Exploring the Ethereum Liquid Staking Ecosystem: A Detailed Overview

Staking is a game-changing concept that lets you contribute to network security by locking up your token for a certain period to earn rewards over the lockup period.

With this concept, once you lock up your token, you won’t have access to the token until you unstake your investment. In other words, your staked tokens become illiquid until you unstake the token.

However, in the ever-evolving DeFi niche, a new concept has been introduced: Liquid Staking.

What’s Liquid staking?

Liquid staking lets you retain liquidity while your token is locked up. When you stake your token, you receive a derivative of the same amount of the token staked, which you can use for other activities, like trading, lending, participating in governance activities, and restaking (if supported). And you continue to receive rewards on your primarily staked token.

For example, let’s say you’re interested in Ethereum staking and decided to stake 20ETH with Lido Finance. Once you stake your ETH, you receive 20stETH (Lido’s liquid staking derivative (Liquid Staking Derivatives) pegged to Ether), which you can use for trading, lending, and participating in governance activities on supported DeFi Protocols. Moreover, the 20ETH you staked is still yielding rewards.

With Liquid staking, even though you locked up your token, you’ll enjoy the benefits of locking up your token to support the network and still have the flexibility to use the asset for other rewarding purposes.

Liquid staking was popularized by the transition of Ethereum from Proof of Work (POW) to Proof of Stake (POS). As a result of the low barrier to entry, the liquid staking derivative (Liquid Staking Derivatives) sub-section has gotten a lot of interest from DeFi investors and traders.

Ethereum liquid staking has attracted over $40 billion in total value locked (TVL). And it accounted for about 80% of the total staked Ether. Overall, liquid staking introduces a flexible approach to earning passive income in DeFi.

In this article, we’ll go through everything you should know about liquid staking and the benefits of this game-changing concept.

Benefits of Liquid Staking Derivatives

Liquid staking derivative is a DeFi instrument that opens new opportunities and possibilities to investors. It solves some of the limitations of traditional staking strategy. Liquid staking unlocked the inherent value of staked tokens, allowing them to be traded and used as collateral in protocols.

Now, let’s check some of the benefits of Liquid Staking Derivatives.

-

Capital Efficiency

Liquid staking improves the efficiency of your token. In traditional staking, once you lock up your token, you only receive rewards, but your token remains dormant and illiquid until you unstake. However, liquid staking lets you use your token for other activities instead of locking it up in some smart contracts vaults.

Moreover, when you stake your token, you get an equivalent of the token derivatives, which you can use for other income-generating activities while you’re still earning rewards from the staked tokens. This lets you earn on both tokens, which maximizes your profit.

-

Lowers the Barrier to Entry

You need to meet some requirements to become an Ethereum staker, but Liquid staking Derivatives have lowered the barrier to entry for Ethereum staking.

For example, to be an Ethereum validator, you need a minimum of 32 ETH, but with Liquid Staking Derivativess, there is no barrier to entry — some Liquid Staking Derivativess, as we’ll see below, even let you stake as low as 0.01 ETH on their platform.

Apart from staking 32 ETH, you still need to participate in several activities like proposing, attesting, and validating blocks or risk getting slashed (losing a percentage of your staked Ether). With Liquid Staking Derivatives, you don’t have to know the technical side of things. The Liquid Staking Derivatives protocol handles the technical difficulties and only pays you your percentage of yield.

-

Risk Management

Ethereum staking also requires you to lock up your Ether for a certain period. Your token stays dormant for a certain period, but with Liquid Staking Derivativess, you can maximize your profit and withdraw your staked ETH anytime you want.

Receiving an equivalent number of tokens you staked in derivatives can also help you manage risk. Instead of your token staying illiquid and dormant in a vault somewhere, you can use the derivatives to invest and maximize your return by trading and speculating to hedge against risk from your staked tokens, thereby minimizing loss.

-

Foster Market Participation and Innovation

The lower barrier to entry provides more accessibility and flexible options for staking and earning rewards. It allows investors who are skeptics to get involved and participate.

Liquid staking also creates new opportunities for financial products and also encourages innovation. Liquid Staking Derivativess let investors try out new innovative ways of increasing their income.

For instance, investors can re-stake their derivatives on any other acceptable platform. Also, you can use the derivative tokens as collateral on lending platforms to borrow tokens you can further invest on other DeFi platforms. The earning possibilities are truly endless.

-

Increased Liquidity

Unlike the traditional staking processes, Liquid Staking Derivativess allow investors to trade the derivatives they receive when they stake their tokens on exchanges, which facilitates efficient market opportunities.

For example, the top Liquid Staking Derivatives tokens are traded on CEX, like Binance, Kraken, etc, which is another earning opportunity for experienced crypto traders.

Instead of the limitation that comes with the traditional staking strategy, liquid staking offers the flexibility for traders and investors to earn more without risk.

Ethereum Liquid Staking Derivatives Protocols Overview

Liquid Staking Derivatives is an innovative way to maximize revenue in DeFi. In this section, we’ll go through some of the popular Liquid Staking Derivativess on ETH. Without ado, let’s get started.

-

LIDO Finance (stETH)

Lido finance is a liquid staking protocol that allows users to earn staking rewards by pooling their funds to be staked on the Ethereum Beacon chain. The protocol provides users with secure and automated methods to earn yield on their staked Ether.

As a liquid staking protocol, users deposit their Ether into the protocol’s smart contract and receive an equal amount of stETH (a derivative pegged to the price of Ether) in return. The Lido DAO then stakes the tokens with the node operators.

Lido is a significant player in the Liquid Staking Derivatives realm. With over $30 billion in Total Value Locked (TVL), the protocol currently dominates the market with an impressive market share of over 70%.

Based on the data obtained from Bitquery Ethereum APIs, as of the 3rd of April 2024, there were about 12 million stETH in circulation with over 188,000 holders of the derivatives — an average of 63 stETH per unique wallet. Throughout the protocol's existence, there have been over 268,000 unique senders and 395,976 unique receivers.

Moreover, the protocol’s validators control over 30% of the Ether staked on the Ethereum beacon chain. So, to decentralize risk, Lido adopts a multi-validator system. And so, their over 220,000 validators were distributed across 37 nodes.

Finally, this DeFi protocol uses the DAO governance structure for its operations, which means you can vote on proposals and determine the direction of the Liquid Staking Derivatives protocol when you hold LDO, the protocol’s native token. Moreover, the DAO handles the pooling and staking of the users' funds. So, the node operators do not have direct access to the user's staked token.

Lido Finance has extended its services to several other chains, including Polygon, Solana, Polkadot, and Kasuma.

-

RocketPool (rETH)

Rocket Pool is considered the first truly decentralized liquid staking protocol in the Liquid Staking Derivatives sub-niche. It's a permissionless proof of stake pool that emphasizes decentralization and security. This DeFi protocol utilizes a dual-token model (RPL and rETH). RPL is the native token of the protocol, while the rETH is the Liquid Staking Derivatives you receive when you stake your Ether. For every Ethereum you stake on Rocketpool, you get an equal amount of rETH in return, which you can use for other activities.

It allows users to pool together their Ether to meet the 32ETH staking requirement on the Ethereum beacon chain. You can stake with as low as 0.01 ether and receive an equivalent amount of the derivative rETH to use as liquidity for other activities.

With a TVL of $4 bln, RocketPool is the second largest Liquid Staking Derivatives after LIDO finance and the 9th largest protocol by TVL in the entire DeFi ecosystem. Unlike the 32 Ether required for solo stakers to become validators in the Ethereum beacon chain, Rocketpool only requires 16 Ether to be part of the validators in the pool.

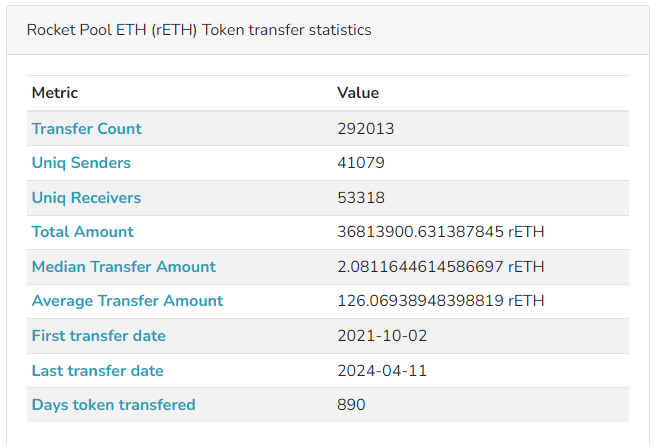

Based on the data retrieved using the Bitquery explorer, there were currently 813,280 ETH staked on the protocol and over 3,620 node operators. There was a total supply of 525,046 rETH in circulation and 17,823 holders — 29rETH per unique holder.

Moreover, the top three wallets hold over 26% of the total rETH in circulation. There are 41,079 unique senders and 53,318 unique receivers, with a total transfer count of 288,762.

-

Frax Ether

Frax is another liquid staking protocol that maximizes yields and simplifies the Ethereum staking process for non-technical investors. It lowers the barrier to entry and leverages the Frax finance ecosystem to maximize DeFi investors’ profit.

Unlike the previously discussed Liquid Staking Derivatives protocols, Frax does not only focus on Liquid Staking Derivatives. It offers many DeFi products like stablecoin (FRAX and FPI), a Decentralized Exchange (FraxSwap), a lending protocol (FRaxlend), and a bridge (Fraxferry).

Frax adding an Liquid Staking Derivatives to its array of DeFi products is to be a one-stop shop for everything DeFi. This derivative aims to help investors remain liquid and earn revenue while staking on the Frax ecosystem. This means even if you stake your token, you can receive a Frax Liquid Staking Derivatives and use the token for other activities like lending, trading, and so on in the ecosystem while maximizing your profit.

However, unlike other Liquid Staking Derivativess we’ve talked about, FRAX Liquid Staking Derivatives is a multi-token system with two separate derivative tokens (sFRXETH for staking and frxETH for farming and withdrawing back to ETH).

The two tokens issued by FRAX are aimed at isolating the earning tokens from the volatile ones. The frxETH is loosely pegged to Ether, and you receive no staking yield. While the sfrxETH is the derivative token you receive when you stake your frxETH.

From the data pulled using the Bitquery API, Frax is among the top 5 Liquid Staking Derivatives protocols by TVL. with a TVL of $880 million and 5,392,641.8 frxETH in circulation. Moreover, as of the 3rd of April 2024, there were 4,801 unique senders and 5,184 unique receivers of the frxETH token. The total transfer count since the inception of the protocol is 85,585.

There were also 1507 unique token holders and a token supply of 264,814 frxETH. Based on this data, there is an average of 175frxETH per unique address.

DAO Token and Governance in Liquid Staking

DAO token and governance in liquid staking play a significant role in controlling the dynamics of the liquid staking protocol. Just as governance affects other sectors of DeFi, it also affects the Liquid staking sector.

A decentralized liquid staking protocol ensures that the protocol is more secure and limits the power of individuals or groups to control the locked asset. It also allows participants to collectively decide the direction and evolvement of the protocol, which aligns with the ethos of web3.

Moreover, a governance token allows a collective decision to be made on the parameters of the staking protocols, such as inflation rate, reward distribution, slashing conditions, and so on. Anyone who holds a protocol governance token will have the power to vote on proposals to make updates and changes.

So DAO tokens and governance in liquid staking shouldn’t be overlooked.

Conclusion

You can see that the emergence of liquid staking derivatives (Liquid Staking Derivativess) has significantly affected the evolution of DeFi, particularly within the Ethereum ecosystem. Liquid staking gives investors the power to retain liquidity while their token is locked away in a vault.

With this article, you now understand the significance of Liquid staking protocols and how it has benefited the DeFi ecosystem.

Written by Emmanuel Ajala

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.