Crypto Travel Rule: From Anonymity to Accountability

Cryptocurrency, no doubt, has revolutionized the way we think about money. It now offers a decentralized, borderless means of transferring value worldwide. With this innovation, however, comes changes, particularly in regulation and compliance. As crypto becomes more integrated into the global financial system, the need for rules, investigation, and enforcement mechanisms grows. This is where the ‘crypto travel rules’ come in.

As the crypto industry continues to grow, the travel rule has become a critical focus, balancing the need for regulatory oversight with the principle of privacy and decentralization that supports the world of digital assets.

Let’s check the impact of the FATF crypto travel rule on the cryptocurrency industry.

What’s the FATF crypto rule

The FATF crypto travel rule also known as ‘recommendation 16’ is a global initiative to mitigate money laundering, terrorist financing, and other illicit activities in the cryptocurrency industry. It’s a set of guidelines that target financial institutions involved in virtual asset transfer. The rule was implemented by FATF, a global financial watchdog created by the G7.

The rule suggests that Virtual Asset Service Providers (VASPs), (like centralized exchanges and wallets) must share specific user data if a transaction exceeds a certain threshold. Although the FATF travel rule has been implemented for traditional finance since July 1989, the rule was updated to include virtual assets and Virtual Assets Service Providers (VASPs) in July 2019.

According to the FATF crypto travel rules, VASPs are required to:

- Collect and share information about the originator (senders) and beneficiary (receivers) of a transaction above a certain amount ($3,000 in the US, and EUR1,000 in Europe). Information including name, wallet address, and if applicable, national identity number or physical address, should be collected and shared among transacting institutions.

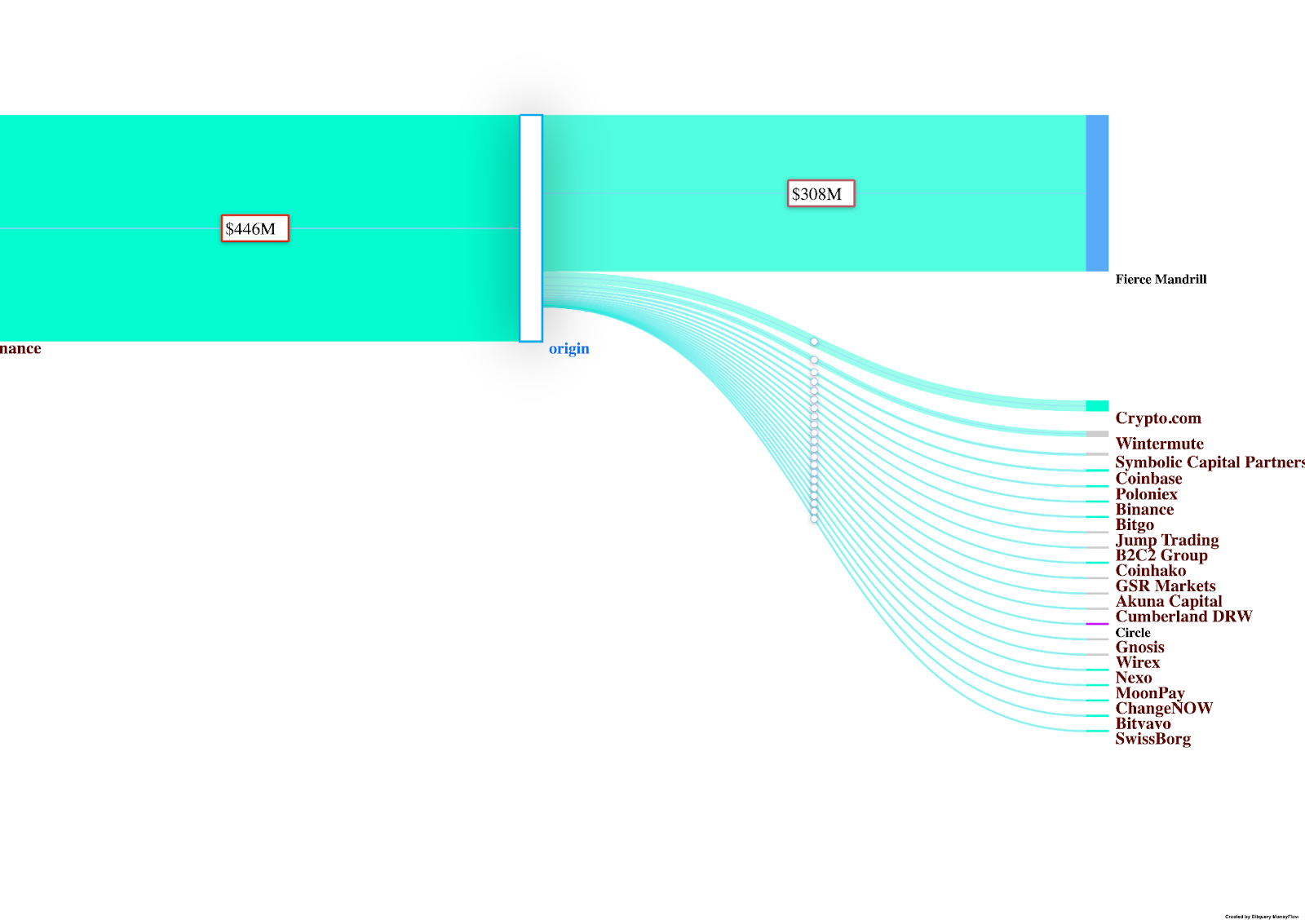

Source:https://moneyflow.bitquery.io/

- Ensures compliance. VASPs are required to implement procedures to ensure compliance, verify customers' identity(KYC), and monitor transactions for suspicious activities.

- Report suspicious activities. VASPs are to report suspicious transactions to relevant authorities, which is not different from how financial institutions handle Suspicious Activity Reports (SARS).

Why is the FATF Crypto Travel Rule Implemented?

The FATF crypto travel rule was implemented to address the growing concern that crypto could be used for illicit activities like money laundering and terrorist financing.

Unlike traditional financial assets, virtual assets have no limitation—they can be moved borderless with no resistance. This raised concerns for regulators that cryptocurrency's anonymity and borderless nature present a new challenge for traditional anti-money laundering (AML) and Counter-Terrorism Financing (CTF) efforts.

Let’s check some other reasons the FATF crypto travel rule was implemented.

Building Trust in the Crypto Industry

It serves as a regulatory framework for the Wild West of the crypto industry. These rules show how VASPs demonstrate their commitment to operating within the law. The rule can also help legitimize the industry and encourage broader adoption of digital assets.

The FATF crypto travel rule required VASPs to comply with the same AML/CTF standards as the traditional financial institutions with few exceptions. This rule helps reassure government agencies, financial institutions, and the general public that the crypto industry is not a haven for illicit activities. And this fosters a positive perception of the industry.

Protect Integrity of the Financial Institutions/Enhanced Global Regulatory Consistency

FATF is a coalition of seven politically and economically powerful countries (Japan, the US, Canada, France, Italy, Germany, and the UK). This coalition helps create a consistent regulatory framework for virtual assets across different jurisdictions.

As a result of this, the FATF crypto travel rule prevents regulatory arbitrage, where criminals exploit less regulated regions to conduct illicit activities. It safeguards the integrity of the global financial system and ensures crypto is transparent and traceable. By this, they can better monitor and enforce compliance. And overall, protect the integrity of the world's financial system.

Prevent Illicit activities

The crypto travel rules help remove anonymity by requiring VASPs to verify the identities of their customers (through KYC processes) and share this information with counterparty institutions when transactions occur.

With this, criminals cannot hide behind pseudonymous addresses. It also makes it difficult to conduct illicit activities. This rule creates a robust data trail, which law enforcement agencies can use to investigate and prosecute financial crimes. This can help authorities identify the individuals involved in illicit transactions, uncover the networks they operate within, and take appropriate legal actions.

Aligning to Traditional Financial Regulations

Similar rules to the crypto travel rules already existed for wire transfers. It requires banks and financial institutions to collect and share information about the sender and receiver of funds. The FATF crypto travel rules extended these requirements to virtual assets to ensure crypto and other virtual assets are subjected to the same level of oversight and regulations as fiat currencies and Traditional Finance.

The travel rules provide interoperability between the regulatory framework governing both sectors (crypto and traditional finance). This ensures that the processes and standards used by VASPs are compatible with those of conventional financial institutions. This enables traditional financial players to engage with the crypto industry while maintaining regulatory compliance.

How is The FATF Affecting Cryptocurrency Users?

The FATF crypto rule, no doubt, has a significant implication for crypto users. What are these implications? Let’s check out how the rule affects the crypto community.

- First, it reduces anonymity: Under recommendation 16, VASPs are to collect and share the personal information of the sender and receiver of transactions exceeding a certain threshold. For users who want to be anonymous or value the pseudonymous nature of cryptocurrency, the increased transparency may be seen as a drawback.

- Second, the crypto space user experience has changed because of the rules. User's interactions with exchanges/wallets are now formalized and regulated, similar to regular/traditional financial institutions. VASPs now have more extensive documentation rather than the direct approach crypto is known for.

- FATF crypto rule has also led to longer processing time and a shift away from the decentralized ethos that attracted many users to cryptocurrency. VASPs needing to collect, verify, and share transaction information can lead to potential delays in the processing of transactions, especially cross-border transfers.

- The increased compliance burden on VASPs may also result in higher operational costs, and this is passed to users in the form of higher fees for transactions or services.

- On a positive note, the FATF crypto travel rule has enhanced the security and legitimacy of the crypto space. By ensuring VASPs comply with AML/CTF regulations, the rule helps to protect users from fraud, scams, and illicit activities. For users, increasing oversight can make them feel safer when engaging with digital assets and this encourages broader adoption.

How Does FATF Travel Rule Enhance Crypto Fund Tracing

The FATF crypto travel rule mandates VASPs to collect and share information about parties involved in crypto transactions. This has enhanced transparency through proper documentation of transactions and their movements. And as a result of this, it’s easier to trace the flow of funds within the ecosystem. It has also provided a clearer audit trail for transactions, which is crucial for tracing the movement of funds across different platforms and jurisdictions.

With proper documentation, VASPs can easily monitor and analyze transaction patterns, identify high-risk behaviors, and flag potential illicit activities. The information collected provided the necessary context for this analysis, and this makes it easier to trace the flow of funds that can be linked to money launderers, terrorist financiers, and other illicit actors.

Apart from collecting and sharing data, and monitoring transactions, VASPs also need to report suspicious transactions to the necessary enforcement agency. So, FATF crypto travel rules also support law enforcement investigations by providing information to law enforcement to track down lawbreakers and bring them to book.

With the information provided, law agencies can trace the origin and destination of funds, identify entities behind addresses, untangle complex criminal cluster groups, and predict the actions of fraudsters based on their past behaviors. A detailed transaction history provided by VASPs, helps law enforcement agencies to piece together the movement of funds and build cases against those involved in illegal activities.

MoneyFlow as a Travel Rule Compliance Solution

With the Moneyflow tool, law enforcement agencies and VASPs can comply with the FATF travel rules. The Moneyflow tool makes it easier to follow the movement of funds, record the source and destination of funds, and monitor the compliance of the wallet. In a recent investigation, it was used to trace $4 million defrauded and sent to exchanges.

The Moneyflow tool makes it easier to track crypto addresses, transactions, entities, and VASPs on more than 40 blockchains. With the Moneyflow tool, you can dive deeper into the world of DeFi, DEXes, bridges, and coin mixers. You can also trace tinted-commingled funds across different chains.

- Comprehensive Counterparty Information: the Moneyflow tool provides access to visualizations that are extensively labeled. This gives you access to information about wallet owners and other necessary data to know who you’re dealing with.

- Case Management Reporting: The Bitquery Moneyflow tool doesn’t only let you access the compliance tool. It allows you to streamline your investigation, making it easier to organize your findings and collaborate with other VASPs.

- Intuitive Visualization to Easily Trace Non-compliant Entities: The Moneyflow tool not only provides transition graphs but also provides highly intuitive and detailed visualization to monitor wallets and the movement of funds across the blockchain.

- Address Labeling and Entity Resolution: The Moneyflow tool doesn’t only visualize the movement of funds but helps in labeling addresses and linking multiple wallet addresses referencing the same entity. The tool uses advanced algorithms to analyze transaction patterns and user behavior in group wallets under one entity. This feature helps to identify tornado cash, mixers, previously flagged wallets, and so on.

- Transaction Filtering Based on Amounts: another feature of the moneyflow tool is the ability to filter transactions based on the amounts transferred. A common technique used by money launderers to avoid triggering anti-money laundering (alert) is structuring their funds below the reporting threshold. With the ability to filter transactions based on the amount, Moneyflow tool makes it easier for VASPs to enforce the FATF crypto travel rule.

- Auto-tracing From/To an Address: manually tracking funds on the blockchain can be intensive work because of the anonymity and the decentralized nature of the blockchain. With the auto-tracing feature of the Bitquery moneyflow tool, you can easily follow the movement of funds between several addresses without losing the direction of flow.

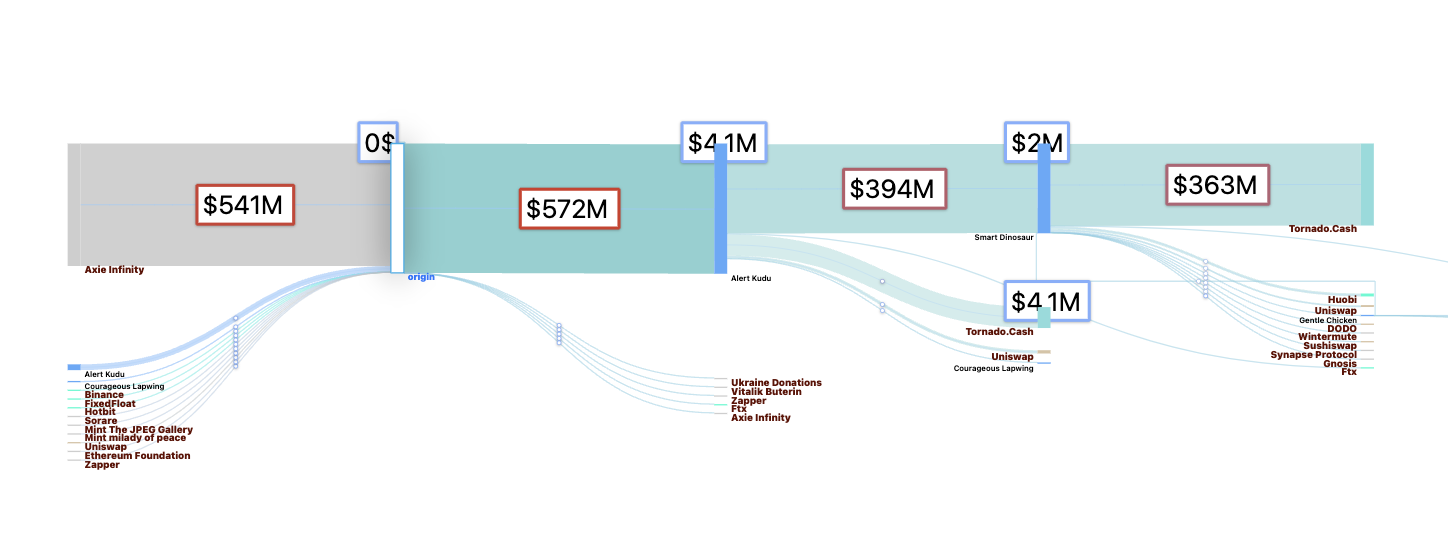

The Sankey visualization above provides detailed information about the movement of funds from and to the wallet being monitored. The visualization above is for the wallet (0x098b716b8aaf21512996dc57eb0615e2383e2f96) used by Axie infinity’s Ronin network exploiter and it showed the movement of funds from different victims to the wallet

From the visualization above, we saw that funds from Axie Infinity are the largest funds received by the wallet ($541 million). While Axier Infinity funds are the largest funds received, we can easily see that funds were stolen and sent from other wallets and smart contracts.

Moreover, the amounts sent out of the wallet are on the right of the origin (0x098b716b8aaf21512996dc57eb0615e2383e2f96). We also saw that the $572 million was sent out at once and other smaller funds were also sent out.

The visualization above makes it easier to see the movement of funds across several wallets. We are able to collect information about the sender and receiver of the funds, check if the funds comply with the FATF crypto travel rules (in this case which isn’t), and can easily flag transactions that go against the rule. Bitquery’s Moneyflow tool offers you a birds-eye view of several wallets

In conclusion, while FATF Recommendation 16, or the crypto travel rule, may be against the ethos of cryptocurrency—such as decentralization and privacy—it has played a crucial role in building trust in the industry and therefore onboarding millions to the industry. With these regulations, there is increased transparency and heightened security, and overall, the crypto world has been aligned to traditional financial systems.

Despite the challenges and changes it introduces, the crypto travel rule has proven to be a vital step in the maturation of the cryptocurrency industry.

-- Written by Emmanuel

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.