Chatting Up a Crypto Storm: The Rise of Telegram Trading Bots

Telegram trading bots automate crypto trades by linking to decentralized exchanges like Uniswap. They make it easier to buy crypto without the usual complex interfaces of Web3 wallets and DEXs.

Each bot has its own look and commands, but mainly they help users quickly buy new tokens as soon as they're available, a strategy known as 'sniping.'

Setting up these bots usually involves visiting their website, starting the bot in a Telegram chat, and following simple command instructions. Each bot is different in how it's laid out and operated. When you start using a bot, you can either make a new wallet address for it or import an existing one with private keys. It's safer to either use a new wallet or a separate account for these bots, instead of your main wallet.

To start trading, you need to put some crypto, like ether (ETH), into your new wallet. Then you choose which tokens to buy by entering their contract addresses. The bot handles the transaction and speeds up the buying process, including dealing with gas fees. This is different from trading new tokens on Uniswap or MetaMask, where you have to go through more steps, like managing digital signatures and setting up transaction fees. The integration of trading bots into widely-used messaging platforms like Telegram has the potential to significantly boost the adoption of cryptocurrency. This approach can onboard a large wave of new crypto users, especially those who are not deeply versed in the complexities of the crypto world.

One of the key advantages of this integration is the familiarity and accessibility of Telegram. Many people already use Telegram for daily communication, so interacting with a trading bot in this environment is less intimidating than navigating specialised crypto trading platforms. This familiarity lowers the entry barrier for new users who might be interested in crypto but are deterred by the complexity and perceived risk of traditional crypto exchanges.

Another benefit is the convenience and speed offered by these bots. The ability to execute trades quickly and efficiently within a chat app can appeal to users looking for a straightforward, hassle-free trading experience. This is particularly attractive in the fast-paced world of crypto trading, where market conditions can change rapidly.

Core Functionalities of Telegram Trading Bots

-

Buy and Sell Tokens: These bots integrate with Telegram, allowing users to buy and sell tokens by inputting contract addresses directly into the chat. Features include real-time updates on trade profitability and support for pre-approved transactions to expedite sales.

-

Set Take-Profit and Stop-Loss Orders: Users can configure bots to autonomously execute trades when certain financial thresholds are reached. These functions are particularly useful for trading new tokens not available on centralized exchanges (CEXs), albeit with higher associated risks.

-

Copy Trading: Certain bots offer the capability to mirror the trades of specified wallet addresses. They act as intermediaries, replicating the trading activities of followed traders in the user’s account.

Advanced Features

-

Liquidity, Method, and Multi-Wallet Sniping: Advanced Telegram trading bots enable various forms of sniping. Liquidity sniping occurs when a bot detects and responds to liquidity being added to a token. Method sniping involves dispatching buy transactions based on the 'Method ID' of a developer's pending transaction, allowing trading on new tokens. Multi-wallet sniping allows simultaneous execution of trades across multiple wallets.

-

Anti-Rug and Honeypot Detection: Advanced bots are equipped with features to counteract rug-pulls and honeypots. Anti-rug functions identify and counteract suspicious transactions in the mempool, while anti-MEV features protect against malicious bots through private relay transactions. Additionally, bots can detect and respond to honeypot scams by liquidating positions swiftly.

-

Airdrop Farming: Some bots specialize in identifying and participating in airdrop campaigns across multiple blockchains. They automate tasks to meet airdrop criteria, potentially increasing rewards through multi-wallet participation.

Risks

-

Security of Assets: Use of these bots involves risks related to private keys, as they are either generated or accessed by the bot. Users should preferably connect a new, non-primary wallet to mitigate custodial risks.

-

Smart Contract Risks: Interaction with unaudited smart contracts can expose users to vulnerabilities in the contract code.

Now, let’s take a look at particular examples of bots and their metrics.

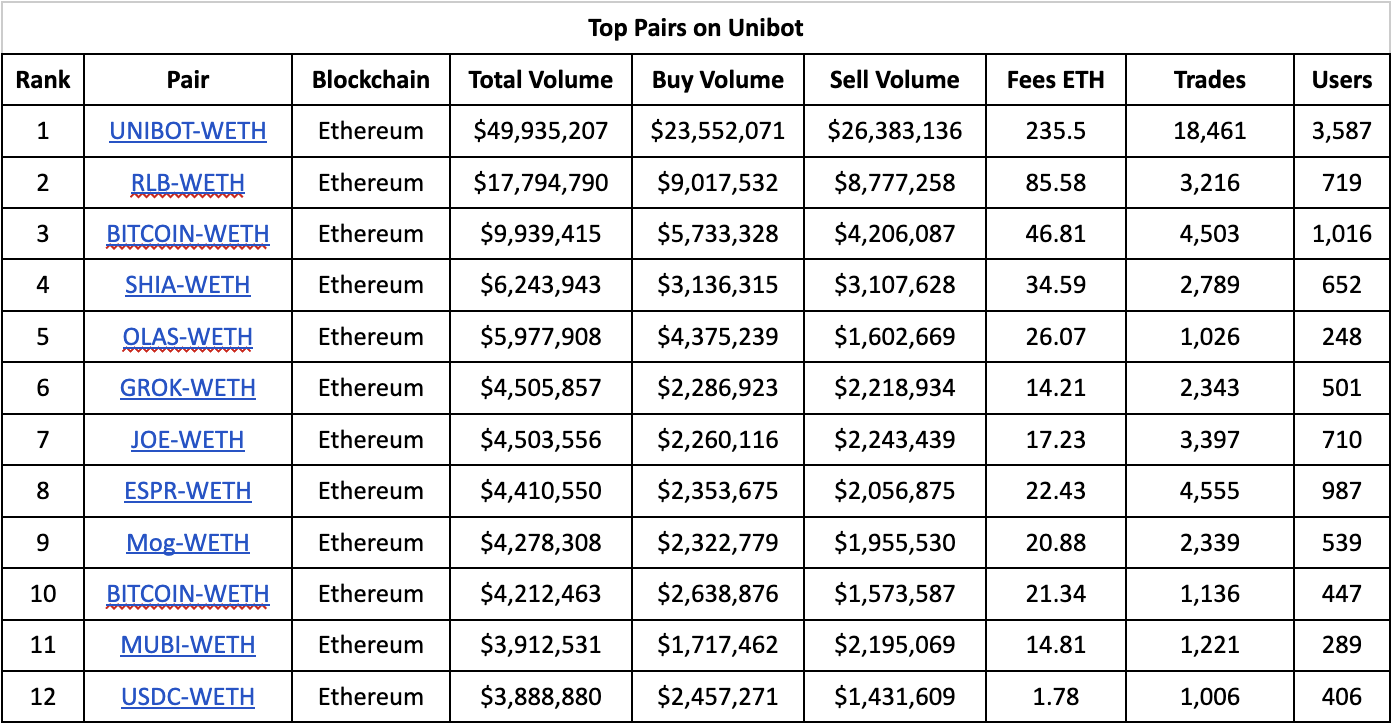

Unibot

Available on: Ethereum, Solana

Unibot, developed by Diamond Protocol for Uniswap V3, is a Leveraged Liquidity Provision (LLP) platform enabling DeFi transactions directly via Telegram. Launched in May 2023 by ex-Apple employee Ayden and an unnamed partner, it quickly gained popularity for offering swift trades and revenue-sharing for its token holders. The bot capitalizes on Telegram's popularity in the web3 community to streamline crypto trading.

In July 2023, UniBot experienced a remarkable growth in trading volumes, nearly tripling to a peak of $7.63 million on July 23. This increase in activity coincided with the launch of Unibot X, an enhanced version of the bot boasting mobile compatibility and improved features. This release played a key role in expanding the user base, which surpassed 7,000 unique wallets during this period.

Concurrently, UniBot's token value reached a record high of $199.90, reflecting its growing adoption and recognition in the market. This surge can be attributed to the bot making the token sniping process more accessible, enabling a wider range of users, including those without advanced technical know-how, to engage in sniping newly released tokens. With its intuitive interface, MEV protection, and the capability for instant purchases of tokens newly listed on Uniswap, UniBot became increasingly popular among diverse traders, particularly those engaging in high-frequency trading.

Since Unibot hopped on board with Solana on January 4, it's been a game-changer for them. Now, a whopping 90% of Unibot's users are coming from Solana, and they're behind over 79% of all the action in terms of volume. This move has been a real money-maker too - Unibot's raked in $275,000 in fees from the Solana side, boosting their total earnings to $534,000 when you count what they made from Ethereum. That's a solid 50% bump in their fee income, all thanks to bringing Solana into the mix.

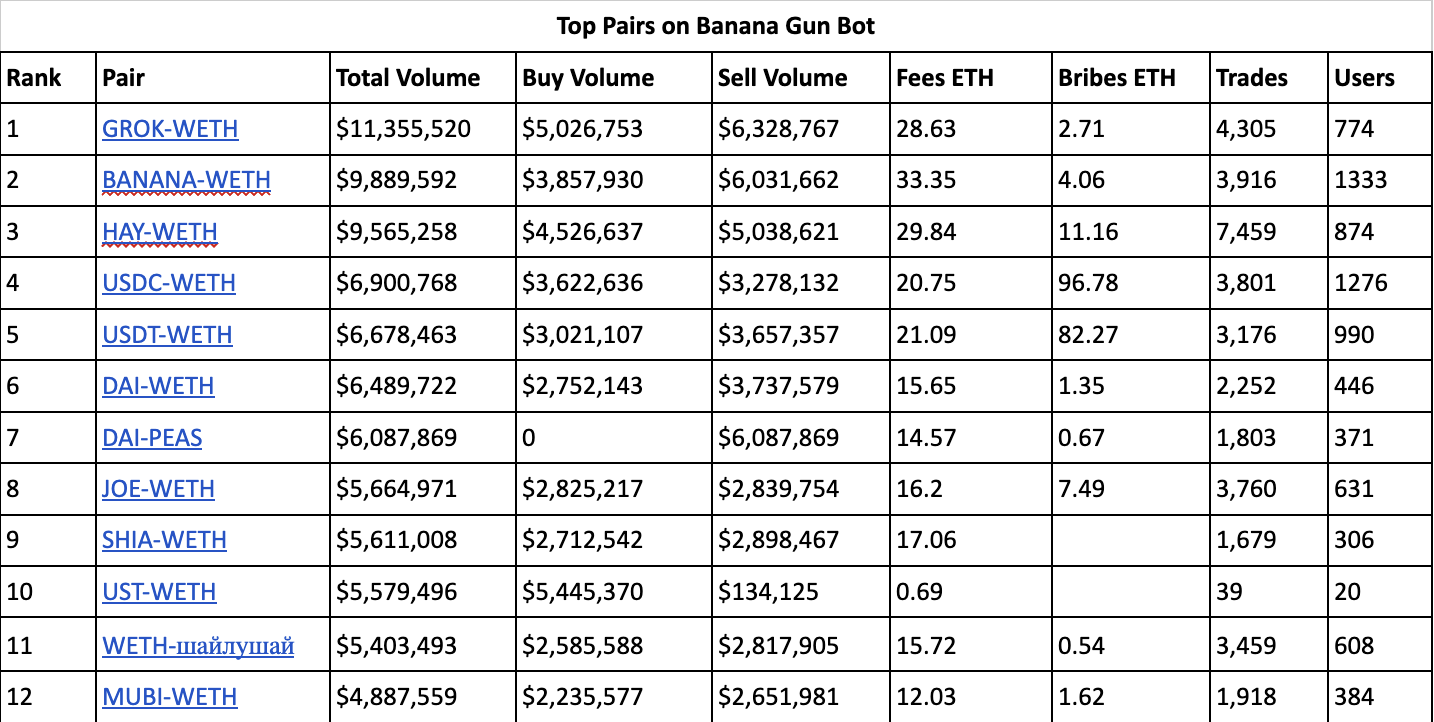

Banana Gun Bot

Available on: Ethereum, Solana

Banana Gun, a trading bot with a humorous yet ambitious approach, currently operates on the Ethereum Network, with plans for multi-chain expansion. It offers features like manual token buying for live Ethereum tokens and auto sniping for new token launches.This bot combines speed, efficiency, and a unique charm in its functionality.

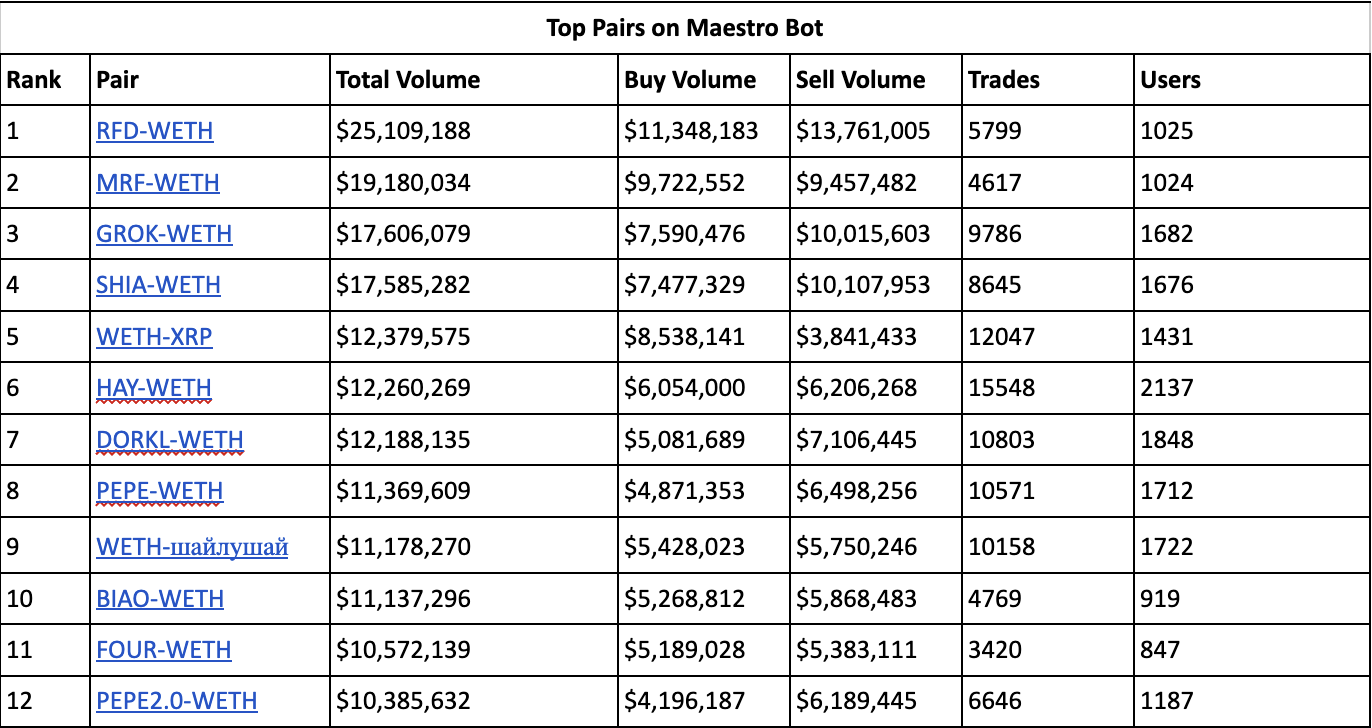

Maestro Bot

Available on: Ethereum, Arbitrum, Binance Smart Chain

Maestro, created by crypto enthusiasts, is a trading bot designed to simplify trading signals, likened to a Mozart symphony for its harmony and ease of use. Its standout features include a user-friendly interface and continuous portfolio monitoring.

Maestro offers several functionalities:

- the Maestro Sniper Bot for fast sniping on multiple chains

- a Whale Bot for tracking large transactions

- a Wallet Tracker for monitoring crypto balances

- price alerts on BSC and ETH, and a Buy Bot for group trading activities.

Additionally, there's a Maestro Pro Bot, a subscription-based service (200$/Month) aimed at serious traders, providing faster transactions, more concurrent trades, and exclusive token indicators.

Exploits

The end of 2023 was a challenging period for Telegram trading bots, marked by several exploits.

In October 2023, Banana Gun and Maestro experienced security incidents. A contract bug in Banana Gun's native token BANANA caused its price to plummet from $8.70 to $0.02 in less than three hours after launch. This bug allowed users to sell their holdings while retaining tax tokens in their wallet, leading to accusations of a "rug pull." Despite these setbacks, Banana Gun Bot recovered, reaching a daily trading peak of over $16 million on August 29.

In the same timeframe, Maestro suffered a 280 ETH hack, leading to the reimbursement of 610 ETH to its users. These incidents underscored the growing interest in trading bots but also highlighted concerns about user safety and platform security.

In mid-October to November, the UniBot contract was compromised, resulting in a loss of around $600,000. The deployer wallet was suspected of links to a known bad actor, which further eroded trust in the product. This event led to a spike in trading activity driven by fear, uncertainty, and doubt (FUD).

Conclusion

Evaluating Maestro, UniBot, and Banana Gun trading bots, each exhibits distinct strengths and areas for improvement. Maestro offers a range of services but can be complex for newcomers. UniBot is noted for its user-friendly interface and effective revenue-sharing program. However, Banana Gun, still in development, requires additional steps for order completion.

An ideal Telegram bot would blend the best features of these examples: efficiency, transparency, revenue sharing, robust security, immediate reward claiming, and user-friendly buying/selling processes. The goal is to enhance user experience in crypto interactions, leveraging familiar web2 interfaces for a smoother transition to web3, and focusing on building permission-less systems. These bots symbolize a convergence of technology, innovation, and forward-thinking, offering diverse opportunities for both novice and experienced crypto users.technology, innovation, and forward-thinking, offering varied opportunities for both newcomers and experienced crypto users.

About Bitquery

Bitquery is a set of software tools that parse, index, access, search, and use information across blockchain networks in a unified way. Our products are:

- Coinpath® APIs provide blockchain money flow analysis for more than 24 blockchains. With Coinpath’s APIs, you can monitor blockchain transactions, investigate crypto crimes such as bitcoin money laundering, and create crypto forensics tools. Read this to get started with Coinpath®.

- Digital Assets API provides index information related to all major cryptocurrencies, coins, and tokens.

- DEX API provides real-time deposits and transactions, trades, and other related data on different DEX protocols like Uniswap, Kyber Network, Airswap, Matching Network, etc.

If you have any questions about our products, ask them on our Telegram channel. Also, subscribe to our newsletter below, we will keep you updated with the latest in the cryptocurrency world.

This article has been written by guest writer Anish Majumdar

Disclaimer: The information provided in this material is published solely for educational and informational purposes. It does not constitute a legal, financial audit, accounting, or investment advice. The article's content is based on the author's own research and, understanding and reasoning. The mention of specific companies, tokens, currencies, groups, or individuals does not imply any endorsement, affiliation, or association with them and is not intended to accuse any person of any crime, violation, or misdemeanor. The reader is strongly advised to conduct their own research and consult with qualified professionals before making any investment decisions. Bitquery shall not be liable for any losses or damages arising from the use of this material.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.