The Ultimate Guide to Crypto Wallet Intelligence: Tracing, Analysis, and Compliance

Wallet Intelligence is the analysis and interpretation of the information (token type, transaction volume, transfer information, etc) associated with a cryptocurrency wallet. With wallet intelligence, you track and understand the behavior, activities, and patterns of transactions made by a specific wallet on the blockchain network.

Importance of Wallet intelligence

Wallet intelligence offers a lot of benefits to crypto users. The analysis of crypto wallets provides insights into the behavior of the users and patterns of their usage. Here are the benefits of wallet intelligence.

-

Anti-money Laundering and Know Your Customer (AML/KYC) Compliance

This helps comply with AML/KYC regulations by verifying transactions that fit the profile of money laundering and enabling quick response or reporting. It verifies users' identity and monitors or surveils wallet activities, which help identify and stop illicit activities in real-time.

Moreover, wallet intelligence helps in regulatory reporting after documenting the suspicious activities to the proper regulatory bodies and ensures adherence to legal requirements.

-

Wallet Balance Reconciliation

With wallet intelligence, you can conduct analysis on a wallet to reconcile past transactions and verify the current balance against historical records. Bitquery APIs enables you to retrieve detail audit trails, which makes it easier to identify discrepancies and ensure accurate reconciliations.

Overall, wallet intelligence makes it easier to audit blockchain wallets and enables you to easily verify transactions ensuring enhanced accuracy, efficiency, and security.

-

Network Relationship mapping

With wallet intelligence, you can conduct network relationship mapping to identify the network of illicit activities and uncover related wallets engaging in coordinated fraudulent activities and scams. You can learn and understand the relationship to disassembling illicit network activities by targeting key wallets and breaking down their criminal networks. You map the interaction between wallets and uncover related wallets.

For example, if a particular wallet is detected to be used by a hacker or fraudster, with wallet intelligence, you can monitor the wallet and uncover related wallets that’s used by those group.

Below is an address link to the Lazarus group (as reported by ZachXBT)

0x0864b5ef4d8086cd0062306f39adea5da5bd2603

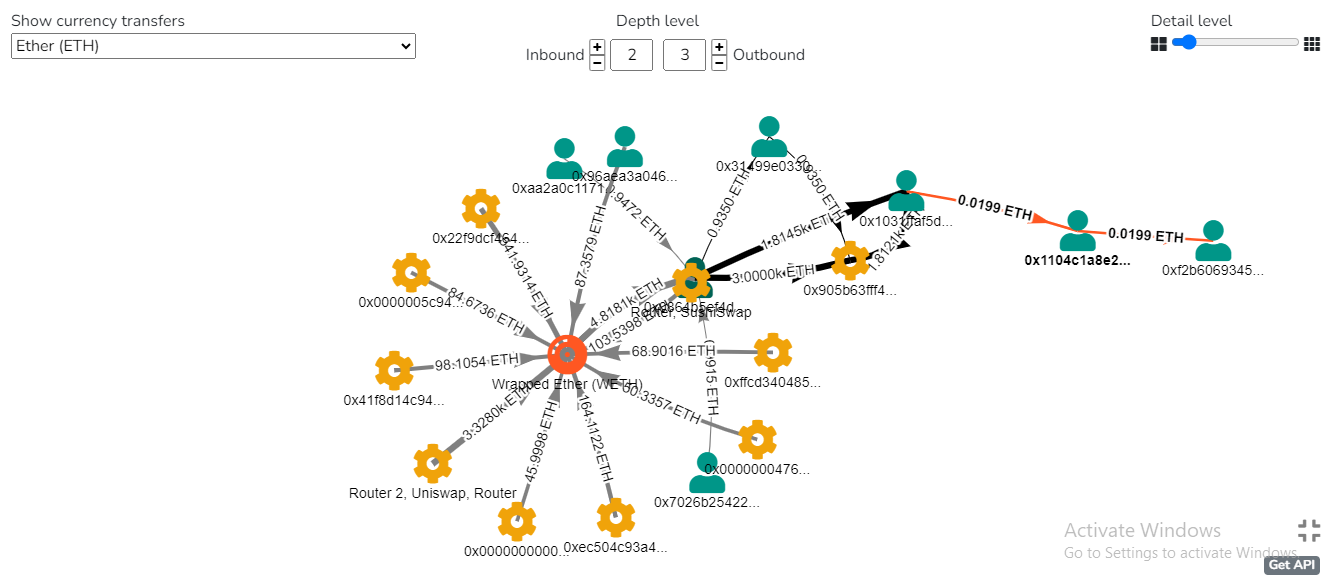

With the Bitquery Coinpath API, we are able to trace the interaction of the wallet with other wallet and thereby discover the network of related scam wallets. Here is a visualization of the movement of funds from the wallet to other wallets:

The visualization above showed how the wallet ten transactions from 10 different sources, with the largest transactions coming from a Uniswap Router. We also saw how transactions were initially sent to two wallets before being consolidated to one.

Moreover, you understand the broader ecosystem and identify influential players, identify clusters related to wallets, and provide useful data and information for coordinated activities like collaborative fraud and market manipulation.

-

Detecting Anomalous Transactions

Wallet intelligence can also help detect unusual activities or deviations from typical patterns. For example, a sudden large transaction from a wallet or a transaction to crypto mixers like Tornado Cash can indicate fraud and hacks may indicate potential security breaches or fraudulent behavior.

With wallet intelligence, you can easily monitor a wallet and so identify suspicious activities that may indicate potential security breaches or fraudulent behavior. And this could prevent them before they eventually happen.

Why Bitquery when it comes to Wallet Intelligence?

Bitquery is a leading provider of blockchain data APIs and crypto tracing tools. It offers a different suite of products that enables cross-chain analytics, DEX insights, and smart contract APIs. It parses, indexes, and stores blockchain data in a unified manner. It’s dedicated to powering and solving blockchain data problems using on-chain data.

Its different APIs let you conduct a deep/comprehensive analysis of a particular wallet. In the next section, we’ll go through a practical process of conducting wallet intelligence in real time using Bitquery APIs on a wallet.

Case Study: How to Conduct a Wallet Intelligence using Bitquery APIs

Here, we’ll walk you through a case study on how you can conduct wallet intelligence analysis using Bitquery APIs.

In this case study, we’ll be conducting an analysis using the below wallet address:

0x41Bc7d0687e6Cea57Fa26da78379DfDC5627C56d

Without further ado let’s get started.

-

Getting the Attribute of the Wallet

After deciding on the wallet to analyze, the next action is to get the attribute or the necessary information concerning the wallet. Using Bitquery’s Address Stats API, you can access the information to analyze the wallet. Here is the link to the GraphQL query to gain the wallet attribute.

With the query, we can retrieve these basic information:

- We discovered that as of the time of writing this article, the total amount sent out from the wallet to other wallets is around $62,871.28 with a total transaction count of 6,469 while the total amount received is $62,981.30 with a total of 8,139 in total received transaction.

- Also, transactions were received from over 1,110 addresses and the total currencies received since the inception of the wallet is 936. While there are 937 unique wallets our wallet has sent tokens to. And the total currencies transferred out is 721.

- We are also able to discover that the first day a transaction was ever conducted on this wallet was on June 9, 2019, at 9:33 am while the last transaction as of the time of writing this article is on July 08, 2024, at 10:41 pm.

These are some of the information we think is important to highlight. If you need more details, you can also access them with this query, information like current balance, total gas fee spent, total transaction count, and so on.

-

Identifying the Type of Asset Held

Once you get the basic information of the wallet you want to analyze, it’s also important to identify the type of asset held. With the Address Balance History API, we can retrieve the information about the tokens held by the wallet.

Here is the query to retrieve the balance update information of the wallet. With the query, we retrieve this information in descending order. Here is a list of the top 10 wallets held by the wallet and the balance in USD.

- This wallet holds $400,000 worth of Blockchain-certified Data Tokens and $325,320 worth of ether.fi governance token, $191,981 Synth sUSD, a stablecoin, $65,621 worth of pound token, $48,876 worth of Frax token, and so on.

- The information gives us access to the wallet balance, which makes us identify and understand the type of wallet, value distribution, quantity breakdown of the wallet balance, and the psychology that guides the wallet owner.

- Overall, we’re able to identify that the wallet is individually owned and that the wallet is classified as a whale since it holds more than $10 million worth of cryptocurrency.

Moreover, a close look at the types of tokens in this wallet lets us know that this investor leans more into yield farming/liquidity providing/staking.

-

Analyzing the Wallet Inflow and Outflow

We can now analyze the movement of funds and the buying/selling patterns of the wallet. With the transfers API, we can access the inflow and outflow of tokens and the movement of funds in the wallet. This will help us gain market insight, map network relationships, and check for suspicious transactions that could point to fraud or hack.

This query helps us pull the information about all inbound transactions after January 1, 2024, and this query helps us pull information about the outbound transactions in the same period.

From the data we pulled using the Bitquery Transfer API, we saw that the wallet, apart from a few stablecoins, received more derivative tokens.

For example, on the first of January, 2024 at 10:41 am, the wallet received over $900k worth of swETH token (a derivative Ethereum token for Swell Network, a liquid restaking platform) from this wallet, 0xaa68ca9c69a4ff22203ce189ce4448d7401875e8.

Also a few hours later at 01:01 pm, the wallet received another $600k worth of swETH from another wallet with this address 0xf951e335afb289353dc249e82926178eac7ded78.

On the other hand, looking at the outbound transactions, we discovered a clear and vivid transaction pattern on the token sent. Looking through the outbound transactions, we discovered two things:

-

The owner only transferred out Ethereum tokens

-

The wallet owner never transferred more than 37.7 Ether ($98,486), as seen on the 11th of January 2024 at 5:17 am

By pulling and analyzing inbound and outbound transactions, we can figure out the buying and selling pattern of the wallet and identify the interaction between this wallet and others.

So, assuming we saw the wallet sending out other tokens apart from Ether and it’s more than the usual amount common to the wallet owner, we can easily raise a red flag and dig deep into the event.

On the other hand, if the wallet seems to receive other tokens aside from derivatives (of course this could happen occasionally) but if it becomes more frequent than normal and the amount is in large numbers, we’d easily know something is wrong and reach out to the necessary authority for a solution.

-

Checking for Interaction with other Wallets and Counterparty

Based on our previous analysis, we discovered that this wallet owner is more of a DeFi investor (i.e. a staker/yield farmer), based on their inbound and outbound transactions. Taking a closer look at the inbound transaction, we saw that the wallet interacts more with a particular wallet.

For example, the wallet received about $1.6 million worth of swETH derivative tokens from 0xe7583af5121a8f583efd82767cccfeb71069d93a and 0xaa68ca9c69a4ff22203ce189ce4448d7401875e8 in less than 24 hours.

Assuming, based on more analysis of the other factors, you find these transactions suspicious, you can even dig deep into the relationship between these wallets to be sure of your conviction before drawing the attention of the necessary authorities.

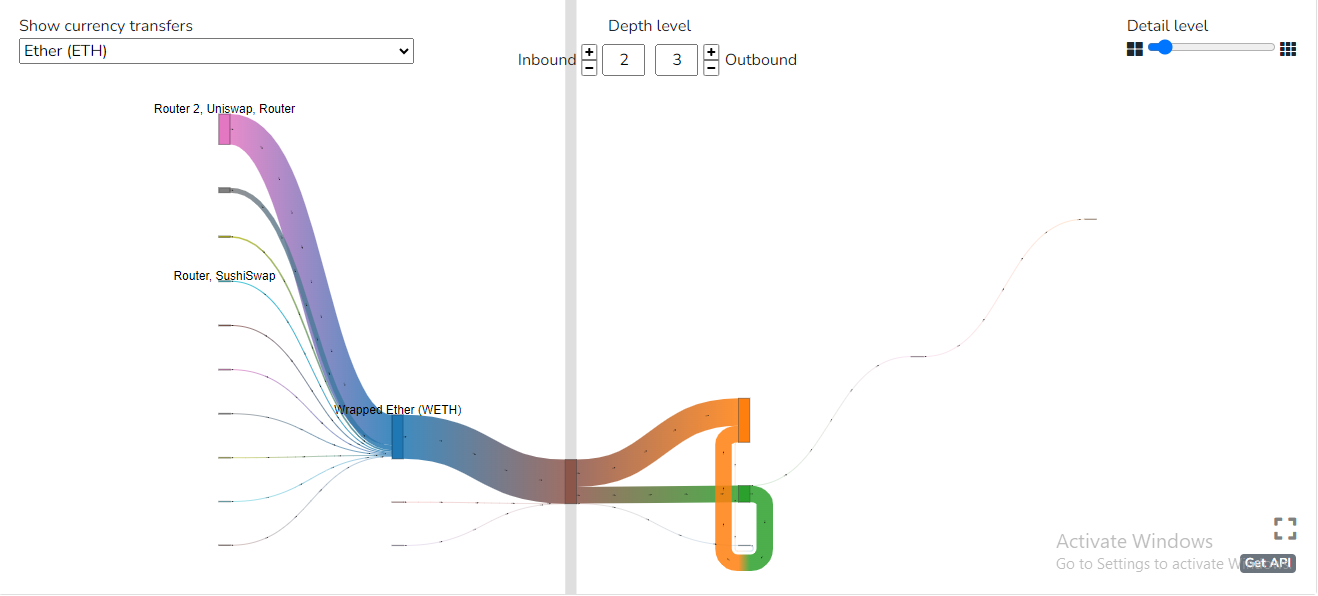

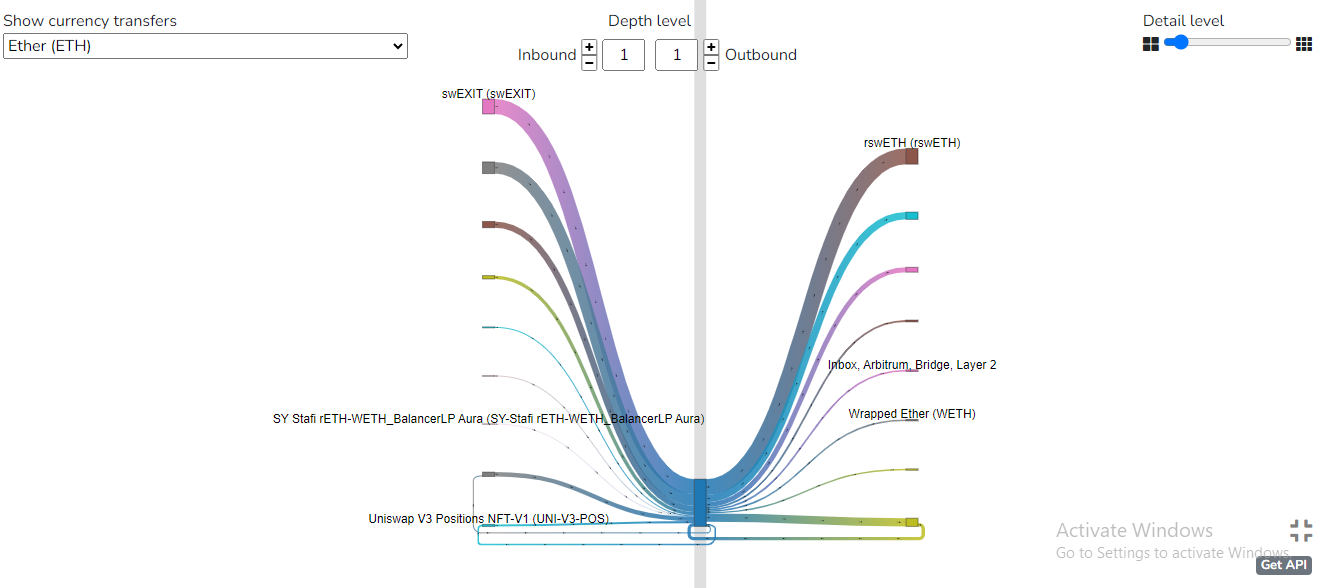

Here, we want to know more about 0xe7583af5121a8f583efd82767cccfeb71069d93a what wallet interacted with this wallet, where the funds sent here come from, and if there is an established interaction between the wallets. With the Coinpath API, you can track the movement of funds, and you can also visualize it using the Moneypath tab in Bitquery Explorer.

With the money path visualization, we discovered that the $900k worth of swETH was also sent from a wallet (0x0ce176e1b11a8f88a4ba2535de80e81f88592bad), which was then sent to our wallet. And there seems to be no prior interaction between any of the wallets.

If our finding seems suspicious, you can dig deep into the wallet to know more about the sender. And if there is any form of fraud, scam, or hack, you can report it to the right authority.

In conclusion, wallet intelligence is an invaluable tool in the cryptocurrency ecosystem. By leveraging various aspects of wallet intelligence, stakeholders can significantly enhance the security, compliance, and operational efficiency of their activities.

As demonstrated in the case study, the practical application of Bitquery APIs can reveal crucial details about a wallet's attributes, asset holdings, transactional patterns, and movement of funds allowing for informed decision-making and proactive risk management. Whether you are an individual investor, a financial institution, or a regulatory body, harnessing the power of wallet intelligence using Bitquery APIs can help you navigate the complexities of the cryptocurrency landscape with confidence and precision.

Written by Emmanuel

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.