Exploring Low-Latency Data Solutions for Crypto Futures Trading

In financial markets, having access to real-time data with little delay is essential for making quick and accurate decisions. This is called low-latency data, and it allows traders to respond rapidly to price changes and take advantage of opportunities before they disappear. This is especially important in cryptocurrency futures trading, where prices can change in milliseconds.

Fast technological advancements have made high-frequency trading (HFT) much more important. Research shows that HFT accounts for between 40% and 70% of trading volume in the U.S. markets. This trend highlights how critical low-latency data is, especially in cryptocurrency markets that are known for their volatility.

Almost half of all cryptocurrency transactions today are driven by high-frequency trading, which depends on getting and processing data very quickly. Without low-latency data, traders risk falling behind faster competitors. In this blog, we will discuss why low-latency data is crucial in crypto futures trading and look at the challenges and solutions related to accessing real-time data.

The Importance of Low-Latency Data in Financial Markets

Low-latency data refers to the quick delivery of information with minimal delay. In trading, especially in futures markets, this concept becomes critically important. When prices fluctuate rapidly even the slightest delay in data delivery can lead to missed opportunities, increased risks, and diminished profits.

Traders must make split-second decisions based on the most current data available to maximize their returns and manage risks effectively. For instance, HFT firms like Citadel Securities and Virtu Financial execute trades at lightning speed, relying on the smallest possible delay between data delivery and execution.

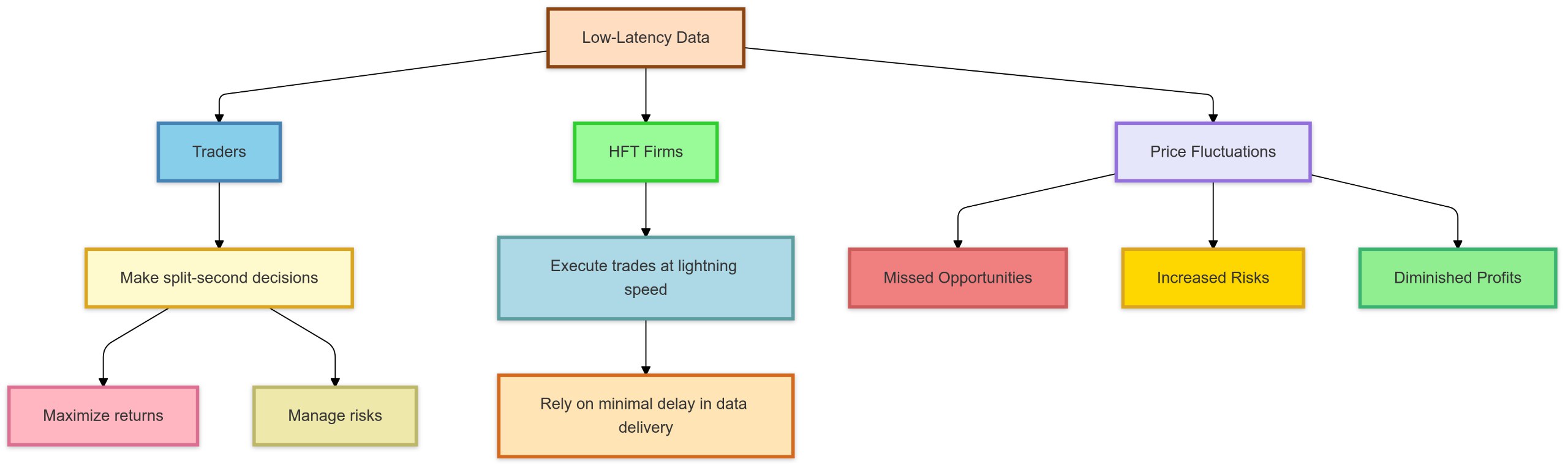

To better understand how low-latency data impacts traders and HFT firms, the following flowchart visualizes the decision-making process in futures trading and how access to real-time data is critical in mitigating risks and maximizing profits.

The flowchart shows how low-latency data flows in financial markets, highlighting its impact on trading outcomes. Traders and HFT firms rely on fast data to make split-second decisions, execute trades quickly, and manage risks from price fluctuations. Delays in data can lead to missed opportunities, increased risks, and reduced profits in volatile markets.

Impact of Low-Latency Data on Futures Markets

In the cryptocurrency futures market, the importance of low-latency data cannot be overstated. The extreme volatility inherent to cryptocurrencies means that prices can swing dramatically within seconds. During significant market events such as the 2021 Bitcoin bull run prices often changed by hundreds of dollars in minutes.

Traders who had access to real-time data were able to capitalize on these rapid fluctuations, whereas those relying on slower data streams faced issues like slippage, where the executed trade price differed from the expected price due to data delays.

On October 21, 2024, Bitcoin surged past $69,000, peaking at $69,408.1 after three months of declines. This rapid price increase emphasized the importance of low-latency data, allowing traders with real-time information to capitalize on volatility and execute profitable trades swiftly. In contrast, those relying on slower data faced slippage, underscoring how crucial timely data is for navigating fast-moving markets.

Recent Transaction Data

The importance of low-latency data is further illustrated by analyzing recent transaction volumes in the cryptocurrency market. This data not only shows trading activity but also highlights how timely information can influence trading decisions.

For instance, on October 24, 2024, Bitcoin recorded an impressive 681,834 transactions, equating to an average of 7.89 transactions per second. Click here for the transaction query. This high transaction volume reflects the active trading environment, where speed and access to real-time data can significantly influence trading outcomes.

In contrast, on October 25, 2024, the Moonbeam network saw 45,835 transactions, averaging about 0.53 transactions per second. Click here for the query. While this figure may seem lower compared to Bitcoin, it underscores the growing activity in diverse blockchain ecosystems and the need for timely data access to navigate these markets effectively.

Traders with real-time insights into these transaction volumes were better positioned to act on market movements, minimizing slippage and maximizing profit opportunities. This data exemplifies how crucial real-time information is for capitalizing on market volatility, highlighting the necessity for traders to utilize low-latency data solutions in their strategies.

High-Frequency Trading (HFT) and Algorithmic Trading

HFT and algorithmic trading are both strategies that heavily depend on low-latency data. HFT involves executing thousands of trades in a matter of seconds, capitalizing on tiny price discrepancies across various exchanges.

These strategies thrive on receiving real-time data to make instantaneous decisions. Even a millisecond delay can result in missed opportunities or unfavorable trade prices.

The Infrastructure Behind HFT

Firms engaged in HFT invest significantly in infrastructure such as colocation placing their servers physically close to the exchange's servers to reduce latency. This speed advantage allows them to react to price movements before other market participants even receive the same information. Such a competitive edge is crucial in a market where every fraction of a second counts.

Algorithmic trading, which uses pre-programmed trading instructions, also relies on low-latency data to execute trades based on real-time market conditions. Without immediate access to data streams, these algorithms may act on outdated information, resulting in poor execution prices and widening spreads.

Key Terms in Low-Latency Trading:

Understanding some key terms related to low-latency trading can provide valuable insights into how real-time data impacts trading efficiency:

- Slippage: This refers to the difference between the expected price of a trade and the actual price at which the trade is executed. Low-latency data minimizes slippage by ensuring trades are executed close to the intended price.

- Spread: This is the difference between the highest bid price and the lowest ask price in a market. Traders aim to minimize the spread to reduce trading costs. Access to real-time data allows traders to reflect spreads in their trading decisions accurately.

- Market Depth: This indicates the liquidity in a market, showing the volume of buy and sell orders at various price levels. Having access to real-time market depth enables traders to gauge supply and demand effectively.

Challenges in Parsing/Indexing On-Chain Data

One of the main challenges in utilizing real-time data in cryptocurrency trading is the parsing and indexing of on-chain data. Blockchain transactions and smart contracts generate vast amounts of data that need to be processed and analyzed quickly to be useful for traders. Delays in processing this information can lead to outdated trading decisions resulting in financial losses.

Here are some specific challenges:

-

Data Volume: The sheer volume of transactions and events on the blockchain makes it difficult to extract relevant information in real-time.

-

Complex Data Structures: Blockchain data often contains complex structures that require sophisticated parsing techniques to interpret correctly.

-

Processing Speed: Ensuring that data is processed quickly enough to provide timely insights for traders can be challenging.

-

Data Integrity: Maintaining the accuracy and reliability of data during parsing and indexing is critical, as inaccuracies can lead to poor trading decisions.

-

Scalability Issues: As the volume of on-chain transactions increases, the systems used for parsing and indexing must scale effectively without compromising performance.

ETL challenges involved in indexing blockchain data, are discussed in detail in this blog.

Solutions: Kafka Streams and Bitquery

To address these challenges, innovative solutions like Kafka streams have emerged. Kafka is a distributed streaming platform that allows for the real-time capture and processing of blockchain events, such as transactions and smart contracts. This technology can efficiently relay crucial data to consumers, enabling traders to stay updated with minimal latency.

Bitquery employs Kafka-based streams to deliver on-chain trade data with minimal latency. It ingests raw data from various blockchain networks in real-time, offering valuable APIs for different ecosystems.

For example, on Ethereum, traders can access the SmartContract API and Mempool API for real-time smart contract interactions and pending transactions. Similarly, the BSC DEX Trades API provides insights into decentralized exchange trades on the Binance Smart Chain.

Bitquery processes this data through Kafka Streams, enabling real-time event processing and data enrichment. The Consumer API offers traders customizable access to processed data, featuring key APIs like the NFT API for tracking ownership and trading activities, and the Balances API for real-time wallet monitoring.

This architecture allows for low-latency access to actionable insights, empowering traders to make informed decisions. By efficiently parsing and indexing on-chain data, Bitquery addresses the critical challenges of real-time cryptocurrency trading, providing a comprehensive solution that enhances traders' abilities to navigate fast-paced markets effectively.

How Kafka-Based Streams Work in Bitquery’s Architecture

- Event Capture: As transactions and smart contracts occur on the blockchain, Bitquery captures these events in real-time. This initial step is crucial for ensuring that the data is current.

- Stream Processing: The captured data is then sent through Kafka Streams for processing. This involves filtering irrelevant data, aggregating important metrics, and preparing the information for consumers. The Streaming API provides powerful tools to manipulate and analyze streaming data efficiently.

- Data Distribution: After processing, the refined data is published to various Kafka topics, which can be subscribed to by different consumer applications. This enables traders and applications to receive tailored data streams relevant to their specific needs.

- Latency Optimization: Bitquery’s architecture is designed to minimize latency. By processing data close to the source and using efficient streaming techniques, traders receive insights with minimal delay, allowing them to act on the most current information available.

Application of Bitquery’s Data Feed in Perpetual Futures Trading

Perpetual futures, a type of derivative product unique to the crypto world, allow traders to speculate on the future price of an asset without the obligation of settling on a specific date. These contracts are popular because they allow traders to leverage positions and capitalize on market volatility.

By integrating Bitquery’s low-latency data streams, traders can optimize their perpetual futures strategies in several ways:

- Reducing slippage by timing trade entries and exits more effectively.

- Minimizing spread losses by having a clear and real-time view of the market’s bid-ask spreads.

- Analyzing market sentiment in real-time by monitoring on-chain activity and wallet movements to make more informed trading decisions.

Case Study: Using Bitquery’s Data for Perpetual Futures Trading

Scenario Overview: A cryptocurrency futures trader is monitoring Ethereum (ETH) price movements and notices significant volatility. To make informed decisions, the trader uses Bitquery’s real-time on-chain data streams to track large transactions, smart contract activity, and DEX trades. This data allows them to anticipate market shifts and capitalize on price swings in the perpetual futures market.

Step-by-Step Breakdown of the Trading Strategy:

- Monitoring Large Transactions:

The trader can use Bitquery’s ERC20 Token Transfers API to track significant wallet transactions. One whale wallet moves 5,000 ETH to a decentralized exchange, signaling potential selling pressure.

- Address: 0x742d35cc6634c0532925a3b844bc454e4438f44e

- Transaction: ETH transfer to an exchange.

- Action: The trader opens a short position in ETH perpetual futures, anticipating a price drop.

- Analyzing Smart Contract Activity:

The trader uses Bitquery’s SmartContract Calls API to monitor smart contract activity. A spike in withdrawals from the Synthetix staking contract suggests that large players are reducing liquidity, which could lead to price instability.

- Smart Contract Address: 0x5e74c9036fb86bd7ecdcb084a0673efc32ea31cb (Synthetix's sETH staking)

- Activity: Large ETH withdrawals signal a bearish outlook.

- Action: The trader strengthens the short position, expecting further price declines.

- Tracking DEX Trades:

By tracking trades on decentralized exchanges using Bitquery’s DEX Trades API, the trader observes significant ETH trading activity on Uniswap, indicating high volatility.

- Action: The trader holds the short position as DEX trade volumes increase, indicating heightened volatility and supporting the bearish outlook

Outcome: Using Bitquery’s real-time data, the trader successfully predicts ETH’s short-term price drop and secures a profit on a leveraged short position. By using data on whale transactions, smart contract activity, and DEX trades, the trader made timely, informed decisions in the volatile cryptocurrency market.

In addition to manual trading strategies, Bitquery’s streaming data can be used to feed automated trading algorithms, helping traders automate their strategies based on real-time market conditions. It can also be used for portfolio risk management and market sentiment analysis, giving traders a broader understanding of the market’s direction.

Written by Aakash

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.