Comparison of Ethereum, Polygon and Arbitrum Networks using On-chain Analysis of Wrapped Ether (WETH)

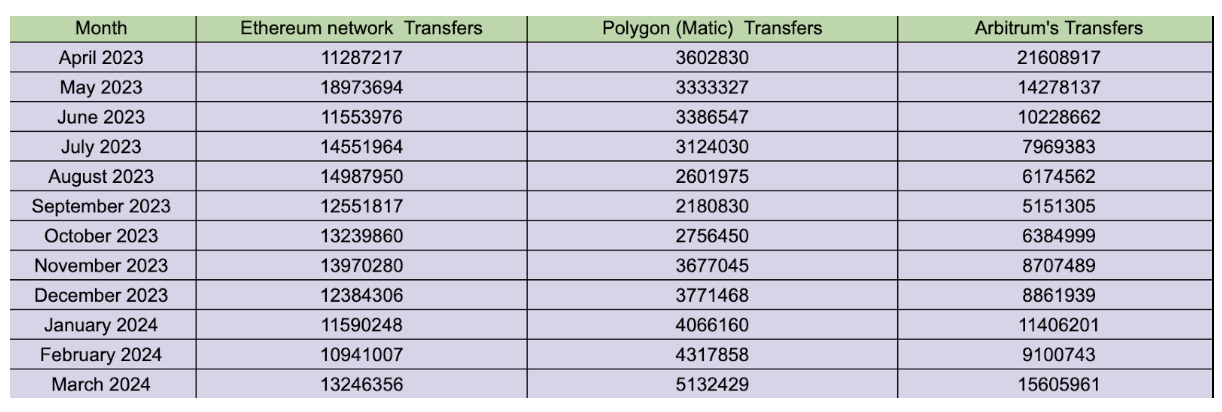

This article analyses the Wrapped Ether(WETH) token in the Ethereum, Polygon (formerly recognized as the Matic Network), and Arbitrum networks from April 2023 to March 2024.

We observe the involvement of WETH across different chains by determining the number of senders, receivers, transactions, and transfers in each network. Furthermore, we investigate the top trading pools of WETH in the Ethereum and Polygon networks, using the total number of trades and trade volume of WETH from April 2023 to March 2024. Additionally, we determine the most traded currencies against WETH.

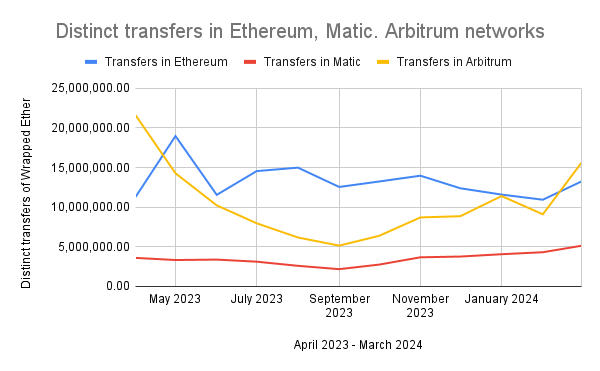

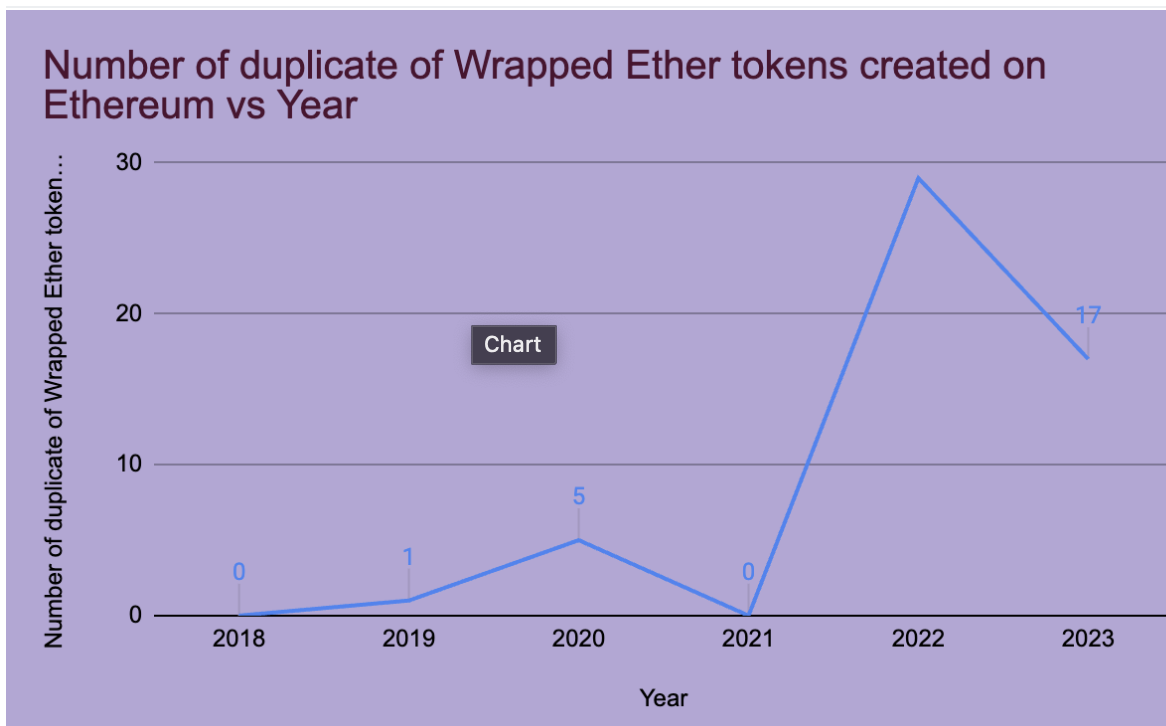

Through WETH trades, we compare exchanges in the Ethereum and Matic networks. We also distinguish between Uniswap v2 and Uniswap v3 by finding the number of newly created pools of WETH in the Ethereum network during the same period. Moreover, we find the number of duplicate WETH tokens in the Ethereum and Arbitrum networks.

-

WETH movement and holders analytics

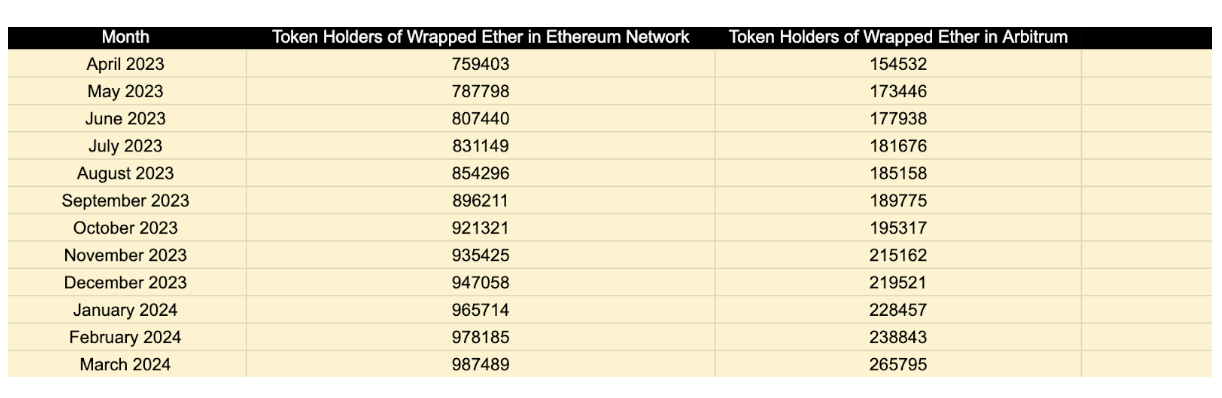

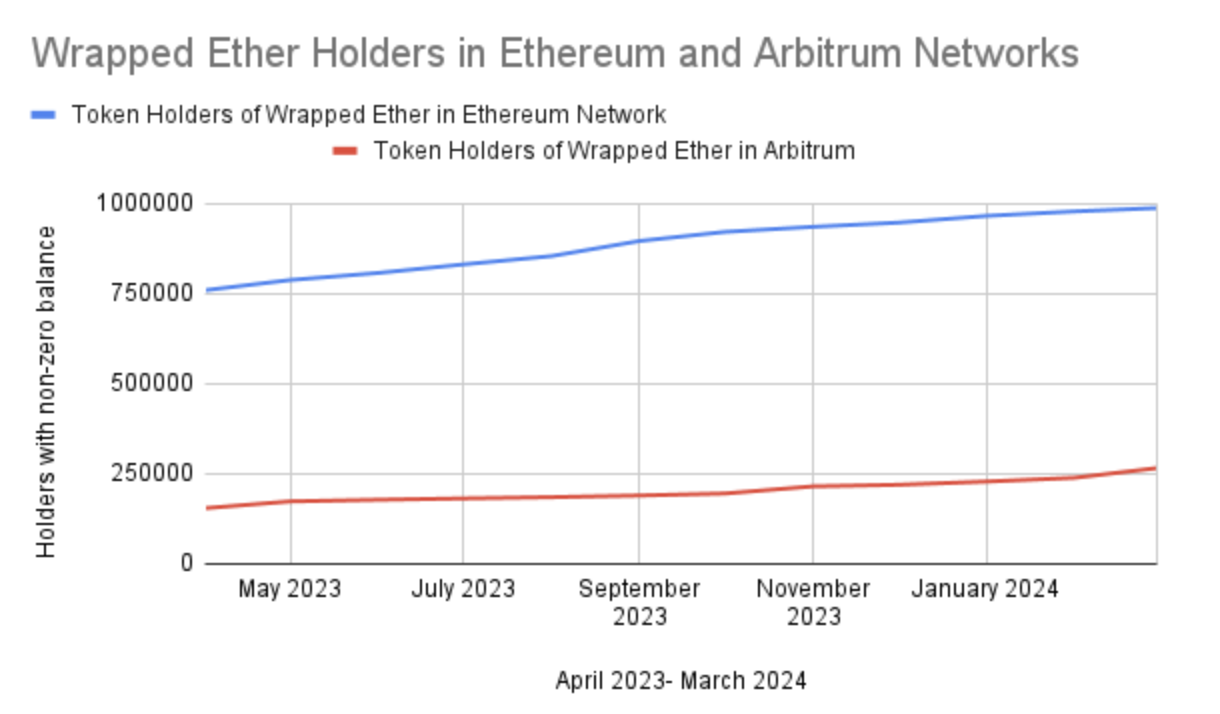

From April 2023- March 2024, WETH holders in the Ethereum network increased by an average of ~2.5 %, whereas holders in the Arbitrum network average growth is ~5 %. WETH holders in the Ethereum network are growing steadily. However, the rapid adoption of WETH in the Arbitrum network can be seen clearly.

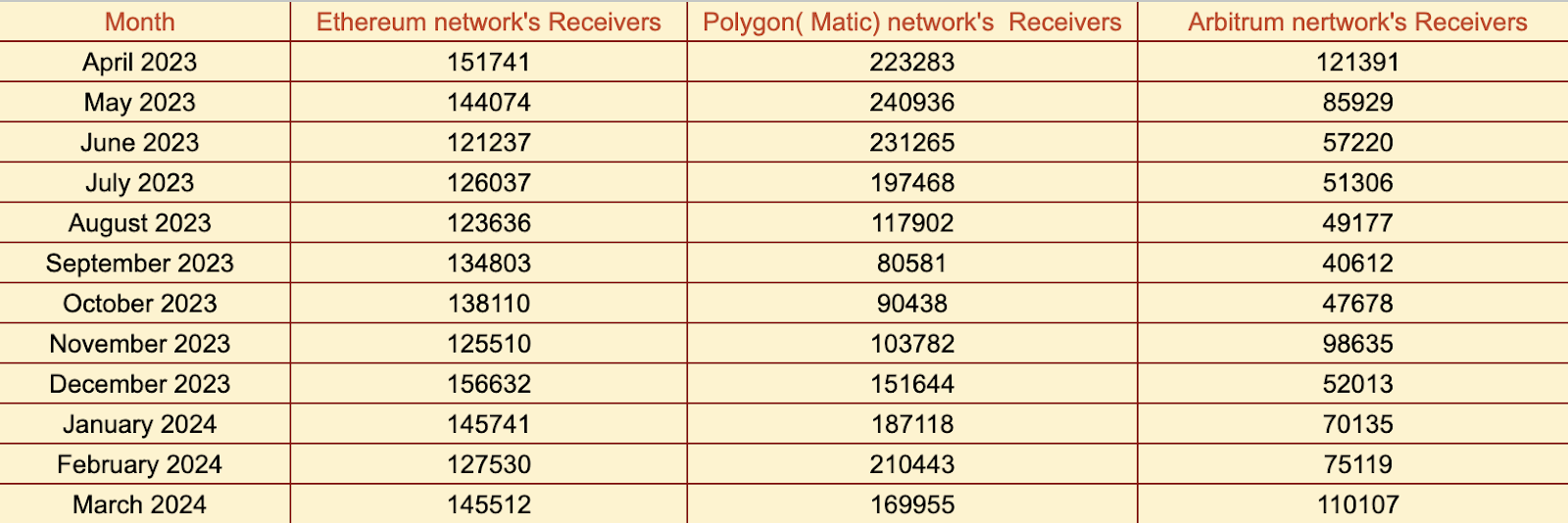

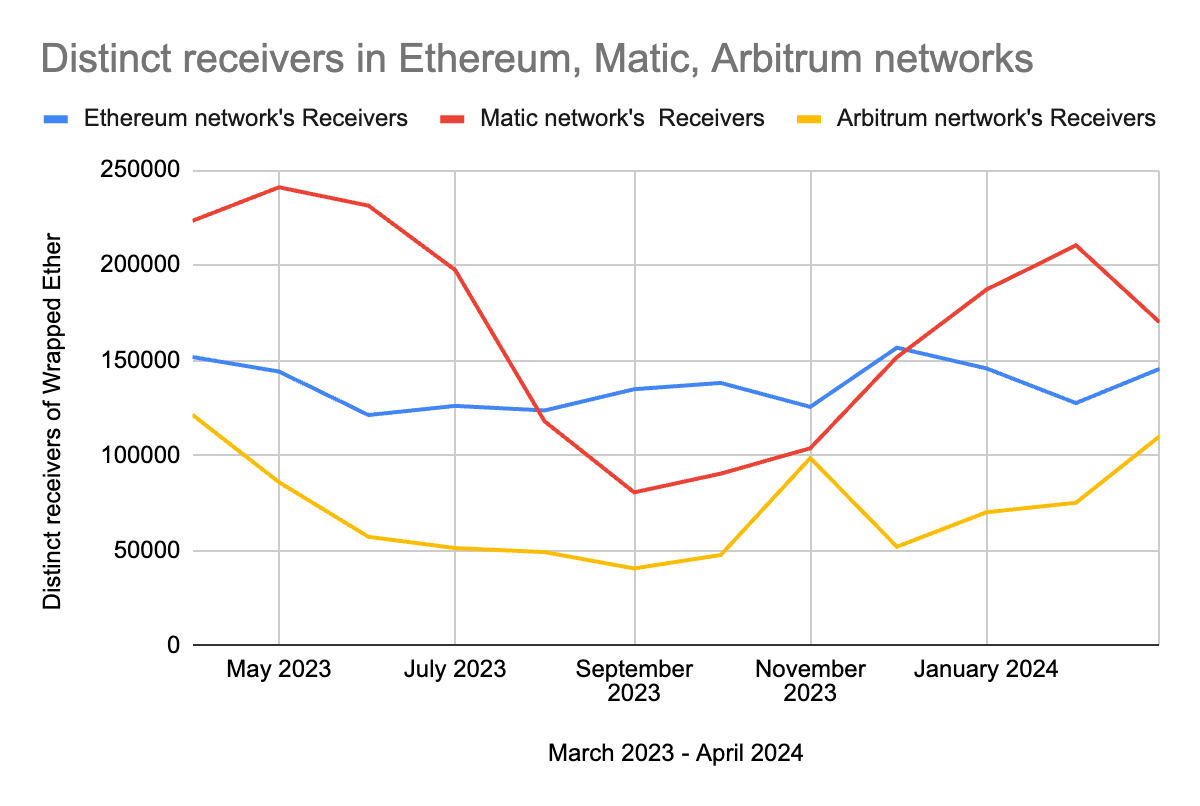

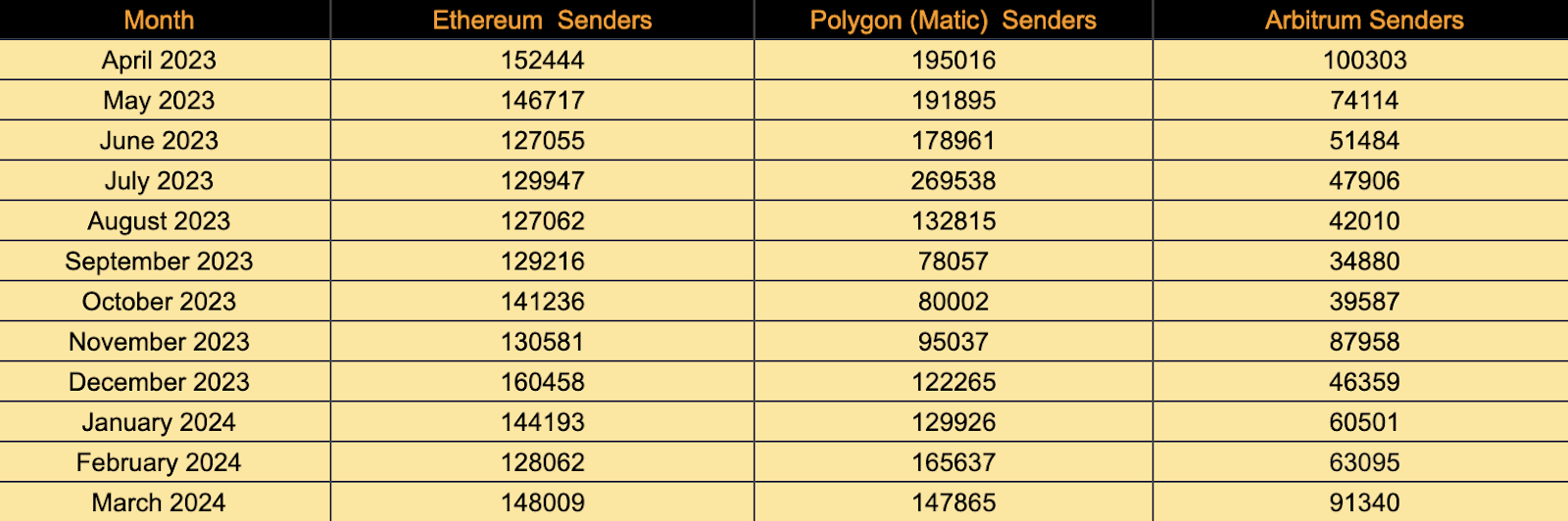

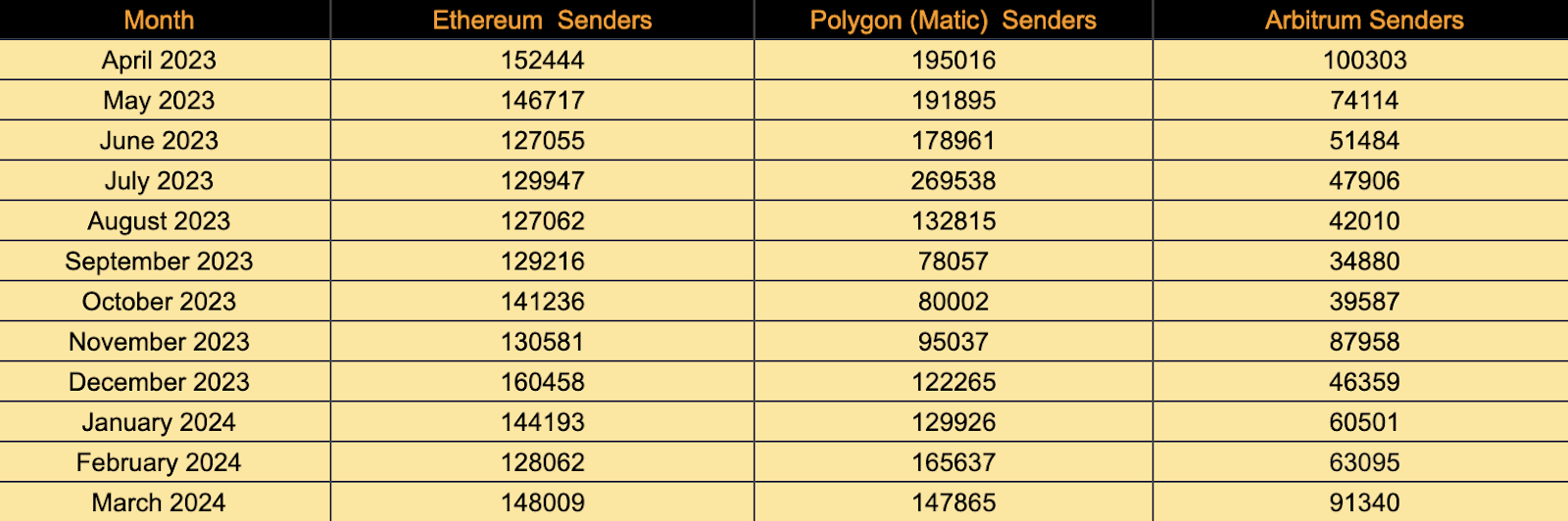

Over the same period, Matic Network surpasses Ethereum by around ~7 % in senders and 22 % in receivers, exceeds Arbitrum by around ~142% in senders and ~133% in receivers, while Ethereum outstrips Arbitrum by around ~125 % in senders and ~91% in receivers.

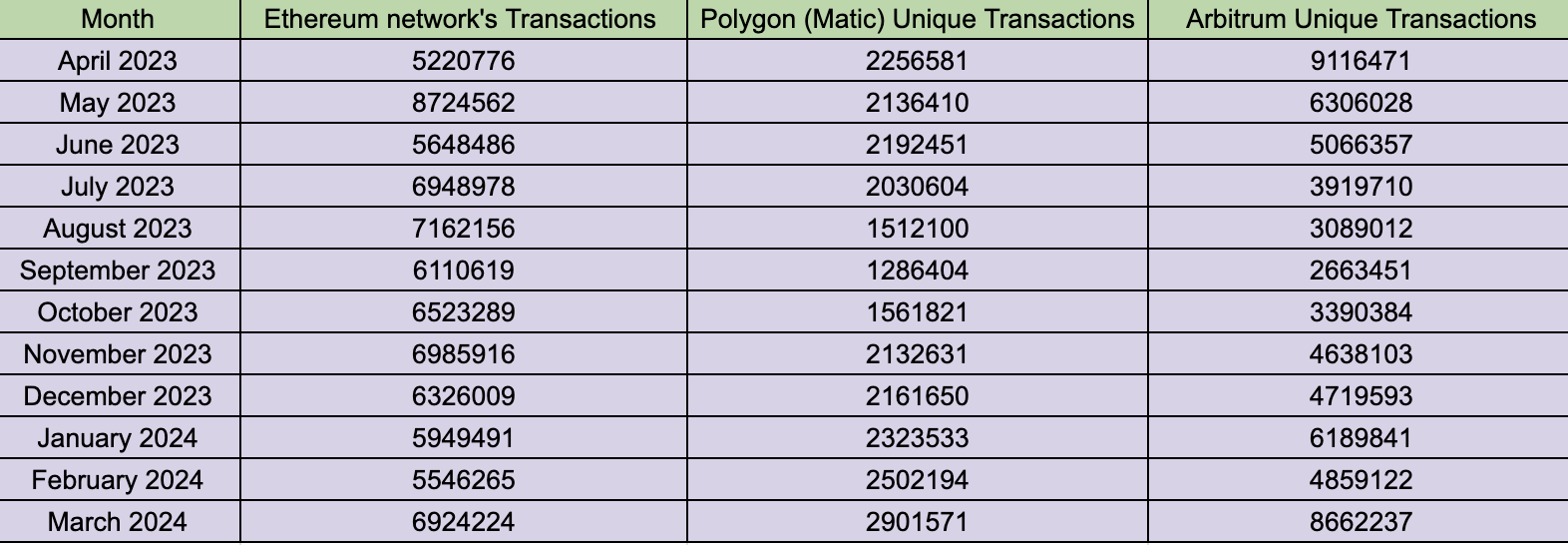

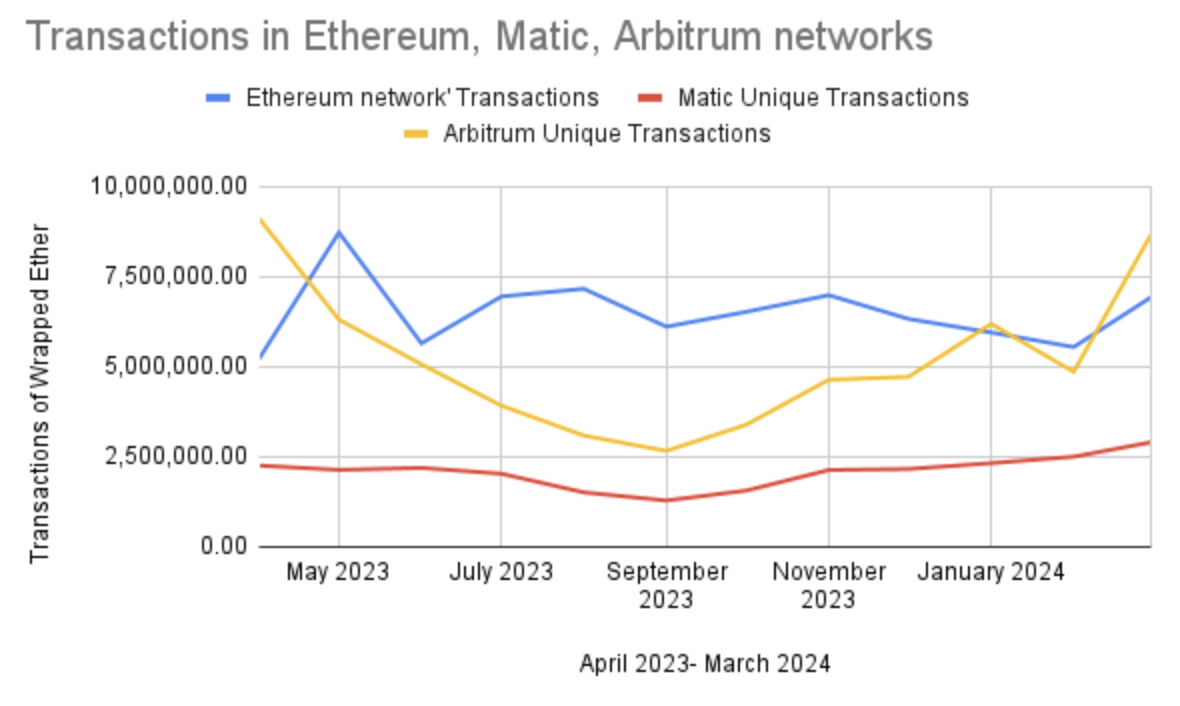

Due to its high throughput and cheaper transaction fees, users of the Ethereum network are shifting toward the Matic network. On Ethereum, there are an average of around 139K senders and 137K receivers of WETH, whereas on Polygon (Matic), these numbers are slightly higher, with an average of around 149K senders and 167K receivers. However, the average transaction volume for WETH remains higher on Ethereum, around 6.5 million transactions, compared to other networks. The reason is that WETH is a tokenized version of Ethereum's native token, ETH.

In contrast, the Arbitrum network has seen fewer senders and receivers, around 72K and 62K, respectively, compared to Matic. Despite this, Arbitrum processes a higher average transaction volume, around 5.2 million transactions, compared to Matic's 2.9 million transactions. This suggests that even though Matic has more users, Arbitrum is handling a larger volume of transactions.

In the Matic network, users rely more on WMATIC as it is the tokenized version of the MATIC token, compared to WETH.

-

Comparison of Uniswap v2 and Uniswap v3: Newly Pool created on Ethereum Network

Uniswap v2 was deployed on the Ethereum mainnet on May 4, 2020. Exactly one year later, on May 4, 2021, its new version, Uniswap v3, was deployed on the Ethereum network.

In the Ethereum network, from April 2023 to March 2023, the number of newly created pools in Uniswap V2 for WETH decreases over time. However, the number of pools created in Uniswap V2 of WETH remains higher than in the latest version of Uniswap V3.

-

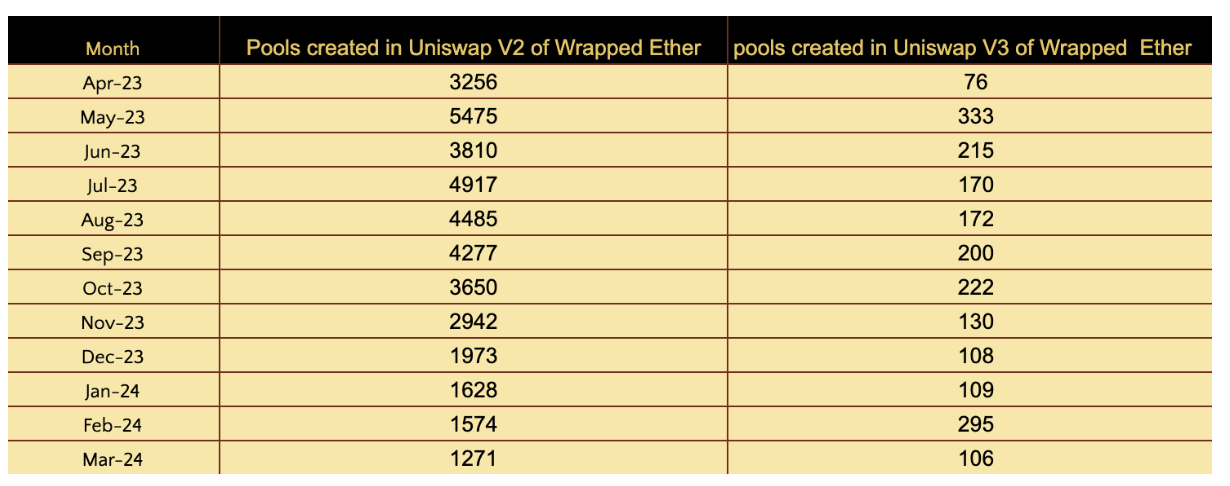

Duplicate Tokens of Wrapped Ether

In the Ethereum network, 53 duplicate tokens of Wrapped Ether were created until March 2024. Most were created in 2022 (29 duplicate tokens), with no duplicate tokens generated before 2019 and none created in 2021. In 2024, only 1 duplicate token was created until March.

In the Arbitrum network, only 2 duplicate tokens of Wrapped Ether have been created until March 2024

-

Top WETH pools on Ethereum

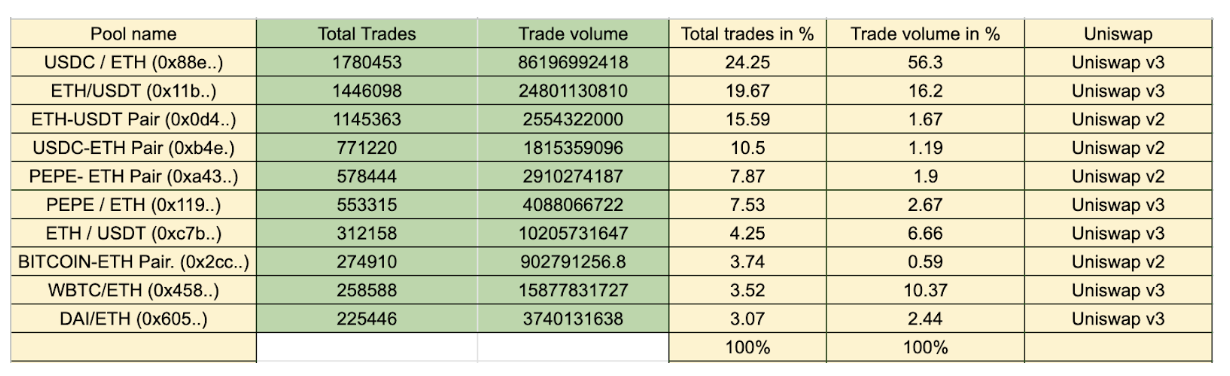

In this section, we find the top 10 pools of WETH in Ethereum network based on total number of trades and trade amount from April 2023 to March 2024. Furthermore, we analyse the top currencies traded against WETH. Finally, we compare the performance and engagement of Uniswap v2 and Uniswap v3 across the identified top WETH pools.

-

Top currencies traded against WETH

We have analyzed through the top 10 pools of WETH that WETH is one of the dominant pair currencies, with over 90% of all pairs or pools created on Ethereum using WETH as the pair currency.

As you can see in the table below, Stablecoins (USDC, USDT, DAI) win the day, with 6 out of 10 pairs belonging to them and 85% of the trading volume.

Even though USDC’s market cap is 1/3rd of USDT, the USDC - WETH pair is the biggest pair on Ethereum with over $86 billion in trading volume in the last 1 year and contributing over 56% of volume among the top 10 WETH pairs we analysed.

From April 2023 to March 2024, there are 2 pools of USDC and WETH, and 3 pools of USDT and WETH. Despite similar trade counts for both USDC and USDT pools (around 35% to 40%), the trade volume in USDC pools was notably higher at around 58 %, compared to USDT pools (25%). This indicates that USDC pools handled transactions of higher trade volume compared to USDT pools

-

WETH Pools : Uniswap v2 and Uniswap v3

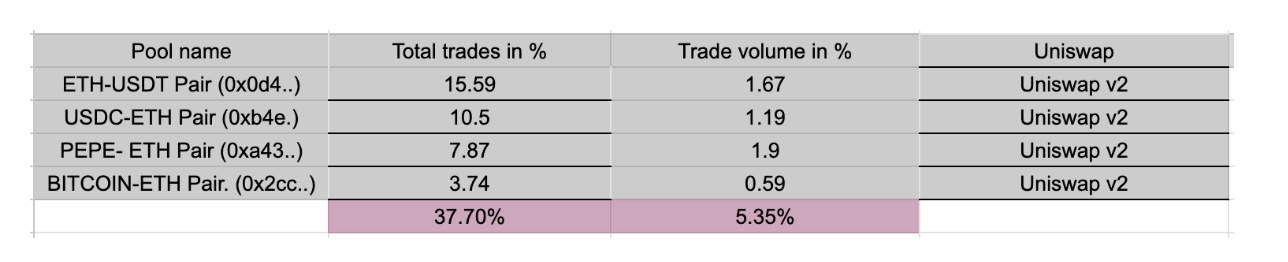

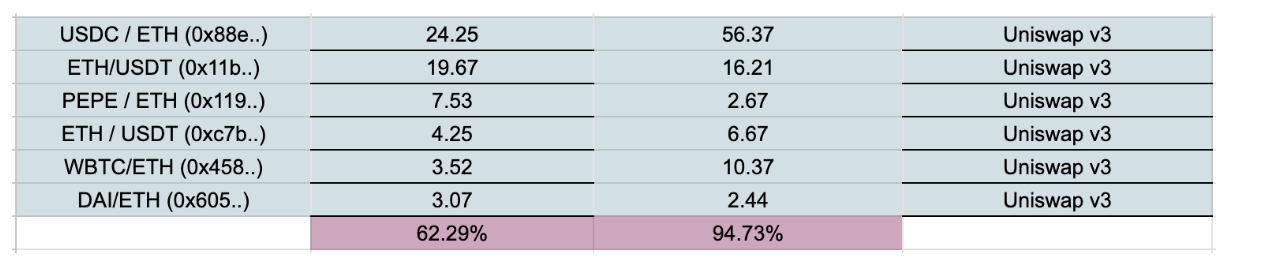

Among the top 10 pools of WETH, we analyzed, 6 were related to Uniswap v3, and 4 belonged to v2. In addition, when it comes to trade count, 6 pools of Uniswap v3 did around 62% of the total trades, compared to 37% of v2's trades.

However, when it comes to volume, Uniswap v3 has completely taken over Uniswap v2 among the top 10 pools with ~ 95% of the trading volume.

Recently, we saw a huge narrative around meme coins. It’s interesting to see a Meme coin (Pepe) among the top 10 pools for WETH, with around 4% of the total trading volume of the top 10 pools.

-

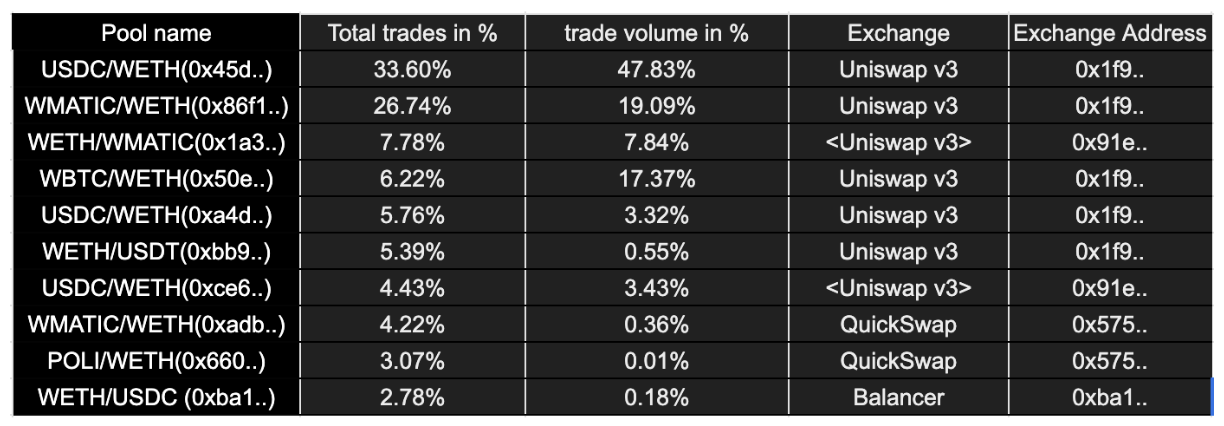

Top WETH pools on matic

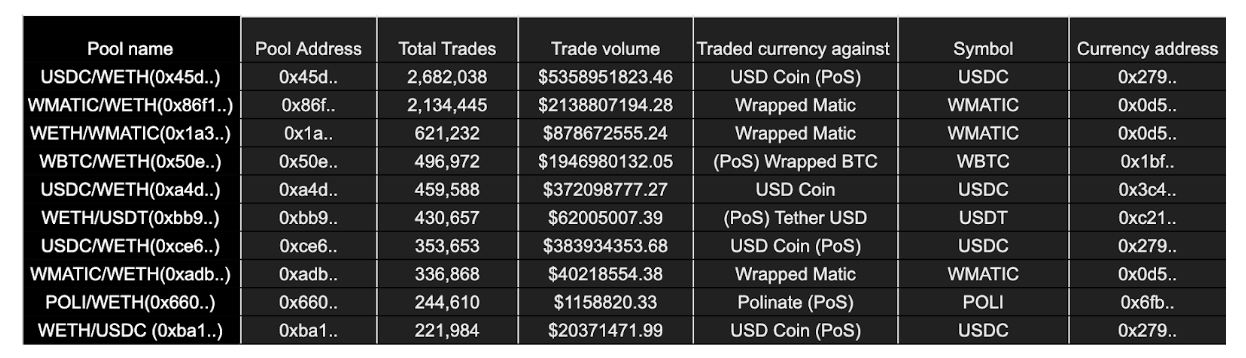

In this section, firstly, we identify and analyse the top 10 pools of Wrapped Ether (WETH) within the Matic Network focusing on their trading volume total number of transactions recorded between April 2023 to March 2023, then we discuss the leading currencies traded against WETH and corresponding most popular trading pairs and exchanges.

-

Top traded currencies against WETH

From April 2023 to March 2024, among the top 10 pools, the important observation is that the stablecoin USD Coin (PoS), which is transacted through the other chains, is being traded more, accounting for around 50% of the trade volume. Meanwhile, the native USDC (USD Coin) token of Matic network is traded very minimally during the same period, around 3% of the trading volume.

The total number of trades of USDC and WMATIC against WETH is nearly equal, at around 40% each. Together, they did approximately 78% of the total volume.

-

Uniswap v3 vs other exchanges

Uniswap v3 was deployed on Polygon mainnet on Dec 20, 2021.

From April 2023 to March 2024, a clear dominance of Uniswap v3 can be seen, as among the top 10 pools, 5 pools belong to Uniswap v3 . Pools of Uniswap v3 account for nearly 80% of the total trades with around 88% of the trade volume. This shows that Uniswap v3 handled more trades of WETH with high transaction volume.

Note that Uniswap v3 was deployed on June 15, 2023, on Polygon mainnet.

Moreover, Uniswap v3 handled the same number of trades and trade volume (nearly 12%). It is important to mention that Uniswap v2 and Uniswap v3 are distinct exchanges, as their addresses differ.

.

Conclusion

WETH is one of the most active tokens in Ethereum and its related layer two chains. When it comes to trading, it has the biggest trading volume and pairs with almost all the tokens in the blockchain. As we discovered above, because of fees, we saw a better growth of WETH activity in Layer 2 chains specially in Arbitrum. Uniswap v3 emerges as the most trusted exchange for trading in Ethereum and Matic. Moreover, we have noticed that stablecoins USDT, USDC and DAI are sitting at the top in terms of trading volume with WETH. Surprisingly, we saw that the bridge USDC is more active in Polygon than Polygon’s own USDC. We have also detected duplicate currencies of WETH with the same name and symbol, mostly used by scammers.

Article written by Vishal

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.