Cryptocurrency Money Laundering Explained

In the 1920s, Al Capone, an American gangster, was earning millions in extortion, prostitution, gambling, and bootleg liquor. Still, he needed to show a legitimate source of his income. Hence he bought multiple laundromats business to mix his illicit earnings with their legitimate earnings. Gangsters choose laundromats because they were cash businesses. Many believe this as the origin story of the term “Money Laundering.”

Nevertheless, Al Capone was prosecuted and convicted in October 1931 for tax evasion because Money laundering was not a crime until 1986 in the United States.

Al Capone (Source)

What is Money Laundering?

Money laundering is an illegal process of legitimizing the money obtained from illicit activities. The term money laundering has been used for both business and financial crimes. In general, money laundering is the misuse of the financial system involving cryptocurrencies, securities, banking, credit cards, and traditional currency, including bypassing international sanctions and terrorism financing.

In the realm of digital currencies, money laundering poses a far greater challenge in front of regulators worldwide.

How Cryptocurrency Money Laundering works

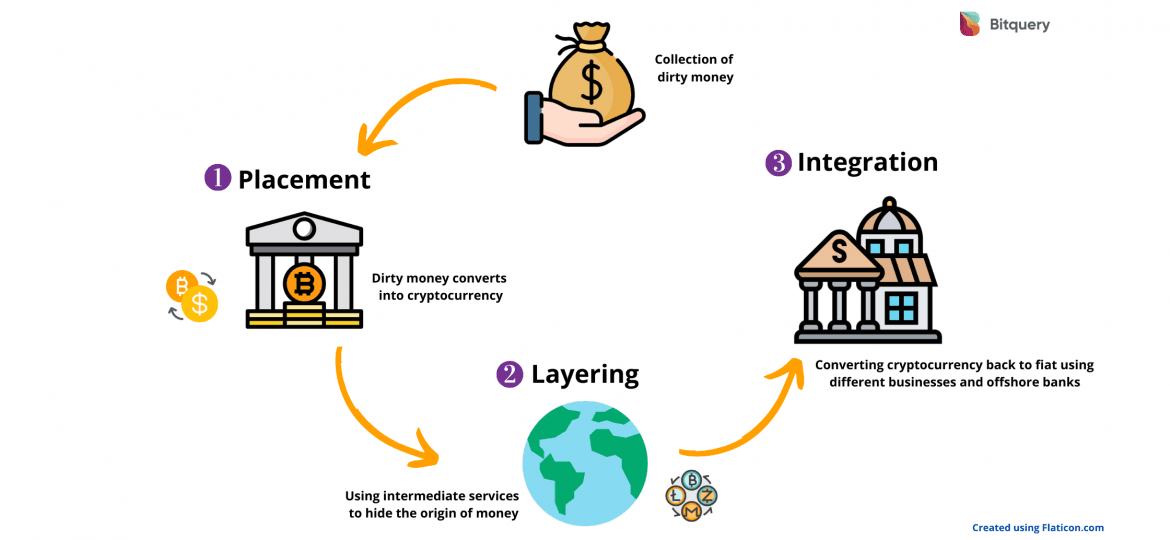

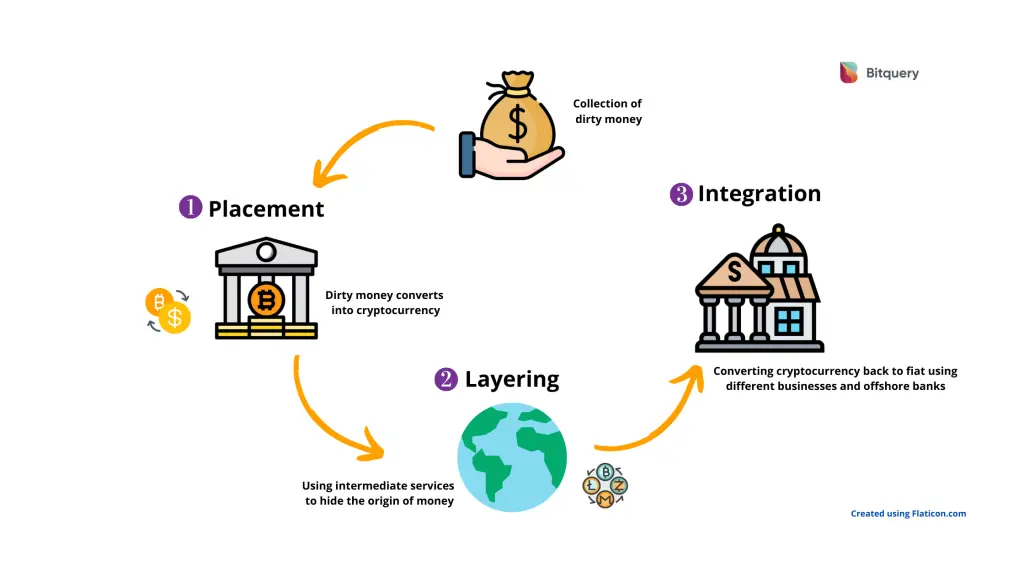

Money Laundering process involves creating a complex money trail to remove the direct association of the funds’ origin and then obtaining the money again by integrating it into the mainstream economy.

In general, the Money laundering process involves three steps. We will talk about how this process works in the context of cryptocurrencies.

Placement

Cryptocurrencies can be obtained using fiat or other cryptocurrencies on exchanges and other crypto services. Criminals use illicit funds to purchase cryptocurrencies, hence introducing the new money into the system. This is where criminals are most vulnerable, and by implementing strict KYC (Know your customer) solutions, the ownership of the funds can be established.

Today, crypto services have varying levels of compliance with regulations regarding financial transactions. Many exchanges are following regulatory requirements and implemented KYC/AML solutions to identify the source of funds. However, many crypto services fall behind to fulfill compliance requirements and are vulnerable to cryptocurrency and bitcoin money laundering.

Layering

Layering is the next phase where criminals use different types of crypto services to create a complex transaction trail to remove the direct association with the funds’ origin.

These transactions are visible on the Blockchain. However, services like tumblers/mixers, crypto gambling, exchange, DeFi (decentralized finance), etc.. can make tracing these funds difficult and, in some cases, impossible.

Our Coinpath® technology helps you to trace money flow on Blockchain in an efficient manner.

Integration

Once the funds’ source is untraceable, the final phase of the cryptocurrency money laundering is to legitimize the funds. For this, criminals process funds through various crypto services, providing fiat gateways.

However, launderers have to explain how they earn this money. There are many ways to do this; sometimes, criminals create new businesses providing services and accepting crypto payments. Then convert the crypto into fiat through off-shore banking services.

Another example is where criminals use gambling and gaming websites, ICOs to show the earnings as profit from the investment.

Common services misused by Crypto launderers

In general, we found that the following services are the most used in cryptocurrency money laundering.

Anonymization services (Tumblers/Mixers)

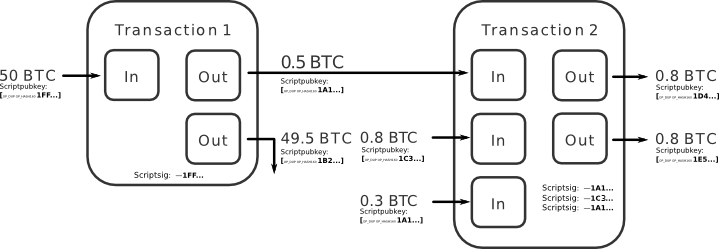

Crypto tumblers or mixing services enhance privacy for personal and business-related transactions. Tumblers mix funds from different origins to make the source of funds unidentifiable.

For example, Mixers split up transactions into multiple smaller transactions and then combine them again. They repeat this process numerous times and every time, making it difficult to determine which funds belong to which source.

Money launders use mixer multiple times at various steps, making funds unidentifiable. Usually, criminals transfer money through multiple hops before and after using any Tumbler.

Cryptocurrency Mixer spiting and mixing Bitcoins

Decentralized & Unregulated Exchanges

Decentralized exchanges(DEX) are mostly unregulated and don’t provide fiat gateways. However, DEX can be used to covert a cryptocurrency into another cryptocurrency. For example, a hacker can use a Decentralized exchange to covert stolen Ethereum into Bitcoin, making it difficult to trace. Besides, there are many unregulated exchanges all over the world, providing fiat gateways also pose challenges to regulators.

Peer to Peer(P2P) exchanges

P2P exchanges also one of the top avenues to dump illicit funds obtained from crypto hacks. Criminals can exchange crypto with fiat in a peer to peer manner, which is difficult to trace. However, the biggest P2P exchange, LocalBitcoins, recently implemented an AML solution to control money laundering activities.

Privacy Coins

Cryptocurrencies such as Zcash, Monero, Verge are privacy-focused cryptocurrencies. If funds are converted into these coins, tracking them is almost impossible. For example, no transaction monitoring system exists for Monero at the time of writing this article. However, our Coinpath® APIs support tracing money on Zcash blockchain.

Bitcoin ATMs

There are more than 8900 Bitcoin ATMs all over the world. Many of these ATMs support multiple cryptocurrencies. Lack of regulatory oversight makes these ATMs vulnerable to Bitcoin money laundering. A report by CipherTrace shows that the percentage of funds sent to high-risk exchanges from US Bitcoin ATMs has doubled every year since 2017. The report also predicts that “Bitcoin ATMs are likely to be the next major regulatory target.”

DeFi (Decentralized Finance)

Ethereum ushered a new era of Decentralized finance (DeFi). Most of the DeFi applications do not need any legal support to enable different financial instruments. Tracing the complex DeFi transactions to stop Ethereum money laundering will post a great challenge for regulators in the coming years.

Gambling and gaming sites

Gambling sites are one of the most attractive avenues for money laundering. Many gambling websites accept cryptocurrencies. Therefore, vulnerable to Bitcoin money laundering. In other words, criminals use these gaming and gambling websites to legitimize their illicit funds and show them as earning.

Challenges in Cryptocurrency money laundering

Private banks create more than 90% of the money in the digital form. All these banks are regulated and follow regulatory guidelines to stop money laundering. However, the United Nations Office of Drugs and Crime estimated in 2011 that the criminals laundered $800 billion — $2 trillion in that one year, which was 2–5% of the global economy.

In a world where central banks and governments control the origin of money, money laundering persists at a large scale. Therefore, tackling the money laundering problem in cryptocurrency will be a more significant challenge for regulators. Because in crypto:

- Any central authority does not control the origin of money.

- No KYC needed to start transacting.

- Tracing problem because anyone can create a complex money trail

- New financial primitives and Internet-only businesses (Decentralized Autonomous Organizations) do not require legal registration.

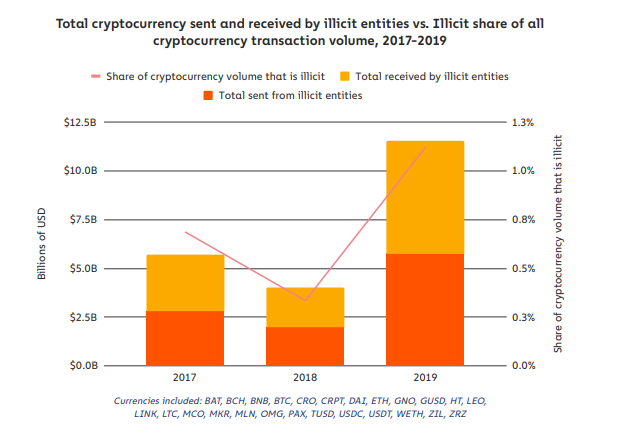

The Chainalysis 2020 Crypto Crime Report shows that more than $10 billion of cryptocurrency transaction volume generated from illicit activities in 2019.

Cryptocurrency volume from illicit activities (source)

The evolution of money and speed of innovation in the blockchain domain poses a hard challenge for regulators worldwide. Law-enforcement authorities need next-generation monitoring tools to restrain cryptocurrency money laundering. At the same time, regulators need to develop regulations that do not hurt innovation and the user’s privacy.

US and global approaches to crypto regulations

In the United stated, The Financial Crimes Enforcement Network (FinCEN) doesn’t consider cryptocurrencies as legal tender.

However, the guidelines published in 2013 by FinCEN suggested that the Bitcoin trading and mining business will be treated as ‘Money transmitters’(based on the jurisdiction). Therefore, these businesses are subject to KYC (Know your customers) and AML (Anti-money laundering) measures as other financial institutions.

In March 2018, the Securities and Exchange Commission (SEC) stated that it was looking to apply securities laws for cryptocurrency wallets and exchanges, considering crypto assets as securities.

On the other hand, The Commodities Futures Trading Commission (CFTC) described bitcoin as a commodity and allowing cryptocurrency derivatives to trade publicly.

In June 2019, The Financial Action Task Force (FATF), a global money laundering and terrorist financing watchdog, published its guidelines stating that crypto exchanges need to abide by “Travel rule” and share sender and recipient information. The countries should make sure that when crypto businesses send money, they:

“… obtain and hold required and accurate originator [sender] information and required beneficiary [receipient] information and submit the information to beneficiary institutions … if any. Further, countries should ensure that beneficiary institutions … obtain and hold required (not necessarily accurate) originator information and required and accurate beneficiary information …”

Fifth Money Laundering Directive (5AMLD)

5AMLD, European Anti-money laundering legislation, came into force on January 10, 2020. The legislations also guide the treatment of digital currencies.

It provides a new legal definition of cryptocurrency in general:

“a digital representation of value that can be digitally transferred, stored or traded and is accepted…as a medium of exchange.”

CFT/AML regulations mentioned in 4AMLD now apply for all cryptocurrency businesses under 5AMLD. Now, cryptocurrency businesses need to conduct customer due diligence (CDD) and submit suspicious activity reports (SAR).

Additionally, crypto exchanges and other businesses have obligations to provide customer’s personal information to Financial Intelligence Units (FIU).

Furthermore, all crypto exchanges and wallets need to register with their respective domestic authorities such as Germany’s BaFin, or the UK’s Financial Conduct Authority.

The 5th Anti-Money Laundering Directive signifies a decisive development in cryptocurrency regulation. It provides transparency to cryptocurrency businesses on their AML and counter-terrorism financing (CTF) obligations.

Governments all over the world started regulating cryptocurrency exchanges. These exchanges are fiat on-off ramp for cryptocurrencies. Therefore exchanges must implement strict KYC solutions and limit the amount of money that can be transacted without KYC verification.

Impact of regulations on the crypto industry

Clear regulatory guidance is the necessity for crypto adoption and the legitimacy of the domain. However, enforcing the system centralization, AML process, and procedure, compliance can harm businesses with many crypto users avoiding such rules and regulations.

For example, Bottle Pay, a UK-based wallet provider, announced its service shut down at the end of the last year. According to a company blog post:

“As we are a UK based custodial Bitcoin wallet provider, we will have to comply with the 5AMLD EU regulation coming into effect on January 10, 2020. The amount and type of extra personal information we would be required to collect from our users would alter the current user experience so radically, and so negatively, that we are not willing to force this onto our community.”

In any case, regulations are essential to legitimize the industry, remove any friction for adoption, and guide entrepreneurs to introduce new products.

How to combat crypto money laundering

Regulators, businesses, and the crypto community need to work together to combat cryptocurrency and bitcoin money laundering. Multiple companies are providing technology to regulators and law enforcement agencies to identify criminal activities such as bitcoin hacks on the Blockchain. However, regulators also need to understand the fundamental values of cryptocurrencies, such as anonymity, and do not push businesses to erode their user’s privacy.

Businesses committed to providing the best service to their users for the long term should look to crypto compliance more closely. And work with authorities to implement proper KYC and AML solutions.

Implementing these solutions can also scare away criminals looking to launder their money through your service.

Since hiding and obfuscating transactions are primary methods of Bitcoin money laundering, proper transaction monitoring, and educating users on the importance of using proper channels when using cryptocurrency will help stop laundering activities.

How to be a crypto AML compliance business?

Deploying anti-money laundering solutions and working with compliance experts can help your business to become and remain AML compliant. However, hiring an in-house compliance team might not feasible for many small businesses. Therefore you can finds experts and engage them on a contract basis. Besides, you need to deploy the right set of compliance tools, which help you with cryptocurrency transaction monitoring and automatically detect and notify about suspicious activities.

You also need to implement proper KYC processes and identity systems for sharing information with other vendors and authorities (in required) while preserving your user’s privacy.

Try Coinpath®

Our Coinpath® technology allows you to trace money flow on Blockchain. Currently, we support more than 24 blockchains. Learn more about how Coinpath® APIs can help you build Cryptocurrency compliance solutions, Bitcoin forensic tools, and Blockchain transaction monitoring systems.

About Coinpath®

Coinpath® APIs provide blockchain money flow analysis for more than 24 blockchains. With Coinpath’s APIs, you can monitor blockchain transactions, investigate crypto crimes such as bitcoin money laundering, and create crypto forensics tools.

If you have any questions about Coinpath®, ask them on our Telegram channel. Also, subscribe to our newsletter below, we will keep you updated with the latest in the cryptocurrency world.

Coinpath® is a Bitquery product. Bitquery is a set of tools that parse, index, access, search, and use information across blockchain networks in a unified way.

About Bitquery

Bitquery is a set of software tools that parse, index, access, search, and use information across blockchain networks in a unified way. Our products are:

-

Coinpath® APIs provide blockchain money flow analysis for more than 24 blockchains. With Coinpath’s APIs, you can monitor blockchain transactions, investigate crypto crimes such as bitcoin money laundering, and create crypto forensics tools. Read this to get started with Coinpath®.

-

Digital Assets API provides index information related to all major cryptocurrencies, coins, and tokens.

-

DEX API provides real-time deposits and transactions, trades, and other related data on different DEX protocols like Uniswap, Kyber Network, Airswap, Matching Network, etc.

If you have any questions about our products, ask them on our Telegram channel. Also, subscribe to our newsletter below, we will keep you updated with the latest in the cryptocurrency world.

Also Read

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.