Opensea vs Blur: Analyzing Top NFT Marketplace

OpenSea, a prominent NFT marketplace, emerged in 2017 following the success of CryptoKitties, with a vision to capitalize on the growing NFT trend. Leveraging the Ethereum's ERC-721 standard, which enables the creation of unique and tradable objects, Opensea differentiated itself by offering a broader marketplace.

The platform strategically lowered its commission to 2.5 percent and entered Y Combinator’s accelerator program in 2018, positioning itself as the "Ebay for crypto assets." Opensea's success is attributed to its early recognition of the potential of NFTs and its ability to provide a scalable platform for buying and selling unique digital assets.

Rise of Blur

While Opensea's grip tightened as the pioneer, its high fees and rigid creator royalty system sowed seeds of discontent amongst users. With each NFT sale, a sizable chunk vanished from both buyer and seller pockets, fueling resentment and a yearning for alternatives.

Enter Blur, a platform built on the very antithesis of Opensea's model.

- Zero trading fees.

- Zero mandatory creator royalties.

And instead of extracting value, Blur incentivised participation with a carefully crafted system of airdrops and gamified farming. Its sleek interface catered to seasoned traders, offering advanced tools like bidding pools and floor sweeps, while its airdrops and loyalty programs rewarded every click and trade.

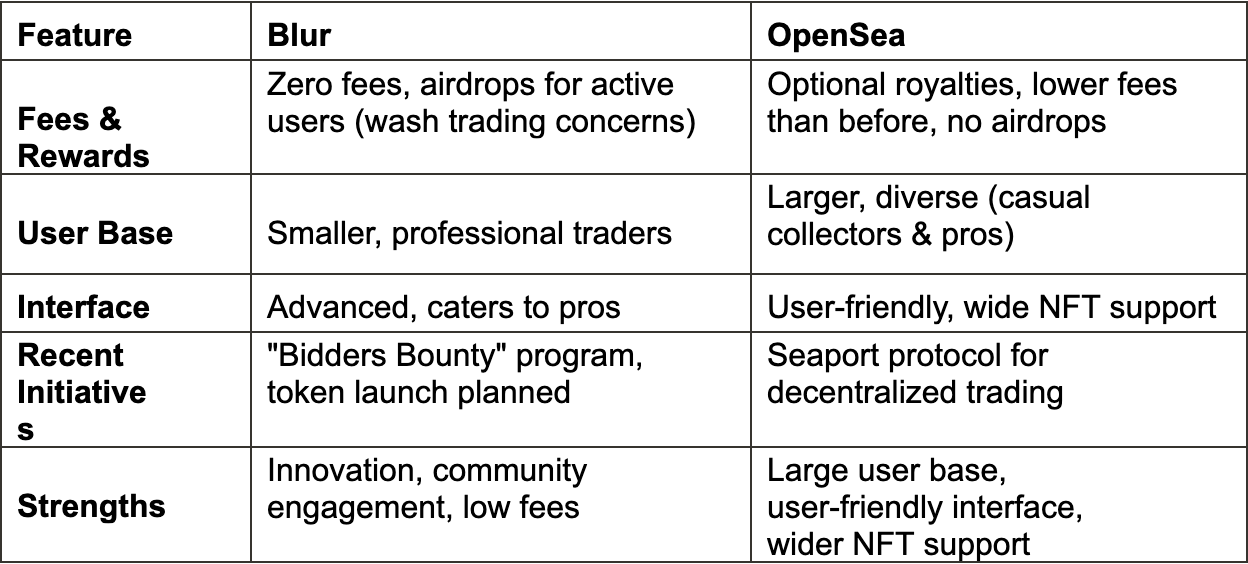

Which marketplace stands stronger?

We can first examine how these two compare against each other as per the basic features.

To dig deeper and look at the tale; From King to Challenger: How Blur Ousted OpenSea in the NFT Marketplace Wars, we will compare and analyze Opensea and Blur in the NFT market.

Userbase

As of Jan 30th, daily users for OpenSea have been ~16k against Blur’s ~5k.

In the 30 days, over 193k unique wallets have engaged with Opensea vs around 54k on Blur. Even with fewer traders, Blur is ahead in terms of volume as much as 5x traded volume with just half of Opensea’s total transactions.

Sales and volume

As Opensea leads with the sales value, with its platform fee, the royalties and transaction fee paid on the platform in the last 30 days was $5.67mn against Blur’s $2.4mn.

When checking the biggest trades on a marketplace through bitquery, for Blur it is-

- Gemesis,

- ins-20,

- XTREME PIXELS,

- Owls of Fortune

and for Opensea it is -

- parallel,

- Gemesis,

- Introducing World App,

- ins-20

If we go deep in dates, the top purchase on Opeansea recorded ~$23.3 million BAYC #8888 in January 2023 (from OpenSea transaction history). On Blur the top recorded purchase was ~$9.1 million Art Blocks "Generative Portraits" in October 2023 (from Blur transaction history).

Unique Buyers

If we look at the unique buyers on both the marketplace, the difference has narrowed since September when it was 56% to 24% in favour of Opensea last year to the present stats when it’s almost similar. Even recent data states the flipping of the trend with Blur capturing around 43% against Opensea’s 41% share in unique buyers. Similarly has been the trend with Sales count.

Conclusion

The NFT market landscape is dynamic, and the balance of power between OpenSea and Blur continues to shift. While Blur currently holds the upper hand regarding market share and trading volume, OpenSea's user base and feature richness remain valuable assets. The clash between Blur and OpenSea transcends mere market share statistics. It represents a fundamental shift in user priorities within the NFT landscape. Efficiency, rewards, and user empowerment are replacing hefty fees and centralised control as the guiding principles of the evolving market.

Both platforms adapt and innovate to attract and retain users, making the competition likely to intensify in the coming months. Only time will tell which platform ultimately claims the crown.

About Bitquery

Bitquery is a set of software tools that parse, index, access, search, and use information across blockchain networks in a unified way. Our products are:

- Coinpath® APIs provide blockchain money flow analysis for more than 24 blockchains. With Coinpath’s APIs, you can monitor blockchain transactions, investigate crypto crimes such as bitcoin money laundering, and create crypto forensics tools. Read this to get started with Coinpath®.

- Digital Assets API provides index information related to all major cryptocurrencies, coins, and tokens.

- DEX API provides real-time deposits and transactions, trades, and other related data on different DEX protocols like Uniswap, Kyber Network, Airswap, Matching Network, etc.

If you have any questions about our products, ask them on our Telegram channel. Also, subscribe to our newsletter below, we will keep you updated with the latest in the cryptocurrency world.

This article is written by a guest writer, Kshitij Chandrachoor

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.