Bitcoin ATM Theft: How to Track and Recover Your Stolen Funds

In the ever-changing world of cryptocurrency, Bitcoin ATMs have emerged as a convenient and accessible means for users to buy and sell Bitcoins. However, these ATMs, including those operated by Bitcoin Depot, come with risks such as high transaction fees, lack of KYC requirements, and susceptibility to scams and technical issues. With the increased use of Bitcoin ATMs, proper monitoring and security measures are important to ensure transaction integrity and user safety.

This article explores Bitcoin ATM transaction monitoring, common issues and scams associated with Bitcoin Depot ATMs, and effective methods for tracking Bitcoin wallet transactions.

Additionally, it highlights real-life cases of lost funds and explains how Bitquery’s crypto investigation services can assist in recovering these assets.

Understanding Bitcoin Depot ATMs

Bitcoin Depot is the largest Bitcoin ATM network worldwide, with over 7,400 locations across the United States, Canada, Puerto Rico, and Australia. The ATMs are

specially designed for buying and selling Bitcoin.

Users can buy Bitcoin using cash or debit cards. By depositing cash into the machine and scanning a QR code, the equivalent amount of Bitcoin is sent to their digital wallet.

Fee Structure and Transaction Limits

The fees charged for transactions vary based on the type of transaction and location.

-

Transaction Fees: For each transaction, users are charged a fee for using the ATM. Fees are calculated as a percentage of the transaction amount and may range from 5% - 10% per transaction.

-

Spreads: Besides transaction fees, spreads between the market price of the cryptocurrency and the price offered at the ATM can affect the overall cost of the transaction.

-

Limits: There are also daily limits on the volume of Bitcoin a customer can buy or sell in a single transaction or within a certain period, You can check the ATM for details on fees and limits.

Lack of KYC Requirements and Associated Risks

Bitcoin Depot ATM users do not require Know Your Customer (KYC) for smaller transactions, this gives the following benefits:

-

Anonymity: Users can purchase or sell their cryptocurrency without disclosing personal information for small transactions at Bitcoin ATMs, ensuring privacy and anonymity.

-

Convenience: Without KYC requirements for small transactions, the process is quicker and more convenient since users can avoid lengthy verification procedures.

While the absence of KYC requirements has advantages, it also carries potential risks.

Risks:

Fraud and Money Laundering: Due to the absence of KYC requirements, the anonymity provided by these ATMs can be exploited for illegal activities such as money laundering and fraud. Here's a deeper look into how this affects users:

-

No Identity Checks: Without KYC requirements, unidentified users can make transactions without verification. This makes it easy for individuals to conduct illegal activities without being traced.

-

Money Laundering: The lack of KYC allows criminals to use these ATMs to convert large amounts of illicit cash into Bitcoin, making it harder to trace. This process helps them "clean" the money and integrate it into the financial system.

-

Scams: The anonymity of these ATMs can increase scams, where users deposit money expecting Bitcoin but never receive it. Legitimate users can also become victims of fraud, as transactions are untraceable, making it extremely difficult to recover lost funds.

Regulatory Issues: Lack of KYC requirements on these ATMs can attract scrutiny from governments and regulatory bodies that may impose stricter regulations on ATMs to prevent misuse. This could impact the availability and operation of these services in the future.

Importance of Monitoring Bitcoin ATM Transactions

Recent events have underscored concerns about rising crypto-related fraud and Bitcoin ATM scams.

In 2023, S&P Solutions, also known as Bitcoin of America, and its executives faced serious charges for operating over 50 Bitcoin kiosks in Ohio without proper licenses. These kiosks were exploited by scammers, resulting in substantial financial losses, including an elderly man losing over $11,000 in an hour.

Despite awareness of the scams, the company continued operating the kiosks, profiting from a 20% fee on transactions. Authorities seized 52 kiosks, with more located in other areas, and the company reportedly earned $3.5 million from these illegal activities in 2021.

These incidents show the importance of monitoring Bitcoin transactions to prevent future scams. Regular and thorough monitoring can help identify unusual or

suspicious activity, allowing for prompt intervention before significant damage occurs.

By monitoring the flow of funds and analyzing transaction patterns, authorities

and individuals can spot warning signs. These signs include money being quickly moved across many addresses or transactions, or small amounts being sent by multiple senders to a particular address and so on.

Using good monitoring tools and practices enhances security and builds trust and transparency within the cryptocurrency ecosystem.

Common Issues and Scams Related to Bitcoin Depot ATMs

Although convenient and easy to use, Bitcoin Depot ATMs can be vulnerable to various issues and scams. They exploit users' trust and lack of knowledge about cryptocurrency transactions.

Government Impersonation Scams: Fraudsters in these scams impersonate officials from legitimate organizations like pension agencies, tax authorities, or utilities. They contact victims, claiming debts such as unpaid bills, and threaten severe consequences for non-payment. Victims are instructed to withdraw cash, convert it to Bitcoin at a Bitcoin Depot ATM, and transfer it to the scammers.

An example of this scam happened in Australia where law enforcement discovered a scheme where fraudsters posing as tax collectors convinced victims to make fraudulent tax payments using Bitcoin ATMs.

Financial Exploitation: This is a scam that targets the elderly's lack of familiarity with digital finance, convincing them to deposit cash into Bitcoin ATMs for convenience. The victims are forced into repeated payments until their savings are exhausted. For instance, a Michigan elderly couple lost $350,000 to scammers posing as Apple support, who instructed them to deposit cash into a Bitcoin ATM. Police in Alabama also uncovered similar schemes targeting elderly victims at gas station Bitcoin ATMs.

Investment scam: In investment scams, scammers pretend to be wealthy investors on social media or dating apps, building trust with victims to push them into crypto investments. They persuade victims to withdraw cash, deposit it into a Bitcoin ATM, convert it to crypto, and send it to the scammers' wallets. Once they receive large sums, typically tens or hundreds of thousands of dollars, the scammers disappear without a trace.

How to Monitor Bitcoin Wallet Transactions with Bitquery?

Bitcoin transactions are recorded on the blockchain, an immutable and transparent ledger. Each transaction consists of inputs and outputs, with a unique transaction ID

as its identifier. Understanding these components is essential for tracking Bitcoin ATM transactions effectively.

Using Bitquery for Bitcoin ATM Transaction Tracking:

Bitquery is a powerful tool that can help you effectively monitor Bitcoin ATM transactions. Here’s how you can do it:

-

Access Bitquery explorer: Open Bitquery explorer.

-

Search for Bitcoin Transactions:

-

Open the Bitcoin mainnet.

-

Enter the Bitcoin addresses you're interested in.

For example, let's use this address: bc1qvtl5lhhnnh9gjcyww0ld3rlx3luvd3sxnxfal8.

- Use filters like date, amount, and other parameters to narrow down and focus on relevant transactions.

In the Bitcoin address example above, the date range is from "July 9, 2024, to July 16, 2024."

- Analyze the Transactions

Bitquery provides comprehensive details for each transaction, including:

- Transaction ID: A unique transaction identifier that can be used to track and reference it.

In the Bitcoin address above, the transaction ID is given as follows: d4b2a26c2c2b0fe432a2af8a7b9ffb33b2dd0272ec40f15a7b1e537d2274b90a.

- Date and Time: The exact timestamp when the transaction occurred, helping to establish the transaction timeline.

The transaction occurred on "2024-07-16 20:48:46"

- Amount: The specific quantity of Bitcoin that was transferred. This is important for understanding the transaction value.

The transaction amount was 0.00652168 BTC.

- Sender and Receiver Addresses: The Bitcoin addresses of both the sender and the receiver, identifying the parties involved in the transaction.

Sender: bc1qvtl5lhhnnh9gjcyww0ld3rlx3luvd3sxnxfal8

Receiver: bc1qspe9cl72mldemst6yd4empqv6fztyft0djfsu

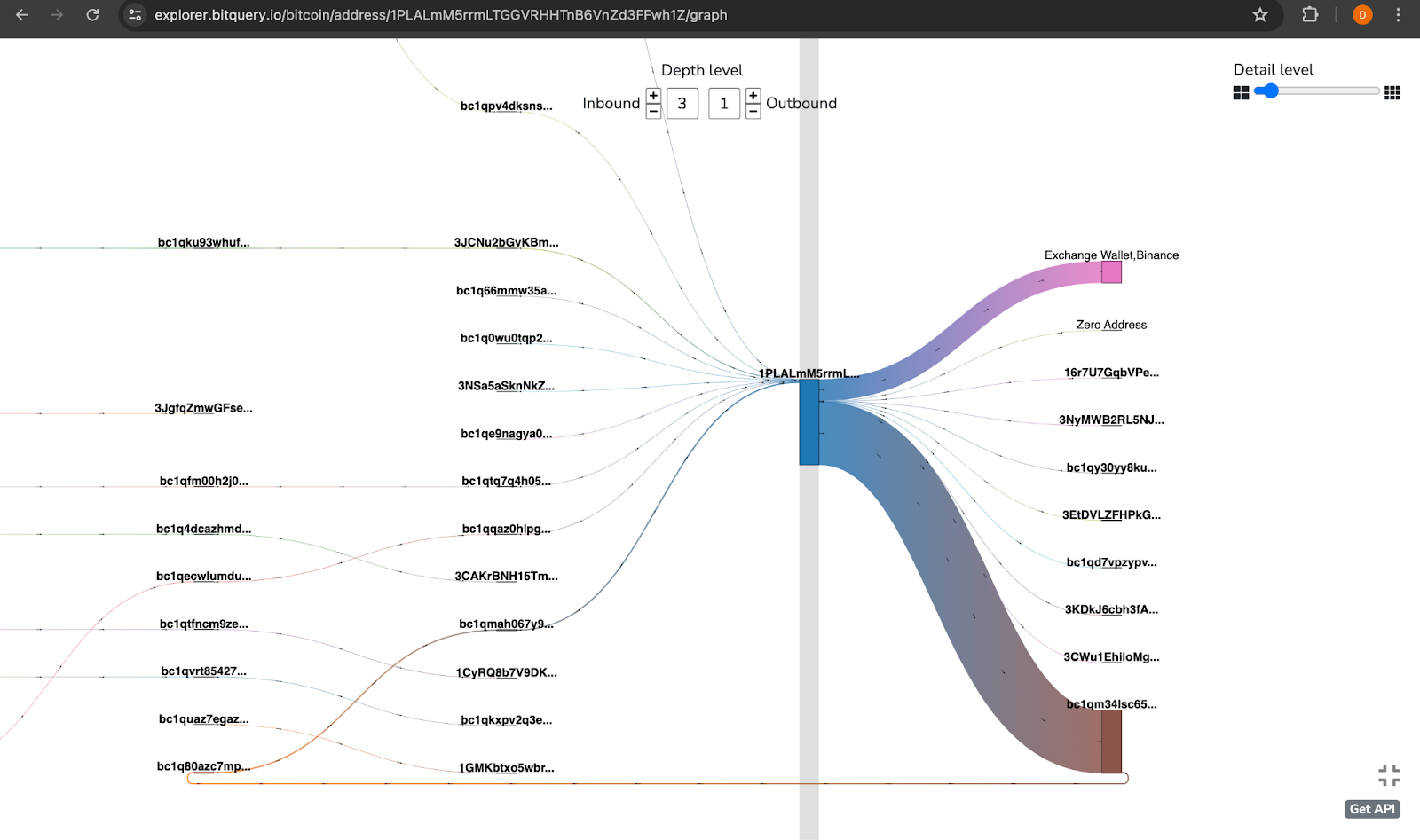

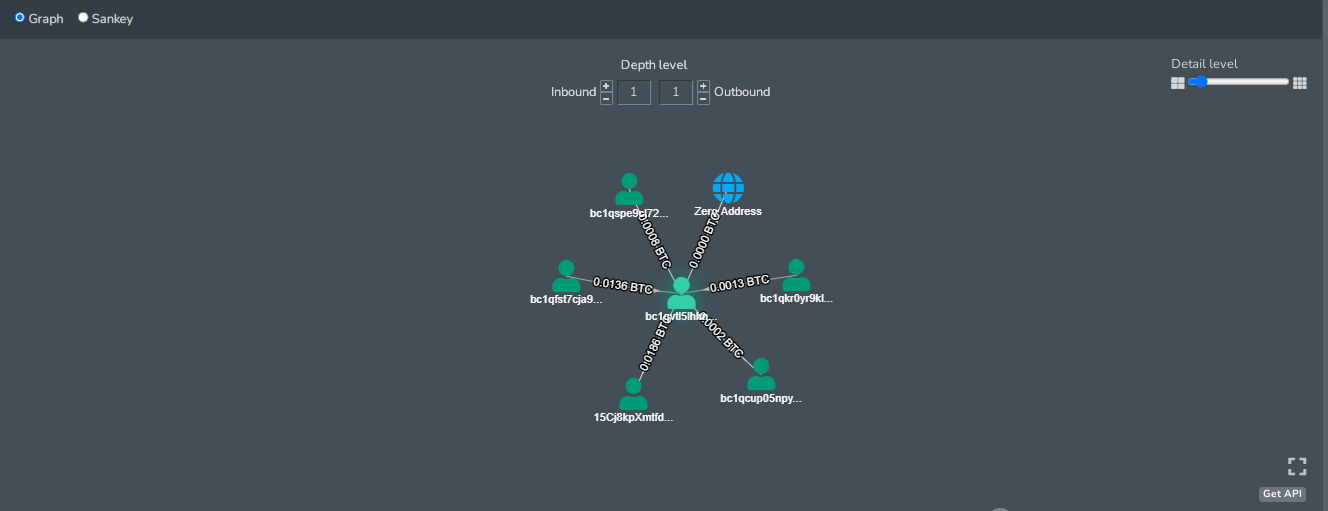

- Visualize Transaction Patterns

Use Bitquery's advanced analytics tools to gain insights into transaction patterns:

- View Transaction Graphs: Plot transaction flows to observe how Bitcoin moves between different addresses, helping to understand the flow and connections.

- Identify Clusters: Group addresses associated with specific ATMs to spot transaction trends and commonalities, making it easier to identify significant patterns.

Following these steps, you can effectively monitor and gain insights into Bitcoin ATM transactions using Bitquery's powerful tools.

How Bitquery Can Help Recover Lost Funds?

Bitquery provides specialized investigation services to track down your stolen digital assets and deliver all types of support that help recover your crypto.

- Funds Tracking: Bitquery can help with tracking funds by using its cutting-edge blockchain analysis tools to track stolen funds. They do this by analyzing and tracking the flow of funds from the originating wallet to the final destination.

-

Legal Support: By providing comprehensive reports on blockchain activities, Bitquery can help connect with seasoned crypto lawyers for legal proceedings and fund recovery efforts.

-

Recovery Assistance: Bitquery offers expert support by coordinating with crypto exchanges and law enforcement agencies to retrieve lost or stolen assets.

How it works

-

If you have lost money after using a BTC ATM and scanning your wallet's QR code, submit a form on Bitquery’s platform to request help.

-

Bitquery’s team will conduct an initial assessment using the Coinpath® tool to trace the flow of funds through Bitcoin ATMs, identifying patterns and addresses involved in your transaction.

-

If promising leads are found, such as suspicious transactions or interactions with known addresses or exchanges, Bitquery conducts further investigations to determine their significance and provide you with detailed insights.

-

You will be contacted to discuss the findings and will be offered the option to purchase a complete report. This report includes a detailed analysis of the transaction, providing valuable information to help trace your funds.

-

Bitquery collaborates with authorities, using the complete report to provide evidence and support for legal and regulatory compliance, helping to recover your lost funds.

How Does MoneyFlow Work?

Bitquery MoneyFlow, is a tool that uses advanced blockchain data analytics to trace and analyze cryptocurrency movements across multiple blockchains, providing detailed transaction insights and counterparty information to aid in compliance, security, and research.

It is the ultimate crypto investigation solution for crypto investigators and law enforcement agencies for the following reasons:

-

Precise Monitoring and Visualization: Coinpath effortlessly tracks specific fund transfers, automates investigation processes, and visualizes fund movement with intuitive tools.

-

Automated Tracing and Clustering: Coinpath automates the tracing of cryptocurrency transactions, reducing the manual effort required to follow the movement of funds. This feature ensures that users can quickly and accurately identify the flow of assets from one address to another, increases the efficiency of the investigation process, saves time, minimizes manual decision-making, and eliminates errors.

-

Labels and Counterparty Info: Coinpath provides detailed information about counterparties involved in transactions. This includes labels that identify known entities and addresses, making it easier to understand the nature of the transaction and the parties involved. This feature is crucial for compliance and risk management.

-

Multiple Chains: One of the standout features of Bitquery Coinpath is its support for 40+ blockchain networks. Users can trace transactions across different chains, providing an overview of cryptocurrency flows.

With these features, Bitquery Coinpath empowers users to gain deeper insights into the movement of cryptocurrencies, enhancing transparency and enabling more informed decision-making.

To learn more about how Bitquery can assist you in monitoring Bitcoin wallet transactions and recovering lost funds, visit Bitquery Crypto Investigation Services.

Conclusion

Monitoring Bitcoin ATM transactions is crucial for maintaining the integrity and security of the cryptocurrency ecosystem. Understanding the features and potential issues related to Bitcoin Depot ATMs can help users navigate these services safely.

By utilizing tools like Bitquery, users can effectively monitor transactions and recover lost funds, ensuring a secure and transparent cryptocurrency experience.

If you've encountered issues with Bitcoin ATM transactions, reach out to Bitquery for expert assistance in tracking and recovering your funds.

Written by Edgar N

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.