Who is actually using Ethereum? (September)

Recently we have seen TLV (Total locked value) plastered all over the crypto sphere touting the success and growth of DeFi protocols. Today, we will use a simple metric “Unique smart contract callers” to understand how many users actually using these protocols.

Note: We have used data from 1–27 September 2020. For many complex protocols, we used one or multiple smart contracts to calculate unique callers.

Smart Contract Unique Callers — Unique addresses which called a smart contract for any reason.

Stablecoins are leading the way

Tether(USDT) is one of the most popular stablecoin in the crypto domain. USDT token smart contract has been called by 937,820 unique callers in the month of September. On the other hand, USDC token smart contract is called by 132,944 callers and the popular DeFi stablecoin DAI Token smart contract is called by 76,811 unique callers.

Other than these 3 stablecoins, every other stablecoin has less than 10K unique callers this month.

DEXs are leading the DeFi protocols

Uniswap is the most popular DeFi project and its router contract had 242,010 unique callers in September.

On the other hand, Sushiswap which made news by forking Uniswap had 15,548 unique callers on its Masterchef staking pool smart contract. However, SushiSwap router’s smart contract is only called by 13,467 unique users.

Another popular DEX protocol Kyber token contract had called by 15,197 unique callers where the main protocol contracts (NetworkProxy contracts) is only called by 3669 times.

One of the earliest DEX protocols, the 0x Token contract called by 10,236 unique callers but 0x exchange contract only called by 710 unique callers.

Other popular DEX/DEX aggregators such as 1inch.exchange had 8,338 and Tokenlon has 7.862 unique callers on their smart contracts in the month of September.

Few using DeFi protocols

As we were looking into data, we realized that almost all the DeFi protocols have more users interacting with their token contracts rather than protocol contracts. In other words, more people are investing in protocols tokens rather than using these protocols.

Recently launched Uniswap token contract, had 242,010 unique callers in the month of September, which is pretty close when it comes to unique callers on its Uniswap exchange contract (242,010).

Sushi token contract had 32,986 unique callers, which is ~2.5 times more unique callers of SushiSwap protocol contracts. (15,548)

Automatic Money Markets (AMMs)

Compound (COMP) token contract had 18,507 unique callers; however, the protocol Comptroller contract, which validates user actions has only 2,313 unique callers.

Similarly, Aave (LEND) token contract has been called by 12,032 unique callers, however, Aave’s lending pool contract is called by 8,058 times.

Another famous Stable coin AMM Curve.finance has 8,833 unique callers on its Curve Token (CRV) smart contract, but it has 10,437 unique callers on its multiple token swap smart contracts.

Swerve.finance, a fork of Curve.finance had 7,950 unique callers Swerve Token contract in the month of September.

Wrapped Tokens

Wrapped tokens are the ERC20 representation of other crypto assets such as Ethereum, Bitcoin.

Because of the DeFi protocols, WETH (Wrapped Ethereum) is also a widely used ERC20 token, which had 21,979 unique callers.

WBTC (Wrapped Bitcoin) is also had tremendous growth in the past few months and had 10,580 unique callers in the month of September. WBTC’s unique callers grew 300% from the month of August.

DeFi Yield Farming Aggregators

DeFi yield aggregators made a lot of noise recently. One of the most popular yield aggregator token YFI token has the highest price in the digital asset. YFI token contract had 14,761 unique callers in the month of September.

However, a similar project YFvalue, had 19,016 unique callers on its YFvalue (YFV) token contract.

A few other DeFi yield farming projects such as KIMCHI.finance, had 9,741 unique callers, YFII.finance had 8,092, and Cream.finance had 7,654 unique callers on their token contracts in the month September.

Don’t forget Ponzis

A lot of Ponzi projects are also thriving on Etherum.

Forsage, a Ponzi project’s smart contract is one of the top 10 smart contracts based on unique callers. It had 40,066 unique callers in the month September.

Another high-risk project, such as Etherchain had 13,735 and Million.money had 8,485 unique callers on their smart contract.

How to check Unique Callers for any contract?

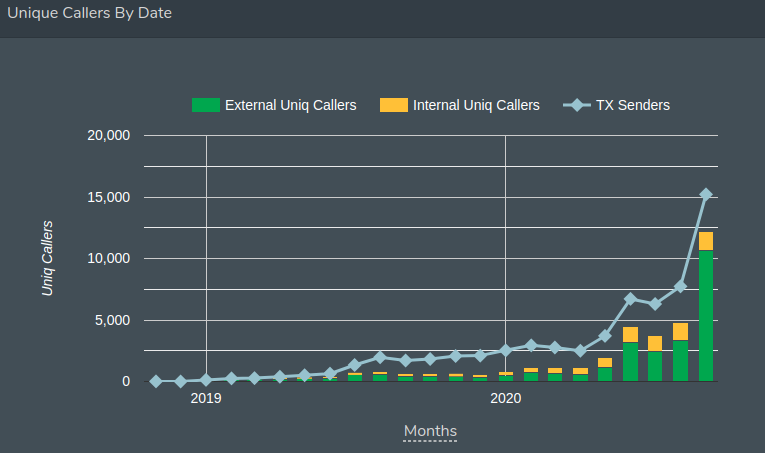

You can check any callers for any given contract on Bitquery explorer or our APIs.

To check unique callers for a given contract, just search that contract on Bitquery explorer, and there you will see a “Unique Callers By Date” widget.

For Ethereum token’s you will find this detail under the “Smart Contract” tab.

Getting Unique callers for smart contracts using Bitquery APIs

You can also use our GraphQL APIs to get unique callers data.

Use this link — https://graphql.bitquery.io/ and run the following query to get top smart contracts with the highest unique callers.

query {

ethereum {

smartContractCalls(

options: { desc: "unique_callers", limit: 100},

date: {since: "2020-09-01"},

external: true) {

unique_callers: count(uniq: callers)

smartContract {

address {

address

annotation

}

}

}

}

}

To get unique callers for a particular smart contract you can use the following query.

query {

ethereum {

smartContractCalls(

options: { desc: "unique_callers"},

date: {since: "2020-09-01"},

external: true,

smartContractAddress: {is: "0x2be5d998c95de70d9a38b3d78e49751f10f9e88b"}) {

unique_callers: count(uniq: callers)

smartContract {

address {

address

annotation

}

}

}

}

}

Also Read:

- APIs to get Latest Uniswap Pair Listing

- Single API to Get Ethereum Token Balance

- API To Get Ethereum Supply And Data

- Simple rest APIs to get Uniswap data (DEX Data APIs)

About Bitquery

Bitquery is a set of software tools that parse, index, access, search, and use information across blockchain networks in a unified way. Our products are:

-

Coinpath® APIs provide blockchain money flow analysis for more than 24 blockchains. With Coinpath’s APIs, you can monitor blockchain transactions, investigate crypto crimes such as bitcoin money laundering, and create crypto forensics tools. Read this to get started with Coinpath®.

-

Digital Assets API provides index information related to all major cryptocurrencies, coins, and tokens.

-

DEX API provides real-time deposits and transactions, trades, and other related data on different DEX protocols like Uniswap, Kyber Network, Airswap, Matching Network, etc.

If you have any questions about our products, ask them on our Telegram channel. Also, subscribe to our newsletter below, we will keep you updated with the latest in the cryptocurrency world.

Subscribe to our newsletter

Subscribe and never miss any updates related to our APIs, new developments & latest news etc. Our newsletter is sent once a week on Monday.