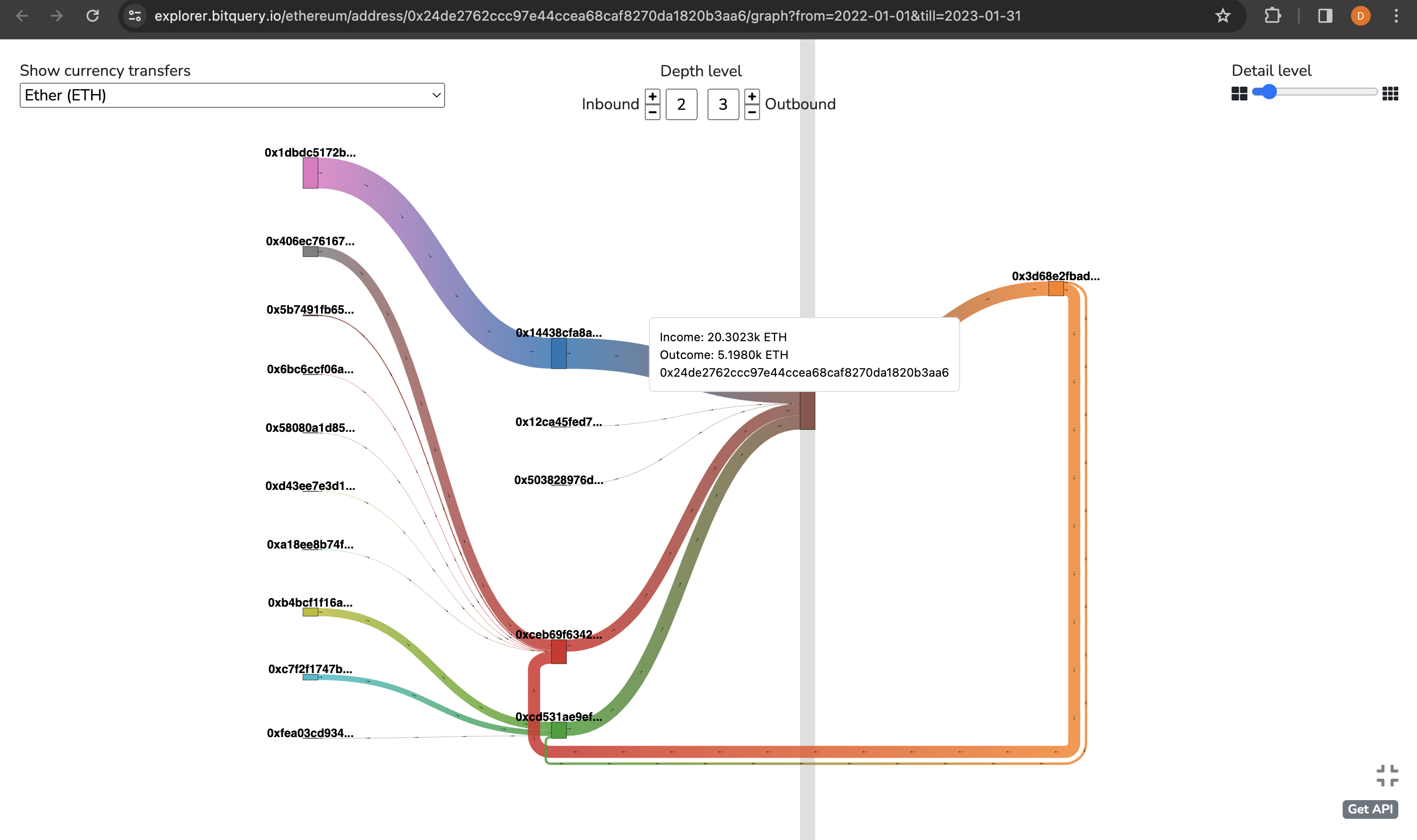

Pantera’s ETH Investments 2022-2023

Pantera Capital lost 80% during 2022, taking a nearly 23% hit in November alone after the implosion of centralized exchange FTX. Let’s go back to historical data to understand the important market movements associated with these tokens and investments.

The Pantera Liquid Token Fund is a multi-strategy vehicle that typically invests in 15-25 liquid tokens at any point in time and is predominantly driven by a discretionary strategy focused on DeFi and adjacent assets, as stated on the firm’s website. The fund started to navigate much of the portfolio away from altcoins and into ether (ETH) in the late spring of 2022. The fund’s top three performers for the hard-hit November period were Cosmos' ATOM token, Chainlink's LINK, and Optimism's OP, while Uniswap's UNI, Solana's SOL and ether took the bottom slots.

Optimism, a layer 2 scaling tool, had become one of the fund’s largest non-ETH positions and was a driver of year-to-date growth alongside ether and UNI.

The FTX crash didn’t impact the fund since the exposure only came in through Blockfolio’s acquisition. It’s worthwhile to note that Pantera is one of the oldest investment firms in the crypto industry, having been founded in 2013. It runs a number of different fund strategies including an early-stage token strategy, a blockchain fund that is a venture fund investing in equity and a liquid token strategy.

Source: Pantera Capital Blog

In the 2 bull cycles, bitcoin consistently outperformed altcoins in phase 1 of the upswing. In phase 2, altcoins substantially outperformed bitcoin. What’s interesting is that the magnitude of outperformance is so large that altcoins have outperformed bitcoin across the full length of both cycles.

Let’s take a quick look at what’s the current status of the liquid token and early-stage token strategy. Let’s also analyze the market status when the investible universe of tokens beyond Bitcoin had a meaningful market share.

Looking at the current holdings across various wallets of Pantera Capital. It’s evident that DeFi and privacy-based solutions would be most investable and evidently their tokens also show an upward trend. Most of the major altcoins held by the VC firm have been up by over 5% including Lifi, MINA, DMTand 1Inch

Source: tokeninsight.com

Understanding the Jump Capital’s web3 investment landscape

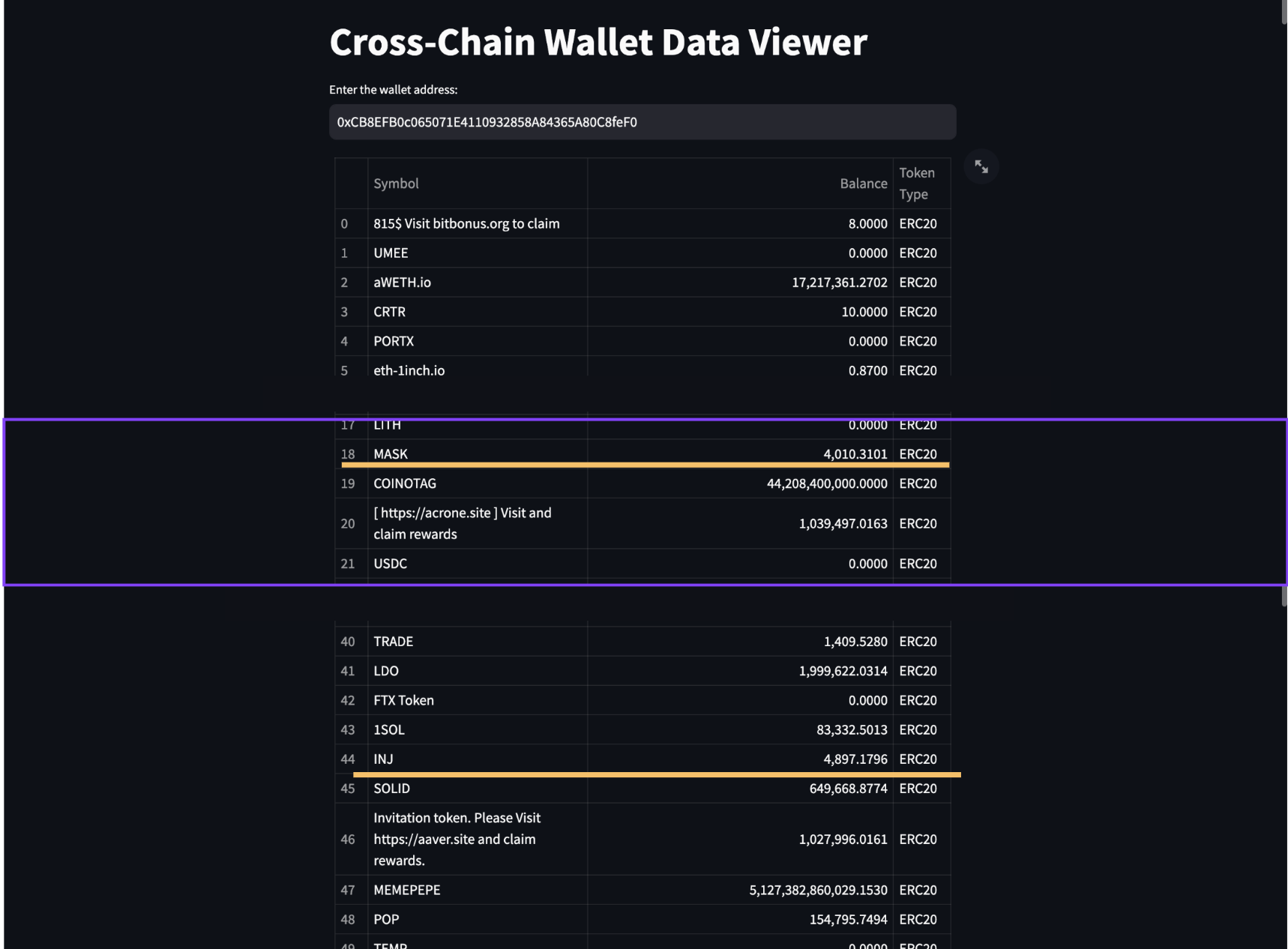

Jump Capital's list of investments includes major exchanges, blockchains, and a variety of Web3 and decentralized finance (DeFi) projects. The majority of the portfolio is DeFi tokens, including LDO, PERP, and MASK.

Jump Trading bought MASK, the native currency of Mask Network, a privacy-focused Layer 2 solution for Ethereum. At the same time, they have accumulated LDO, the governance token of the Lido DAO, a liquidity staking platform that supports various tokens, including Ethereum and Polygon (MATIC).

Source: Multi Chain Portfolio Tracker

Among other coins, they have bought considerable amounts of LEVER and PERP, the native tokens of LeverFi, a decentralized margin trading platform, and Perpetual Protocol, a decentralized perpetual contract exchange, respectively.

Their gravitation towards DeFi tokens, based on their accumulation trend, is not yet known. However, what’s evident is that DeFi activity has been on the rise since the end of 2023 and an upward trend from here is expected.

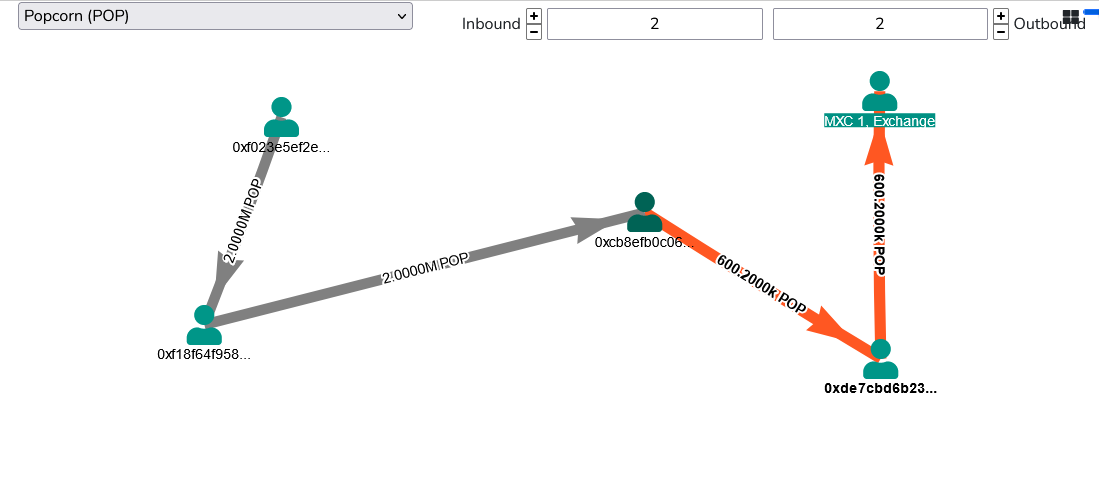

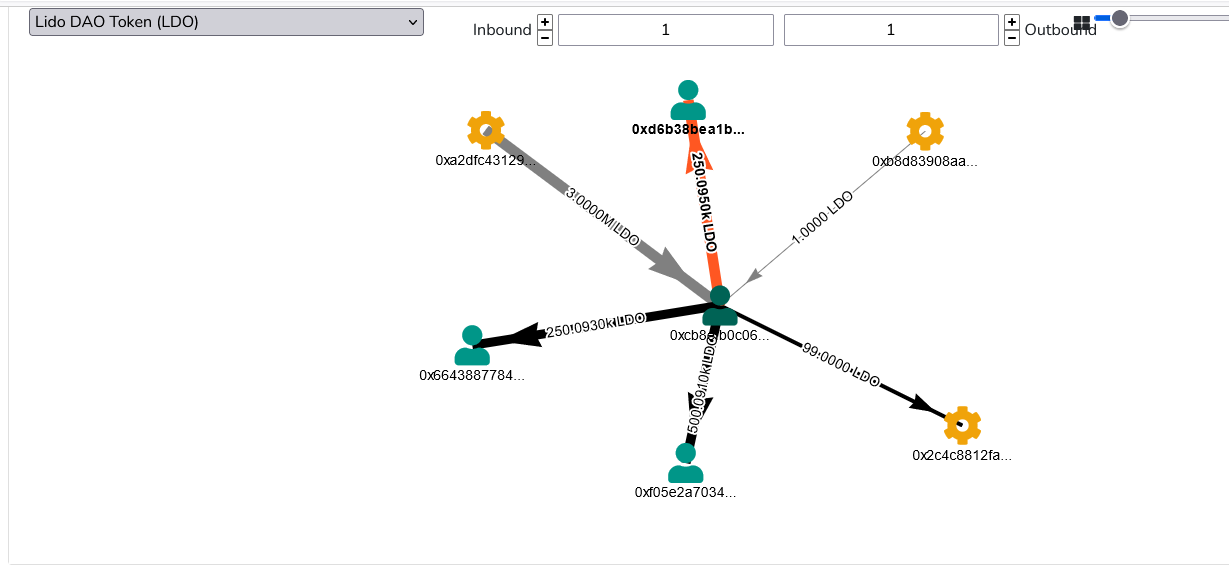

You can view the inflow and outflow of tokens from Jump Trading Wallets’ in a given time frame using Bitquery APIs

Some of the money movements for major tokens held by jump trading- POP and LDO

Based on the on-chain data, Jump Trading currently holds a whopping 3.8 million LDO worth $11.6 million; 2.1 million LINK worth 32 million, and 161 million threshold network token worth $4.4 million at around spot rates. A deeper look at their address reveals that Jump Trading holds 195 tokens worth over $39 million.

Notably, one of their largest altcoin holdings isLINK worth 32 million, LDO, at over $11 million, and SD, the native token of Stader, at more than $2 million. Meanwhile, USDT, the world’s most liquid stablecoin by circulating supply, is the largest holding at over $56 billion.

Conclusion

In the fast-paced world of cryptocurrencies, knowledge is power. The synergy between VC-backed projects and their associated tokens is a crucial thread that binds the ecosystem together. Understanding the dynamics of VC-backed projects and their associated tokens is a crucial element in making informed investment decisions and managing risks effectively.

Regularly check for updates on token holdings, monitor transaction volumes, and stay informed about major developments within the projects of interest.

The broader implications of VC involvement underscore their role as key influencers in shaping the crypto ecosystem. Leveraging Bitquery APIs is not just a recommendation but a strategic imperative for investors looking to stay ahead. By embracing these tools, investors can navigate the intricate web of VC activities, gaining valuable insights and positioning themselves for success in the dynamic and unpredictable world of crypto investments.

Written by Laisha

The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.